How do insurance companies invest Idea

Home » Trending » How do insurance companies invest IdeaYour How do insurance companies invest images are available in this site. How do insurance companies invest are a topic that is being searched for and liked by netizens today. You can Find and Download the How do insurance companies invest files here. Find and Download all free vectors.

If you’re looking for how do insurance companies invest images information linked to the how do insurance companies invest topic, you have come to the ideal blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

How Do Insurance Companies Invest. Warren buffett’s insurance company, geico, has been a particularly successful insurance company, because buffett has invested the premiums geico has received exceptionally well. And (3) reduced overall claims expense. Insurance companies invest and manage the monies they receive from their customers for their own benefit. An insurance company also makes money by measuring risks.

The Insurers Most Actively Investing In Startups Across From pinterest.com

The Insurers Most Actively Investing In Startups Across From pinterest.com

This is the difference in the amount of money collected from the people as premiums and the money paid when a claim is filed in the hour of need. The reinsurer then liquidates the securities when they need to pay out claims. Similar to financial institutions that hold onto your money like banks, insurance companies will invest the premium dollars they hold in the hopes of turning an even bigger profit on wall street. An insurance company will invest the money anticipating a certain return, and provides slightly less to the annuity holder. The second, and more important, way insurance companies make money is by investing the money they take in before it is paid out for claims. However, they do invest smaller amounts in common stocks, mortgages and first leans, and highly.

What you pay as a premium is invested further so that it accrues interest over time and that is further used to.

If a business or area is prone to high levels of risks, an insurance company may elect to avoid offering insurance coverage for that type of business. For instance, if an area is prone to earthquake, insurance companies may avoid insuring homes in that area. When the company invests $10 million of the payments it receives, it will generate $100,000 in. The insurance company keeps all the premiums already paid, pays the customer with interest earned on their investments, and keep the remaining cash. How do the insurers invest your money? For example, thousands of people invest in a term plan with a coverage of rs.

Source: quora.com

Anyone with a healthcare policy pays a monthly insurance premium. After the life insurance application and underwriting process, you’re assigned a premium based on your health and other risk factors. This is the difference in the amount of money collected from the people as premiums and the money paid when a claim is filed in the hour of need. Warren buffett’s insurance company, geico, has been a particularly successful insurance company, because buffett has invested the premiums geico has received exceptionally well. Insurance companies invest and manage the monies they receive from their customers for their own benefit.

Source: chaospost.com

Source: chaospost.com

After the life insurance application and underwriting process, you’re assigned a premium based on your health and other risk factors. This is the difference in the amount of money collected from the people as premiums and the money paid when a claim is filed in the hour of need. For instance, if an area is prone to earthquake, insurance companies may avoid insuring homes in that area. Similar to financial institutions that hold onto your money like banks, insurance companies will invest the premium dollars they hold in the hopes of turning an even bigger profit on wall street. Remember they receive a lot of money from premiums during the year in exchange for a commitment to pay claims.

Source: mysiponline.blogspot.com

Source: mysiponline.blogspot.com

These premiums are also interest free unlike bank deposits where banks pay some form of interest for the amount deposited with them. It’s invested — to recoup underwriting losses, insurance companies also use money collected from premiums for investments. Insurance companies make money in the following two ways: What happens inside an insurance company is a smart investment of the crores of rupees that are collected through small premiums by millions of investors. Since life insurance companies know the risk of losing money, they invest premiums in stocks, bonds, and accounts that pay them interest.

Source: youtube.com

Source: youtube.com

For instance, if an area is prone to earthquake, insurance companies may avoid insuring homes in that area. An insurance company will invest the money anticipating a certain return, and provides slightly less to the annuity holder. These premiums are also interest free unlike bank deposits where banks pay some form of interest for the amount deposited with them. In that sense, cash value payouts are actually. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums.

Source: austinwealthmgmt.com

Source: austinwealthmgmt.com

Brought to you by techwalla. The second, and more important, way insurance companies make money is by investing the money they take in before it is paid out for claims. This spread between the money earned and the money paid out is profit for the insurance company. The investments help insurance companies keep your premium low. This money is known as the float.

