Homeowners insurance law and ordinance coverage Idea

Home » Trend » Homeowners insurance law and ordinance coverage IdeaYour Homeowners insurance law and ordinance coverage images are ready in this website. Homeowners insurance law and ordinance coverage are a topic that is being searched for and liked by netizens today. You can Find and Download the Homeowners insurance law and ordinance coverage files here. Get all royalty-free photos.

If you’re looking for homeowners insurance law and ordinance coverage pictures information connected with to the homeowners insurance law and ordinance coverage topic, you have come to the ideal blog. Our website always provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

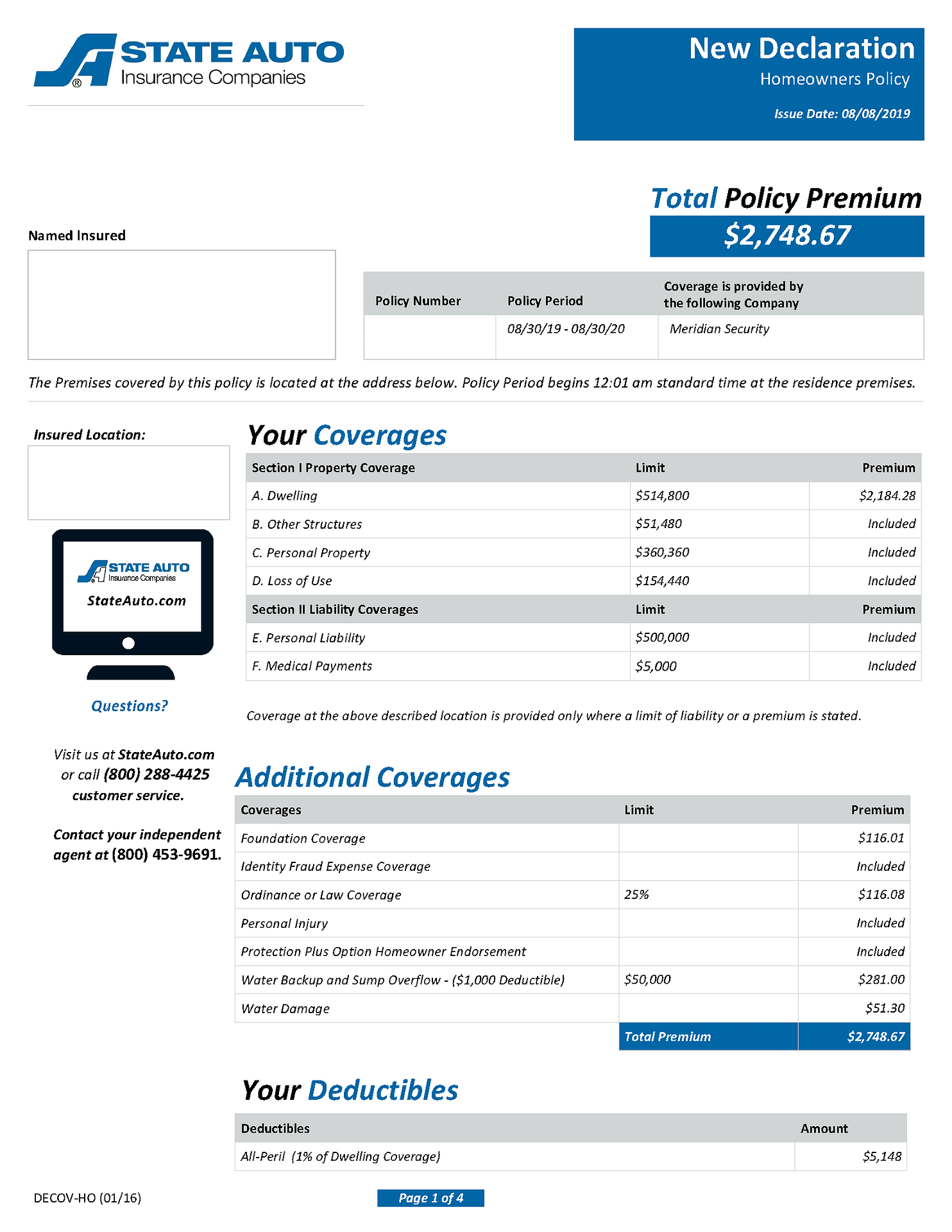

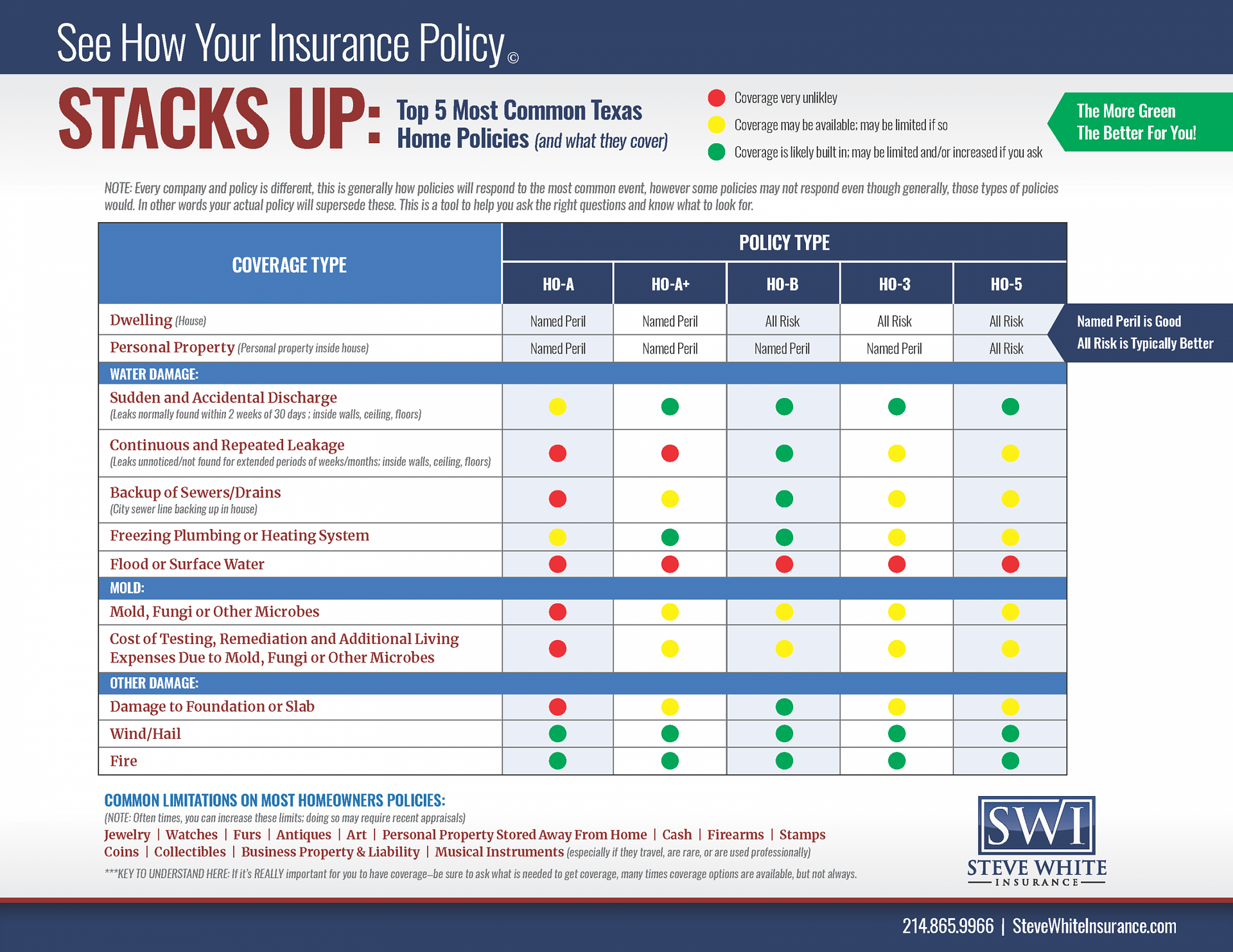

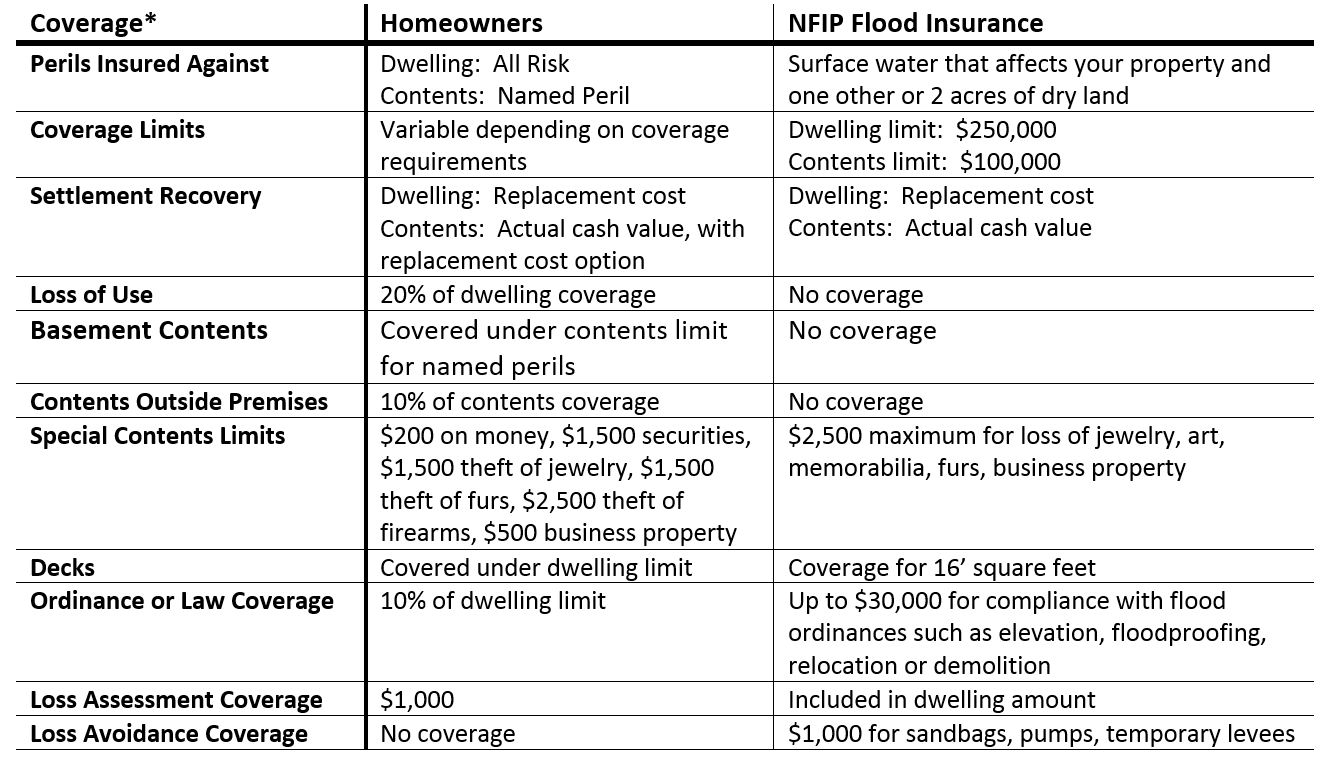

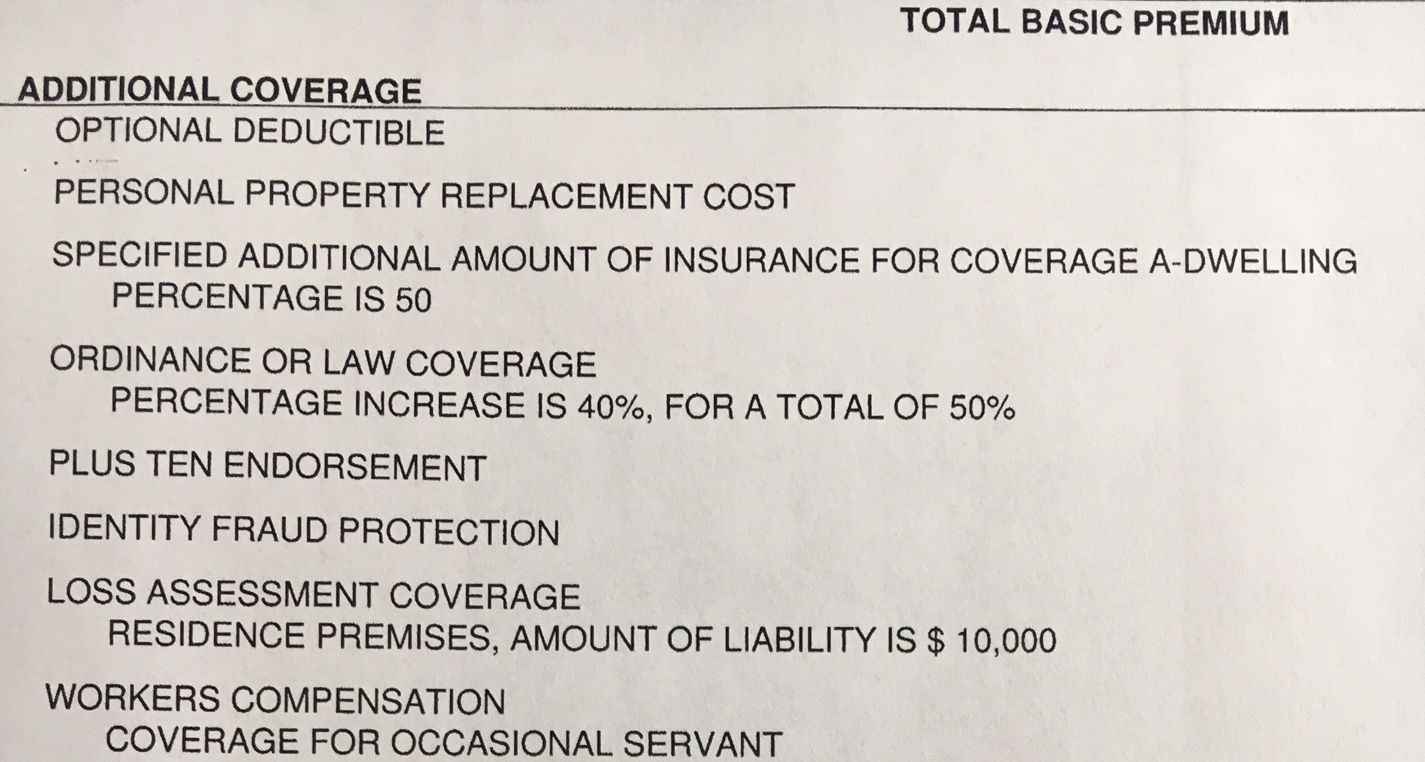

Homeowners Insurance Law And Ordinance Coverage. In short without ordinance and law coverage you insurance company will only pay to replace the building to its condition prior to the loss any difference will fall on