Homeowners insurance utah Idea

Home » Trend » Homeowners insurance utah IdeaYour Homeowners insurance utah images are ready in this website. Homeowners insurance utah are a topic that is being searched for and liked by netizens today. You can Find and Download the Homeowners insurance utah files here. Get all royalty-free images.

If you’re looking for homeowners insurance utah pictures information connected with to the homeowners insurance utah interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Homeowners Insurance Utah. If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon). However, it’s to note here home insurance rates will vary from one home to another. Homeowners insurance in utah serving the cities of sandy, draper, midvale, murray, south jordan, west jordan, herriman, lehi, and cottonwood heights. Utah home insurance is a type of property insurance that covers any damages or losses to a person’s property.

Aspen Villas Renters Insurance In Park City, UT From effectivecoverage.com

Aspen Villas Renters Insurance In Park City, UT From effectivecoverage.com

From salt lake city to moab and ogden to provo, we make it easy and convenient to get homeowners insurance in utah. Get a free utah homeowners insurance review. What you need to know. The basics nested in the very heart of the west of the united states, utah is the state of the largest lake in the western hemisphere. The cheapest homeowners insurance quotes in utah. Get a personalized quote root home uses data to provide you with a quote in just a few simple steps, including discounts for things like having a fire alarm or indoor sprinklers.

Home insurance coverage options in utah.

The national average homeowners insurance premium is $1,211 annually, which is almost double utah�s rate of $692 per year. In regards to the monthly average, utah homeowners have to pay $55 on home insurance while the national monthly average is $99. Farmers smart plan home® in utah gives you three highly customizable packages as a starting point: This is cheaper than the national average cost of homeowners insurance at $1,312 per year,. If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon). Our insurance agent will assist you in.

Source: cinsuregroup.com

Source: cinsuregroup.com

In utah, homeowners insurance is a necessary item. Reimbursement for costs to temporarily live at another place while your home, damaged for a covered loss, is being repaired. If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon). Get a personalized quote root home uses data to provide you with a quote in just a few simple steps, including discounts for things like having a fire alarm or indoor sprinklers. Homeowners insurance in utah serving the cities of sandy, draper, midvale, murray, south jordan, west jordan, herriman, lehi, and cottonwood heights.

Source: americaninsurance.com

Source: americaninsurance.com

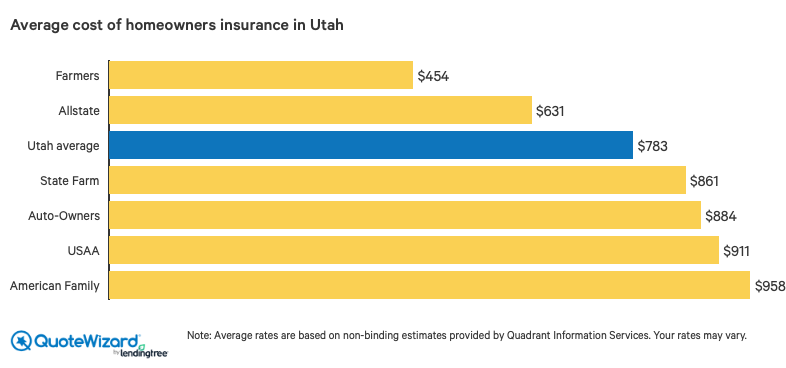

If you want to know your exact costs for homeowners coverage, you�ll need to obtain quotes from a licensed professional. Premiere—comes with the highest coverage limits and greatest choice of features. When deciding on policy coverage, utah residents should consider the state’s snowy winters and risk of wildfires. Home insurance coverage options in utah. Rates for homeowners insurance in ut do vary depending on the company, so it makes a lot of sense to compare rates from different insurers before you commit to buying a policy.

If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon). What you need to know. Homeowners insurance in utah serving the cities of sandy, draper, midvale, murray, south jordan, west jordan, herriman, lehi, and cottonwood heights. In utah, homeowners insurance is a necessary item. If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon).

Source: mountainridgeinsurance.com

Source: mountainridgeinsurance.com

This is cheaper than the national average cost of homeowners insurance at $1,312 per year,. Utah home insurance is a type of property insurance that covers any damages or losses to a person’s property. Progressive tops the list of best homeowners insurance companies in utah. In utah, homeowners insurance is a necessary item. Floods, landslides, snow storms and tornadoes can strike in utah, and home insurance may not provide enough coverage.

Source: quotewizard.com

Source: quotewizard.com

Progressive tops the list of best homeowners insurance companies in utah. Homeowners insurance may be optional, but it�s important. The national average homeowners insurance premium is $1,211 annually, which is almost double utah�s rate of $692 per year. This is much lower than the national average. A nationwide on your side® review is a free, annual consultation and insurance assessment that can help you:

Source: quynn-tebbs.com

Source: quynn-tebbs.com

Get a free utah homeowners insurance review. The cheapest homeowners insurance quotes in utah. This is much lower than the national average. Farmers smart plan home® in utah gives you three highly customizable packages as a starting point: We commit to finding homeowners insurance plans that meet our customers� coverage and budgetary needs.

