Hospital indemnity vs accident insurance Idea

Home » Trending » Hospital indemnity vs accident insurance IdeaYour Hospital indemnity vs accident insurance images are available. Hospital indemnity vs accident insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Hospital indemnity vs accident insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for hospital indemnity vs accident insurance images information connected with to the hospital indemnity vs accident insurance topic, you have pay a visit to the ideal site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Hospital Indemnity Vs Accident Insurance. In lieu of accident insurance, another option you can consider is hospital indemnity. A hospital indemnity insurance policy may include coverage on, but is. Hospital indemnity typically pays a set schedule. Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings.

Services PERSONAL ACCIDENT INSURANCE from Rajasthan From exportersindia.com

Services PERSONAL ACCIDENT INSURANCE from Rajasthan From exportersindia.com

Since hospital indemnity insurance is a sum of money paid to you relative to the terms of your plan, providers cannot deny your insurance. Generally speaking, hospital indemnity insurance policies pay a direct benefit to the beneficiary in the event hospital admission is required, and the visit meets the terms and conditions of the policy. A hospital indemnity insurance policy may include coverage on, but is. What is hospital indemnity insurance? You have two coverage options—high and low. $1,000 for the hospital admittance.

In lieu of accident insurance, another option you can consider is hospital indemnity.

Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings. A hospital indemnity insurance policy may include coverage on, but is. Hospital indemnity policies typically pay a lump sum directly to you, not a hospital or medical facility. If you don’t go to the hospital, hospital indemnity insurance does not pay benefits. There are some ways in which hospital insurance and accident insurance overlap but a key difference is whether you go to the hospital. Type difference between hospital indemnity and accident insurance insurance is critical illness insurance ( cii ) plans provide more flexibility when picking a doctor hospital.

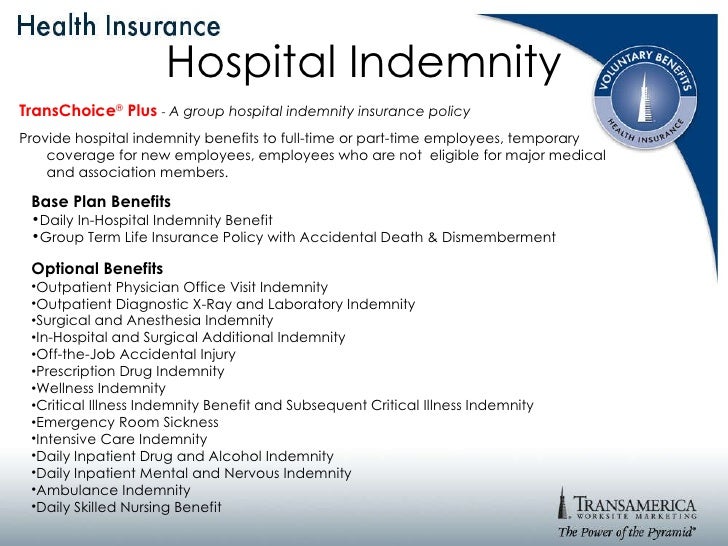

Source: slideshare.net

Source: slideshare.net

Hospital indemnity insurance is very similar to accident insurance. Portable coverage should you decide to leave your current employer 3. Hospital indemnity insurance is very similar to accident insurance. Accident insurance is a different type of supplemental insurance that pays out a lump sum if you incur specific kinds of injury as a result of an accident. Guaranteed acceptance for you and eligible family members 2.

Source: escolabressolelrial.blogspot.com

Source: escolabressolelrial.blogspot.com

You are in the hospital for 3 days. What is hospital indemnity insurance? Its advantage over accident insurance is that it covers illnesses in addition to accidents. Hospital indemnity insurance benefits may include: Similar to accident insurance, it is a supplemental option to your primary health coverage.

Source: ailife.com

Source: ailife.com

Type difference between hospital indemnity and accident insurance insurance is critical illness insurance ( cii ) plans provide more flexibility when picking a doctor hospital. What is hospital indemnity insurance? Its advantage over accident insurance is that it covers illnesses in addition to accidents. Hospital insurance hospital indemnity insurance provides fixed indemnity benefits for covered medical services associated with being hospitalized (including because of an accident). Hospital indemnity insurance can be used to help

Source: pinterest.com

Source: pinterest.com

A hospital indemnity insurance policy may include coverage on, but is. They usually pay you this daily benefit amount for up to a year. Hospital indemnity insurance can be used to help So, what is the difference between hospital indemnity and accident insurance? You have two coverage options—high and low.

Source: dreamfulfilledinlondon.blogspot.com

Source: dreamfulfilledinlondon.blogspot.com

Generally speaking, hospital indemnity insurance policies pay a direct benefit to the beneficiary in the event hospital admission is required, and the visit meets the terms and conditions of the policy. What is hospital indemnity insurance? Hospital indemnity typically pays a set schedule. 1 if you don’t go to the hospital, your benefits won’t get paid to you. Accident insurance covers an accident or injury, whereas hospital indemnity would cover you in the hospital.