the association. Ordinance or law coverage is offered as an endorsement, which means it’s not covered under a standard homeowner policy. Law and ordinance coverage is a type of insurance coverage that, in most cases, should be included in a homeowners, business, or community association insurance portfolio. Partial losses are far more likely.

When does homeowner’s insurance cover mold? (Infographic) From blogarama.com

When does homeowner’s insurance cover mold? (Infographic) From blogarama.com

That amount is often insufficient if the work necessary to update and rebuild the house or building is extensive. Law & ordinance kicks in when the florida building code requirements impact what will be required in order to obtain a co (certificate of occupancy) in order to reoccupy the damaged structure. Additional coverage may be purchased that would help pay for the value of the undamaged part of the house and the increased cost to rebuild according to the new code. Most homeowners policies will limit the amount of coverage for the following additional increased costs caused by adherence to current laws and ordinances. Ordinance or law coverage provides limited protection for losses caused by implementation of ordinances or laws regulating construction and repair of damaged buildings. Ordinance or law coverage is typically included in homeowners insurance policies up to a limited amount — generally 10% of your home’s dwelling coverage limit.

Ordinance or law coverage, also referred to as ordinance and law coverage, building ordinance coverage, code compliance insurance, code upgrade coverage, and building code upgrade coverage is part of your standard home insurance policy.

Though it is commonly a part of commercial property coverage, it is also an important part of homeowners insurance. Ordinance or law coverage is offered as an endorsement, which means it’s not covered under a standard homeowner policy. That’s where ordinance or law coverage comes in. What is law or ordinance coverage? You can always add more. Sometimes referred to as “law and ordinance coverage,” this additional endorsement to your homeowners insurance policies protects you in case local law or building codes require updates to your property.

Source: pinterest.com

Source: pinterest.com

In some jurisdictions the law requires that partially damaged buildings be demolished. What all does ordinance or law. You can always add more. Most people opt only for 10% of coverage a for ordinance or law coverage on a standard homeowners insurance policy. If the insured does not have replacement cost coverage, then actual cash value.

Source: stevewhiteinsurance.com

Source: stevewhiteinsurance.com

However, florida insurance carriers are obligated by law to offer this coverage, but homeowners may opt out (in writing) if they decide to go without it. Ordinance or law coverage is a homeowners insurance protection that helps cover the cost of getting your house up to code after a covered loss. While each ordinance or law endorsement may differ, the following is a common approach to determine the amount of loss paid under ordinance or law coverage: Partial losses are far more likely. That said, a court of law might determine that hoa directives are valid and require an insurer to adjust the loss to comply.