Source: straitstimes.com

Source: straitstimes.com

Generally, insurance companies invest the money they are paid by customers in stocks and bonds. This means insurance companies keep a relatively small cash component sufficient to meet claims. Underwriting income and investment income. The second, and more important, way insurance companies make money is by investing the money they take in before it is paid out for claims. The reinsurer then liquidates the securities when they need to pay out claims.

Source: vocal.media

Source: vocal.media

For example, thousands of people invest in a term plan with a coverage of rs. Huge profits can be reaped, or lost, as a result. And (3) reduced overall claims expense. Life insurance companies make money on life insurance policies in four main ways: Life insurance companies invest alongside the expected profile of their cash needs.

Source: pinterest.com

Source: pinterest.com

The second, and more important, way insurance companies make money is by investing the money they take in before it is paid out for claims. When an insurance company receives its monthly premiums, the insurance company takes those monies and invests them in the financial markets, to increase their revenues. It’s invested — to recoup underwriting losses, insurance companies also use money collected from premiums for investments. This means insurance companies keep a relatively small cash component sufficient to meet claims. Huge profits can be reaped, or lost, as a result.

Source: yonghui.sg

Source: yonghui.sg

For example, thousands of people invest in a term plan with a coverage of rs. Underwriting income and investment income. This means insurance companies keep a relatively small cash component sufficient to meet claims. Their enterprise does not create money in. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums.

Source: vocal.media

Source: vocal.media

What happens inside an insurance company is a smart investment of the crores of rupees that are collected through small premiums by millions of investors. And (3) reduced overall claims expense. What happens inside an insurance company is a smart investment of the crores of rupees that are collected through small premiums by millions of investors. The reinsurer then liquidates the securities when they need to pay out claims. For example, thousands of people invest in a term plan with a coverage of rs.

Source: quora.com

Insurance companies invest and manage the monies they receive from their customers for their own benefit. Life insurance companies make money on life insurance policies in four main ways: How do insurance companies make money? Generally, insurance companies invest the money they are paid by customers in stocks and bonds. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums.