Source: tranquilplanningcenter.com

Source: tranquilplanningcenter.com

Hospital indemnity plans have been available privately and at work through companies like aflac, allstate and metlife for a long time. Similar to accident insurance, it is a supplemental option to your primary health coverage. If you don’t go to the hospital, hospital indemnity insurance does not pay benefits. This can help alleviate the burden of costly hospital expenses that may remain after health insurance deductibles or copays. Hospital insurance hospital indemnity insurance provides fixed indemnity benefits for covered medical services associated with being hospitalized (including because of an accident).

Source: slideshare.net

Source: slideshare.net

1 if you don’t go to the hospital, your benefits won’t get paid to you. This can help alleviate the burden of costly hospital expenses that may remain after health insurance deductibles or copays. This includes things like hospital room and board, inpatient physician’s visits and inpatient surgery. Its advantage over accident insurance is that it covers illnesses in addition to accidents. Similar to accident insurance, it is a supplemental option to your primary health coverage.

Source: pinterest.com

Source: pinterest.com

A hospital indemnity plan may pay: As an important voluntary coverage, a hospital indemnity (hi) insurance plan can help round out your benefit package and help employees protect against the added financial stress of being in a hospital while recovering from an accident or serious She is also keeping her private 10 year term life insurance policy at $10 a month for a $150,000 policy. Hospital indemnity insurance similar to accident insurance, hospital indemnity insurance pays benefits directly to policyholders (unless otherwise assigned) to help cover unexpected costs. Accident insurance covers an accident or injury, whereas hospital indemnity would cover you in the hospital.

Source: iiflinsurance.com

Source: iiflinsurance.com

Guaranteed acceptance for you and eligible family members 2. Hospital indemnity insurance similar to accident insurance, hospital indemnity insurance pays benefits directly to policyholders (unless otherwise assigned) to help cover unexpected costs. By contrast, hospital indemnity insurance triggers payments when specific events associated with hospital visits occur. There are some ways in which hospital insurance and accident insurance overlap but a key difference is whether you go to the hospital. Get a hospital indemnity insurance quote.

Source: singsaver.com.sg

Source: singsaver.com.sg

It is also used to supplement any expenses incurred outside of your health coverage. Hospital indemnity insurance provides a set cash payment to use for. A hospital indemnity insurance policy may include coverage on, but is not limited to the following: As an additional option, you can likely use it to pay any. This type of coverage pays you direct cash if you have to go to the hospital.

Source: aig.ie

Source: aig.ie

This can help alleviate the burden of costly hospital expenses that may remain after health insurance deductibles or copays. What is hospital indemnity insurance? While accident insurance applies to hospital stays, you can seek treatment from your primary care doctor. Hospital indemnity policies typically pay a lump sum directly to you, not a hospital or medical facility. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement.

Source: aig.com.hk

Source: aig.com.hk

1 if you don’t go to the hospital, your benefits won’t get paid to you. Accident insurance covers an accident or injury, whereas hospital indemnity would cover you in the hospital. Hospital indemnity insurance covers set payments for bills you need to pay. While accident insurance applies to hospital stays, you can seek treatment from your primary care doctor. This type of coverage pays you direct cash if you have to go to the hospital.

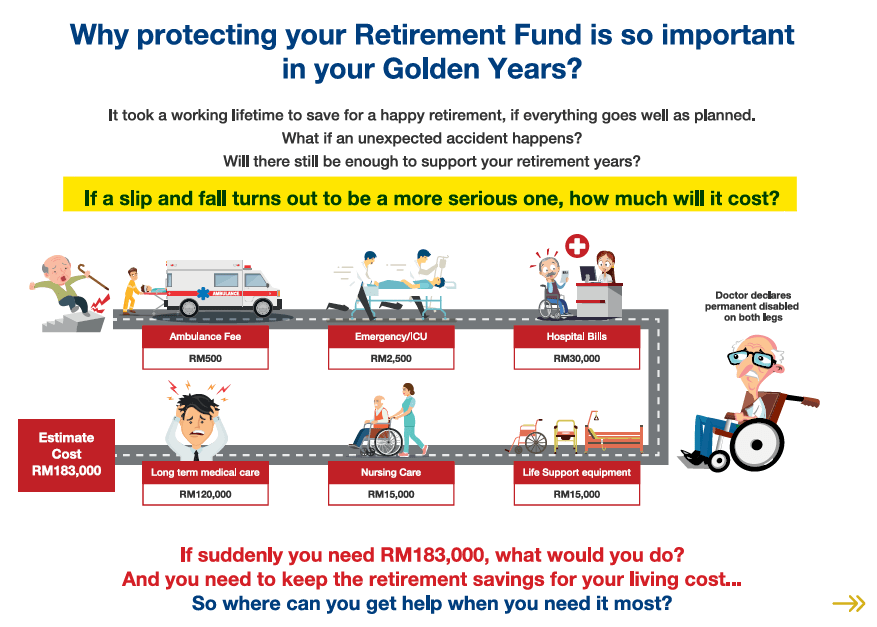

Source: nomoneylah.com

Source: nomoneylah.com

Hospital indemnity insurance covers set payments for bills you need to pay. Portable coverage should you decide to leave your current employer 3. Since hospital indemnity insurance is a sum of money paid to you relative to the terms of your plan, providers cannot deny your insurance. Similar to accident insurance, it is a supplemental option to your primary health coverage. In lieu of accident insurance, another option you can consider is hospital indemnity.

