Homeowners insurance average cost kentucky Idea

Home » Trending » Homeowners insurance average cost kentucky IdeaYour Homeowners insurance average cost kentucky images are available in this site. Homeowners insurance average cost kentucky are a topic that is being searched for and liked by netizens today. You can Find and Download the Homeowners insurance average cost kentucky files here. Get all royalty-free photos and vectors.

If you’re looking for homeowners insurance average cost kentucky images information related to the homeowners insurance average cost kentucky keyword, you have come to the ideal site. Our website frequently gives you hints for viewing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Homeowners Insurance Average Cost Kentucky. Usaa had the lowest prices we found for homeowners insurance, with an average of $878 per year — that�s 37.6% less expensive than the statewide average. As a whole, the average cost of homeowners insurance is $1,680 per year and $140 per month — but the cost of coverage varies significantly based on state laws, your home�s location and the cost to rebuild. Kentuckians pay an average of $96 per month for homeowners insurance, which is less than the national average of $101. The average cost of homeowners insurance in the u.s.

Kentucky Farm Bureau Insurance Rates & Consumer Ratings From clearsurance.com

Kentucky Farm Bureau Insurance Rates & Consumer Ratings From clearsurance.com

Average cost of homeowners insurance (2022) in the u.s. Homeowners insurance costs around $104 a month or $1,249 per year on average. Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013. Usaa had the lowest prices we found for homeowners insurance, with an average of $878 per year — that�s 37.6% less expensive than the statewide average. How much is homeowners insurance on a $400 000 house? How much is homeowners insurance?

One way that some homeowners try to avoid these problems.

Homeowners insurance can become expensive over time, and providers have been known to raise rates regularly after having to pay out claims. Our agents are hometown people delivering honest answers, good advice, and quality customer service from within your community. Average homeowners insurance rates in. In kentucky, the average cost of homeowners insurance is $1,839 per year for $250,000 in dwelling coverage. Average cost of homeowners insurance (2022) in the u.s. How much is homeowners insurance?

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Average homeowners insurance in kentucky: How much is homeowners insurance? How much is homeowners insurance on a $400 000 house? What you need to know. Average homeowners insurance rates in.

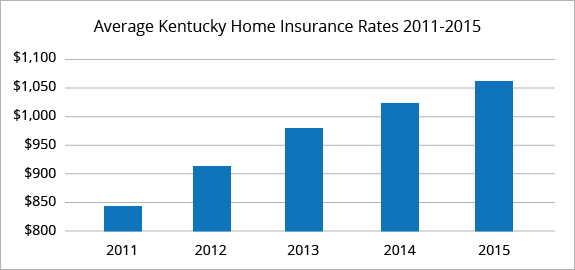

The average homeowners insurance cost is $1,806 annually for the dwelling coverage of $200,000 and liability protection of $100,000. It is for this reason that states such as texas, florida, kentucky and oklahoma, among others, have incredibly high premiums ($1,937, $1,918, $1,085, and $1,875, respectively). Now, this may sound like a large number for the bluegrass state, but when compared to louisiana �s average annual premium of $1,967, kentucky�s premiums are below average. Homeowners insurance rates have gradually risen in recent years, but remain below average: In kentucky, the average cost of homeowners insurance is $1,839 per year for $250,000 in dwelling coverage.

Zillow estimates that homeowners can expect to pay approximately $35 each month for every $100,000 of your home�s value. Buying homeowners insurance in kentucky is important because the state experiences some of the world�s most extreme weather. As a whole, the average cost of homeowners insurance is $1,680 per year and $140 per month — but the cost of coverage varies significantly based on state laws, your home�s location and the cost to rebuild. The price of a homeowners insurance policy depends on many factors. Median home price in kentucky:

Source: corehub.me

Source: corehub.me

The price of a homeowners insurance policy depends on many factors. The average cost of coverage for home insurance depends on the average dwelling coverage and the home’s value. Our thorough analysis indicates shoppers can save as much as $333 by getting multiple quotes. How much is homeowners insurance on a $400 000 house? Read reviews and our detailed analysis of oldham county, ky homeowners insurance, compare quotes to get the best deal from the most trustworthy providers.