Source: worldpropertyjournal.com

Source: worldpropertyjournal.com

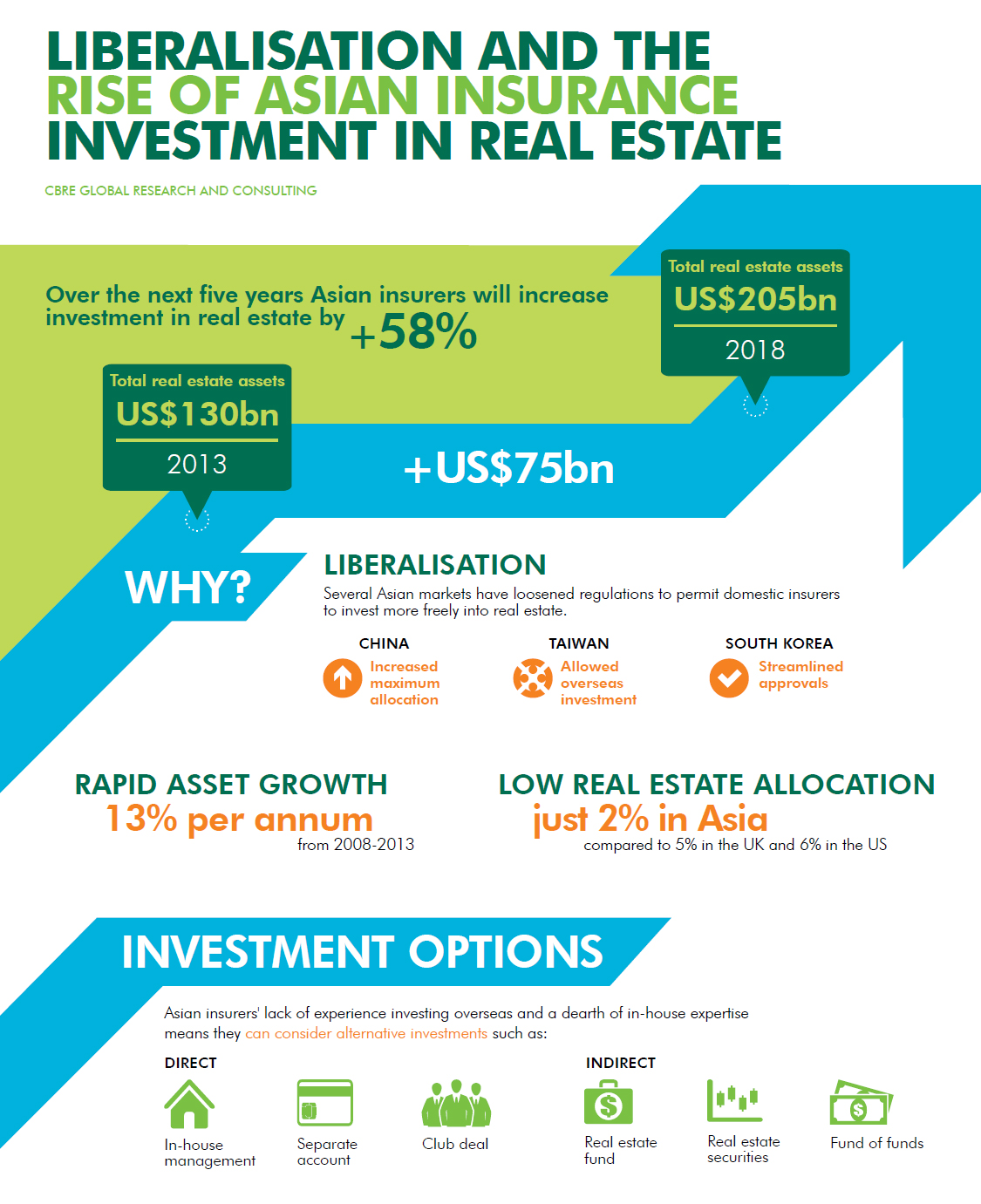

For instance, if an area is prone to earthquake, insurance companies may avoid insuring homes in that area. This spread between the money earned and the money paid out is profit for the insurance company. Generally, insurance companies invest the money they are paid by customers in stocks and bonds. The investments help insurance companies keep your premium low. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums.

Source: pinterest.com

Source: pinterest.com

The rest of the money is invested in bonds with yields high enough to cover expenses and future cash needs. How do insurance companies make money? Insurance companies make money in two main ways: This spread between the money earned and the money paid out is profit for the insurance company. This unique situation allows insurance companies to invest that money while it’s not being used.

Source: treatsinc.org

Source: treatsinc.org

It both is and isn�t. Insurance companies invest and manage the monies they receive from their customers for their own benefit. This money is known as the float. How do the insurers invest your money? Insurance companies make money in two main ways:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This unique situation allows insurance companies to invest that money while it’s not being used. When the company invests $10 million of the payments it receives, it will generate $100,000 in. How do insurance companies make money? The reinsurer then liquidates the securities when they need to pay out claims. Anyone with a healthcare policy pays a monthly insurance premium.

Source: blog.runnymede.com

Source: blog.runnymede.com

An insurance company also makes money by measuring risks. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums. This spread between the money earned and the money paid out is profit for the insurance company. The reinsurer then liquidates the securities when they need to pay out claims. Now, the investment experts in the insurance.

Source: riskman1.com

Source: riskman1.com

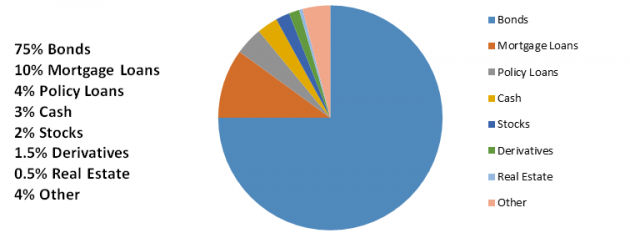

Insurance companies also make money through investing. When the company invests $10 million of the payments it receives, it will generate $100,000 in. Some state regulators use an insurance company’s investment returns to determine if the company is charging a fair price for their premiums. A large portion of the investment income is invested in the bond market, either in government or corporate bonds, thus insurance companies are among the largest investors in the bond markets and are. The investments help insurance companies keep your premium low.

Source: pinterest.com

Source: pinterest.com

Brought to you by techwalla. What you pay as a premium is invested further so that it accrues interest over time and that is further used to. If a business or area is prone to high levels of risks, an insurance company may elect to avoid offering insurance coverage for that type of business. These premiums are also interest free unlike bank deposits where banks pay some form of interest for the amount deposited with them. Brought to you by techwalla.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how do insurance companies invest by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.