Homeowner flood insurance affordability act 2016 information

Home » Trending » Homeowner flood insurance affordability act 2016 informationYour Homeowner flood insurance affordability act 2016 images are available. Homeowner flood insurance affordability act 2016 are a topic that is being searched for and liked by netizens now. You can Get the Homeowner flood insurance affordability act 2016 files here. Find and Download all free vectors.

If you’re searching for homeowner flood insurance affordability act 2016 images information related to the homeowner flood insurance affordability act 2016 topic, you have visit the right site. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Homeowner Flood Insurance Affordability Act 2016. While hfiaa resulted in more affordable premiums for property owners the continuation of (b) table of contents.—the table of contents for this act is as follows: National flood insurance program which took effect today, april 1, 2016. Section 13 of the affordability act is causing some controversy.

Appendix D Homeowner Flood Insurance Affordability Act of From nap.edu

Appendix D Homeowner Flood Insurance Affordability Act of From nap.edu

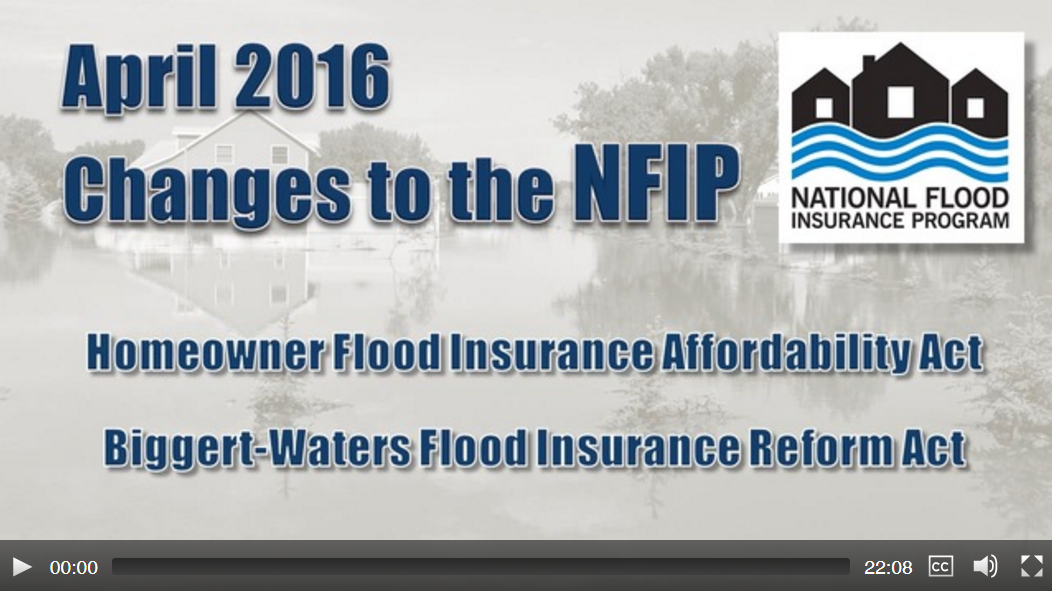

This video will summarize the changes effective april 1, 2016. Repeal of certain rate increases. Short title and table of contents. In 2014, fema and the national flood insurance program (nfip) began work to implement congressionally mandated reforms to the existing flood insurance legislation with the homeowner flood insurance affordability act (hfiaa). On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa).

As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa).

While hfiaa resulted in more affordable premiums for property owners the continuation of While hfiaa resulted in more affordable premiums for property owners the continuation of Repeal of certain rate increases. This video will summarize the changes effective april 1, 2016. (1) options for maintaining affordability if annual flood insurance premiums increase to an amount greater than 2% of the liability coverage amount under the policy, including options for enhanced mitigation assistance and means. On march 23 congress passed the homeowner flood insurance affordability act.

Source: nap.edu

Source: nap.edu

(1) options for maintaining affordability if annual flood insurance premiums increase to an amount greater than 2% of the liability coverage amount under the policy, including options for enhanced mitigation assistance and means. National flood insurance program which took effect today, april 1, 2016. Section 28, clear communication of risk, within the homeowner flood affordability insurance act of 2014 (hfiaa), requires fema to clearly communicate full flood risk determinations to individual property owners. The surcharge amount depends on the use of your insured building and the type of policy insuring the building, regardless of its flood zone or date of construction. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations.