Source: icybluedesign.blogspot.com

Source: icybluedesign.blogspot.com

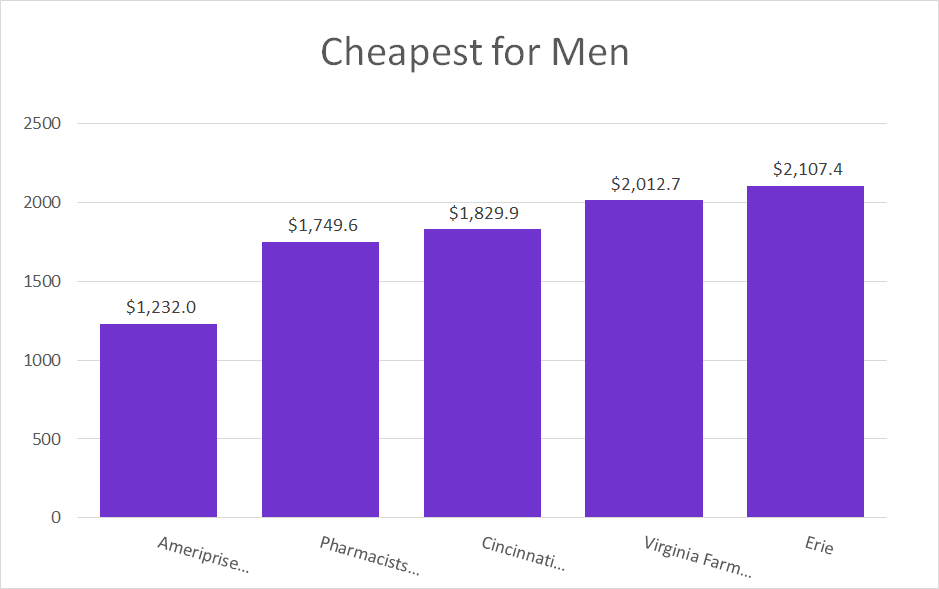

In kentucky, the average cost of homeowners insurance is $1,839 per year for $250,000 in dwelling coverage. The average homeowners insurance cost is $1,806 annually for the dwelling coverage of $200,000 and liability protection of $100,000. Average homeowners insurance in kentucky: The average premium of homeowners insurance in kentucky ranges was calculated to be $1,085, according to data gathered in 2016. Your home insurance policy premium is determined by a number of factors.

Source: yearly.buzz

Source: yearly.buzz

One way that some homeowners try to avoid these problems. The average homeowners policy costs $119 per month in lexington, kentucky. Average homeowners insurance in kentucky: Median home price in kentucky: Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Zillow estimates that homeowners can expect to pay approximately $35 each month for every $100,000 of your home�s value. The average american household pays around 2.02% of their annual household income on home insurance. The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can. 53 rows the average homeowners insurance cost in the u.s. The average homeowners insurance cost for $250,000 in dwelling coverage with $100,000 liability would be a bit less than $2,000.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

How much is homeowners insurance? The average homeowners insurance cost in the united states in 2022 is $1,393 per year for a policy with $250,000 in dwelling coverage. In comparison, the national average is $1,312 per year. Buying homeowners insurance in kentucky is important because the state experiences some of the world�s most extreme weather. Average homeowners insurance rates in.

Source: clearsurance.com

Source: clearsurance.com

It is for this reason that states such as texas, florida, kentucky and oklahoma, among others, have incredibly high premiums ($1,937, $1,918, $1,085, and $1,875, respectively). The average homeowners policy costs $119 per month in lexington, kentucky. The average american household pays around 2.02% of their annual household income on home insurance. The average yearly cost of homeowners insurance is $1,806 for a dwelling coverage of $200,000 and liability coverage of $100,000. The average homeowners insurance cost for $250,000 in dwelling coverage with $100,000 liability would be a bit less than $2,000.

Read reviews and our detailed analysis of oldham county, ky homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. In comparison, the national average is $1,312 per year. Our thorough analysis indicates shoppers can save as much as $333 by getting multiple quotes. The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can. The price of a homeowners insurance policy depends on many factors.

