How does force placed auto insurance work information

Home » Trend » How does force placed auto insurance work informationYour How does force placed auto insurance work images are ready in this website. How does force placed auto insurance work are a topic that is being searched for and liked by netizens today. You can Find and Download the How does force placed auto insurance work files here. Get all royalty-free vectors.

If you’re looking for how does force placed auto insurance work pictures information linked to the how does force placed auto insurance work interest, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

How Does Force Placed Auto Insurance Work. What does forced placed car insurance cover? Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled. If you do not provide your lender with proof of your insurance; What rights does my lender have in regard to force placed auto insurance?

The Insurance Place at Insurance From revisi.net

The Insurance Place at Insurance From revisi.net

Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled. This process occurs if a borrower. If the borrower does not purchase insurance, or allows their insurance to lapse, the lender has the right to purchase insurance, known as. The policy also protects you as the driver. If you do not provide your lender with proof of your insurance; If you do not have insurance on your home, do not have enough coverage, or allow the coverage to lapse;

Keep in mind that your monthly mortgage payment could.

It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. If you fail to obtain insurance or you let your insurance lapse, the contract usually gives the lender the right to get insurance to cover the vehicle. This process occurs if a borrower. Typically, when a consumer takes out an automobile loan, they are obligated to maintain acceptable insurance on the vehicle. It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised.

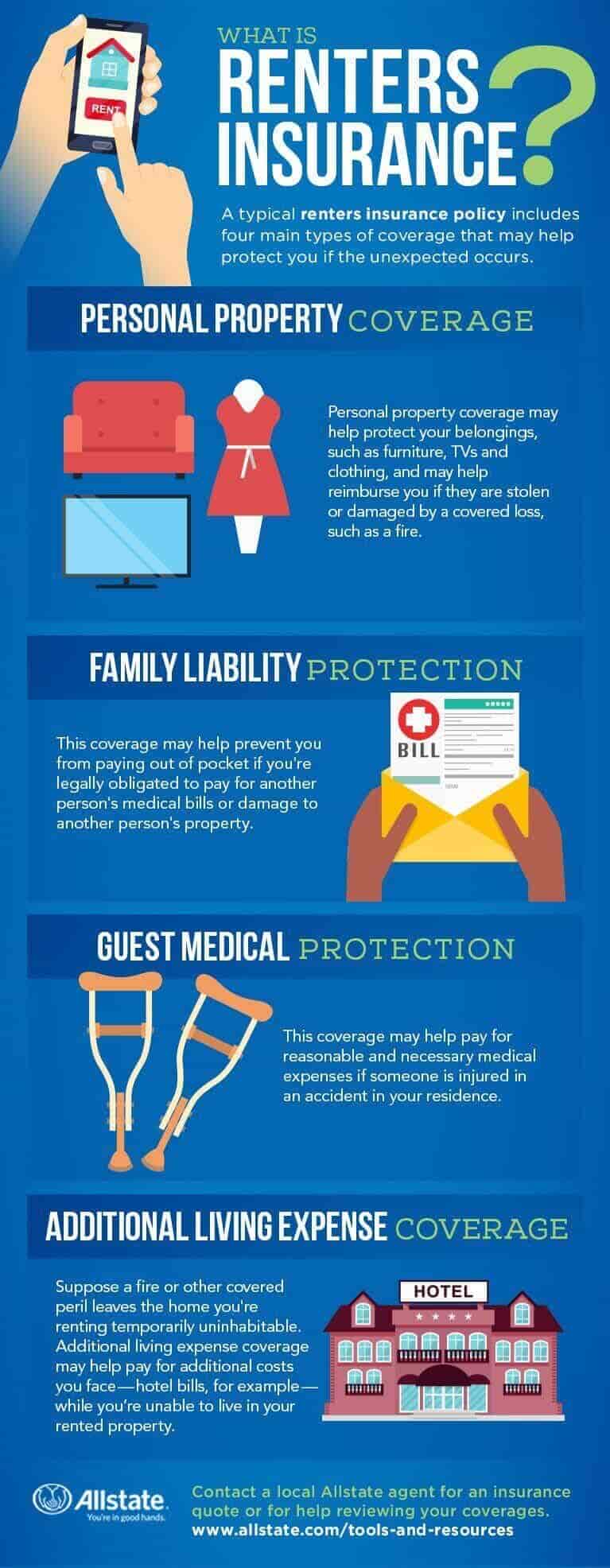

Source: allstate.com

Source: allstate.com

If the borrower does not purchase insurance, or allows their insurance to lapse, the lender has the right to purchase insurance, known as. They, in turn, add the monthly premium to your monthly home or auto loan invoice. What does forced placed car insurance cover? If you are involved in an accident, any damage to your car lowers its resale value and puts the banks money in jeopardy. Cpi provides the insurance that you need to satisfy your agreement and protects your lender by insuring your car against physical damage.

Source: duaapaixonada.blogspot.com

Source: duaapaixonada.blogspot.com

If you are involved in an accident, any damage to your car lowers its resale value and puts the banks money in jeopardy. If the borrower does not purchase insurance, or allows their insurance to lapse, the lender has the right to purchase insurance, known as. This ensures that if the car is damaged it is repaired, and if it is totaled the bank gets their full loan amount. What does forced placed car insurance cover? It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised.

