How does insurance distribute the financial consequences of individual losses information

Home » Trending » How does insurance distribute the financial consequences of individual losses informationYour How does insurance distribute the financial consequences of individual losses images are ready in this website. How does insurance distribute the financial consequences of individual losses are a topic that is being searched for and liked by netizens now. You can Download the How does insurance distribute the financial consequences of individual losses files here. Find and Download all free photos and vectors.

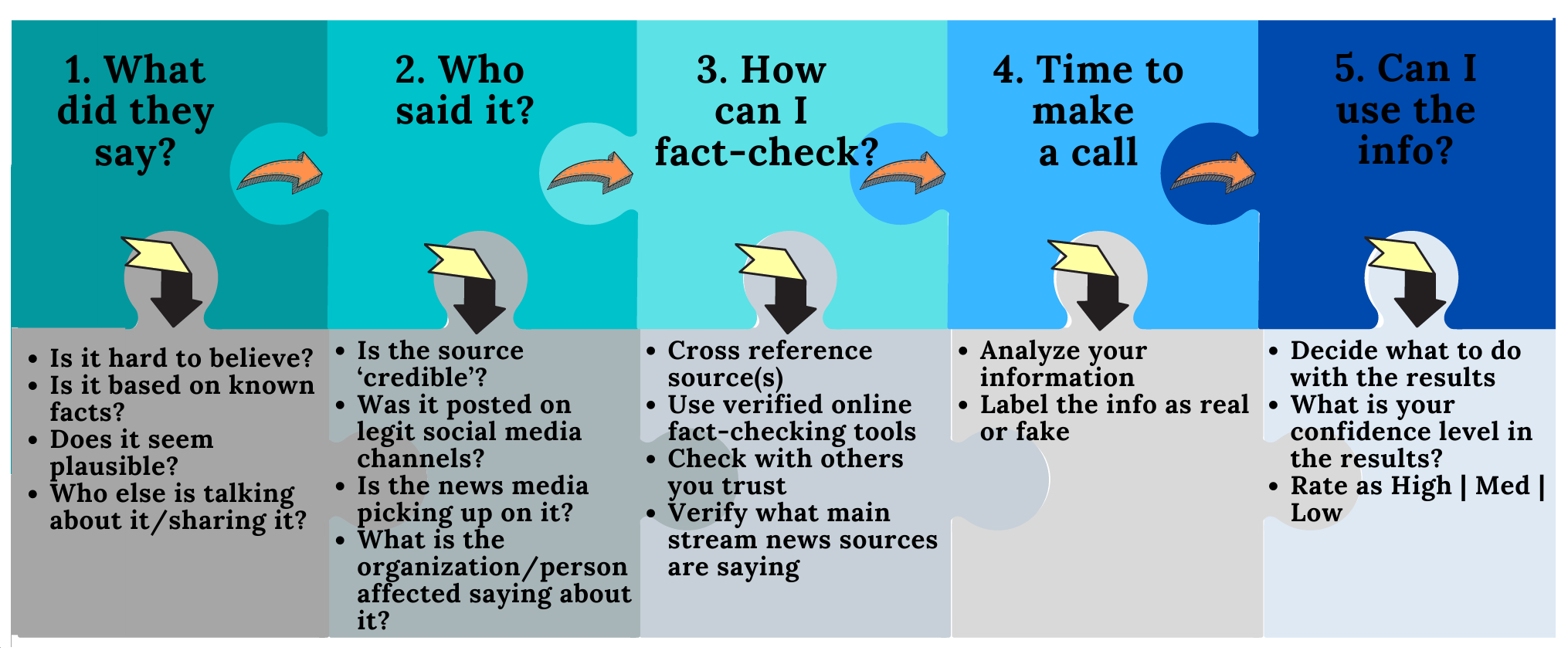

If you’re searching for how does insurance distribute the financial consequences of individual losses images information connected with to the how does insurance distribute the financial consequences of individual losses keyword, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

How Does Insurance Distribute The Financial Consequences Of Individual Losses. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) The insured was severely injured and incurred medical expenses of $100,000. Crop losses are usually paid within 30 days of the date the farmer files a claim.

