How do self funded insurance plans work information

Home » Trend » How do self funded insurance plans work informationYour How do self funded insurance plans work images are ready. How do self funded insurance plans work are a topic that is being searched for and liked by netizens today. You can Get the How do self funded insurance plans work files here. Get all royalty-free photos and vectors.

If you’re searching for how do self funded insurance plans work images information connected with to the how do self funded insurance plans work interest, you have pay a visit to the right site. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

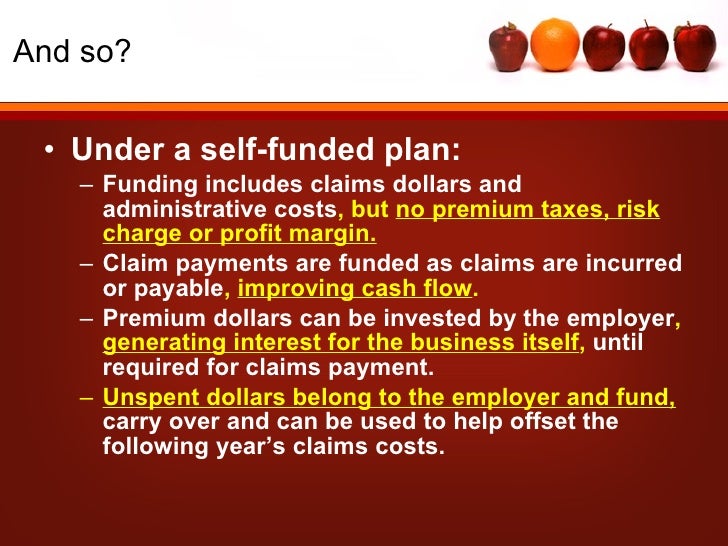

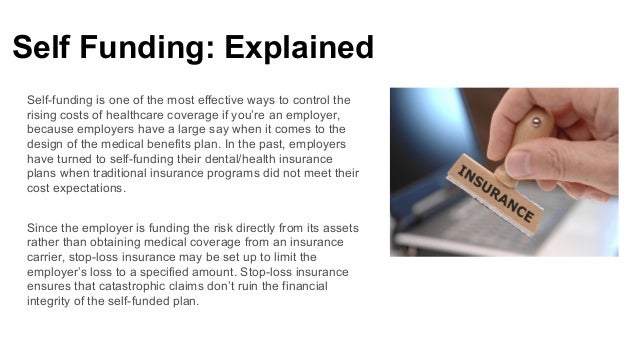

How Do Self Funded Insurance Plans Work. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest. That means that instead of paying an insurance company a predefined rate,. The insurance company manages the payments, but the employer is the one who pays the claims. The company may hire a third party administer to handle claims, but costs are picked up by the employer.

