How can an insurance company minimize exposure to loss Idea

Home » Trending » How can an insurance company minimize exposure to loss IdeaYour How can an insurance company minimize exposure to loss images are ready in this website. How can an insurance company minimize exposure to loss are a topic that is being searched for and liked by netizens today. You can Download the How can an insurance company minimize exposure to loss files here. Find and Download all free vectors.

If you’re looking for how can an insurance company minimize exposure to loss images information connected with to the how can an insurance company minimize exposure to loss interest, you have pay a visit to the right blog. Our site frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

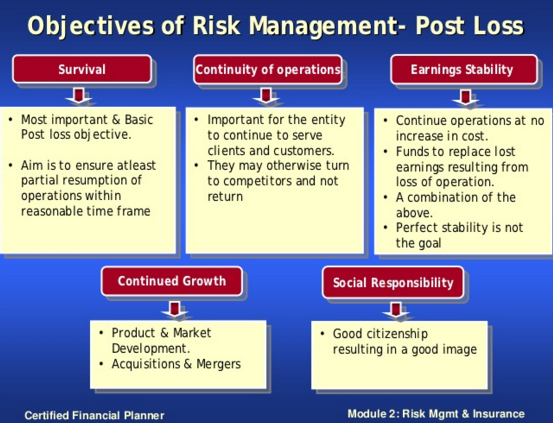

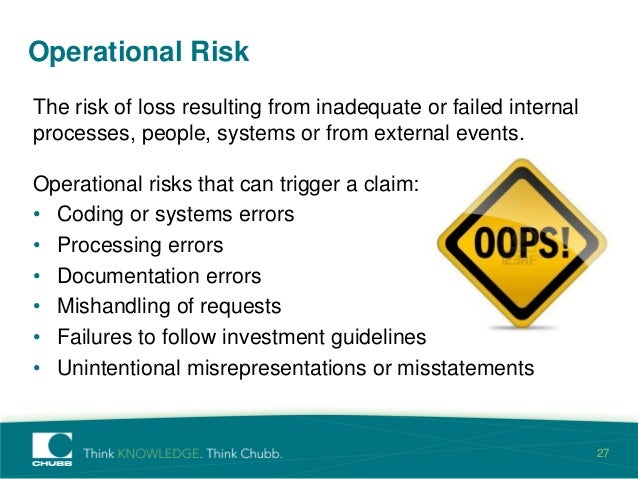

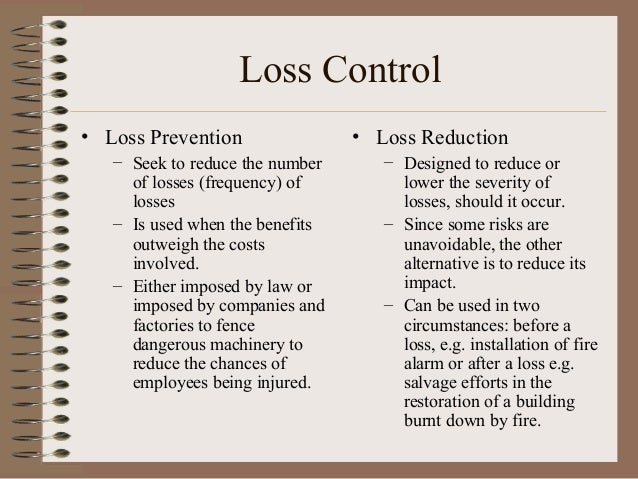

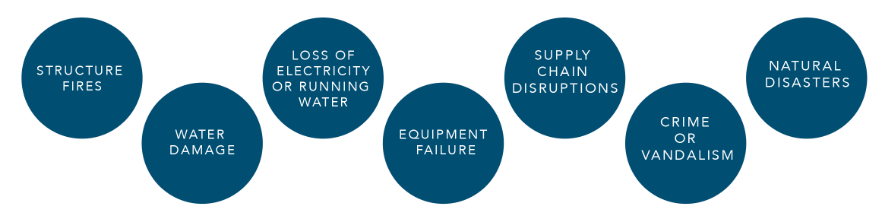

How Can An Insurance Company Minimize Exposure To Loss. The trick here is to put the risk in dollars. Commercial property insurance covers losses and damage to physical company property. An effective risk management and loss prevention program will in most instances lower your insurance premiums and diminish the probability of filing claims, replacing damaged property, and defending yourself in a lawsuit. Insurance, training and communication can go a long way toward protecting your equipment rental business from exposure to liability.