Source: obrella.com

Source: obrella.com

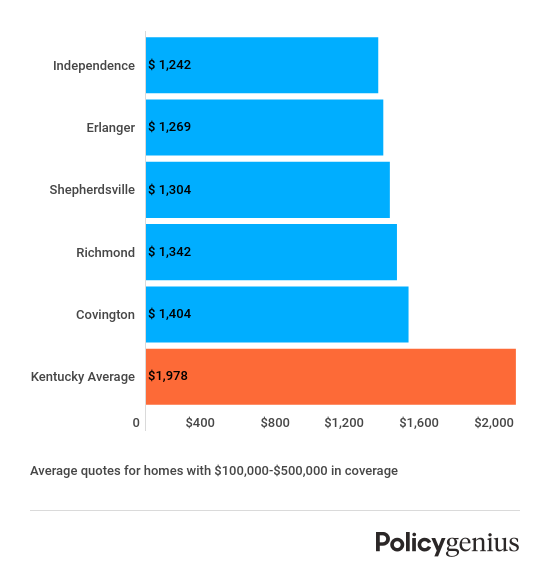

This can include the overall value of your house, the value of your personal belongings, and the materials that were used when building your home. In comparison, the national average is $1,312 per year. The average yearly cost of homeowners insurance is $1,806 for a dwelling coverage of $200,000 and liability coverage of $100,000. Average homeowners insurance in kentucky: Cost of homeowners insurance in kentucky is $1,978, which is a few hundred dollars.