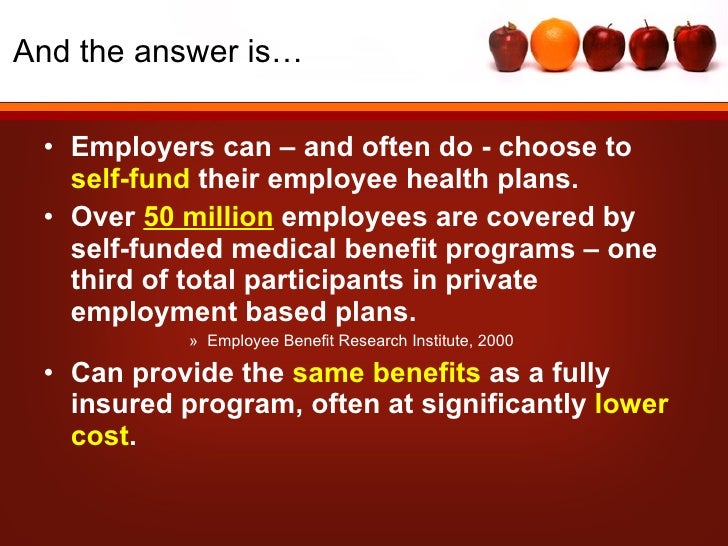

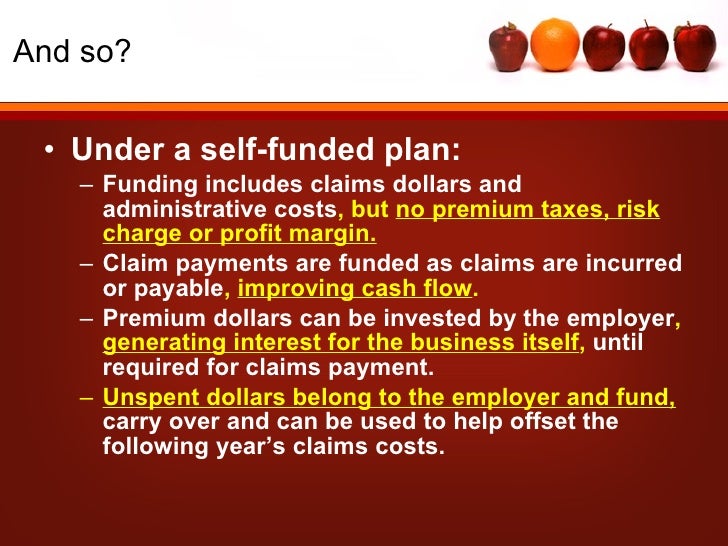

Self Funded Health Plans 101 From slideshare.net

Self Funded Health Plans 101 From slideshare.net

These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. Employers will still contract with insurance. Self funded basically means the company will purchase a large deductible plan from an insurance company and the company will be responsible for any claims that fall under that large deductible plan. The insurance company manages the payments, but the employer is the one who pays the claims. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. But keep in mind, if you work for a large company, with thousands of employees, there.

This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents.

Employers will still contract with insurance. Also, rates are calculated with the expectation that the employer will receive funds from the plan at the end of the year. The company may hire a third party administer to handle claims, but costs are picked up by the employer. That means that instead of paying an insurance company a predefined rate,. Employers will still contract with insurance. The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other.

Source: slideshare.net

Source: slideshare.net

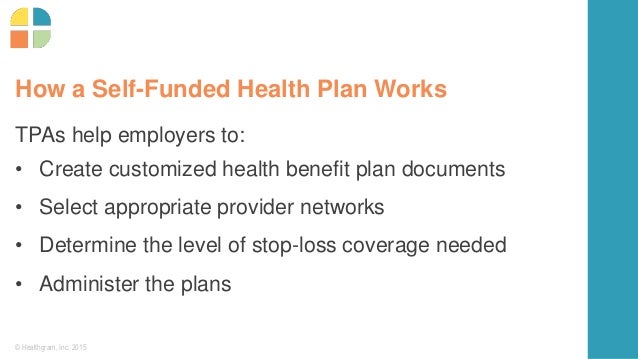

Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims, administrative costs and. They will be able to help you draft the specific details of a plan, help you find a provider network of healthcare professionals, and help find you a third party administrator (tpa) to manage the ongoing busywork, like claims filings. That means that instead of paying an insurance company a predefined rate,. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents.

Source: youtube.com

Source: youtube.com

The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other. But keep in mind, if you work for a large company, with thousands of employees, there. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. The company may hire a third party administer to handle claims, but costs are picked up by the employer. A self funded plan does not pay a premium to an insurance company for benefits, instead the funds are kept in house.

Source: youtube.com

Source: youtube.com

This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. The company may hire a third party administer to handle claims, but costs are picked up by the employer. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. But keep in mind, if you work for a large company, with thousands of employees, there. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest.

Source: compass.k12albemarle.org

Source: compass.k12albemarle.org

A self funded plan does not pay a premium to an insurance company for benefits, instead the funds are kept in house. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest. The company may hire a third party administer to handle claims, but costs are picked up by the employer. That means that instead of paying an insurance company a predefined rate,. This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Source: precisionwellness.io

Source: precisionwellness.io

A self funded plan does not pay a premium to an insurance company for benefits, instead the funds are kept in house. Also, rates are calculated with the expectation that the employer will receive funds from the plan at the end of the year. They will be able to help you draft the specific details of a plan, help you find a provider network of healthcare professionals, and help find you a third party administrator (tpa) to manage the ongoing busywork, like claims filings. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest.

