How does dual coverage dental insurance work Idea

Home » Trend » How does dual coverage dental insurance work IdeaYour How does dual coverage dental insurance work images are available in this site. How does dual coverage dental insurance work are a topic that is being searched for and liked by netizens now. You can Get the How does dual coverage dental insurance work files here. Get all free images.

If you’re looking for how does dual coverage dental insurance work pictures information connected with to the how does dual coverage dental insurance work interest, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

How Does Dual Coverage Dental Insurance Work. Dual coverage saves money for you and your group by sharing the total cost of covered dental. If you’re fortunate enough to be covered by two dental plans, you have what is called dual coverage. Typical dental premiums range from around $20 to $60 per month, but this can vary greatly depending on your coverage and even where you live. There’s a way for you to get covered by two health insurance plans.

AARP Dental Plans and Other Options for Seniors From 1dental.com

AARP Dental Plans and Other Options for Seniors From 1dental.com

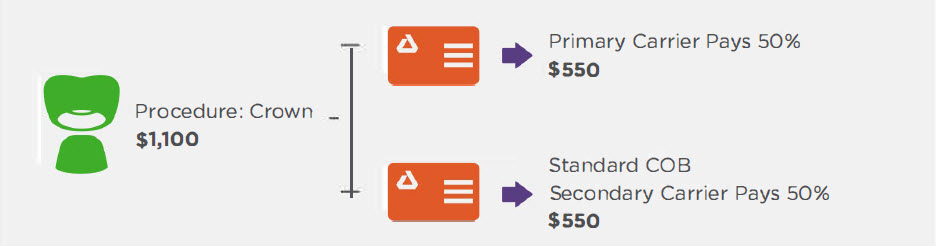

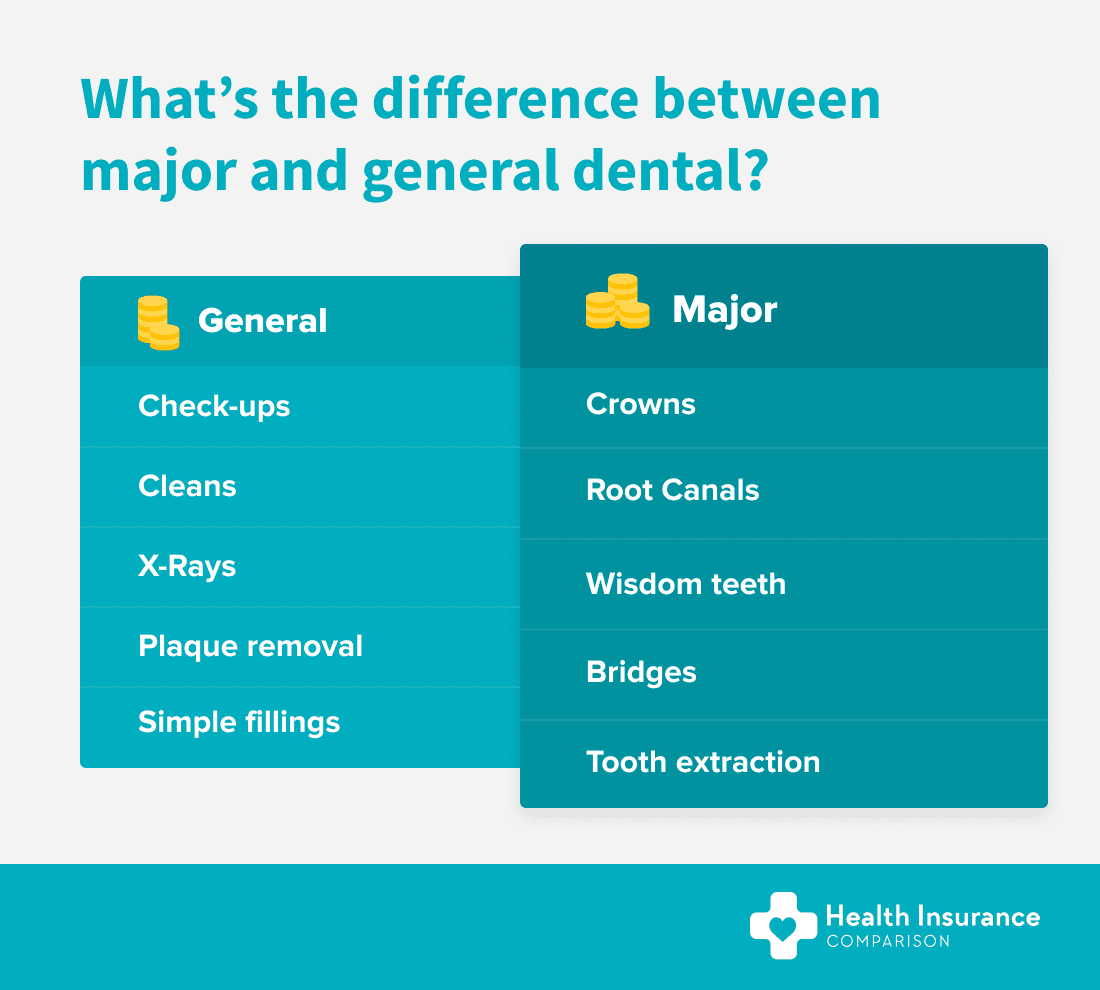

If each of your plans covers two cleanings a year, you will only be covered for two cleanings a year—not four. Your secondary insurance may pick up some or all of the remaining costs. Primary carrier o per industry standards, the dental insurance you receive through your employer is considered your primary insurance plan. Having dual coverage doesn�t double your benefits, but you might pay less for. The primary carrier pays its portion. It simply means that your dentist insurance providers will work together to coordinate your benefits.

Dual dental coverage typically occurs when you have two jobs that each provide dental benefits, or you are covered by your spouse’s dental plan in addition to your own.

Having dual coverage doesn�t double your benefits, but you might pay less for. Dual dental coverage does not double your coverage or benefits. Dual coverage saves money for you and your group by sharing the total cost of covered dental. The primary carrier pays its portion. Supplemental policies—those purchased specifically to cover dental treatment that is not included in a medical or other dental plan (the gaps)—is a wise choice when other policies do not provide coverage for dental. Dual coverage doesn’t mean that your benefits are doubled.

Source: knowyourinsurance.net

Source: knowyourinsurance.net

Dual coverage doesn’t mean that your benefits are doubled. You may have coverage from your job and additional coverage from your spouse�s plan. The primary carrier pays its portion. Dual coverage saves money for you and your group by sharing the total cost of covered dental. Generally, dental plans coordinate benefits so that eligible claims are paid up to 100 percent between the two plans.