Key Person Insurance SaverNotes From savernotes.com

Key Person Insurance SaverNotes From savernotes.com

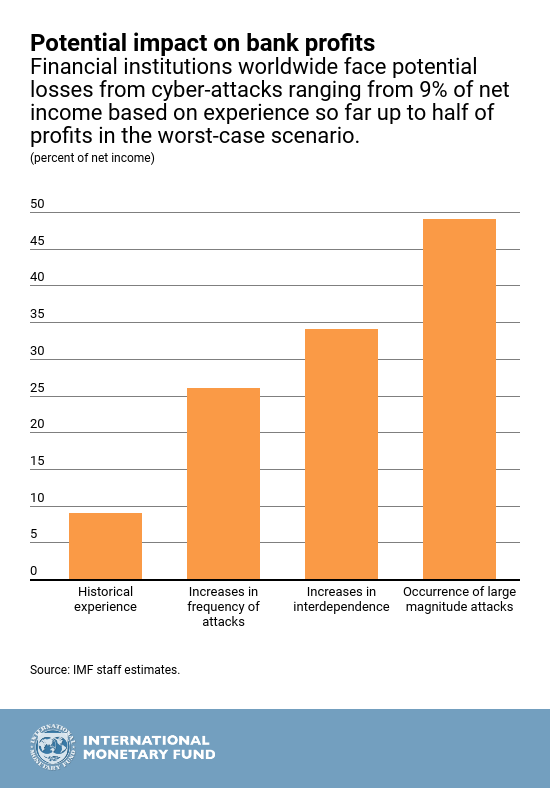

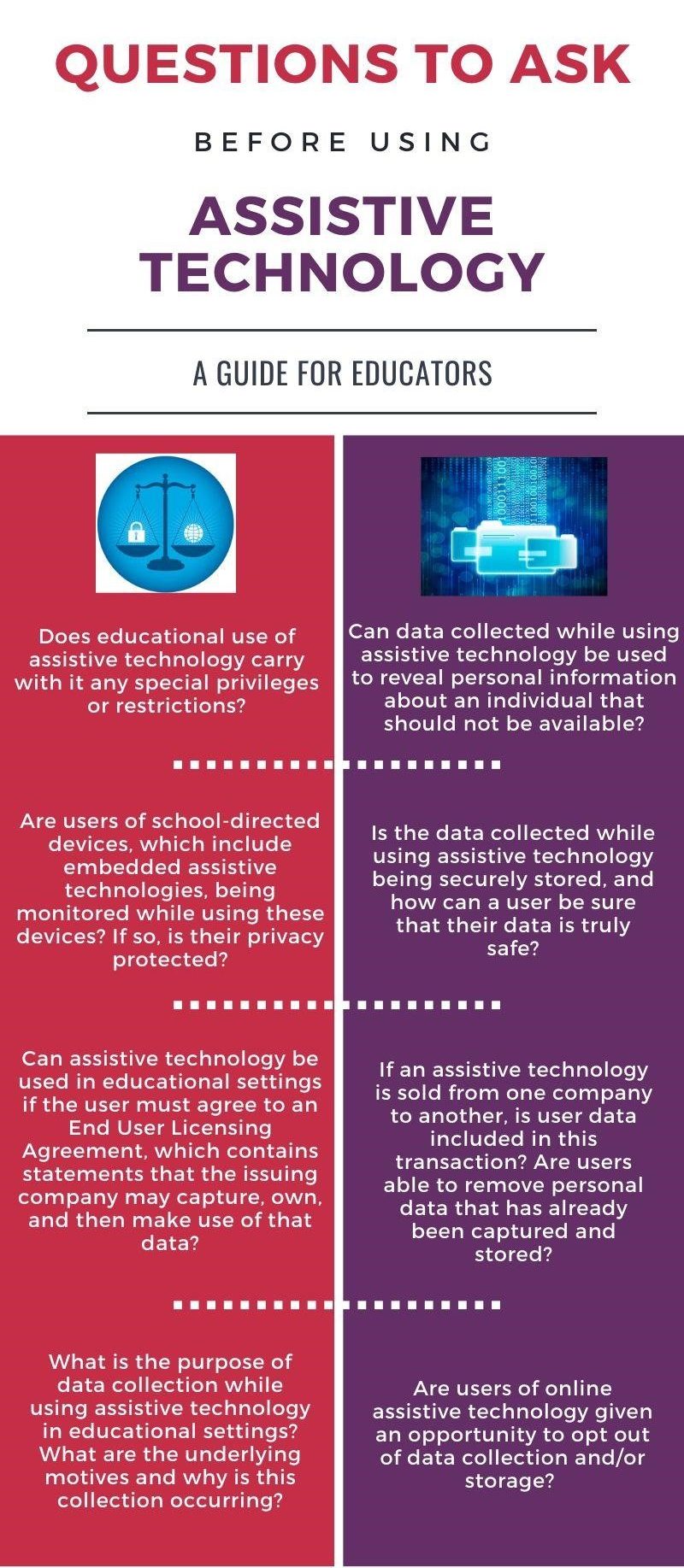

Insurance generates significant impact on the economy by mobilizing domestic savings. A loss of faith in the insurance company because of a denial of claims. Voluntary behaviors that produce rewarding or punishing consequences are called Business insurance also helps drive growth. The insured brought a recovery action against the manufacturers of the auto and the tires. Insurance is a system of both transferring and sharing the costs of losses b/c the potential financial consequences of certain loss exposures are transferee to an insurer, which in turn, pays for covered losses and, in effect, distributes the costs of losses among all insured in 2017 the.

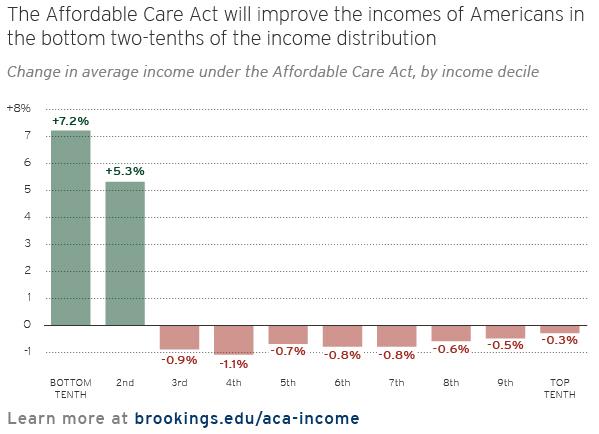

Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium rating category.

In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) The court held that the tire was the cause of the accident. Insurers are financial first responders. What were two consequences of the french and indian war; Crop losses are usually paid within 30 days of the date the farmer files a claim. The number of people without insurance could increase to over 40 million.

Source: theasset.nl

Source: theasset.nl

A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. This form shows each partner’s distributive share of profits, losses, credits, and deductions. For nations, the impact could optimistically be 1.5% lower gdp throughout the remainder of the century and proportionately even lower if education systems are slow to return to prior levels of performance. The court held that the tire was the cause of the accident. Insurers are financial first responders.

Source: pfaasia.com

Source: pfaasia.com

The insurers distribute the policies through independent agents. Hospitals have already seen some of the effects manifest; For nations, the impact could optimistically be 1.5% lower gdp throughout the remainder of the century and proportionately even lower if education systems are slow to return to prior levels of performance. Bad debt and charity care increased 13% over the previous year in march, according to a recent study from kaufman hall. How does insurance distribute the financial consequences of individual losses.

Source: dlawgroup.com