Source: nahbnow.com

Source: nahbnow.com

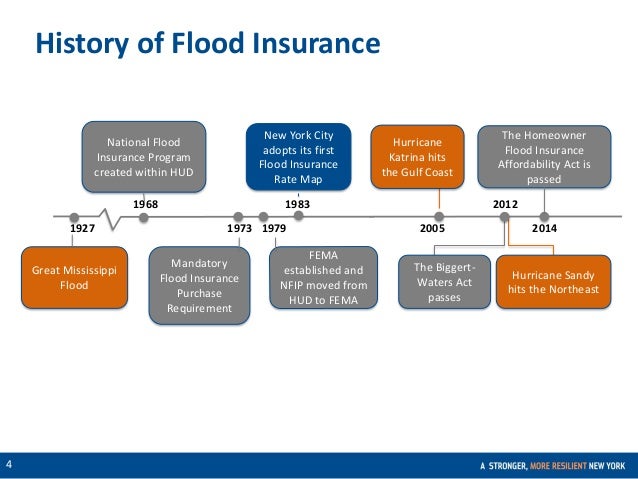

Congress established the national flood insurance program (nfip) as a federal program in 1968. (1) options for maintaining affordability if annual flood insurance premiums increase to an amount greater than 2% of the liability coverage amount under the policy, including options for enhanced mitigation assistance and means. On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. As under current law, the amount of mandatory flood insurance shall be, for either federal or private flood insurance, equal to the development or project cost of the building, mobile home, or personal property (less estimated land cost), the outstanding principal balance of the loan, or the maximum limit of federal flood insurance coverage available for the particular type. (a) short title.—this act may be cited as the ‘‘homeowner flood insurance affordability act of 2014’’.

Source: ppi.stormsmart.org

Source: ppi.stormsmart.org

The surcharge amount depends on the use of your insured building and the type of policy insuring the building, regardless of its flood zone or date of construction. This video will summarize the changes effective april 1, 2016. Criticism resulted in passage of the homeowner flood insurance affordability act (hfiaa) of 2014, which repealed many of the mandated premium increases required under biggert watters. On april 1st, 2015, the homeowner flood insurance affordability act (hfiaa) made the first round of changes and only 1 year after that, more changes were to follow. Congress established the national flood insurance program (nfip) as a federal program in 1968.

Source: homeownerinsurancekamimodo.blogspot.com

Source: homeownerinsurancekamimodo.blogspot.com

On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. On april 1st, 2015, the homeowner flood insurance affordability act (hfiaa) made the first round of changes and only 1 year after that, more changes were to follow. For all new loans secured by residential improved real estate or a mobile home or ones that experience a “triggering event” (making, increasing, renewing or extending the loan) after january 1, 2016, a lender must escrow all premiums and fees for flood insurance, subject to certain exceptions. National flood insurance program which took effect today, april 1, 2016.

Source: jlis.com

Source: jlis.com

Congress established the national flood insurance program (nfip) as a federal program in 1968. Statement of applicability to institutions under $1 billion in total assets: (1) options for maintaining affordability if annual flood insurance premiums increase to an amount greater than 2% of the liability coverage amount under the policy, including options for enhanced mitigation assistance and means. National flood insurance program which took effect today, april 1, 2016. Criticism resulted in passage of the homeowner flood insurance affordability act (hfiaa) of 2014, which repealed many of the mandated premium increases required under biggert watters.

Source: nap.edu

Source: nap.edu

National flood insurance program which took effect today, april 1, 2016. Highlights of the changes include the following and apply to new insurance policies and renewals effective on or after april 1, 2016: (a) short title.—this act may be cited as the ‘‘homeowner flood insurance affordability act of 2014’’. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations. To address the need, the u.s.

Source: cnycn.org

To address the need, the u.s. On april 1st, 2015, the homeowner flood insurance affordability act (hfiaa) made the first round of changes and only 1 year after that, more changes were to follow. Criticism resulted in passage of the homeowner flood insurance affordability act (hfiaa) of 2014, which repealed many of the mandated premium increases required under biggert watters. (b) table of contents.—the table of contents for this act is as follows: As under current law, the amount of mandatory flood insurance shall be, for either federal or private flood insurance, equal to the development or project cost of the building, mobile home, or personal property (less estimated land cost), the outstanding principal balance of the loan, or the maximum limit of federal flood insurance coverage available for the particular type.