Source: pinterest.com

Source: pinterest.com

Dual coverage can often bring the employee’s costs down to zero for a given claim. Your secondary insurance may pick up some or all of the remaining costs. Having dual coverage does not mean that you have double the benefits, rather both insurance companies work together to. Children may also be covered on both parents� dental plans. Dual insurance helps people maximize their benefits.

For instance, if each plan provides two cleanings per year, you aren�t entitled to four cleanings. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com). Dual dental coverage does not double your coverage or benefits. The dentist’s office will bill the insurance company directly for your care. If you are covered by two dental plans.

Source: outsourcestrategies.com

Source: outsourcestrategies.com

The remainder of the bill is sent to the secondary benefits carrier. Dual coverage saves money for you and your group by sharing the total cost of covered dental. Having dual coverage doesn�t double your benefits, but you might pay less for. Dual dental coverage does not double your coverage or benefits. When you have two forms of health insurance coverage, your primary insurance pays the first portion of the claim up to your coverage limits.

Source: 1dental.com

Source: 1dental.com

However, you still might be. Coordination of benefits (cob) is the guide insurance companies, like delta dental of arizona, follow to determine how much each dental plan will pay. Dental insurance works a lot like health insurance. The remainder of the bill is sent to the secondary benefits carrier. If you are covered under two different dental insurance plans, then you have dual dental coverage.

Source: asthedrillturns.com

Source: asthedrillturns.com

You will notice many insurance companies do in fact work together to coordinate your patient�s benefits. There’s a way for you to get covered by two health insurance plans. Your secondary insurance may pick up some or all of the remaining costs. Generally, dental plans coordinate benefits so that eligible claims are paid up to 100 percent between the two plans. Dual coverage works the same way whether you are covered by two delta dental plans or by delta dental and another carrier.

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

Benefits may be covered at different coverage levels. Dual dental coverage typically occurs when you have two jobs that each provide dental benefits, or you are covered by your spouse’s dental plan in addition to your own. Since some dental insurance provides little to no coverage for more expensive treatments, dual coverage helps make treatments more affordable for patients. It simply means that your dentist insurance providers will work together to coordinate your benefits. The dentist’s office will bill the insurance company directly for your care.