Source: dlawgroup.com

A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. They collect premiums, issue policies, and pay claims. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) One example of risk retention is the deductible. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums.

Source: franceiearn.blogspot.com

Source: franceiearn.blogspot.com

When disaster does strike, insurance is one of the best financial tools businesses can call upon to help tackle these challenges. Techniques can be things that will prevent certain risks from arising, minimizing the frequency or number of times that risk can actually happen, or even minimizing the damage. Rta also has an enormous effect on health related issues. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. In the strict insurance definition, risk is the uncertainty regarding financial loss.

Source: quora.com

Limitations on insurance protection • it is restricted to reducing those consequences of random events that can be measured in monetary terms. Insurance generates significant impact on the economy by mobilizing domestic savings. However, the economic consequences can go beyond just less consumption. The deductible is the portion of loss that the policy holder will pay out of pocket before the insurance coverage takes over. The court held that the tire was the cause of the accident.

A loss of faith in the insurance company because of a denial of claims. However, the economic consequences can go beyond just less consumption. • insurance does not directly reduce the probability of loss. Techniques can be things that will prevent certain risks from arising, minimizing the frequency or number of times that risk can actually happen, or even minimizing the damage. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Source: franceiearn.blogspot.com

Source: franceiearn.blogspot.com

Insurance is a system of both transferring and sharing the costs of losses b/c the potential financial consequences of certain loss exposures are transferee to an insurer, which in turn, pays for covered losses and, in effect, distributes the costs of losses among all insured in 2017 the. Thus, insurance plays a crucial role in. Voluntary behaviors that produce rewarding or punishing consequences are called The federal government acts as a reinsurer, meaning it insures the insurance companies. • insurance does not directly reduce the probability of loss.