Source: aspray.com

Source: aspray.com

Affordability of national flood insurance program premiums: The changes took place on april 1st, 2016 and they’ll undoubtedly affect anyone who purchased a flood insurance policy. Section 13 of the affordability act is causing some controversy. Congress established the national flood insurance program (nfip) as a federal program in 1968. Criticism resulted in passage of the homeowner flood insurance affordability act (hfiaa) of 2014, which repealed many of the mandated premium increases required under biggert watters.

Source: cnycn.org

Source: cnycn.org

As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). As under current law, the amount of mandatory flood insurance shall be, for either federal or private flood insurance, equal to the development or project cost of the building, mobile home, or personal property (less estimated land cost), the outstanding principal balance of the loan, or the maximum limit of federal flood insurance coverage available for the particular type. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations. This video will summarize the changes effective april 1, 2016. (b) table of contents.—the table of contents for this act is as follows:

Source: archive.constantcontact.com

Source: archive.constantcontact.com

For all new loans secured by residential improved real estate or a mobile home or ones that experience a “triggering event” (making, increasing, renewing or extending the loan) after january 1, 2016, a lender must escrow all premiums and fees for flood insurance, subject to certain exceptions. Affordability of national flood insurance program premiums: (b) table of contents.—the table of contents for this act is as follows: Fema currently has the authority. Repeal of certain rate increases.

Source: nap.edu

Source: nap.edu

Section 28, clear communication of risk, within the homeowner flood affordability insurance act of 2014 (hfiaa), requires fema to clearly communicate full flood risk determinations to individual property owners. While hfiaa resulted in more affordable premiums for property owners the continuation of Short title and table of contents. (b) table of contents.—the table of contents for this act is as follows: Highlights of the changes include the following and apply to new insurance policies and renewals effective on or after april 1, 2016:

Source: nap.edu

Source: nap.edu

This video will summarize the changes effective april 1, 2016. This video will summarize the changes effective april 1, 2016. Section 13 of the affordability act is causing some controversy. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). On march 23 congress passed the homeowner flood insurance affordability act.

Source: dlnreng.hawaii.gov

Source: dlnreng.hawaii.gov

Criticism resulted in passage of the homeowner flood insurance affordability act (hfiaa) of 2014, which repealed many of the mandated premium increases required under biggert watters. Short title and table of contents. On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. National flood insurance program which took effect today, april 1, 2016. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations.

Source: nap.edu

Source: nap.edu

Short title and table of contents. Statement of applicability to institutions under $1 billion in total assets: On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. Repeal of certain rate increases. On march 23 congress passed the homeowner flood insurance affordability act.

Source: lawleyinsurance.com

Source: lawleyinsurance.com

(b) table of contents.—the table of contents for this act is as follows: As under current law, the amount of mandatory flood insurance shall be, for either federal or private flood insurance, equal to the development or project cost of the building, mobile home, or personal property (less estimated land cost), the outstanding principal balance of the loan, or the maximum limit of federal flood insurance coverage available for the particular type. Repeal of certain rate increases. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations. Statement of applicability to institutions under $1 billion in total assets:

Source: jackscomplianceresource.com

Source: jackscomplianceresource.com

On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016. (a) short title.—this act may be cited as the ‘‘homeowner flood insurance affordability act of 2014’’. To address the need, the u.s. This is a major change from the prior flood insurance regulations, which. Affordability of national flood insurance program premiums:

Source: myescambia.com

Source: myescambia.com

As under current law, the amount of mandatory flood insurance shall be, for either federal or private flood insurance, equal to the development or project cost of the building, mobile home, or personal property (less estimated land cost), the outstanding principal balance of the loan, or the maximum limit of federal flood insurance coverage available for the particular type. National flood insurance program which took effect today, april 1, 2016. In 2014, fema and the national flood insurance program (nfip) began work to implement congressionally mandated reforms to the existing flood insurance legislation with the homeowner flood insurance affordability act (hfiaa). Repeal of certain rate increases. On october 2, 2015, fema announced changes that the nfip will implement effective april 1, 2016.

Source: slideshare.net

Source: slideshare.net

In 2014, fema and the national flood insurance program (nfip) began work to implement congressionally mandated reforms to the existing flood insurance legislation with the homeowner flood insurance affordability act (hfiaa). Section 13 of the affordability act is causing some controversy. Waters flood insurance reform act, the homeowner flood insurance affordability act, and the agency’s final rules on flood insurance at part 339 of title 12 of the code of federal regulations. While hfiaa resulted in more affordable premiums for property owners the continuation of Highlights of the changes include the following and apply to new insurance policies and renewals effective on or after april 1, 2016:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowner flood insurance affordability act 2016 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.