Creating a Personal Risk Management Plan From hedgethink.com

Creating a Personal Risk Management Plan From hedgethink.com

While you can�t prevent all property losses from occurring, you can minimize the severity of property losses by following these tips: Determine how much of this risk you can bear, and; We can help you think through your options! Insurers can predict losses more accurately if they insure many risks rather than a few. If problems arise, handle them quickly and completely. By insuring tangible assets like equipment and property, you can mitigate risk.

Reinsurance companies are concerned with the risk of catastrophe loss and they are working out method to control their exposure.

Commercial property insurance covers losses and damage to physical company property. Also, the probabilistic estimates used by the insurance company, by logic, assume a large number of units in a distribution, and insurance products are priced accordingly. Figure out which insurances make the most sense for your business. Let’s look at some examples of how a company or an individual can reasonably minimize risk exposure and losses: Commercial property insurance covers losses and damage to physical company property. Money › insurance handling risk.

Source: slideshare.net

Source: slideshare.net

Purchasing business insurance is only one part of minimizing business losses. A contingent loss may be suffered by a party who is dependent upon the activities of another party owning or operating the property that is damaged. Insurance, training and communication can go a long way toward protecting your equipment rental business from exposure to liability. Responsive coverage should respond to the company’s use of experts in identifying the scope of loss and possible exposures including: Money › insurance handling risk.

Source: tmc-assist.co.uk

Source: tmc-assist.co.uk

Insurance loss control is a form of risk management that reduces the potential for losses in an insurance policy. Risk management is a formal method of identifying, eliminating, or mitigating risks for an organization, but can also be used by individuals. Money › insurance handling risk. By insuring tangible assets like equipment and property, you can mitigate risk. Identify risks and implement procedures to minimize them.

Here’s a little more detail and some comments on these 3 steps. The trick here is to put the risk in dollars. Money › insurance handling risk. By insuring tangible assets like equipment and property, you can mitigate risk. Figure out which insurances make the most sense for your business.

Source: invizenit.com

Source: invizenit.com

Responsive coverage should respond to the company’s use of experts in identifying the scope of loss and possible exposures including: How can an insurance company minimize exposure to loss? Purchasing business insurance is only one part of minimizing business losses. Insurers can predict losses more accurately if they insure many risks rather than a few. These are losses which occur when, as a result of damage to real or personal property, income is reduced or additional expenses are incurred other than for the repair or replacement of damaged property.

Source: slideshare.net

Source: slideshare.net

Insurance loss control is a form of risk management that reduces the potential for losses in an insurance policy. Telling oneself that an investment is not a loss until it’s realized (i.e., when the investment is sold) rational strategies for avoiding losses. It’s impossible to completely eliminate risk in your. By isolating loss exposures from one another, you can minimize the adverse effects of a single loss. The trick here is to put the risk in dollars.

Source: blog.psionline.com

Source: blog.psionline.com

Separation of exposure units can reduce a business’s dependence on a single asset, activity, or person, making individual losses smaller. The trick here is to put the risk in dollars. Risk management is a formal method of identifying, eliminating, or mitigating risks for an organization, but can also be used by individuals. What type of risk involves the potential for loss with no possibility for gain? Telling oneself that an investment is not a loss until it’s realized (i.e., when the investment is sold) rational strategies for avoiding losses.

Source: thestartupgarage.com

Source: thestartupgarage.com

Determine how much of this risk you can bear, and; What type of risk involves the potential for loss with no possibility for gain? An insurable risk must meet certain requirements before an insurance company will cover the risk: Insurers can predict losses more accurately if they insure many risks rather than a few. Purchasing business insurance is only one part of minimizing business losses.

Source: coremarkins.com

Source: coremarkins.com

Determine how much of this risk you can bear, and; We can help you think through your options! Insure the remainder of the risk; Let’s look at some examples of how a company or an individual can reasonably minimize risk exposure and losses: How can an insurance company minimize exposure to loss?

Source: rxpharmacyassurance.com

Source: rxpharmacyassurance.com

While you can�t prevent all property losses from occurring, you can minimize the severity of property losses by following these tips: Commercial property insurance covers losses and damage to physical company property. An effective risk management and loss prevention program will in most instances lower your insurance premiums and diminish the probability of filing claims, replacing damaged property, and defending yourself in a lawsuit. In fact, a better understanding of a client’s risk exposure can help all involved parties: The trick here is to put the risk in dollars.

