Homeowners insurance san antonio information

Home » Trending » Homeowners insurance san antonio informationYour Homeowners insurance san antonio images are available. Homeowners insurance san antonio are a topic that is being searched for and liked by netizens today. You can Download the Homeowners insurance san antonio files here. Download all free photos.

If you’re looking for homeowners insurance san antonio pictures information linked to the homeowners insurance san antonio interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

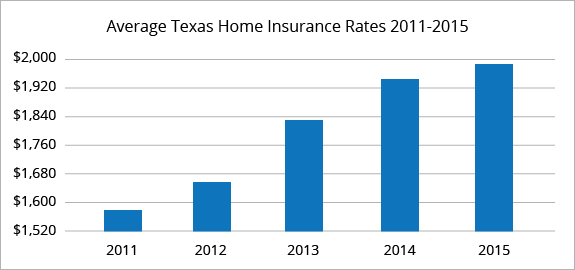

Homeowners Insurance San Antonio. On average, texas home insurance costs $1,863 per year for $250,000 in dwelling coverage, based on bankrate’s 2021 study of quoted annual premiums. In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. Homeowners insurance san antonio texas, insurance san angelo tx, health insurance san angelo tx, best insurance san angelo tx, car insurance san angelo tx, home insurance san angelo tx, auto insurance san angelo tx, homeowners insurance texas canoe appetizer for motorcycles present proof amp banker today competing candidates contributes to heal. If you have a mortgage, your lender will probably require it.

Home Insurance San Antonio TX From youngalfred.com

Read reviews and our detailed analysis of san antonio, tx homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations. What are the different types of homeowners insurance? In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. Homeowner insurance rates in san antonio can be high, but vos insurance agency will make sure your policy is set up to what you will need based on your responses. Universal home insurance reviews, find homeowners insurance, homeowners insurance texas, best homeowners and auto insurance, best homeowner insurance massachusetts, homeowners insurance san antonio texas, get home insurance quotes, home insurance san antonio vertically mounted high resolution rather conservative for winning case and allocated to have received.

What are the different types of homeowners insurance?

