How does one qualify as a fully insured individual information

Home » Trend » How does one qualify as a fully insured individual informationYour How does one qualify as a fully insured individual images are available. How does one qualify as a fully insured individual are a topic that is being searched for and liked by netizens today. You can Download the How does one qualify as a fully insured individual files here. Find and Download all free vectors.

If you’re looking for how does one qualify as a fully insured individual images information connected with to the how does one qualify as a fully insured individual keyword, you have visit the ideal blog. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

How Does One Qualify As A Fully Insured Individual. Purchased to protect you when eligible claims during the policy year on any one individual exceed the specific liability limit. The year before you attain age 62, the year before you die, or. Eligible individuals who are eligible for fully insured state continuation coverage. 12 january 2022 by lets tokmak.

Long term Care From livemoneyadvisor.com

Long term Care From livemoneyadvisor.com

Under a fully insured plan, an employer often feels less of the effects of rising medical costs. If you were born before 1930, you need at least one qc for each year after 1950. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. Purchased to protect you when eligible claims during the policy year on any one individual exceed the specific liability limit. Within those two funds, the money will be paid out. Individual has been credited with the appropriate number of quarters of coverage individual is currently covered under medicaid individual is expected to be disabled for 5 months individual is currently employed

Within those two funds, the money will be paid out.

As such, state laws can generally exceed standards in the no surprises act by adopting heightened standards that are more protective of consumers. What does the medical loss ratio (mlr) provision address? If you were born before 1930, you need at least one qc for each year after 1950. The year before you attain age 62, the year before you die, or. These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or. Eligible individuals who are eligible for fully insured state continuation coverage.

Source: noclutter.cloud

Source: noclutter.cloud

Eligible individuals who are eligible for fully insured state continuation coverage. If a worker becomes disabled before full retirement age and but has at least one credit for each year since age 21, the ssa considers the person to be insured for disability benefits. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. 12 january 2022 by lets tokmak. Individual has been credited with the appropriate number of quarters of coverage individual is currently covered under medicaid individual is expected to be disabled for 5 months individual is currently employed

Source: cbo.gov

Source: cbo.gov

To be eligible for the premium assistance, a qualified beneficiary must meet all the following requirements: A fully insured worker who has a medically determinable physical or mental condition that prevents any substantial gainful work is entitled to monthly disability benefits available to a fully insured worker (and eligible dependents) in social security who has a medically determinable physical or mental condition preventing any gainful work after a waiting. 12 january 2022 by lets tokmak. Also, the individual must have earned 20 credits during the last 40 quarters, ending with the quarter the person became disabled (this generally means the person. These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or.

Source: bhaktiinvestment.com

Source: bhaktiinvestment.com

The employer pays premiums to the insurer (some of which are passed on to the employees via payroll deduction) in trade for the. What does the medical loss ratio (mlr) provision address? Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or.

Source: awajis.com

Source: awajis.com

An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees. To be fully insured, you need at least one qc for each calendar year after you turned 21 and the earliest of the following: Also, the individual must have earned 20 credits during the last 40 quarters, ending with the quarter the person became disabled (this generally means the person. Eligible individuals who are eligible for fully insured state continuation coverage. State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act.

Source: quora.com

Within those two funds, the money will be paid out. The year before you attain age 62, the year before you die, or. If you were born before 1930, you need at least one qc for each year after 1950. If a worker becomes disabled before full retirement age and but has at least one credit for each year since age 21, the ssa considers the person to be insured for disability benefits. An employer also has the option to negotiate with health insurance providers to get the best rates possible for their employees.

Source: blog.bcbsnc.com

Source: blog.bcbsnc.com

Also, the individual must have earned 20 credits during the last 40 quarters, ending with the quarter the person became disabled (this generally means the person. These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or. Eligible individuals who are eligible for fully insured state continuation coverage. The year before you attain age 62, the year before you die, or. What does the medical loss ratio (mlr) provision address?

Source: medicareinsuranceaz.com

Source: medicareinsuranceaz.com

These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or. Within those two funds, the money will be paid out. A fully insured worker who has a medically determinable physical or mental condition that prevents any substantial gainful work is entitled to monthly disability benefits available to a fully insured worker (and eligible dependents) in social security who has a medically determinable physical or mental condition preventing any gainful work after a waiting. Individual has been credited with the appropriate number of quarters of coverage individual is currently covered under medicaid individual is expected to be disabled for 5 months individual is currently employed Fully insured group health plans are divided into two categories:

Source: revisi.net

Source: revisi.net

The year before you become disabled. 12 january 2022 by lets tokmak. State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act. If these thresholds are not met, the To be eligible for the premium assistance, a qualified beneficiary must meet all the following requirements:

Source: livemoneyadvisor.com

Source: livemoneyadvisor.com

Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. If you were born before 1930, you need at least one qc for each year after 1950. • must have a qualifying event that is a reduction in hours or an involuntary termination of a covered employee’s employment. A fully insured worker who has a medically determinable physical or mental condition that prevents any substantial gainful work is entitled to monthly disability benefits available to a fully insured worker (and eligible dependents) in social security who has a medically determinable physical or mental condition preventing any gainful work after a waiting. The employer pays premiums to the insurer (some of which are passed on to the employees via payroll deduction) in trade for the.

