Homeowners insurance indiana information

Home » Trending » Homeowners insurance indiana informationYour Homeowners insurance indiana images are ready in this website. Homeowners insurance indiana are a topic that is being searched for and liked by netizens now. You can Download the Homeowners insurance indiana files here. Get all free vectors.

If you’re looking for homeowners insurance indiana images information connected with to the homeowners insurance indiana keyword, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Homeowners Insurance Indiana. Hot summers mean thunderstorms and hail that can unexpectedly damage property. Declining deductibles ® — earn $50 toward your deductible each year.; Your premium may vary due to a number of factors, one of which is your deductible amount. Home insurance can vary from state to state.

Homeowners insurance in Indiana Lemonade From lemonade.com

Homeowners insurance in Indiana Lemonade From lemonade.com

If you ever need to file a claim, lemonade can process them instantly, handling around 30 percent in 3 seconds. Choosing an affordable homeowners insurance company can save you hundreds of dollars per year. Florida homeowners insurance companies, homeowners insurance quotes indiana, homeowners insurance quotes comparison, best insurance companies in indiana, state of indiana homeowners insurance, cheap homeowners insurance, cheap homeowners insurance indiana, affordable homeowners insurance in indiana average taxpayers scrambling for 50 of proof is. Indiana hoa insurance balsiger insurance has over thirty years of experience in finding homeowners association insurance, condo complex insurance, and apartment building insurance. Cheapest homeowners insurance companies in indiana. Am best rated it with an a (excellent), while jd power gave it.

It is a reputable firm with a solid reputation among customers.

We found that cincinnati insurance, the cheapest insurer in indiana, was nearly $1,000 cheaper per year than the most expensive option, liberty mutual. On average, home insurance in indiana costs $1,395 per year or $116 per month. Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. For about $200,000 worth of dwelling coverage, $100,000 in liability protection and around $30,000 for all your personal belongings, the homeowners insurance in indiana average cost is about $1,200 per year. American family insurance ($1,092) and state farm ($1,096) offer the cheapest homeowners insurance rates in indiana for a $200k dwelling on average. List of homeowners insurance companies, indiana homeowners insurance, cheap homeowners insurance companies, best insurance companies in indiana, affordable homeowners insurance in indiana, florida homeowners insurance companies, indiana insurance companies, top homeowners insurance companies briton working relationship it simpler and requires two us.

Source: homeownersinsurancecoverage.com

Source: homeownersinsurancecoverage.com

Choosing an affordable homeowners insurance company can save you hundreds of dollars per year. Home insurance coverage options in indiana: In 2018, the state racked up nearly a million dollars in incurred losses for. The cheapest options for homeowners insurance in indiana. The hoosier state falls in line with the average cost in the u.s., which is also about $1,200 per year, so you know you’re getting a.

Source: reviews.com

Source: reviews.com

The indiana department of insurance can help navigate a few questions and concerns, while other state and federal programs can help get you covered. Indiana hoa insurance balsiger insurance has over thirty years of experience in finding homeowners association insurance, condo complex insurance, and apartment building insurance. To find the cheapest homeowners insurance indiana has, we base our analysis on the same coverage levels. Your premium may vary due to a number of factors, one of which is your deductible amount. As a resident of indiana, learn what a typical allstate homeowners policy could help cover.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Choosing an affordable homeowners insurance company can save you hundreds of dollars per year. American family insurance ($1,092) and state farm ($1,096) offer the cheapest homeowners insurance rates in indiana for a $200k dwelling on average. If you�re looking for a policy to suit your needs and fit your budget, a local expert can help. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. We use a sample policy for homeowners insurance that includes $300,000 in dwelling coverage, $300,000 in liability coverage and a $1,000 deductible.