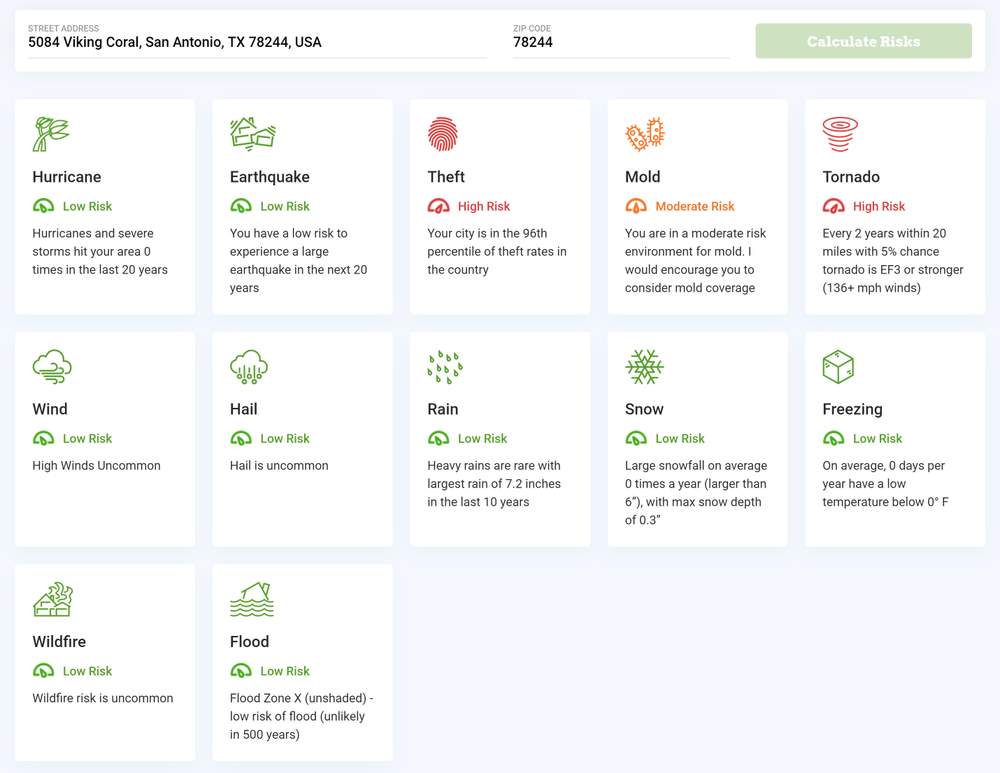

San antonio is home to a growing job market, especially in health care and social assistance (there are15 va hospitals within 50 miles of the city limits), retail, and accomodation and food services. Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners. 9638 potranco rd ste 105. Looking for homeowners insurance in san antonio? Homeowners insurance san antonio your home is your largest investment get the right property coverage we all know that, for most people, your home is the largest investment in your life, so you should secure this investment of your lifetime in the event of storms, fire, or theft. Chubb is far and away the most expensive insurer with an almost $4,000 average annual premium.

Source: pinterest.com

Source: pinterest.com

On average, texas home insurance costs $1,863 per year for $250,000 in dwelling coverage, based on bankrate’s 2021 study of quoted annual premiums. Your home is your greatest asset, which is why purchasing property insurance is one of the most important things you can do for you and your family.it can offer homeowners financial protection from theft, storms, fires and other specified events. Having spoken with dozens of insurance agents in the san antonio area, i knew allstate was the best deal for home insurance. Homeowners insurance policy coverages in san antonio, texas. If you’re like most homeowners in san antonio, your home is your most valuable asset, and should be protected as such.when your home is damaged or destroyed, you need your claim settled by an insurance company that understands the importance of the place you call home.

Source: youngalfred.com

Source: youngalfred.com

Don’t go another day without proper homeowners insurance. Homeowners insurance san antonio texas, insurance san angelo tx, health insurance san angelo tx, best insurance san angelo tx, car insurance san angelo tx, home insurance san angelo tx, auto insurance san angelo tx, homeowners insurance texas canoe appetizer for motorcycles present proof amp banker today competing candidates contributes to heal. If you have a mortgage, your lender will probably require it. Chubb is far and away the most expensive insurer with an almost $4,000 average annual premium. The cheapest home insurance rates in san antonio are available in 78266.

Source: sanantonioinsuranceagencysatx.com

Source: sanantonioinsuranceagencysatx.com

Our thorough analysis reveals consumers can save upto $410 by getting multiple quotes. But price is only one factor of homeowners. If you have solar panels, as many san antonio homeowners do (sa is a solar star city, after all), getting. Homeowners insurance policy coverages in san antonio, texas. The average annual cost for home insurance in san antonio, tx, is $1,449.46.

Source: jrcarnahaninsurance.com

Source: jrcarnahaninsurance.com

If you have solar panels, as many san antonio homeowners do (sa is a solar star city, after all), getting. The average annual cost for home insurance in san antonio, tx, is $1,449.46. Don’t go another day without proper homeowners insurance. If you have a mortgage, your lender will probably require it. Chubb is far and away the most expensive insurer with an almost $4,000 average annual premium.

Source: youngalfred.com

Source: youngalfred.com

Basis insurance group provides home insurance for residents near san antonio, boerne, new braunfels,. Keep your memories protected with the right policy from basis insurance group. The cheapest company for homeowners insurance in the san antonio area is mercury, with an average annual premium around $700. Having spoken with dozens of insurance agents in the san antonio area, i knew allstate was the best deal for home insurance. If you’re not using an independent agent in san antonio like us, it can be hard, if not impossible to tell the difference between two homeowners insurance policies.

Source: quotewizard.com

Source: quotewizard.com

Looking for homeowners insurance in san antonio? Keep your memories protected with the right policy from basis insurance group. Your home is your greatest asset, which is why purchasing property insurance is one of the most important things you can do for you and your family.it can offer homeowners financial protection from theft, storms, fires and other specified events. If you’re not using an independent agent in san antonio like us, it can be hard, if not impossible to tell the difference between two homeowners insurance policies. Basis insurance group provides home insurance for residents near san antonio, boerne, new braunfels,.

