Homeowners insurance cost seattle information

Home » Trend » Homeowners insurance cost seattle informationYour Homeowners insurance cost seattle images are available in this site. Homeowners insurance cost seattle are a topic that is being searched for and liked by netizens today. You can Download the Homeowners insurance cost seattle files here. Download all royalty-free photos and vectors.

If you’re searching for homeowners insurance cost seattle pictures information connected with to the homeowners insurance cost seattle keyword, you have come to the right blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

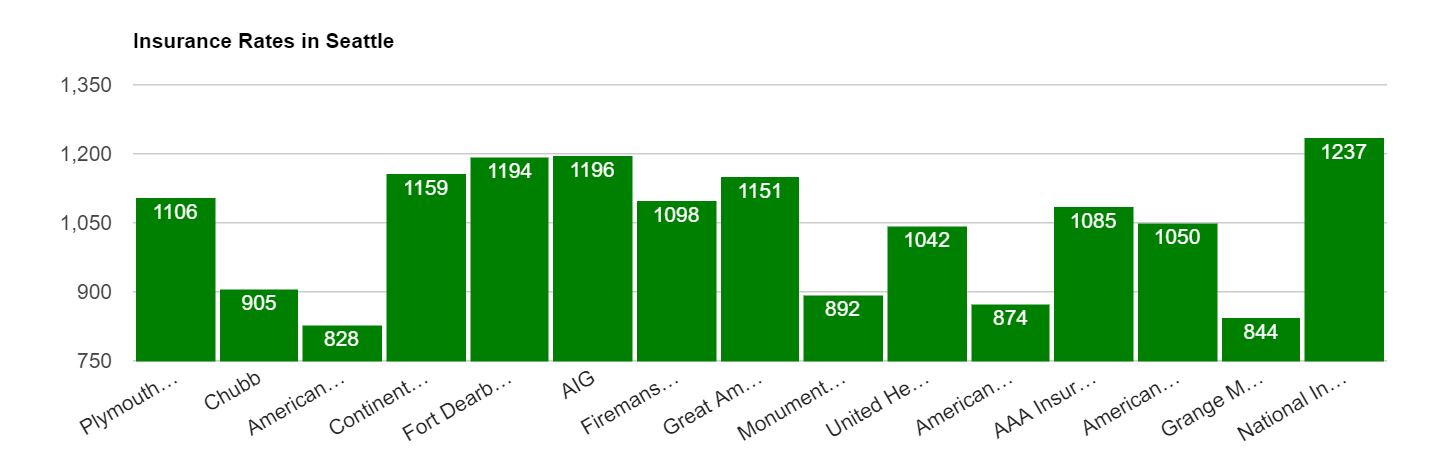

Homeowners Insurance Cost Seattle. How much you want to cover. Average homeowners insurance cost in wa state. For example, if you had a $500 deductible, you would be responsible for paying the first $500 of the covered loss. Homeowners insurance rates in seattle vary from one insurance company to another.

What Makes Car Insurance Rates Expensive in Seattle, WA From gavop.com

What Makes Car Insurance Rates Expensive in Seattle, WA From gavop.com

Higher deductibles usually lower your premium price by shifting part of the loss payment to you. Increasingly, it is recommended that homeowners consider purchasing at least $300,000 to $500,000 worth of coverage of liability protection. How much you want to cover. According to insure.com, the average annual homeowners insurance rate in oklahoma city is $6045, while seattle’s average rate is $1214. Each insurance company has algorithms they use to calculate premiums. Average cost of homeowners insurance in washington.

The most expensive company is country financial, at $1,642 annually.

According to insure.com, the average annual homeowners insurance rate in oklahoma city is $6045, while seattle’s average rate is $1214. Clearly, there is a notable difference between these two premiums. However, premiums vary greatly between providers and are based on your personal. Each insurance company has algorithms they use to calculate premiums. $780 a year, or about $65 a month, on average. 53 rows new hampshire:

Source: smartasset.com

Source: smartasset.com

We collected home insurance quotes from 12 of the most popular insurance companies in washington to determine which one offers the best rates to homeowners. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. Clearly, there is a notable difference between these two premiums. Metlife had the highest rates, with an average annual premium of $1,050 for $375,000 of coverage. For example, if you had a $500 deductible, you would be responsible for paying.

Source: seattleinsuranceanderisablog.com

Source: seattleinsuranceanderisablog.com

Each insurance company has algorithms they use to calculate premiums. The price of your coverage will vary depending on what coverage you require. Increasingly, it is recommended that homeowners consider purchasing at least $300,000 to $500,000 worth of coverage of liability protection. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. The most affordable home insurance in seattle is safeco offering average annual rates at just $277 per year.

Source: sav-on.com

Source: sav-on.com

Our ability to match your needs with a valuable and affordable. How much you want to cover. Higher deductibles usually lower your premium price by shifting part of the loss payment to you. According to insure.com, the average annual homeowners insurance rate in oklahoma city is $6045, while seattle’s average rate is $1214. Average cost of homeowners insurance in washington.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

In seattle, washington, homeowners insurance costs an average of $1,075 per year or about $90 per month. Read reviews and our detailed analysis of king county, wa homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. Seattle, wa homeowners insurance cost based on deductible. These are the most expensive states for homeowners insurance: $780 a year, or about $65 a month, on average.

Sound insurance in seattle have 50 years in regards to assisting you with renters insurance. For example, if you had a $500 deductible, you would be responsible for paying the first $500 of the covered loss. The average yearly cost of homeowners insurance in washington is $863 for a $250,000 dwelling coverage policy. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. But the price you will pay for home insurance will depend on the age.