Source: deltadentalazblog.com

Source: deltadentalazblog.com

Dual health insurance coverage also provides a backstop for an employee who loses their job. Delta dental of kansas works with the other insurance company (i.e. The remainder of the bill is sent to the secondary benefits carrier. Dual coverage—having two or more dental insurance policies—can offer financial benefits when you or a family member needs expensive dental treatment. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com).

Source: centraldental.com

Source: centraldental.com

Having dual coverage does not mean that you have double the benefits, rather both insurance companies work together to coordinate who manages and pays for your dental care. The primary carrier pays its portion. Your secondary insurance may pick up some or all of the remaining costs. Typical dental premiums range from around $20 to $60 per month, but this can vary greatly depending on your coverage and even where you live. The dentist’s office will bill the insurance company directly for your care.

Source: pinterest.com

Source: pinterest.com

If each of your plans covers two cleanings a year, you will only be covered for two cleanings a year—not four. Dual coverage can often bring the employee’s costs down to zero for a given claim. It simply means that your dentist insurance providers will work together to coordinate your benefits. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com). Dual insurance helps people maximize their benefits.

Source: revisi.net

Source: revisi.net

The primary carrier pays its portion. Dual coverage saves money for you and your group by sharing the total cost of covered dental. Dual coverage works the same way whether a patient is covered by two dental plans that are the same or two entirely different dental insurance companies. The primary carrier pays its portion. This does not mean that your coverage is doubled;

Source: dailyherald.com

Source: dailyherald.com

Benefits may be covered at different coverage levels. Dual coverage can often bring the employee’s costs down to zero for a given claim. Dual coverage saves money for you and your group by sharing the total cost of covered dental. You will notice many insurance companies do in fact work together to coordinate your patient�s benefits. Aetna, cigna, blue cross blue shield,

Source: mediclarity.org

Source: mediclarity.org

When you are covered by two dental plans this is called “dual coverage.” this does not “double” your coverage. Gaps in coverage can occur when the primary policy’s annual spending limit is reached, or when a policy doesn’t provide coverage for necessary or desired dental treatments” (“supplemental dental insurance”). When you are covered by two dental plans, this is called dual coverage. Generally, dental plans coordinate benefits so that eligible claims are paid up to 100 percent between the two plans. The primary carrier pays its portion.

Source: dailyherald.com

Source: dailyherald.com

Children may also be covered on both parents� dental plans. Dual health insurance coverage also provides a backstop for an employee who loses their job. Dual coverage allows a person to access both insurance plans to help cover their dental claim costs. Typical dental premiums range from around $20 to $60 per month, but this can vary greatly depending on your coverage and even where you live. Primary carrier o per industry standards, the dental insurance you receive through your employer is considered your primary insurance plan.

Source: vvcfvdf.dataprivacyinternational.com

Source: vvcfvdf.dataprivacyinternational.com

When you are covered by two dental plans this is called “dual coverage.” this does not “double” your coverage. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com). Supplemental policies—those purchased specifically to cover dental treatment that is not included in a medical or other dental plan (the gaps)—is a wise choice when other policies do not provide coverage for dental. Covered by a second dental plan in addition to your own, you have what is called dual coverage. Dual coverage allows a person to access both insurance plans to help cover their dental claim costs.

Source: hub.jhu.edu

Source: hub.jhu.edu

Delta dental of kansas works with the other insurance company (i.e. Having dual coverage doesn�t double your benefits, but you might pay less for. The primary carrier pays its portion. When you are covered by two dental plans, this is called dual coverage. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com).

Source: pinterest.com

Source: pinterest.com

Dual dental coverage typically occurs when you have two jobs that each provide dental benefits, or you are covered by your spouse’s dental plan in addition to your own. However, dual coverage is not double insurance coverage. Dual coverage works the same way whether a patient is covered by two dental plans that are the same or two entirely different dental insurance companies. The dentist’s office will bill the insurance company directly for your care. Dual coverage doesn’t mean that your benefits are doubled.

Source: dailyherald.com

Source: dailyherald.com

Delta dental simply works with the other insurance company to coordinate your benefits. Being covered by two dental insurance plans means that you are fortunate enough to have what is known as dual coverage. Typical dental premiums range from around $20 to $60 per month, but this can vary greatly depending on your coverage and even where you live. Dual coverage doesn’t mean that your benefits are doubled. The advantage of having dual coverage is that it fills gaps in coverage that can occur when the individual’s primary policy’s annual spending limit is reached, or when a plan does not provide coverage for necessary or desired dental treatments (www.dentalbilling.com).

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does dual coverage dental insurance work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.