Source: pinterest.com

Source: pinterest.com

What is law or ordinance coverage? A lot of properties that experienced hurricane irma losses will have law & ordinance issues. There are very few total losses; It can actually be an important part of your homeowners insurance policy, so it is important. Sometimes referred to as “law and ordinance coverage,” this additional endorsement to your homeowners insurance policies protects you in case local law or building codes require updates to your property.

Source: stevewhiteinsurance.com

Source: stevewhiteinsurance.com

Ordinance or law coverage provides limited protection for losses caused by implementation of ordinances or laws regulating construction and repair of damaged buildings. The adjuster is correct that ordinance or law coverage was not intended to cover decrees made by hoa boards that might, in some instances, send out whimsical orders meant to be authoritative. Law and ordinance coverage is a type of insurance coverage that, in most cases, should be included in a homeowners, business, or community association insurance portfolio. In general there are three parts to ordinance and law coverage: New laws may require expensive upgrades in construction, electrical, plumbing, or hvac (heating, ventilation and air conditioning) and other improvements.

Source: raymondroe.com

Source: raymondroe.com

Additional coverage may be purchased that would help pay for the value of the undamaged part of the house and the increased cost to rebuild according to the new code. How law & ordinance coverage will impact your insurance claim. When inquiring about homeowners insurance, the term building ordinance or law coverage might come up. New laws may require expensive upgrades in construction, electrical, plumbing, or hvac (heating, ventilation and air conditioning) and other improvements. There are very few total losses;

Source: ontophome.com

Source: ontophome.com

Partial losses are far more likely. Below, is the language you’ll typically see under the additional coverage section of a homeowners policy: You may have heard of the term ordinance or law coverage in relation to commercial property insurance, but many people are unaware that this type of coverage can also be a part of your homeowners insurance policy. Partial losses are far more likely. Ordinance or law assists in paying for demolition costs & or increased construction costs as a result of newer building code enforcement or ordinances when repairing or replacing your dwelling after a covered insurance loss.

Source: harrisinsurance.com

Source: harrisinsurance.com

Ordinance or law coverage is typically included in homeowners insurance policies up to a limited amount — generally 10% of your home’s dwelling coverage limit. Most standard homeowners insurance policies include a clause that states that the insurer will not cover the costs associated with the enforcement of any ordinance or law which regulates the use, construction, repair and demolition (including removal of debris) of any property after an insured event has occurred. How law & ordinance coverage will impact your insurance claim. Ordinance or law coverage is a homeowners insurance protection that helps cover the cost of getting your house up to code after a covered loss. That’s where ordinance or law coverage comes in.

Source: sixbeyinsurance.com

Source: sixbeyinsurance.com

This would include energy efficiency, environmental, structural, and safety standards. It can actually be an important part of your homeowners insurance policy, so it is important. The construction, demolition, remodeling, renovation or repair of a building or other structure That amount of coverage helps prevent. Sometimes referred to as “law and ordinance coverage,” this additional endorsement to your homeowners insurance policies protects you in case local law or building codes require updates to your property.

Source: trustedchoice.com

Source: trustedchoice.com

Of course, this doesn’t mean that all insurance policies will provide for law and ordinance coverage, and the parties may agree to any type of coverage they desire. You may have heard of the term ordinance or law coverage in relation to commercial property insurance, but many people are unaware that this type of coverage can also be a part of your homeowners insurance policy. Most people opt only for 10% of coverage a for ordinance or law coverage on a standard homeowners insurance policy. In general there are three parts to ordinance and law coverage: Law and ordinance coverage is a type of insurance coverage that, in most cases, should be included in a homeowners, business, or community association insurance portfolio.

Source: hoganlegal.com

Source: hoganlegal.com

New laws may require expensive upgrades in construction, electrical, plumbing, or hvac (heating, ventilation and air conditioning) and other improvements. Most homeowners policies will limit the amount of coverage for the following additional increased costs caused by adherence to current laws and ordinances. Additional coverage may be purchased that would help pay for the value of the undamaged part of the house and the increased cost to rebuild according to the new code. Below, is the language you’ll typically see under the additional coverage section of a homeowners policy: But a partial loss could trigger the enforcement of an ordinance or law that could cause you to have to pay more than the amount of loss covered by your policy.