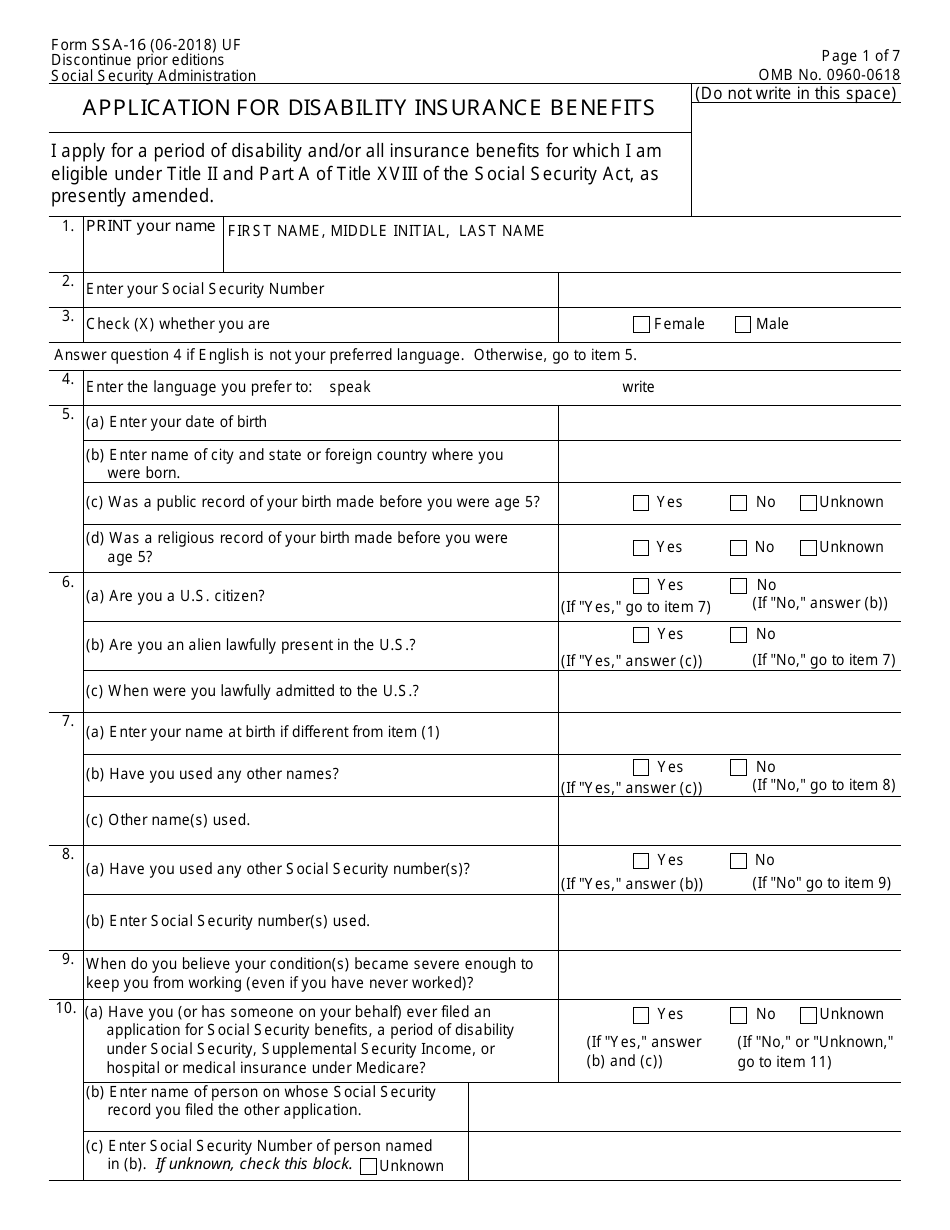

Source: templateroller.com

Source: templateroller.com

State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act. Eligible individuals who are eligible for fully insured state continuation coverage. To be eligible for the premium assistance, a qualified beneficiary must meet all the following requirements: A fully insured worker who has a medically determinable physical or mental condition that prevents any substantial gainful work is entitled to monthly disability benefits available to a fully insured worker (and eligible dependents) in social security who has a medically determinable physical or mental condition preventing any gainful work after a waiting. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company.