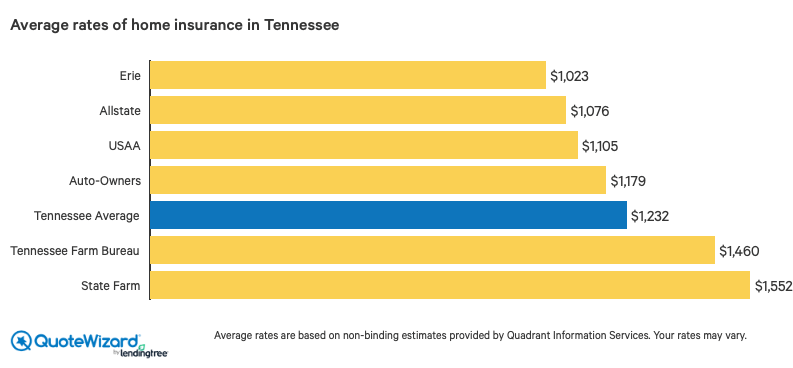

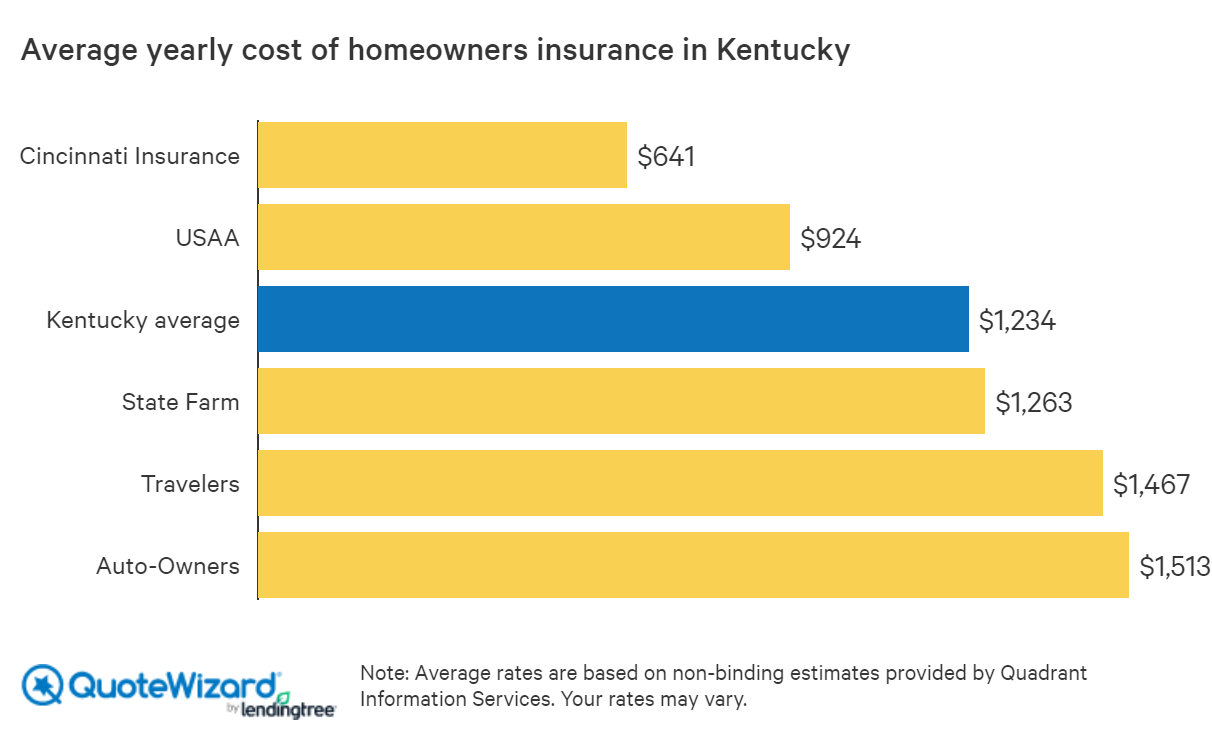

Source: quotewizard.com

Source: quotewizard.com

The cost of insuring a home has continued to rise steadily throughout the country. Join the more than 325,000 kentuckians who protect their home with an insurance company based right here in the bluegrass state. The average homeowners insurance cost in the united states in 2022 is $1,393 per year for a policy with $250,000 in dwelling coverage. How much is homeowners insurance? The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can.