Source: guardiananytime.com

Source: guardiananytime.com

Employers will still contract with insurance. Most companies that self insure also pay for stoploss insurance, which is a high deductible plan that kicks to pay claims for a large claim a. The company may hire a third party administer to handle claims, but costs are picked up by the employer. Employers will still contract with insurance. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims, administrative costs and.

Source: pinterest.fr

Source: pinterest.fr

This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Most companies that self insure also pay for stoploss insurance, which is a high deductible plan that kicks to pay claims for a large claim a. The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other. The insurance company manages the payments, but the employer is the one who pays the claims.

Source: medcost.com

Source: medcost.com

That means that instead of paying an insurance company a predefined rate,. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims, administrative costs and. But keep in mind, if you work for a large company, with thousands of employees, there. Employers will still contract with insurance. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can.

Source: slideshare.net

Source: slideshare.net

This is a type of plan in which an employer takes on most or all of the cost of benefit claims. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Self funded basically means the company will purchase a large deductible plan from an insurance company and the company will be responsible for any claims that fall under that large deductible plan. This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. But keep in mind, if you work for a large company, with thousands of employees, there.

Source: funkishusvedhavet.blogspot.com

They will be able to help you draft the specific details of a plan, help you find a provider network of healthcare professionals, and help find you a third party administrator (tpa) to manage the ongoing busywork, like claims filings. Self funded basically means the company will purchase a large deductible plan from an insurance company and the company will be responsible for any claims that fall under that large deductible plan. The insurance company manages the payments, but the employer is the one who pays the claims. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest. They will be able to help you draft the specific details of a plan, help you find a provider network of healthcare professionals, and help find you a third party administrator (tpa) to manage the ongoing busywork, like claims filings.

Source: slideshare.net

Source: slideshare.net

These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. They will be able to help you draft the specific details of a plan, help you find a provider network of healthcare professionals, and help find you a third party administrator (tpa) to manage the ongoing busywork, like claims filings. That means that instead of paying an insurance company a predefined rate,.

Source: olympiabenefits.com

A self funded plan does not pay a premium to an insurance company for benefits, instead the funds are kept in house. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims, administrative costs and. That means that instead of paying an insurance company a predefined rate,.

Source: natinspartners.com

Source: natinspartners.com

This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest. This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. These plans do not make much sense for smaller companies because there are not enough employees to spread the risk and small companies usually do not have the. That means that instead of paying an insurance company a predefined rate,.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. Employees will continue to incur payroll deductions for coverage and those funds are ultimately used by the employer to cover a portion of incurred claims, administrative costs and. This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. A self funded plan does not pay a premium to an insurance company for benefits, instead the funds are kept in house. This alternative workers’ comp solution has grown in popularity in recent years, and industry estimates suggest.

Source: slideshare.net

Source: slideshare.net

This is different from fully insured plans where the employer contracts an insurance company to cover the employees and dependents. But keep in mind, if you work for a large company, with thousands of employees, there. Also, rates are calculated with the expectation that the employer will receive funds from the plan at the end of the year. These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. The insurance company manages the payments, but the employer is the one who pays the claims.

Source: youtube.com

Source: youtube.com

Self funded basically means the company will purchase a large deductible plan from an insurance company and the company will be responsible for any claims that fall under that large deductible plan. Most companies that self insure also pay for stoploss insurance, which is a high deductible plan that kicks to pay claims for a large claim a. Also, rates are calculated with the expectation that the employer will receive funds from the plan at the end of the year. Self funded basically means the company will purchase a large deductible plan from an insurance company and the company will be responsible for any claims that fall under that large deductible plan. Employers will still contract with insurance.

Source: slideserve.com

Source: slideserve.com

These plans are often more flexible for you as the employer because you may not be subject to certain state requirements, and at the end of the plan year, you can. Also, rates are calculated with the expectation that the employer will receive funds from the plan at the end of the year. The insurance company manages the payments, but the employer is the one who pays the claims. The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other. That means that instead of paying an insurance company a predefined rate,.

Source: slideshare.net

Source: slideshare.net

The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other. The insurance company manages the payments, but the employer is the one who pays the claims. The employer or union may hire a third party administrator to perform such services as paying claims, collecting premiums, or supplying other. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. That means that instead of paying an insurance company a predefined rate,.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how do self funded insurance plans work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.