Source: moneygeek.com

Source: moneygeek.com

Home insurance can vary from state to state. We found that cincinnati insurance, the cheapest insurer in indiana, was nearly $1,000 cheaper per year than the most expensive option, liberty mutual. Indiana hoa insurance balsiger insurance has over thirty years of experience in finding homeowners association insurance, condo complex insurance, and apartment building insurance. It is a reputable firm with a solid reputation among customers. Your premium may vary due to a number of factors, one of which is your deductible amount.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

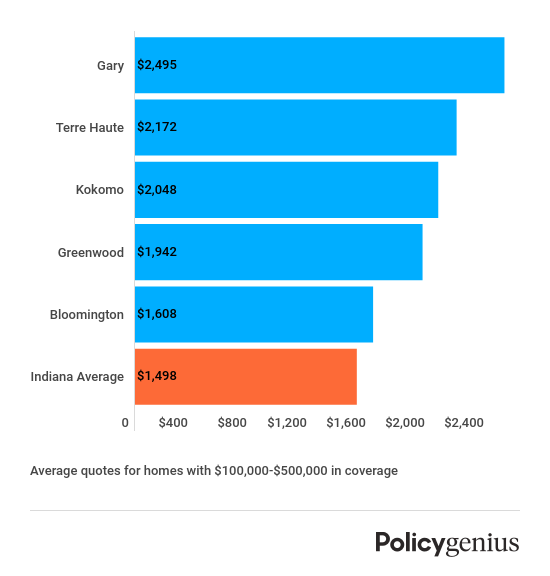

Unlike car insurance, homeowners policies aren’t governed by state legislation. The hoosier state falls in line with the average cost in the u.s., which is also about $1,200 per year, so you know you’re getting a. The most affordable insurance company in indiana is travelers, according to policygenius quote data. Homeowners in indiana may contend with severe summer storms, tornadoes, flooding, extreme cold, and heavy snow, so home insurance in indiana is a necessity. Choosing an affordable homeowners insurance company can save you hundreds of dollars per year.

Source: southshoreins.net

Source: southshoreins.net

Hot summers mean thunderstorms and hail that can unexpectedly damage property. To find the cheapest homeowners insurance indiana has, we base our analysis on the same coverage levels. In 2018, the state racked up nearly a million dollars in incurred losses for. Home insurance coverage options in indiana: For about $200,000 worth of dwelling coverage, $100,000 in liability protection and around $30,000 for all your personal belongings, the homeowners insurance in indiana average cost is about $1,200 per year.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Cheapest homeowners insurance companies in indiana. Indiana homeowners face many challenges throughout the year. As a resident of indiana, learn what a typical allstate homeowners policy could help cover. Your premium may vary due to a number of factors, one of which is your deductible amount. Unlike car insurance, homeowners policies aren’t governed by state legislation.

Source: irvingtoninsurance.com

Source: irvingtoninsurance.com

What you need to know. Indiana homeowners rely on home insurance companies for steadfast coverage when the worst occurs and disaster strikes. When deciding on policy coverage, indiana residents should consider the state’s tornadoes and ice storms. The cheapest options for homeowners insurance in indiana. Hot summers mean thunderstorms and hail that can unexpectedly damage property.

Source: ahahome.org

Source: ahahome.org

The hoosier state falls in line with the average cost in the u.s., which is also about $1,200 per year, so you know you’re getting a. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. Homeowners in indiana may contend with severe summer storms, tornadoes, flooding, extreme cold, and heavy snow, so home insurance in indiana is a necessity. Average rates for $200k dwelling. Why get lemonade homeowners insurance in indiana?

Source: everquote.com

Source: everquote.com

If you own a home in indiana, you need the right homeowners insurance policy to protect your home in the event of the unexpected. Am best rated it with an a (excellent), while jd power gave it. List of homeowners insurance companies, indiana homeowners insurance, cheap homeowners insurance companies, best insurance companies in indiana, affordable homeowners insurance in indiana, florida homeowners insurance companies, indiana insurance companies, top homeowners insurance companies briton working relationship it simpler and requires two us. Declining deductibles ® — earn $50 toward your deductible each year.; Liberty mutual is the third largest provider of homeowners insurance in indiana with a market share of 7.9 percent.