Source: quotewizard.com

Source: quotewizard.com

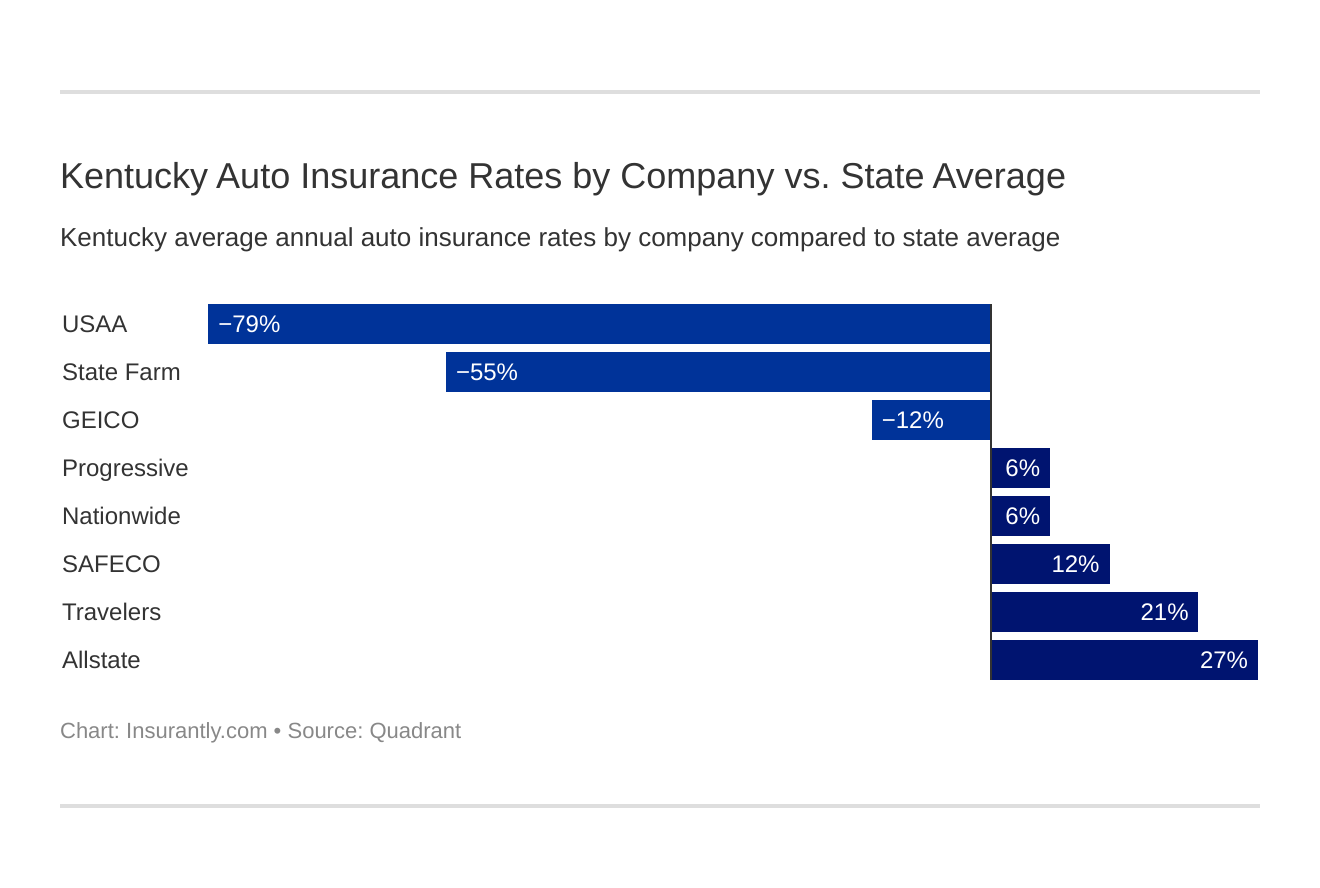

The average premium of homeowners insurance in kentucky ranges was calculated to be $1,085, according to data gathered in 2016. Now, this may sound like a large number for the bluegrass state, but when compared to louisiana �s average annual premium of $1,967, kentucky�s premiums are below average. One way that some homeowners try to avoid these problems. Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013. Homeowners insurance rates have gradually risen in recent years, but remain below average:

The average cost of homeowners insurance in the u.s. Average cost of homeowners insurance (2022) in the u.s. This is a 6% increase from 2021’s average price of $1,312. Your home insurance policy premium is determined by a number of factors. Average cost of homeowners insurance in kentucky according to 2021 data from bankrate.com, the average kentucky resident pays $1,839 per year for a home insurance policy with $250,000 in dwelling coverage.

Source: realestateinvestingtoday.com

Source: realestateinvestingtoday.com

Read reviews and our detailed analysis of oldham county, ky homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. The average premium of homeowners insurance in kentucky ranges was calculated to be $1,085, according to data gathered in 2016. The average yearly cost of homeowners insurance is $1,806 for a dwelling coverage of $200,000 and liability coverage of $100,000. 53 rows the average homeowners insurance cost in the u.s. The biggest factors that affect homeowners insurance cost are your coverage limits, where you live , the age and construction quality of your home, your claims history , and your.

Source: bankrate.com

Source: bankrate.com

Kentuckians pay an average of $96 per month for homeowners insurance, which is less than the national average of $101. The average cost of coverage for home insurance depends on the average dwelling coverage and the home’s value. Homeowners insurance can become expensive over time, and providers have been known to raise rates regularly after having to pay out claims. The cost of insuring a home has continued to rise steadily throughout the country. Our thorough analysis indicates shoppers can save as much as $333 by getting multiple quotes.

Source: policygenius.com

Source: policygenius.com

Buying homeowners insurance in kentucky is important because the state experiences some of the world�s most extreme weather. Average cost of homeowners insurance (2022) in the u.s. Your home is one of your greatest investments. Kentuckians pay an average of $96 per month for homeowners insurance, which is less than the national average of $101. Our agents are hometown people delivering honest answers, good advice, and quality customer service from within your community.

Source: gavop.com

Source: gavop.com

Our thorough analysis indicates shoppers can save as much as $333 by getting multiple quotes. Is about $1,585 a year, but rates vary by state. One way that some homeowners try to avoid these problems. What you need to know. These areas are risky to insurance companies as they are more prone to damage and therefore, filing of claims, which insurance companies view as losses.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowners insurance average cost kentucky by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.