Source: thesummitexpress.com

Source: thesummitexpress.com

You may still need additional auto insurance If the policy you purchase does not meet the lender’s requirements Cpi provides the insurance that you need to satisfy your agreement and protects your lender by insuring your car against physical damage. What you need to know. Force placed insurance only covers damages of the vehicle that the lien has been placed on, up to the value of the loan.

Source: randomstory.org

Source: randomstory.org

What you need to know. This ensures that if the car is damaged it is repaired, and if it is totaled the bank gets their full loan amount. The premium cost is then added to your monthly mortgage or car loan payment. Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled. Keep in mind that your monthly mortgage payment could.

Source: revisi.net

Source: revisi.net

Cpi provides the insurance that you need to satisfy your agreement and protects your lender by insuring your car against physical damage. Force placed insurance only covers damages of the vehicle that the lien has been placed on, up to the value of the loan. This process occurs if a borrower. What rights does my lender have in regard to force placed auto insurance? They, in turn, add the monthly premium to your monthly home or auto loan invoice.

Source: duaapaixonada.blogspot.com

Source: duaapaixonada.blogspot.com

Insurance companies say the higher premiums are necessary because coverage is extended to whoever a lender says must have it. Insurance companies say the higher premiums are necessary because coverage is extended to whoever a lender says must have it. If you do not provide your lender with proof of your insurance; If the policy you purchase does not meet the lender’s requirements It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised.

Source: revisi.net

Source: revisi.net

If you do not have insurance on your home, do not have enough coverage, or allow the coverage to lapse; If the policy you purchase does not meet the lender’s requirements This insurance protects only the lender, not you, but the lender will charge you for the insurance. If you let this hazard insurance coverage lapse, the loan servicer can order insurance coverage at your expense. Typically, when a consumer takes out an automobile loan, they are obligated to maintain acceptable insurance on the vehicle.

Source: finder.com

Source: finder.com

Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled. Insurance companies say the higher premiums are necessary because coverage is extended to whoever a lender says must have it. Typically, when a consumer takes out an automobile loan, they are obligated to maintain acceptable insurance on the vehicle. What rights does my lender have in regard to force placed auto insurance? What you need to know.

Source: npa1.org

Source: npa1.org

If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. Keep in mind that your monthly mortgage payment could. If you are involved in an accident, any damage to your car lowers its resale value and puts the banks money in jeopardy. Remember that forced placed car insurance simply protects the investment your bank makes in your vehicle. Pricing is a major issue.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

This process occurs if a borrower. If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. What rights does my lender have in regard to force placed auto insurance? They, in turn, add the monthly premium to your monthly home or auto loan invoice. Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled.

Source: vortexes.net

Source: vortexes.net

If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. If you are involved in an accident, any damage to your car lowers its resale value and puts the banks money in jeopardy. Since your lender is a lienholder on your vehicle, they will be listed on your auto insurance policy and will be notified if the policy has been canceled. If you let this hazard insurance coverage lapse, the loan servicer can order insurance coverage at your expense.

Source: futmarx.com

Source: futmarx.com

The policy also protects you as the driver. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. The premium cost is then added to your monthly mortgage or car loan payment. The policy also protects you as the driver. If you do not have insurance on your home, do not have enough coverage, or allow the coverage to lapse;

Source: duaapaixonada.blogspot.com

Source: duaapaixonada.blogspot.com

What does forced placed car insurance cover? If you fail to obtain insurance or you let your insurance lapse, the contract usually gives the lender the right to get insurance to cover the vehicle. Remember that forced placed car insurance simply protects the investment your bank makes in your vehicle. Pricing is a major issue. What rights does my lender have in regard to force placed auto insurance?

Source: wiseinsurancegroup.com

Source: wiseinsurancegroup.com

If you are involved in an accident, any damage to your car lowers its resale value and puts the banks money in jeopardy. This insurance protects only the lender, not you, but the lender will charge you for the insurance. Typically, when a consumer takes out an automobile loan, they are obligated to maintain acceptable insurance on the vehicle. Cpi provides the insurance that you need to satisfy your agreement and protects your lender by insuring your car against physical damage. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract.

Source: duaapaixonada.blogspot.com

Source: duaapaixonada.blogspot.com

If the policy you purchase does not meet the lender’s requirements If the borrower does not purchase insurance, or allows their insurance to lapse, the lender has the right to purchase insurance, known as. They, in turn, add the monthly premium to your monthly home or auto loan invoice. Remember that forced placed car insurance simply protects the investment your bank makes in your vehicle. You may still need additional auto insurance

Source: classaction.org

Source: classaction.org

If you do not provide your lender with proof of your insurance; Pricing is a major issue. If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. Keep in mind that your monthly mortgage payment could. The premium cost is then added to your monthly mortgage or car loan payment.

Source: happinessman.co.uk

Source: happinessman.co.uk

Cpi provides the insurance that you need to satisfy your agreement and protects your lender by insuring your car against physical damage. This insurance protects only the lender, not you, but the lender will charge you for the insurance. Insurance companies say the higher premiums are necessary because coverage is extended to whoever a lender says must have it. They, in turn, add the monthly premium to your monthly home or auto loan invoice. This ensures that if the car is damaged it is repaired, and if it is totaled the bank gets their full loan amount.

Source: tuningblog.eu

Source: tuningblog.eu

What you need to know. If the policy you purchase does not meet the lender’s requirements If you pay for property taxes, mortgage insurance and homeowners insurance through your escrow account, your lender will likely streamline your payments from there. You may still need additional auto insurance It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does force placed auto insurance work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.