How auto insurance works in ontario information

Home » Trending » How auto insurance works in ontario informationYour How auto insurance works in ontario images are ready. How auto insurance works in ontario are a topic that is being searched for and liked by netizens today. You can Download the How auto insurance works in ontario files here. Download all free images.

If you’re searching for how auto insurance works in ontario pictures information related to the how auto insurance works in ontario topic, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

How Auto Insurance Works In Ontario. Tort claim settlements and accident benefits are claimed together when dealing with the insurer. Broker = sells through independent brokers, who also offer quotes from other insurance companies. Insurance companies are closely audited to ensure they can cover these costs in the event. You are free to shop around for car insurance rates from a large number of insurance companies.

Official Automotive Blog of Ontario Chrysler Jeep Dodge Ram From ontariochrysler.ca

Official Automotive Blog of Ontario Chrysler Jeep Dodge Ram From ontariochrysler.ca

Although there is a minimum requirement for your coverage set out by the government, beyond that you can pick and choose. There are three types of contacts to help you get insured: If you are coming from one of the provinces that use a public insurance system, you will find the private insurance system in ontario very different. But this doesn’t mean it is right for you. For example, if you pay the provincial average of $1,634 annually, your average monthly car insurance costs in will be $136. The average annual car insurance premium in british columbia is $1,680, nearly 14% higher than the next name on the list — ontario ($1,445).

Broker — sells you the best insurance rate from a number of different companies they represent;

How does business car insurance work? Broker — sells you the best insurance rate from a number of different companies they represent; If you are found driving without valid auto insurance, you can have your driver�s licence suspended and your vehicle impounded. How does business car insurance work? Are you considering sharing a car with a family member, friend, or colleague? The type of vehicle you drive learn how your car measures up by reading how cars measure up.

Source: birthonlaborday.com

Source: birthonlaborday.com

Let’s say if you have a vehicle over 10 years old, you may not want to carry a $1,000 deductible because the vehicle value is likely within a few thousand dollars. Insurance companies may refer to car insurance as property and casualty insurance. There are three types of contacts to help you get insured: The type of vehicle you drive learn how your car measures up by reading how cars measure up. Your rate is determined using a combination of factors or risk characteristics, outlined below.

Source: kijiji.ca

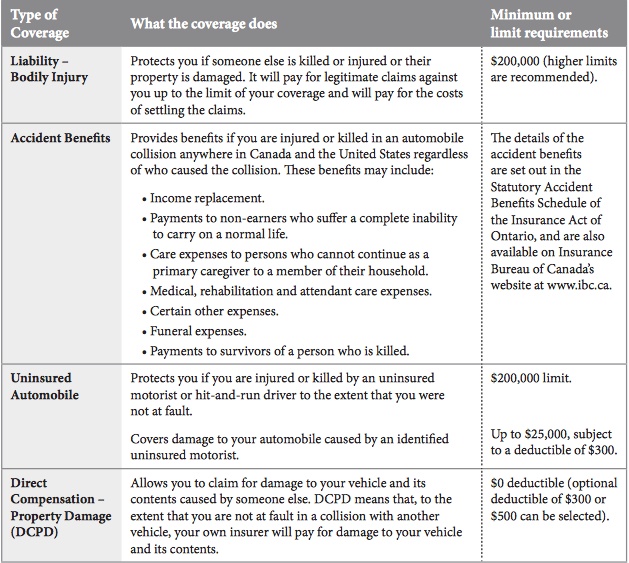

It also includes coverage for damage to your car up to $25,000. There are three types of contacts to help you get insured: The average annual car insurance premium in british columbia is $1,680, nearly 14% higher than the next name on the list — ontario ($1,445). But once you are behind the wheel,. Ontario auto insurance is provided by private insurance carriers and is regulated by the financial services regulatory authority of ontario (fsrao).

Source: buddschev.com

Source: buddschev.com

Placed third and fourth on the list are alberta ($1,251) and newfoundland & labrador ($1,132), while manitoba rounds out the top five with an annual average premium of $1,080. Ontario law requires that all motorists have auto insurance. All companies selling automobile insurance in ontario must be licensed by the financial services commission of ontario (fsco) (1), which also licenses agents. Required by law across canada, auto insurance covers the owner/driver, passengers, pedestrians and property affected by a vehicle collision. There are three types of contacts to help you get insured:

Source: onlia.ca

Source: onlia.ca

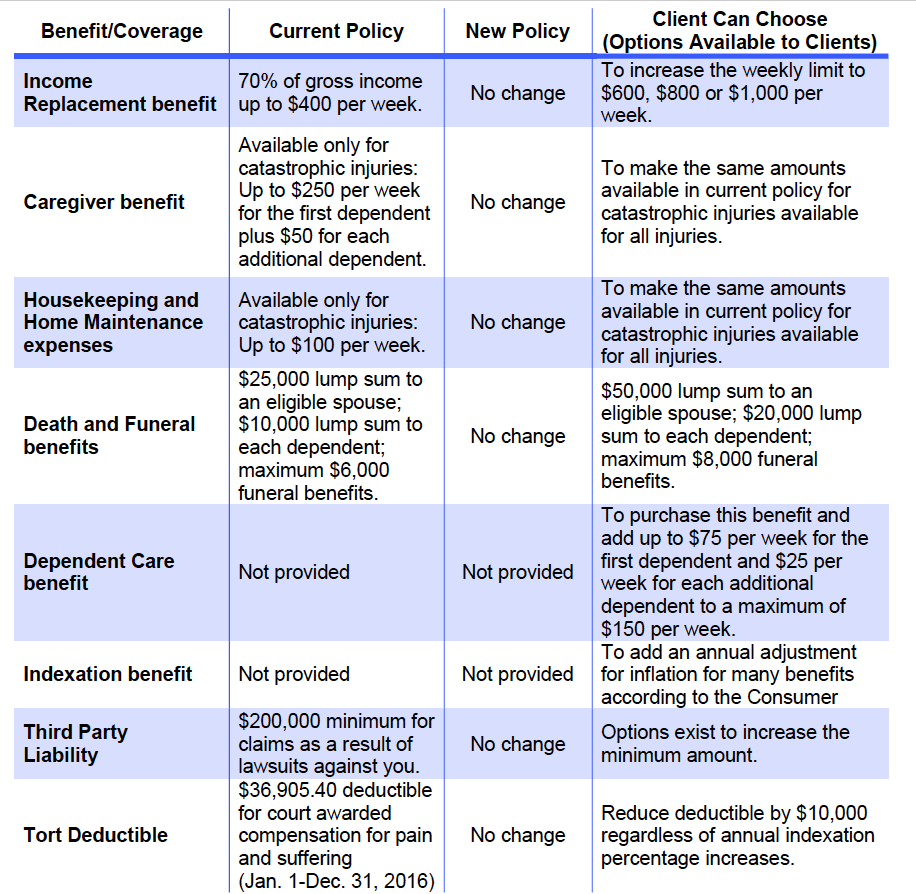

You are free to shop around for car insurance rates from a large number of insurance companies. Every person is entitled to basic compensation through his or her own insurer based on ontario’s driver insurance scheme. You can estimate your average car insurance in ontario per month by dividing your total premiums by 12 months. Liability claims if you�re held responsible for an accident causing damage to another person’s vehicle or injury to other people. Fortunately, all ontario auto insurance policies contain a provision for ‘uninsured automobile coverage,’ which protects insured ontario motorists and certain family members to.

Source: thestar.com

Source: thestar.com

Your personal profile your personal insurance profile is created by your insurance company based on: For example, if you pay the provincial average of $1,634 annually, your average monthly car insurance costs in will be $136. If you are coming from one of the provinces that use a public insurance system, you will find the private insurance system in ontario very different. Agent — usually sells insurance only for a single company. There are three types of contacts to help you get insured:

Source: ilscorp.com

Source: ilscorp.com

But this doesn’t mean it is right for you. You are free to shop around for car insurance rates from a large number of insurance companies. * agent = sells through a network of agents that only sell their products. Placed third and fourth on the list are alberta ($1,251) and newfoundland & labrador ($1,132), while manitoba rounds out the top five with an annual average premium of $1,080. Agent — usually sells insurance only for a single company.

Source: bstinsurance.com

Source: bstinsurance.com

Fsco maintains an updated list of licensed insurance companies. Every person is entitled to basic compensation through his or her own insurer based on ontario’s driver insurance scheme. Required by law across canada, auto insurance covers the owner/driver, passengers, pedestrians and property affected by a vehicle collision. Let’s say if you have a vehicle over 10 years old, you may not want to carry a $1,000 deductible because the vehicle value is likely within a few thousand dollars. Last year ontario drivers using ratesdotca paid on an average 30% less than the median market rate.

Source: myinsurancebroker.com

Source: myinsurancebroker.com

Driving a vehicle is a basic necessity for many canadians. Fsco maintains an updated list of licensed insurance companies. * agent = sells through a network of agents that only sell their products. So, if you live in a town or city with a high accident or theft rate, your car insurance provider will need to charge you more to offset the potential expenses they�ll incur if an event takes place in the future. Direct = sells direct to the public, usually online or by phone.