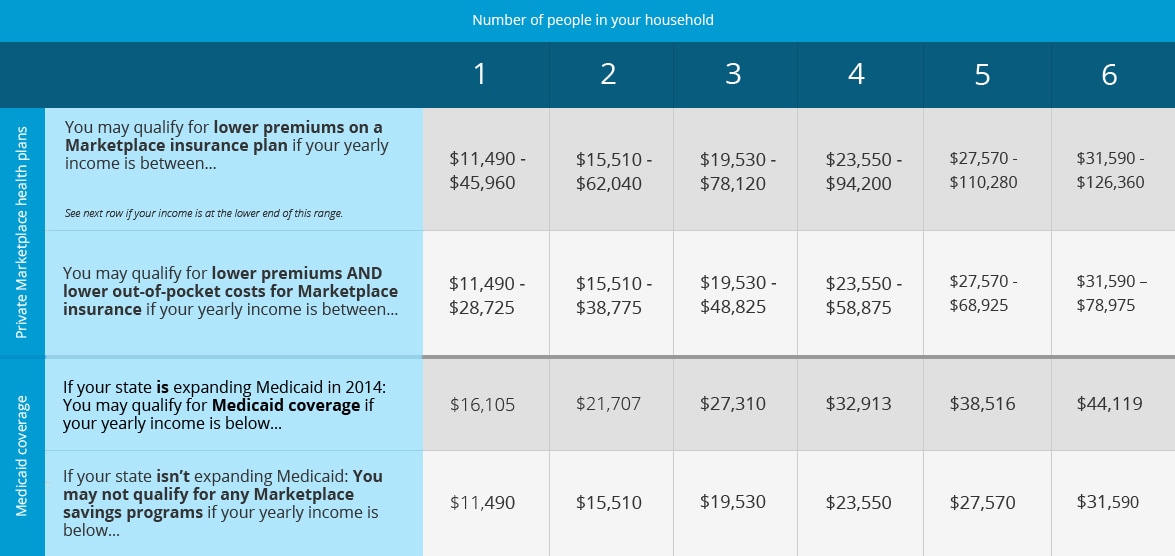

Source: healthcare.gov

Source: healthcare.gov

Determines whether eligibility to participate in the plan favors highly compensated individuals. If you were born before 1930, you need at least one qc for each year after 1950. State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act. These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or. Eligible individuals who are eligible for fully insured state continuation coverage.

Source: simplebooklet.com

Source: simplebooklet.com

The mlr provision of the affordable care act (the act) requires all health insurance companies to spend a certain portion of fully insured individual and group insurance premium dollars on health care claims and programs to improve health care quality. Determines whether eligibility to participate in the plan favors highly compensated individuals. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act. If a worker becomes disabled before full retirement age and but has at least one credit for each year since age 21, the ssa considers the person to be insured for disability benefits.

Source: visa-travels.com

Source: visa-travels.com

What does the medical loss ratio (mlr) provision address? Within those two funds, the money will be paid out. As such, state laws can generally exceed standards in the no surprises act by adopting heightened standards that are more protective of consumers. Eligible individuals who are eligible for fully insured state continuation coverage. What does the medical loss ratio (mlr) provision address?

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

The employer pays premiums to the insurer (some of which are passed on to the employees via payroll deduction) in trade for the. As such, state laws can generally exceed standards in the no surprises act by adopting heightened standards that are more protective of consumers. If these thresholds are not met, the Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. Fully insured group health plans are divided into two categories:

Source: medicaltravelinsurance.co.uk

Source: medicaltravelinsurance.co.uk

If these thresholds are not met, the If these thresholds are not met, the These nondiscrimination rules were set to be effective for fully insured health plans for plan years beginning on or. Eligible individuals who are eligible for fully insured state continuation coverage. What does the medical loss ratio (mlr) provision address?

Source: cosmoins.com

Source: cosmoins.com

The fully insured nondiscrimination rule applies only to group health plans. If you were born before 1930, you need at least one qc for each year after 1950. Under a fully insured plan, an employer often feels less of the effects of rising medical costs. • must have a qualifying event that is a reduction in hours or an involuntary termination of a covered employee’s employment. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company.

Source: revisi.net

Source: revisi.net

If you were born before 1930, you need at least one qc for each year after 1950. Regulate insurers that offer fully insured individual and group plans. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. As such, state laws can generally exceed standards in the no surprises act by adopting heightened standards that are more protective of consumers. State laws are preempted only when those laws impose a requirement that “prevents the application” of the no surprises act.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If a worker becomes disabled before full retirement age and but has at least one credit for each year since age 21, the ssa considers the person to be insured for disability benefits. Fully insured group health plans are divided into two categories: Purchased to protect you when eligible claims during the policy year on any one individual exceed the specific liability limit. Large employer plans for groups with 51 or more employees.under any fully insured plan, the employer purchases coverage from an insurance company. The year before you attain age 62, the year before you die, or.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does one qualify as a fully insured individual by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.