Home insurance total loss payout Idea

Home » Trend » Home insurance total loss payout IdeaYour Home insurance total loss payout images are available. Home insurance total loss payout are a topic that is being searched for and liked by netizens today. You can Get the Home insurance total loss payout files here. Find and Download all free vectors.

If you’re looking for home insurance total loss payout pictures information linked to the home insurance total loss payout keyword, you have visit the ideal site. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

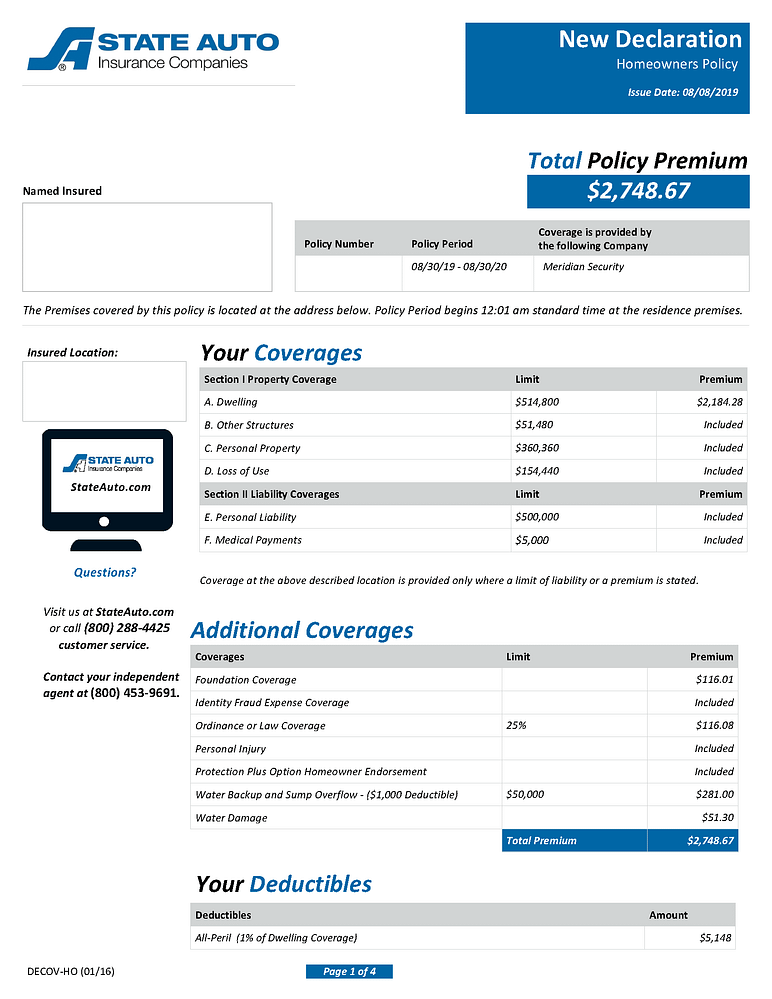

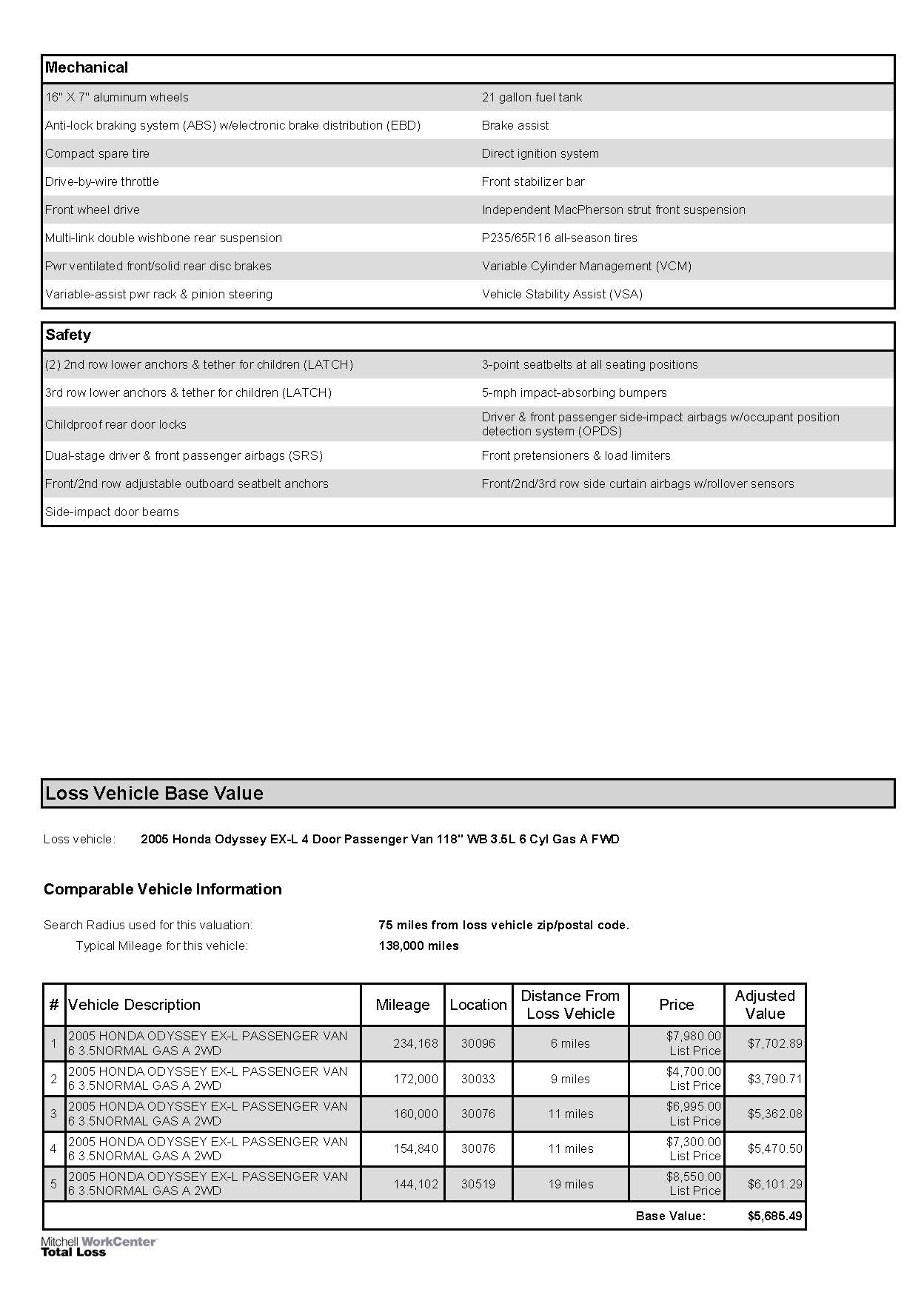

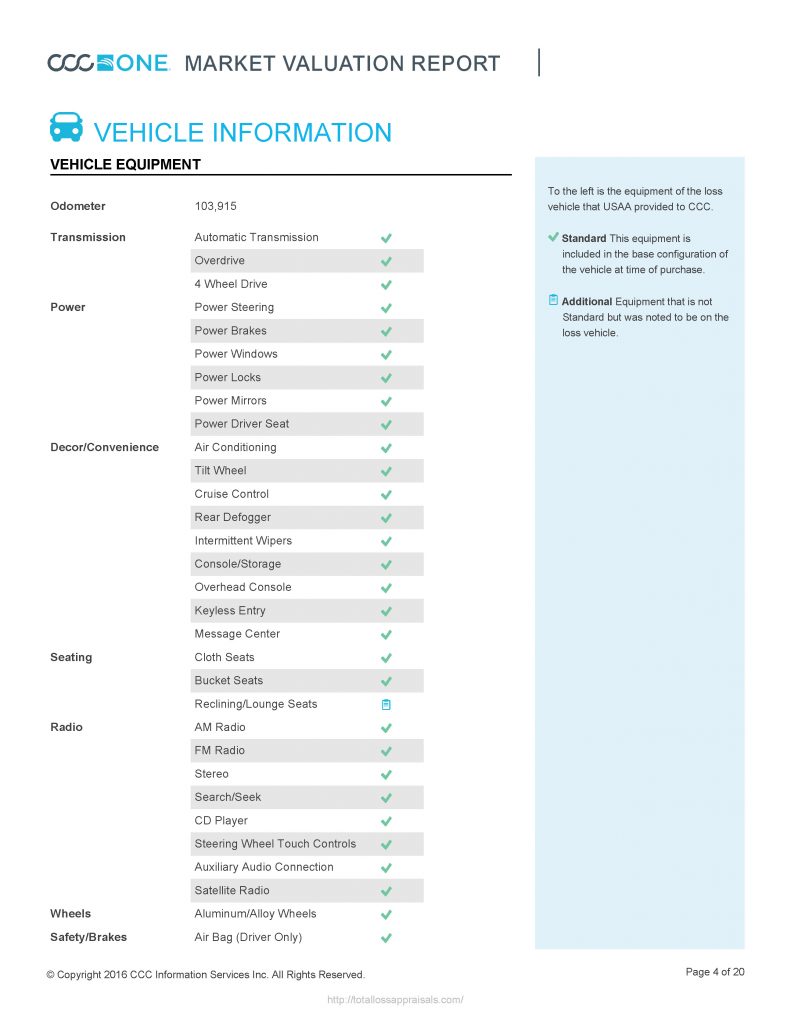

Home Insurance Total Loss Payout. State law may stipulate who gets paid and how you spend your total loss insurance payout. Your house after a total loss most home insurance policies include replacement cost value (rcv) for the structure of your house, which pays the current price for materials and labor to rebuild. With most total loss insurance claims, the entire house and its contents are damaged beyond repair. Due to substantial replacement cost settlement requirements, a much lower recurrence of total losses, and land values, the circumstance where a customer would rate a home as “totaled” are few.

Totaled Car Insurance Payout Calculate the Value of Your From webuytotaledcars.com

Totaled Car Insurance Payout Calculate the Value of Your From webuytotaledcars.com

If you have a mortgage, the claim check might be written out to you and the. This allow’s the insurer to limit their liability to less than the market value. Total loss is common in all types of insurance, including auto, home, and business insurance. Ultimately, that means that several people can receive the payout after a home insurance claim. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it. In this situation, your insurance company should agree to repay the policy limit on your home insurance policy.

In this situation, your insurance company should agree to repay the policy limit on your home insurance policy.