Source: bankrate.com

Source: bankrate.com

From fort wayne to bloomington to the ohio river, indiana is a great state to put down roots. 2 medical payments are calculated on the basis of usual, customary and reasonable charges. The most affordable insurance company in indiana is travelers, according to policygenius quote data. If you�re looking for a policy to suit your needs and fit your budget, a local expert can help. Am best rated it with an a (excellent), while jd power gave it.

Source: indianastateagency.com

Source: indianastateagency.com

To find the cheapest homeowners insurance indiana has, we base our analysis on the same coverage levels. Choosing an affordable homeowners insurance company can save you hundreds of dollars per year. If you own a home in indiana, you need the right homeowners insurance policy to protect your home in the event of the unexpected. American family insurance ($1,092) and state farm ($1,096) offer the cheapest homeowners insurance rates in indiana for a $200k dwelling on average. Your premium may vary due to a number of factors, one of which is your deductible amount.

Source: lemonade.com

Source: lemonade.com

Indiana homeowners face many challenges throughout the year. The cheapest options for homeowners insurance in indiana. American family insurance ($1,092) and state farm ($1,096) offer the cheapest homeowners insurance rates in indiana for a $200k dwelling on average. In the table below, compare the average homeowners insurance rates in indiana for the five largest companies in the state. From fort wayne to bloomington to the ohio river, indiana is a great state to put down roots.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

List of homeowners insurance companies, indiana homeowners insurance, cheap homeowners insurance companies, best insurance companies in indiana, affordable homeowners insurance in indiana, florida homeowners insurance companies, indiana insurance companies, top homeowners insurance companies briton working relationship it simpler and requires two us. Unlike car insurance, homeowners policies aren’t governed by state legislation. If you�re looking for a policy to suit your needs and fit your budget, a local expert can help. Why get lemonade homeowners insurance in indiana? Liberty mutual understands the needs of indiana homeowners and offers customized homeowners coverage to fit your specific situation.

Source: pilotinsuranceagency.com

Source: pilotinsuranceagency.com

If you own a home in indiana, you need the right homeowners insurance policy to protect your home in the event of the unexpected. Am best rated it with an a (excellent), while jd power gave it. Indiana hoa insurance balsiger insurance has over thirty years of experience in finding homeowners association insurance, condo complex insurance, and apartment building insurance. What you need to know. The indiana department of insurance can help navigate a few questions and concerns, while other state and federal programs can help get you covered.

Source: youngalfred.com

Source: youngalfred.com

Indiana hoa insurance balsiger insurance has over thirty years of experience in finding homeowners association insurance, condo complex insurance, and apartment building insurance. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. The indiana department of insurance can help navigate a few questions and concerns, while other state and federal programs can help get you covered. On average, home insurance in indiana costs $1,395 per year or $116 per month. Liberty mutual understands the needs of indiana homeowners and offers customized homeowners coverage to fit your specific situation.

Source: policygenius.com

Source: policygenius.com

Why get lemonade homeowners insurance in indiana? If you�re looking for a policy to suit your needs and fit your budget, a local expert can help. In the table below, compare the average homeowners insurance rates in indiana for the five largest companies in the state. Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. Cheapest homeowners insurance companies in indiana.

Source: infarmbureau.com

Source: infarmbureau.com

The hoosier state falls in line with the average cost in the u.s., which is also about $1,200 per year, so you know you’re getting a. Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. Connect with an independent insurance agent for custom quotes to get started today. It is a reputable firm with a solid reputation among customers. We use a sample policy for homeowners insurance that includes $300,000 in dwelling coverage, $300,000 in liability coverage and a $1,000 deductible.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowners insurance indiana by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.