Homeowner flood insurance affordability act of 2014 Idea

Home » Trend » Homeowner flood insurance affordability act of 2014 IdeaYour Homeowner flood insurance affordability act of 2014 images are ready in this website. Homeowner flood insurance affordability act of 2014 are a topic that is being searched for and liked by netizens now. You can Download the Homeowner flood insurance affordability act of 2014 files here. Find and Download all free photos.

If you’re searching for homeowner flood insurance affordability act of 2014 images information related to the homeowner flood insurance affordability act of 2014 interest, you have pay a visit to the ideal blog. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

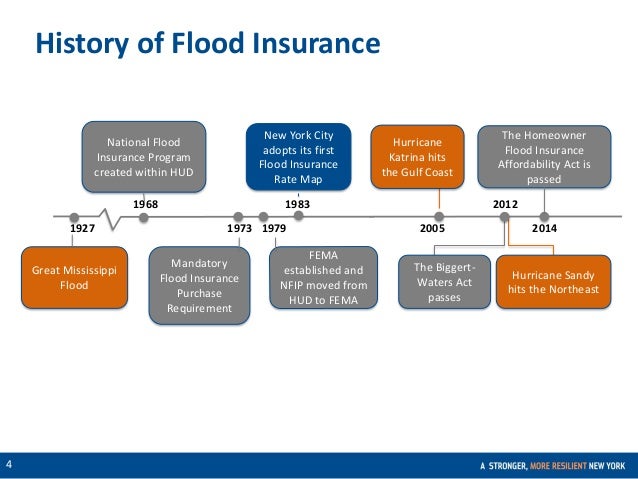

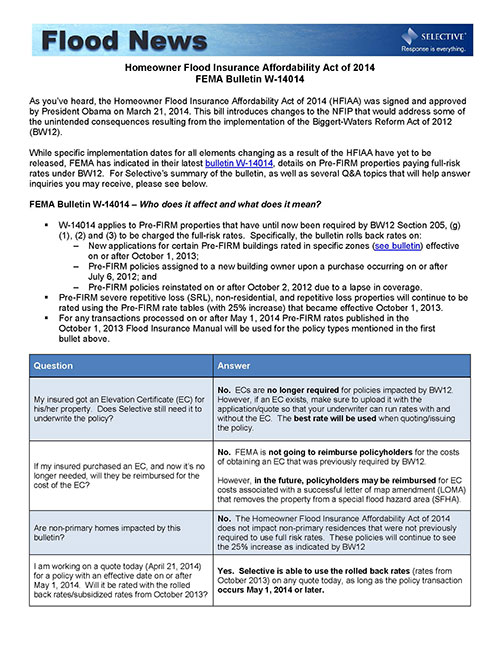

Homeowner Flood Insurance Affordability Act Of 2014. Hr 3370 homeowner flood insurance flood affordability act of 2014 summary help for homeowners caps yearly premium increases. (b) table of contents.—the table of contents for this act is as follows: (a) short title.—this act may be cited as the ‘‘homeowner flood insurance affordability act of 2014’’. As you’ve heard, the homeowner flood insurance affordability act of 2014(hfiaa) was signed and approved by president obama on march 21, 2014.

H.R. 3370 (113th) Homeowner Flood Insurance Affordability From govtrack.us

On march 21, 2014, the homeowner flood insurance affordability act of 2014 was signed into law. Short title and table of contents. The surcharge amount depends on the use of your insured building and the type of policy insuring the building, regardless of its flood zone or date of construction. Rate based on true flood risk) the homeowner flood insurance affordability act of 2014 (hfiaa) requires gradual insurance rate increases to properties that currently receive artificially low (or subsidized) rates, rather than immediate increases to reflect the property�s full flood risk. The new law limits the rate of increase for individual. H.r.3370 homeowner flood insurance affordability act of 2014 written by burrage sais1979 monday, november 15, 2021 add comment edit the senate today went along with the house of representatives by passing a bill to reverse flood insurance reforms and curb flood insurance premium increases.