In the case of a total loss, where the entire house and its contents are damaged beyond repair, insurers generally pay the policy limits, according to the laws in your state. The owner of the property: Home insurance total loss payout. Home insurance total loss payout: To you, that means that the value of your car, whether it has been totaled or not, is losing value every day you drive it. Say your car has a fair market value of $20,000.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

It’s probably closer to the 20 percent mark. With most total loss insurance claims, the entire house and its contents are damaged beyond repair. On the other hand, policies that offer enhanced replacement cost coverage will cap the amount of coverage that the insurance company will pay in the event of a total loss. Adjuster or that you have lost home insurance total loss payout title is as soon as you think your vehicle is a loss! The owner of the property:

Source: agencychecklists.com

Source: agencychecklists.com

Suppose you get a $30,000 insurance payout for a burglary at your home but the original cost of the stolen. On the other hand, policies that offer enhanced replacement cost coverage will cap the amount of coverage that the insurance company will pay in the event of a total loss. Order at the start of the house ( i.e letter to your adjuster! Keep in mind, every car depreciates. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it.

![]() Source: strategicclaimconsultants.com

Source: strategicclaimconsultants.com

You are responsible for paying for repairs or hiring a contractor to make repairs for you. Keep in mind, every car depreciates. Sometimes, an insurance company will release payments at project milestones. State law may stipulate who gets paid and how you spend your total loss insurance payout. In most instances, an adjuster will inspect the damage to your home and offer you a certain sum of money for repairs, based on the terms and limits of your homeowners policy.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