Source: info.bcarm.co.uk

The trick here is to put the risk in dollars. The law of large numbers is based on the idea that losses become easier to predict as the number of risks increases. Risk transfer has two common forms. The most popular type is insurance, essentially shifting risk to an insurance carrier for a fee. Also, the probabilistic estimates used by the insurance company, by logic, assume a large number of units in a distribution, and insurance products are priced accordingly.

Source: dnb.com

Source: dnb.com

Commercial property insurance covers losses and damage to physical company property. Commercial property insurance covers losses and damage to physical company property. An effective risk management and loss prevention program will in most instances lower your insurance premiums and diminish the probability of filing claims, replacing damaged property, and defending yourself in a lawsuit. In fact, a better understanding of a client’s risk exposure can help all involved parties: Responsive coverage should respond to the company’s use of experts in identifying the scope of loss and possible exposures including:

Source: allchoiceinsurance.com

Source: allchoiceinsurance.com

For example, if a major. An insurable risk must meet certain requirements before an insurance company will cover the risk: Reinsurance companies are concerned with the risk of catastrophe loss and they are working out method to control their exposure. According to the law of large numbers, how would losses be affected if the number of similar insured units increases? If problems arise, handle them quickly and completely.

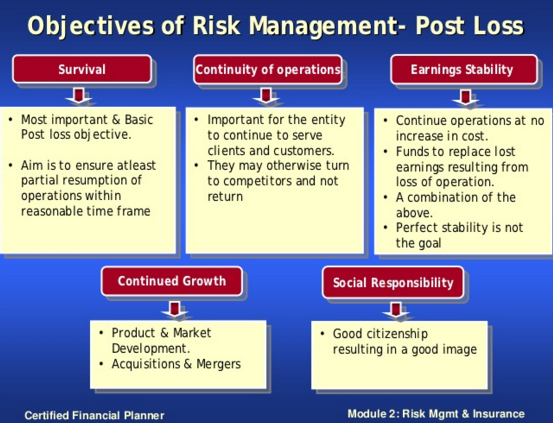

Source: slideserve.com

Source: slideserve.com

Update electrical wiring, heating, plumbing and the roof at least every 20 to 25 years. We can help you think through your options! Predictability of losses will be improved abc company is attempting to minimize the severity of potential losses within its company. Reinsurance companies are concerned with the risk of catastrophe loss and they are working out method to control their exposure. By protecting your business operations from outside events, like natural disasters, if the worst happens, you are.

Source: xtralis.com

Source: xtralis.com

For example, storing inventory at two separate warehouses will minimize losses if one facility is destroyed. Loss prediction is an important part of the rate development process. Improve existing controls before deploying new ones enterprise, it and vendor risk management professionals often start down the road of proposing the implementation of new controls without examining the effectiveness of existing ones. The loss costs can then be spread over all insured’s in the underwriting class. By isolating loss exposures from one another, you can minimize the adverse effects of a single loss.

Source: hedgethink.com

Source: hedgethink.com

By isolating loss exposures from one another, you can minimize the adverse effects of a single loss. 1 insurers pool risks by accepting a large number of policyholders that have a low risk of incurring losses. Loss prediction is an important part of the rate development process. In order to reduce your exposure. By insuring tangible assets like equipment and property, you can mitigate risk.

Source: snappyedu.com

Source: snappyedu.com

A second requirement is that the loss should be both. Insurance, training and communication can go a long way toward protecting your equipment rental business from exposure to liability. The most popular type is insurance, essentially shifting risk to an insurance carrier for a fee. Separation of exposure units can reduce a business’s dependence on a single asset, activity, or person, making individual losses smaller. Let’s look at some examples of how a company or an individual can reasonably minimize risk exposure and losses:

![]() Source: rsaglobalinsurance.com

Source: rsaglobalinsurance.com

Figure out which insurances make the most sense for your business. If problems arise, handle them quickly and completely. Primary companies managed their catastrophe exposures simply by purchasing appropriate reinsurance and ignored their concentrations of exposure. Also, the probabilistic estimates used by the insurance company, by logic, assume a large number of units in a distribution, and insurance products are priced accordingly. Predictability of losses will be improved abc company is attempting to minimize the severity of potential losses within its company.

Source: slideshare.net

Source: slideshare.net

For example, if a major. According to the law of large numbers, how would losses be affected if the number of similar insured units increases? These are losses which occur when, as a result of damage to real or personal property, income is reduced or additional expenses are incurred other than for the repair or replacement of damaged property. Risk transfer has two common forms. In fact, a better understanding of a client’s risk exposure can help all involved parties:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how can an insurance company minimize exposure to loss by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.