Source: thankgoodnessforinsurance.org

Source: thankgoodnessforinsurance.org

How law & ordinance coverage will impact your insurance claim. Ordinance or law coverage is typically included in homeowners insurance policies up to a limited amount — generally 10% of your home’s dwelling coverage limit. For example, let’s say that your home insurance policy covers fires (and most do!), and a fire damages 70% of your home’s structure. Ordinance or law assists in paying for demolition costs & or increased construction costs as a result of newer building code enforcement or ordinances when repairing or replacing your dwelling after a covered insurance loss. What is law or ordinance coverage?

Source: adjustersinternational.com

Source: adjustersinternational.com

Ordinance or law coverage is either included in your homeowners policy or you can purchase it as an endorsement, depending on where you live, and it covers the cost to rebuild or repair a home that’s been damaged by a covered peril up to the latest local building codes. This means if your home is insured for $350,000, you’d have up to $35,000 in building ordinance or law coverage. In short without ordinance and law coverage you insurance company will only pay to replace the building to its condition prior to the loss any difference will fall on the association. However, florida insurance carriers are obligated by law to offer this coverage, but homeowners may opt out (in writing) if they decide to go without it. It can actually be an important part of your homeowners insurance policy, so it is important.

Source: blogarama.com

Source: blogarama.com

When inquiring about homeowners insurance, the term building ordinance or law coverage might come up. Ordinance or law coverage can help protect you from increased costs due to these regulations. Below, is the language you’ll typically see under the additional coverage section of a homeowners policy: You may have heard of the term ordinance or law coverage in relation to commercial property insurance, but many people are unaware that this type of coverage can also be a part of your homeowners insurance policy. Ordinance or law coverage is either included in your homeowners policy or you can purchase it as an endorsement, depending on where you live, and it covers the cost to rebuild or repair a home that’s been damaged by a covered peril up to the latest local building codes.

Source: everquote.com

Source: everquote.com

This means if your home is insured for $350,000, you’d have up to $35,000 in building ordinance or law coverage. The construction, demolition, remodeling, renovation or repair of a building or other structure You may use up to 10% of the limit of liability that applies to coverage a for the increased costs you incur due to the enforcement of any ordinance or law which requires or regulates In general there are three parts to ordinance and law coverage: Most homeowners policies will limit the amount of coverage for the following additional increased costs caused by adherence to current laws and ordinances.

Source: loanscalc.org

Source: loanscalc.org

You may use up to 10% of the limit of liability that applies to coverage a for the increased costs you incur due to the enforcement of any ordinance or law which requires or regulates Specifically, the statute requires that whenever a homeowner’s insurance policy is issued, the insurer has a statutory duty to offer this type of coverage. Ordinance or law coverage provides limited protection for losses caused by implementation of ordinances or laws regulating construction and repair of damaged buildings. Ordinance or law coverage is a homeowners insurance protection that helps cover the cost of getting your house up to code after a covered loss. This would include energy efficiency, environmental, structural, and safety standards.

Source: trustedchoice.com

Source: trustedchoice.com

Of course, this doesn’t mean that all insurance policies will provide for law and ordinance coverage, and the parties may agree to any type of coverage they desire. There are very few total losses; In some jurisdictions the law requires that partially damaged buildings be demolished. However, florida insurance carriers are obligated by law to offer this coverage, but homeowners may opt out (in writing) if they decide to go without it. You may use up to 10% of the limit of liability that applies to coverage a for the increased costs you incur due to the enforcement of any ordinance or law which requires or regulates

Source: chrisearley.com

Source: chrisearley.com

You may have heard of the term ordinance or law coverage in relation to commercial property insurance, but many people are unaware that this type of coverage can also be a part of your homeowners insurance policy. Ordinance or law coverage is an additional coverage that is typically included in all homeowners policies. What is ordinance or law insurance coverage? If the insured does not have replacement cost coverage, then actual cash value. A lot of properties that experienced hurricane irma losses will have law & ordinance issues.

Source: chrisoberbroeckling.fbfsagents.com

Source: chrisoberbroeckling.fbfsagents.com

Most homeowners policies will limit the amount of coverage for the following additional increased costs caused by adherence to current laws and ordinances. Ordinance or law coverage is a homeowners insurance protection that helps cover the cost of getting your house up to code after a covered loss. Law and ordinance coverage is a type of insurance coverage that, in most cases, should be included in a homeowners, business, or community association insurance portfolio. That amount is often insufficient if the work necessary to update and rebuild the house or building is extensive. Most people opt only for 10% of coverage a for ordinance or law coverage on a standard homeowners insurance policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title homeowners insurance law and ordinance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.