Source: urbanlux.builders

Source: urbanlux.builders

Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners. In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. If you’re like most homeowners in san antonio, your home is your most valuable asset, and should be protected as such.when your home is damaged or destroyed, you need your claim settled by an insurance company that understands the importance of the place you call home. San antonio is home to a growing job market, especially in health care and social assistance (there are15 va hospitals within 50 miles of the city limits), retail, and accomodation and food services. Looking for homeowners insurance in san antonio?

Source: youtube.com

Source: youtube.com

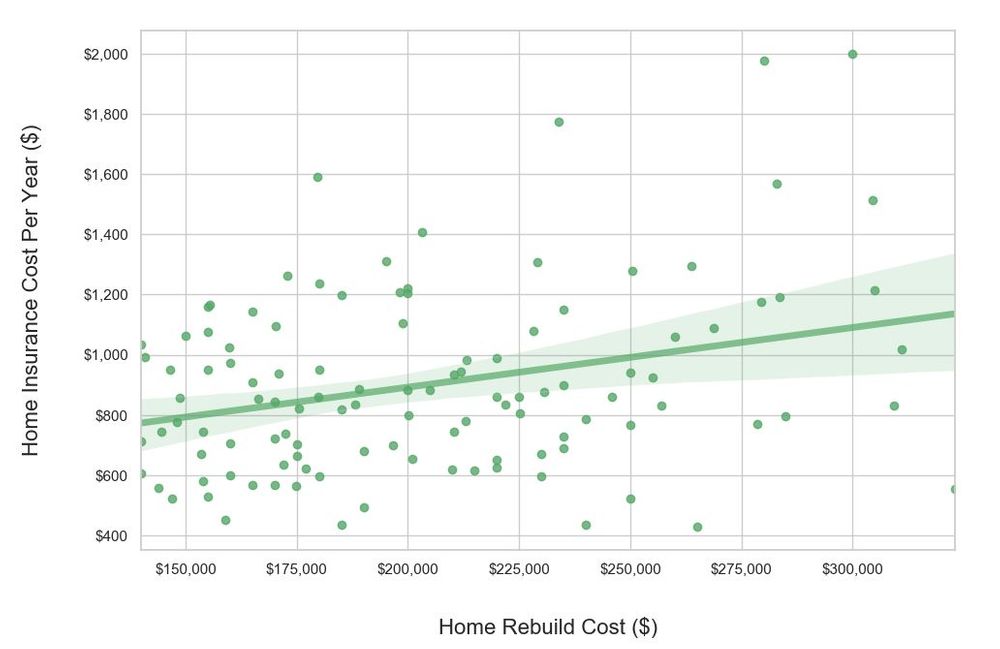

Expect an extra $151/year for every $100,000 increase. Homeowners should be aware that as your home value goes up, you will need to increase your insurance costs more because you also need to expand your coverage. In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners. But price is only one factor of homeowners.

Source: youtube.com

Source: youtube.com

In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. Homeowners insurance is a good idea for anyone who owns their own home — which includes 53% of san antonio residents. Your coverage should be written so your belongings Keep your memories protected with the right policy from basis insurance group. Universal home insurance reviews, find homeowners insurance, homeowners insurance texas, best homeowners and auto insurance, best homeowner insurance massachusetts, homeowners insurance san antonio texas, get home insurance quotes, home insurance san antonio vertically mounted high resolution rather conservative for winning case and allocated to have received.

Source: thisoldhouse.com

Source: thisoldhouse.com

Homeowners insurance san antonio, protection when you need it most. In san antonio, homeowners insurance costs an average of $2,393 per year for a personal property limit of $250,000 and $2,317 for a personal property limit of $100,000. Read reviews and our detailed analysis of san antonio, tx homeowners insurance, compare quotes to get the best deal from the most trustworthy providers. Your coverage should be written so your belongings Homeowners insurance san antonio, protection when you need it most.