Source: insurify.com

Source: insurify.com

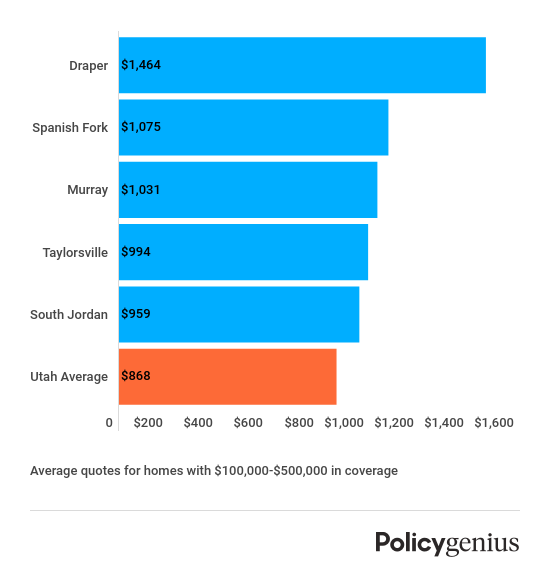

Home insurance is important coverage for fires, wind, explosions, damage from the weight of snow, and other problems. The annual average home insurance rate in utah is a very nominal $664 while the national annual average is $1,192. Utah homeowners can face a variety of natural disasters, and having the proper insurance coverage is crucial. Utah homeowners enjoy low home insurance rates, about 51% below the national average. Whereas american family is one of the cheapest homeowners insurance companies, its average annual premium is $1,007.

Source: policygenius.com

Source: policygenius.com

The national average homeowners insurance premium is $1,211 annually, which is almost double utah�s rate of $692 per year. Utah home insurance is a type of property insurance that covers any damages or losses to a person’s property. Enhanced —provides higher coverage limits and extra features. In regards to the monthly average, utah homeowners have to pay $55 on home insurance while the national monthly average is $99. Progressive tops the list of best homeowners insurance companies in utah.

Source: m8ic.com

Source: m8ic.com

Standard —reduced coverage for a reduced price. Home insurance is important coverage for fires, wind, explosions, damage from the weight of snow, and other problems. While many people visit the state in winter to enjoy skiing and other outdoor activities, the season also brings snow, ice dams, and frozen pipes. Utah homeowners enjoy low home insurance rates, about 51% below the national average. It has earned 821 scores out of 1000 from j.d.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

Homeowners in utah face many challenges throughout the year. Home insurance coverage options in utah. Farmers smart plan home® in utah gives you three highly customizable packages as a starting point: Utah homeowners can face a variety of natural disasters, and having the proper insurance coverage is crucial. It helps to defend your dwelling and property against a variety of misfortunes.

Source: thesimpledollar.com

Source: thesimpledollar.com

While many people visit the state in winter to enjoy skiing and other outdoor activities, the season also brings snow, ice dams, and frozen pipes. Increase or decrease your deductible (s) determine the home insurance coverage options that are right for your budget and situation. It has earned 821 scores out of 1000 from j.d. Utah homeowners enjoy low home insurance rates, about 51% below the national average. While many people visit the state in winter to enjoy skiing and other outdoor activities, the season also brings snow, ice dams, and frozen pipes.

Source: reviews.com

Source: reviews.com

The national average homeowners insurance premium is $1,211 annually, which is almost double utah�s rate of $692 per year. Building coverage for your home, garage, and other structures. Utah homeowners can face a variety of natural disasters, and having the proper insurance coverage is crucial. Increase or decrease your deductible (s) determine the home insurance coverage options that are right for your budget and situation. The annual average home insurance rate in utah is a very nominal $664 while the national annual average is $1,192.

Source: effectivecoverage.com

Source: effectivecoverage.com

Because everyone�s needs are not the same, it is best to consult your agent to help assess your needs and find the insurance policy that is right for you. What you need to know. This also includes any assets damaged inside the property. Homeowners in utah face many challenges throughout the year. Get a free utah homeowners insurance review.

In utah, homeowners insurance is a necessary item. The following are the primary coverages provided in the homeowners policy: Reimbursement for costs to temporarily live at another place while your home, damaged for a covered loss, is being repaired. A nationwide on your side® review is a free, annual consultation and insurance assessment that can help you: Additionally, homeowners insurance offers liability coverage against any accidents that occur within or on the property.

Source: easternutah.com

Source: easternutah.com

Progressive tops the list of best homeowners insurance companies in utah. If you’re looking for a place to save, utah is an excellent option as it’s the second least expensive state for home insurance in the entire country (the least expensive state is oregon). Homeowners insurance in utah serving the cities of sandy, draper, midvale, murray, south jordan, west jordan, herriman, lehi, and cottonwood heights. The national average homeowners insurance premium is $1,211 annually, which is almost double utah�s rate of $692 per year. Progressive tops the list of best homeowners insurance companies in utah.

Source: reviews.com

Source: reviews.com

Progressive tops the list of best homeowners insurance companies in utah. Home insurance is important coverage for fires, wind, explosions, damage from the weight of snow, and other problems. The cheapest homeowners insurance company in utah is stillwater, according to policygenius quote data. Enhanced —provides higher coverage limits and extra features. Get a personalized quote root home uses data to provide you with a quote in just a few simple steps, including discounts for things like having a fire alarm or indoor sprinklers.

Source: smartfinancial.com

Source: smartfinancial.com

This also includes any assets damaged inside the property. Homeowners in utah face many challenges throughout the year. For instance, did you recently build a garage or gazebo. Increase or decrease your deductible (s) determine the home insurance coverage options that are right for your budget and situation. Rates for homeowners insurance in ut do vary depending on the company, so it makes a lot of sense to compare rates from different insurers before you commit to buying a policy.

Source: mountainridgeinsurance.com

Source: mountainridgeinsurance.com

It has earned 821 scores out of 1000 from j.d. This is much lower than the national average. It has earned 821 scores out of 1000 from j.d. The cheapest homeowners insurance quotes in utah. Reimbursement for costs to temporarily live at another place while your home, damaged for a covered loss, is being repaired.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title homeowners insurance utah by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.