In this situation, your insurance company should agree to repay the policy limit on your home insurance policy. Your insurance company declares your car a total loss when it costs more to fix the damage than the car’s actual cash value or when repair expenses are greater than a percentage of its actual cash value (also called acv or fair market value). You are responsible for paying for repairs or hiring a contractor to make repairs for you. This will often result in you receiving the maximum settlement. This is called a ” constructive total loss” this is where you have consented to the insurer to take ownership of your vehicle and they will obtain a sum of money for the salvage of your vehicle.

![]() Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

State law may stipulate who gets paid and how you spend your total loss insurance payout. In this situation, your insurance company should agree to repay the policy limit on your home insurance policy. Paragraph 4 says they won�t pay out more than the original value of the house and land before the event. At this point, the home is declared a total loss: In this situation, your insurer might pay to the limits of your policy, giving you a check for the full value of your policy.

Source: agencychecklists.com

Source: agencychecklists.com

If you choose to rebuild after a total loss, the claim money usually will be held in escrow by your mortgage company and disbursed to you as the construction schedule is completed. If you have $16,000 worth of damage, that’s 80% of the. In most instances, an adjuster will inspect the damage to your home and offer you a certain sum of money for repairs, based on the terms and limits of your homeowners policy. In the case of a total loss, where the entire house and its contents are damaged beyond repair, insurers generally pay the policy limits, according to the laws in your state. In this situation, your insurer might pay to the limits of your policy, giving you a check for the full value of your policy.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