Source: blog.avibra.com

Source: blog.avibra.com

If you don’t go to the hospital, hospital indemnity insurance does not pay benefits. $3,000 for each day in the hospital ($9,000) you receive a check for $10,000 and use the money to pay for your hospital bills and anything else. Similar to accident insurance, hospital indemnity insurance pays benefits directly to policyholders (unless otherwise assigned) to help cover unexpected costs. Similar to accident insurance, it is a supplemental option to your primary health coverage. This includes things like hospital room and board, inpatient physician’s visits and inpatient surgery.

Source: youtube.com

Source: youtube.com

What is a hospital indemnity insurance plan? This, in a nutshell, is hospital indemnity insurance. Hospital indemnity insurance covers set payments for bills you need to pay. Yes, after the first full year you’ll have coverage at 70% for major services like dentures and hearing aids. Hospital indemnity insurance is coverage you can add to your existing health insurance plan.

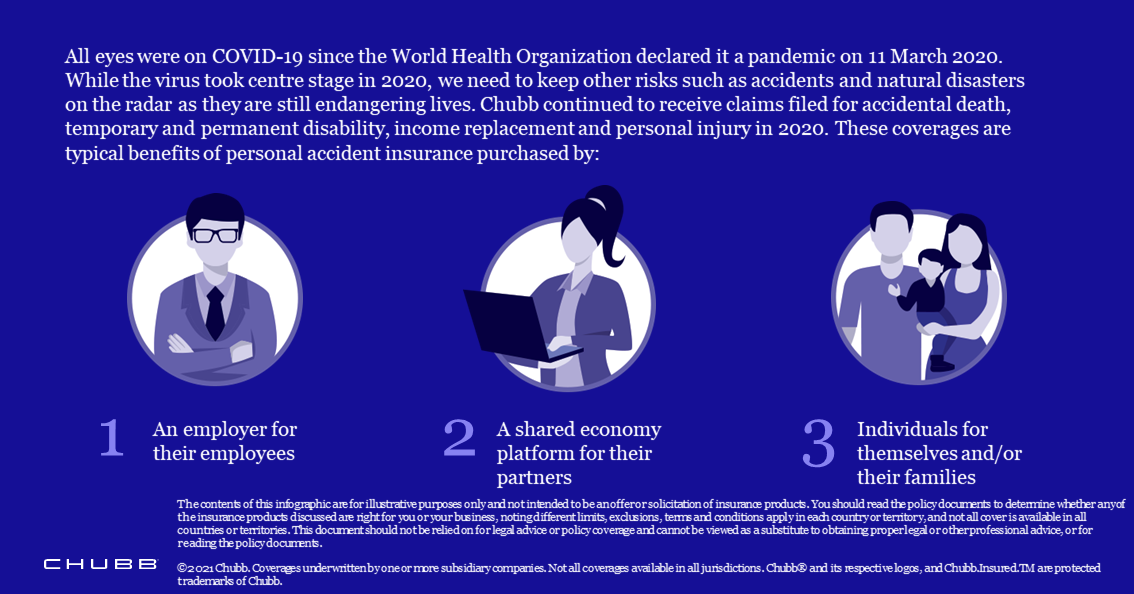

Source: chubb.com

Source: chubb.com

Its advantage over accident insurance is that it covers illnesses in addition to accidents. As an additional option, you can likely use it to pay any. $1,000 for the hospital admittance. What is a hospital indemnity insurance plan? Unlike accident insurance, hospital indemnity insurance pays benefits for covered hospitalizations due to illness and injury.

Source: slideshare.net

Source: slideshare.net

Hospital indemnity insurance similar to accident insurance, hospital indemnity insurance pays benefits directly to policyholders (unless otherwise assigned) to help cover unexpected costs. A hospital indemnity insurance policy may include coverage on, but is not limited to the following: $1,000 for the hospital admittance. It is also used to supplement any expenses incurred outside of your health coverage. What does a hospital indemnity.

Source: quickinsuranceservice.com

Source: quickinsuranceservice.com

Accident insurance is a different type of supplemental insurance that pays out a lump sum if you incur specific kinds of injury as a result of an accident. Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings. This, in a nutshell, is hospital indemnity insurance. Portable coverage should you decide to leave your current employer 3. Hospital indemnity policies typically pay a lump sum directly to you, not a hospital or medical facility.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hospital indemnity vs accident insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.