Source: insurancequote.deals

Source: insurancequote.deals

Each insurance company has algorithms they use to calculate premiums. Homeowners insurance rates in seattle vary from one insurance company to another. Of the insurers offered by policygenius, we determined the most affordable homeowners insurance company in seattle is stillwater with an average annual premium of around $850 for $275,000 of coverage. According to quadrant information services research, seattle homeowners pay an annual homeowners insurance premium of $823 per year for coverage with $250,000 worth of dwelling coverage. Washington is the 30th most expensive state for home insurance premiums.

Source: pinterest.com

Source: pinterest.com

Washington is the 30th most expensive state for home insurance premiums. According to quadrant information services research, seattle homeowners pay an annual homeowners insurance premium of $823 per year for coverage with $250,000 worth of dwelling coverage. Higher deductibles usually lower your premium price by shifting part of the loss payment to you. Of the insurers offered by policygenius, we determined the most affordable homeowners insurance company in seattle is stillwater with an average annual premium of around $850 for $275,000 of coverage. We found that nationwide offers the best home rates by far, with an average cost of just $511.

Source: revisi.net

Source: revisi.net

This puts washington below the national average cost for a homeowners policy, making it one of the most affordable states in the country when it comes to home insurance coverage. Average cost of homeowners insurance in washington. Each insurance company has algorithms they use to calculate premiums. Higher deductibles usually lower your premium price by shifting part of the loss payment to you. The price of your coverage will vary depending on what coverage you require.

Source: filerinsurance.com

Source: filerinsurance.com

The average yearly cost of homeowners insurance in washington is $863 for a $250,000 dwelling coverage policy. Each insurance company has algorithms they use to calculate premiums. How much you want to cover. Higher deductibles usually lower your premium price by shifting part of the loss payment to you. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy.

Higher deductibles usually lower your premium price by shifting part of the loss payment to you. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. Our detailed research indicates shoppers can save as much as $252 by getting multiple quotes. Yet, less than half of its homes were occupied by owners. The cheapest provider in seattle is travelers, with rates of $662 per year on average.

Source: thebalance.com

Source: thebalance.com

Metlife had the highest rates, with an average annual premium of $1,050 for $375,000 of coverage. Read reviews and our detailed analysis of king county, wa homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. Sound insurance in seattle have 50 years in regards to assisting you with renters insurance. We found that nationwide offers the best home rates by far, with an average cost of just $511. For example, if you had a $500 deductible, you would be responsible for paying the first $500 of the covered loss.

Source: quotewizard.com

Source: quotewizard.com

Homeowners insurance rates in seattle vary from one insurance company to another. Seattle, wa average homeowners insurance cost. Our detailed research indicates shoppers can save as much as $252 by getting multiple quotes. Generally, most homeowners insurance policies provide a minimum of $100,000 worth of liability insurance, but higher amounts are available. Don swanson insurance has helped all kinds of homeowners throughout burien, normandy park, seattle, des moines, sea tac, west seattle, and all areas throughout the puget sound region.

Source: revisi.net

Source: revisi.net

These are the most expensive states for homeowners insurance: The price of your coverage will vary depending on what coverage you require. Seattle, wa average homeowners insurance cost. This is considerably cheaper than the city’s average homeowners premium of $2,249. We collected home insurance quotes from 12 of the most popular insurance companies in washington to determine which one offers the best rates to homeowners.

Yet, less than half of its homes were occupied by owners. However, premiums vary greatly between providers and are based on your personal. We collected home insurance quotes from 12 of the most popular insurance companies in washington to determine which one offers the best rates to homeowners. It’s comparison shopping at the click of a mouse. Clearly, there is a notable difference between these two premiums.

Source: bankrate.com

Source: bankrate.com

For example, if you had a $500 deductible, you would be responsible for paying. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. Seattle homeowners pay an average annual homeowners insurance premium of $823 for a policy with $250,000 in dwelling coverage. Homeowners insurance rates in seattle vary from one insurance company to another. The most affordable home insurance in seattle is safeco offering average annual rates at just $277 per year.

Source: thesimpledollar.com

Source: thesimpledollar.com

Our detailed research indicates shoppers can save as much as $252 by getting multiple quotes. Generally, most homeowners insurance policies provide a minimum of $100,000 worth of liability insurance, but higher amounts are available. How much you want to cover. $744 a year, or about $62 a month, on average. This puts washington below the national average cost for a homeowners policy, making it one of the most affordable states in the country when it comes to home insurance coverage.

Source: gavop.com

Source: gavop.com

The most affordable home insurance in seattle is safeco offering average annual rates at just $277 per year. How much you want to cover. According to average annual rates from coverage.com, the average cost of home insurance in washington is $1,149 for $200,000 in dwelling coverage. $780 a year, or about $65 a month, on average. Each insurance company has algorithms they use to calculate premiums.

Source: seattletimes.com

Source: seattletimes.com

Generally, most homeowners insurance policies provide a minimum of $100,000 worth of liability insurance, but higher amounts are available. The price of your coverage will vary depending on what coverage you require. Here is the average cost of condo insurance per month for common coverage levels, all with $1,000 deductible and $300,000 in liability. Oftentimes homeowners insurance options are priced individually, so how much you’ll pay for your policy depends on what coverages you buy. This is considerably cheaper than the city’s average homeowners premium of $2,249.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title homeowners insurance cost seattle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.