Source: formsbirds.com

Source: formsbirds.com

You can estimate your average car insurance in ontario per month by dividing your total premiums by 12 months. Having to pay to repair your car or other vehicle if it�s damaged or in an accident. It’s a system that has prioritized the claims process for drivers who need reimbursement so that the drivers aren’t kept waiting. Press j to jump to the feed. Auto insurance is required by law across canada.

Source: thinkinsure.ca

Source: thinkinsure.ca

But this doesn’t mean it is right for you. The first step entails reviewing the insurance agreement to know the extent of available benefits. How does business car insurance work? Fortunately, all ontario auto insurance policies contain a provision for ‘uninsured automobile coverage,’ which protects insured ontario motorists and certain family members to. Any insurance you get must come through a company or broker who is licensed to sell car insurance by the government of ontario.

Source: carinsuranceonswa.blogspot.com

The average cost of car insurance in ontario per month will vary based on the amount of your annual premiums. But this doesn’t mean it is right for you. Fsrao ensures rate increases are substantiated. Ontario vehicle ownership allows you to lend someone your car from time to time, and they will be covered under your policy, but if you plan to share it on a regular basis, legally you need to add them to your insurance policy. It also includes coverage for damage to your car up to $25,000.

Source: fin.gov.on.ca

Source: fin.gov.on.ca

Fortunately, all ontario auto insurance policies contain a provision for ‘uninsured automobile coverage,’ which protects insured ontario motorists and certain family members to. But once you are behind the wheel,. Buying home insurance as a homeowner, you need to insure your house for replacement costs so that in the event of serious damage or destruction you have adequate coverage. Ontario vehicle ownership allows you to lend someone your car from time to time, and they will be covered under your policy, but if you plan to share it on a regular basis, legally you need to add them to your insurance policy. Ontario law requires that all motorists have auto insurance.

Source: ahainsurance.ca

Source: ahainsurance.ca

But once you are behind the wheel,. Driving a vehicle is a basic necessity for many canadians. You can also voluntarily add insurance that gives you coverage for damage. Broker — sells you the best insurance rate from a number of different companies they represent; Car insurance may protect you from:

Source: ratelab.ca

Source: ratelab.ca

57 rows best auto insurance companies in ontario. But this doesn’t mean it is right for you. For example, if you pay the provincial average of $1,634 annually, your average monthly car insurance costs in will be $136. Fortunately, all ontario auto insurance policies contain a provision for ‘uninsured automobile coverage,’ which protects insured ontario motorists and certain family members to. Auto insurance is required by law across canada.

Source: ahainsurance.ca

Source: ahainsurance.ca

Car insurance may protect you from: Agent — usually sells insurance only for a single company. Fsco maintains an updated list of licensed insurance companies. Press j to jump to the feed. All companies selling automobile insurance in ontario must be licensed by the financial services commission of ontario (fsco) (1), which also licenses agents.

Source: lowestrates.ca

Source: lowestrates.ca

Car insurance may protect you from: Mandatory ontario auto insurance coverage includes (full descriptions below) In ontario, the standard deductible offered by insurance companies is $500 for collision and $300 for comprehensive. Billions of dollars are paid out every year to cover the cost of auto insurance claims in canada alone. Ontario insurance is a private industry that means the policy is purchased by a private company.

Source: dulibaninsurance.com

Source: dulibaninsurance.com

Placed third and fourth on the list are alberta ($1,251) and newfoundland & labrador ($1,132), while manitoba rounds out the top five with an annual average premium of $1,080. The type of vehicle you drive learn how your car measures up by reading how cars measure up. But this doesn’t mean it is right for you. Ontario auto insurance is provided by private insurance carriers and is regulated by the financial services regulatory authority of ontario (fsrao). Ontario insurance is a private industry that means the policy is purchased by a private company.

Source: allinsurancesforyou.blogspot.com

Source: allinsurancesforyou.blogspot.com

You can also voluntarily add insurance that gives you coverage for damage. Liability claims if you�re held responsible for an accident causing damage to another person’s vehicle or injury to other people. Last year ontario drivers using ratesdotca paid on an average 30% less than the median market rate. Fortunately, all ontario auto insurance policies contain a provision for ‘uninsured automobile coverage,’ which protects insured ontario motorists and certain family members to. Thinking of buying a small business, but thinking of hiring a contractor/employee to do some work, which involves driving to some locations and.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how auto insurance works in ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.