Short title, see 42 u.s.c.

Congress was concerned that as nfip rate discounts phased out, flood insurance premiums would become. Affordability of national flood insurance program premiums: In govtrack.us, a database of bills in the u.s. On march 21, 2014, the homeowner flood insurance affordability act of 2014 was signed into law. Short title, see 42 u.s.c. The president signed the new homeowners flood insurance affordability act (hfiaa) into law on 3/21/ 2014.

Source: insurox.com

Source: insurox.com

The homeowner flood insurance affordability act of 2014 will do the following: H.r.3370 homeowner flood insurance affordability act of 2014 written by burrage sais1979 monday, november 15, 2021 add comment edit the senate today went along with the house of representatives by passing a bill to reverse flood insurance reforms and curb flood insurance premium increases. Homeowner flood insurance affordability act of 2014 section by section summary on march 21, 2014, president obama signed into law the homeowner flood insurance affordability act of 2014 (hifaa) (p.l. On march 21, 2014, the homeowner flood insurance affordability act of 2014 was signed into law. Homeowner flood insurance affordability act of 2014 (hfiaa) news.

Source: nap.edu

Source: nap.edu

Congress was concerned that as nfip rate discounts phased out, flood insurance premiums would become. (b) table of contents.—the table of contents for this act is as follows: Repeals requirement that flood insurance premiums increase immediately to full actuarial rates for homes that are sold. Homeowner flood insurance affordability act of 2014. Rate based on true flood risk) the homeowner flood insurance affordability act of 2014 (hfiaa) requires gradual insurance rate increases to properties that currently receive artificially low (or subsidized) rates, rather than immediate increases to reflect the property�s full flood risk.

Source: jaainsurance.com

Source: jaainsurance.com

Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. The surcharge amount depends on the use of your insured building and the type of policy insuring the building, regardless of its flood zone or date of construction. The president signed the new homeowners flood insurance affordability act (hfiaa) into law on 3/21/ 2014. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). The homeowner flood insurance affordability act.

Source: pinterest.com

Source: pinterest.com

The new law limits the rate of increase for individual. Repeal of certain rate increases. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). Homeowner flood insurance affordability act of 2014.

Source: agordon.com

Source: agordon.com

The homeowner flood insurance affordability act. Repeal of certain rate increases. The homeowner flood insurance affordability act of 2014 (hr 3370) (hfiaa) was signed into law by president obama on 21 march 2014. In govtrack.us, a database of bills in the u.s. Restores “grandfathering” for properties that were paying premiums applicable to their initial

Source: nap.edu

Source: nap.edu

Short title and table of contents. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. 3) amends the national flood insurance act of 1968 (nfia) to repeal the prohibition against any extension by the administrator of the federal emergency management agency (fema) of flood insurance premium subsidies to prospective insureds for property: The homeowner flood insurance affordability act of 2014 will do the following: Repeals requirement that flood insurance premiums increase immediately to full actuarial rates for homes that are sold.

Source: www1.nyc.gov

Source: www1.nyc.gov

Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. Homeowner flood insurance affordability act of 2014 (hfiaa) news. Repeal of certain rate increases. The new hfiaa certainly does not repeal all of bw12. Hfiaa, as its name would suggest, was prompted by concerns over the affordability of national flood insurance program (“nfip”) policies for consumers.

Source: slideshare.net

Source: slideshare.net

Homeowner flood insurance affordability act of 2014 (hfiaa) news. House subcommittee renews call for private flood insurance. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. Homeowner flood insurance affordability act of 2014. 957) is amended— (1) in paragraph (3), by striking “and” at the end;

Source: thomeinsurance.com

Source: thomeinsurance.com

The new hfiaa certainly does not repeal all of bw12. Short title and table of contents. Repeals requirement that flood insurance premiums increase immediately to full actuarial rates for homes that are sold. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). Hfiaa, as its name would suggest, was prompted by concerns over the affordability of national flood insurance program (“nfip”) policies for consumers.