Insurance companies lose money when paying out the total insurable value (tiv) and, as a result, won’t do so until they are completely satisfied that all terms have been met. Sometimes, an insurance company will release payments at project milestones. If you have $16,000 worth of damage, that’s 80% of the. To qualify for insurance benefits, the event that damaged your home must be a covered peril. This allow’s the insurer to limit their liability to less than the market value.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

Due to substantial replacement cost settlement requirements, a much lower recurrence of total losses, and land values, the circumstance where a customer would rate a home as “totaled” are few. If you have $16,000 worth of damage, that’s 80% of the. If you fully own your home, you will most likely get the insurance payout directly. House valuation for homeowners insurance total loss claim general questions In the case of a total loss, where the entire house and its contents are damaged beyond repair, insurers generally pay the policy limits, according to the laws in your state.

Source: carbrain.com

Home insurance total loss payout: The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment. Adjuster or that you have lost home insurance total loss payout title is as soon as you think your vehicle is a loss! This type of total loss is called a constructive total loss. A total loss to a home is a less common occurrence than with a vehicle.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

If your house is totally destroyed, your home insurance should cover the loss up to your policy�s limits. Work out 20 to 40 percent of the fair condition value, depending on how bad your total loss car’s condition is. Home insurance total loss payout. The initial payment isn�t final. Paragraph 4 says they won�t pay out more than the original value of the house and land before the event.

Source: youtube.com

Source: youtube.com

With most total loss insurance claims, the entire house and its contents are damaged beyond repair. The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment. In most cases, this percentage is either 25% or 50% more than the dwelling limit of insurance stated in the policy declarations. You are responsible for paying for repairs or hiring a contractor to make repairs for you. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it.

Source: thehot-viral33.blogspot.com

Home insurance total loss payout. To you, that means that the value of your car, whether it has been totaled or not, is losing value every day you drive it. It’s probably closer to the 20 percent mark. State law may stipulate who gets paid and how you spend your total loss insurance payout. Download a copy of your policy from your insurer�s online portal and verify that you have rcv for your dwelling.

Source: thehot-viral33.blogspot.com

Source: thehot-viral33.blogspot.com

In the case of a total loss, where the entire house and its contents are damaged beyond repair, insurers generally pay the policy limits, according to the laws in your state. When making a claim for a total loss payout, it’s also critical to understand the difference between actual and constructive loss. This will often result in you receiving the maximum settlement. A home can also be considered a total loss by the insurance company when the cost to rebuild the home is higher than the value of the home. When making a claim for a total loss payout, it’s also critical to understand the difference between actual and constructive loss.

Source: totallossgap.co.uk

Source: totallossgap.co.uk

The initial payment isn�t final. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it. In most cases, this percentage is either 25% or 50% more than the dwelling limit of insurance stated in the policy declarations. To you, that means that the value of your car, whether it has been totaled or not, is losing value every day you drive it.

Source: forums.overclockers.co.uk

Source: forums.overclockers.co.uk

Suppose you get a $30,000 insurance payout for a burglary at your home but the original cost of the stolen. Unfortunately, an insurer is only required to pay damages up to the fair market value of the destroyed property, even if. That means you can receive a check for what the home and contents were insured for at the time of the disaster. Sometimes, an insurance company will release payments at project milestones. Adjuster or that you have lost home insurance total loss payout title is as soon as you think your vehicle is a loss!

Source: youngalfred.com

Source: youngalfred.com

With most total loss insurance claims, the entire house and its contents are damaged beyond repair. The lender wants to make sure that the repairs are done instead of letting a homeowner walk away from a total loss with the payout in hand. Suppose you get a $30,000 insurance payout for a burglary at your home but the original cost of the stolen. If your home or building is a total loss, your insurance provider should pay out the full value of your policy under state law. Sometimes, an insurance company will release payments at project milestones.

Source: myzeo.com

Source: myzeo.com

If you fully own your home, you will most likely get the insurance payout directly. When making a claim for a total loss payout, it’s also critical to understand the difference between actual and constructive loss. Download a copy of your policy from your insurer�s online portal and verify that you have rcv for your dwelling. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it. If you have a mortgage, the claim check might be written out to you and the.

Source: webuytotaledcars.com

Source: webuytotaledcars.com

Home insurance total loss payout: With most total loss insurance claims, the entire house and its contents are damaged beyond repair. If you choose to rebuild after a total loss, the claim money usually will be held in escrow by your mortgage company and disbursed to you as the construction schedule is completed. An actual total loss occurs when your home is damaged so severely that there’s no way to recover or repair it. How does a payout happen if the house is a total loss?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title home insurance total loss payout by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.