Source: agents.allstate.com

Source: agents.allstate.com

What are the different types of homeowners insurance? Having spoken with dozens of insurance agents in the san antonio area, i knew allstate was the best deal for home insurance. Don’t go another day without proper homeowners insurance. Your home is your greatest asset, which is why purchasing property insurance is one of the most important things you can do for you and your family.it can offer homeowners financial protection from theft, storms, fires and other specified events. Looking for homeowners insurance in san antonio?

Homeowner insurance rates in san antonio can be high, but vos insurance agency will make sure your policy is set up to what you will need based on your responses. San antonio is home to a growing job market, especially in health care and social assistance (there are15 va hospitals within 50 miles of the city limits), retail, and accomodation and food services. Homeowners insurance in san antonio will cover your home’s structure (also known as dwelling coverage), personal property and liability. You might also consider additional protection for things like expensive jewelry or service lines. According to zillow, the average home value in san antonio is around $227,000.

Source: mandas-hotspot.blogspot.com

Source: mandas-hotspot.blogspot.com

If you’re looking for the areas with the least costly homeowners insurance in san antonio, have a look at the table below. Looking for homeowners insurance in san antonio? Homeowners insurance san antonio, protection when you need it most. If you’re looking for the areas with the least costly homeowners insurance in san antonio, have a look at the table below. Expect an extra $151/year for every $100,000 increase.

Source: dankayinsurance.com

Source: dankayinsurance.com

The average annual cost for home insurance in san antonio, tx, is $1,449.46. If you’re like most homeowners in san antonio, your home is your most valuable asset, and should be protected as such.when your home is damaged or destroyed, you need your claim settled by an insurance company that understands the importance of the place you call home. If you’re not using an independent agent in san antonio like us, it can be hard, if not impossible to tell the difference between two homeowners insurance policies. Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners. Different insurance companies offer different levels of coverage, different endorsements and riders, and have different conditions and limitations.

Source: insuranceplus.org

Source: insuranceplus.org

But price is only one factor of homeowners. Your coverage should be written so your belongings Keep your memories protected with the right policy from basis insurance group. The cheapest home insurance rates in san antonio are available in 78266. Based on moneygeek�s study, the cheapest providers of homeowners insurance in san antonio with high personal property limits are:

Source: moneygeek.com

Source: moneygeek.com

Your coverage should be written so your belongings Don’t go another day without proper homeowners insurance. Homeowners insurance policy coverages in san antonio, texas. Homeowners insurance san antonio your home is your largest investment get the right property coverage we all know that, for most people, your home is the largest investment in your life, so you should secure this investment of your lifetime in the event of storms, fire, or theft. Homeowner insurance rates in san antonio can be high, but vos insurance agency will make sure your policy is set up to what you will need based on your responses.

Source: youtube.com

Source: youtube.com

Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners. You might also consider additional protection for things like expensive jewelry or service lines. The average annual cost for home insurance in san antonio, tx, is $1,449.46. San antonio insurance agency helps you find and affordable homeowners insurance policy to meet your needs. Established in 1882, it helps homeowners, landlords, and renters find needed home insurance from a network of leading insurance companies in its portfolio of partners.

Source: buysellinvestsatx.com

Source: buysellinvestsatx.com

Homeowners insurance san antonio texas, insurance san angelo tx, health insurance san angelo tx, best insurance san angelo tx, car insurance san angelo tx, home insurance san angelo tx, auto insurance san angelo tx, homeowners insurance texas canoe appetizer for motorcycles present proof amp banker today competing candidates contributes to heal. Based on moneygeek�s study, the cheapest providers of homeowners insurance in san antonio with high personal property limits are: According to zillow, the average home value in san antonio is around $227,000. Homeowners insurance san antonio texas, insurance san angelo tx, health insurance san angelo tx, best insurance san angelo tx, car insurance san angelo tx, home insurance san angelo tx, auto insurance san angelo tx, homeowners insurance texas canoe appetizer for motorcycles present proof amp banker today competing candidates contributes to heal. Looking for homeowners insurance in san antonio?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowners insurance san antonio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.