Source: savernotes.com

Source: savernotes.com

The insured brought a recovery action against the manufacturers of the auto and the tires. A 0 it transfers the risk to associates of the insured. They collect premiums, issue policies, and pay claims. The federal government acts as a reinsurer, meaning it insures the insurance companies. The potential for the insurance company to increase premiums after a loss.

Source: sec.gov

Source: sec.gov

This form shows each partner’s distributive share of profits, losses, credits, and deductions. Bad debt and charity care increased 13% over the previous year in march, according to a recent study from kaufman hall. The intended beneficial consequences of people�s actions are known as; In cases where the potential financial loss is significant or the probability of such a loss is high, risk retention may end in economic disaster. The insurers distribute the policies through independent agents.

Source: theincidentaleconomist.com

Source: theincidentaleconomist.com

Insurance is a system of both transferring and sharing the costs of losses b/c the potential financial consequences of certain loss exposures are transferee to an insurer, which in turn, pays for covered losses and, in effect, distributes the costs of losses among all insured in 2017 the. Techniques can be things that will prevent certain risks from arising, minimizing the frequency or number of times that risk can actually happen, or even minimizing the damage. Insurance drives economic growth by expediting the recovery of claimants and beneficiaries. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Rta also has an enormous effect on health related issues.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

18 these coverage losses put families at financial risk and increase uncompensated care at hospitals. In the strict insurance definition, risk is the uncertainty regarding financial loss. Bad debt and charity care increased 13% over the previous year in march, according to a recent study from kaufman hall. The increase of loss caused by attempts to defraud the insurer. In cases where the potential financial loss is significant or the probability of such a loss is high, risk retention may end in economic disaster.

Source: instantdisability.com

Source: instantdisability.com

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Ignores the economic consequences of a standard or rule. Insurance enables to mitigate loss, financial stability and promotes trade and commerce activities those results into economic growth and development. Thus, insurance plays a crucial role in. The insurers distribute the policies through independent agents.

Source: ransin.com

Source: ransin.com

The number of people without insurance could increase to over 40 million. Insurance generates significant impact on the economy by mobilizing domestic savings. Risk reduction refers to the way an insurance company or organization can reduce its financial losses by implementing measures that reduce the financial impacts of potential losses. For nations, the impact could optimistically be 1.5% lower gdp throughout the remainder of the century and proportionately even lower if education systems are slow to return to prior levels of performance. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Source: theisozone.com

Source: theisozone.com

Rta also has an enormous effect on health related issues. Thus, insurance plays a crucial role in. Many people will turn to retirement savings in a pinch, and. The number of people without insurance could increase to over 40 million. Rta also has an enormous effect on health related issues.

Source: m3ins.com

Source: m3ins.com

Insurers are financial first responders. This form shows each partner’s distributive share of profits, losses, credits, and deductions. How does insurance distribute the financial consequences of individual losses. Rta also has an enormous effect on health related issues. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium rating category.

Source: bankonus.com

Source: bankonus.com

The court held that the tire was the cause of the accident. The potential for the insurance company to increase premiums after a loss. The intended beneficial consequences of people�s actions are known as; Insurance is used to minimize the risk of uncertainty by spreading the risk over a large enough number of similar exposures to predict the individual chance of loss. Many people will turn to retirement savings in a pinch, and.

Source: weightwise.com

Source: weightwise.com

Insurance turn accumulated capital into productive investments. When disaster does strike, insurance is one of the best financial tools businesses can call upon to help tackle these challenges. In 2017 the insurance industry paid roughly $1.5 trillion (an average of $125 billion per month) A loss of faith in the insurance company because of a denial of claims. The insurers distribute the policies through independent agents.

Source: thestar.com

Source: thestar.com

The insured brought a recovery action against the manufacturers of the auto and the tires. Insurance generates significant impact on the economy by mobilizing domestic savings. The increase of loss caused by attempts to defraud the insurer. “primary consideration should be given to the consequences of eliminating the individual mandate on premiums, coverage rates, and the stability of the insurance market,” the academy concluded. Risk reduction refers to the way an insurance company or organization can reduce its financial losses by implementing measures that reduce the financial impacts of potential losses.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does insurance distribute the financial consequences of individual losses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.