Source: slideshare.net

Source: slideshare.net

Hr 3370 homeowner flood insurance flood affordability act of 2014 summary help for homeowners caps yearly premium increases. Short title, see 42 u.s.c. The homeowner flood insurance affordability act of 2014 (hr 3370) (hfiaa) was signed into law by president obama on 21 march 2014. The homeowner flood insurance affordability act of 2014 will do the following: House subcommittee renews call for private flood insurance.

Source: hendersonbrothers.com

Source: hendersonbrothers.com

Homeowner flood insurance affordability act of 2014 (hfiaa) news. Short title and table of contents. H.r.3370 homeowner flood insurance affordability act of 2014 written by burrage sais1979 monday, november 15, 2021 add comment edit the senate today went along with the house of representatives by passing a bill to reverse flood insurance reforms and curb flood insurance premium increases. Affordability of national flood insurance program premiums: Homeowner flood insurance affordability act of 2014 section by section summary on march 21, 2014, president obama signed into law the homeowner flood insurance affordability act of 2014 (hifaa) (p.l.

Source: neptunetownship.org

Source: neptunetownship.org

Homeowner flood insurance affordability act of 2014. House subcommittee renews call for private flood insurance. Hfiaa, as its name would suggest, was prompted by concerns over the affordability of national flood insurance program (“nfip”) policies for consumers. In govtrack.us, a database of bills in the u.s. (1) not insured as of the date of.

Source: nap.edu

Source: nap.edu

The homeowner flood insurance affordability act. Congress was concerned that as nfip rate discounts phased out, flood insurance premiums would become. (b) table of contents.—the table of contents for this act is as follows: Affordability of national flood insurance program premiums: The homeowner flood insurance affordability act of 2014 (hr 3370) (hfiaa) was signed into law by president obama on 21 march 2014.

Source: lawleyinsurance.com

Source: lawleyinsurance.com

Hfiaa, as its name would suggest, was prompted by concerns over the affordability of national flood insurance program (“nfip”) policies for consumers. The new law limits the rate of increase for individual. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. (b) table of contents.—the table of contents for this act is as follows: 957) is amended— (1) in paragraph (3), by striking “and” at the end;

Source: govtrack.us

House subcommittee renews call for private flood insurance. Congress was concerned that as nfip rate discounts phased out, flood insurance premiums would become. As of april 1, 2015, every new or renewed nfip policy includes an annual surcharge required by the homeowner flood insurance affordability act of 2014 (hfiaa). Affordability of national flood insurance program premiums: Repeals requirement that flood insurance premiums increase immediately to full actuarial rates for homes that are sold.

Source: govtrack.us

Homeowner flood insurance affordability act of 2014 (hfiaa) news. Short title, see 42 u.s.c. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. Homeowner flood insurance affordability act of 2014. The homeowner flood insurance affordability act of 2014 will do the following:

Source: iiabsc.com

Source: iiabsc.com

The homeowner flood insurance affordability act. Be it enacted by the senate and house of representatives of the united states of america in congress assembled, section 1. Affordability of national flood insurance program premiums: House subcommittee renews call for private flood insurance. The homeowner flood insurance affordability act.

Source: nap.edu

Source: nap.edu

Hfiaa, as its name would suggest, was prompted by concerns over the affordability of national flood insurance program (“nfip”) policies for consumers. Restores “grandfathering” for properties that were paying premiums applicable to their initial The homeowner flood insurance affordability act of 2014 (hr 3370) (hfiaa) was signed into law by president obama on 21 march 2014. The president signed the new homeowners flood insurance affordability act (hfiaa) into law on 3/21/ 2014. (a) short title.—this act may be cited as the ‘‘homeowner flood insurance affordability act of 2014’’.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowner flood insurance affordability act of 2014 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.