How is life insurance profitable information

Home » Trending » How is life insurance profitable informationYour How is life insurance profitable images are available. How is life insurance profitable are a topic that is being searched for and liked by netizens today. You can Download the How is life insurance profitable files here. Get all free photos and vectors.

If you’re searching for how is life insurance profitable images information connected with to the how is life insurance profitable interest, you have come to the ideal blog. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

How Is Life Insurance Profitable. As of q2 2021, life insurance companies had a net profit margin (npm) of 4.1% for the trailing 12 months (ttm). I haven’t looked at industry totals for a while but there are several misstatements in previous answers i want to address. Income tax charged for life insurance business has been kept relatively low, as little as 8%, as opposed to other nature of businesses, at about 24%, according to the income tax act 1967. The benefit to them is that they keep some of the interest the money accrued as profit, and that they get to use the money right away on things they might make more money from.

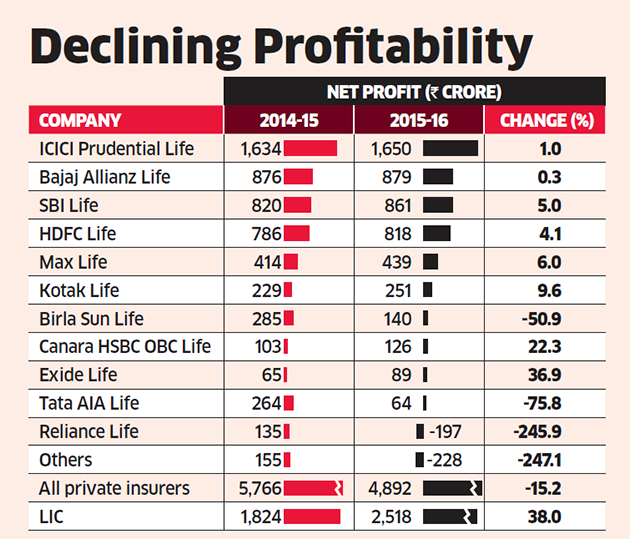

LIC profit rises 38, private players see 15 decline From economictimes.indiatimes.com

LIC profit rises 38, private players see 15 decline From economictimes.indiatimes.com

Traditionally life assurance companies have reported financial results to shareholders on the basis of the statutory requirements of the insurance companies� legislation. What is an insurance company? Therefore basic formula to calculate profits for the insurance companies is : Second, commission percentages are very high compared to other insurance sales, such as health insurance. If you were to go out and write 10 policies today that all got issued you would get paid. The chance to fulfill growing customer needs while returning to profitability and growth.

The report added that the life insurance industry remains reasonably concentrated, with the top five life insurers accounting for 68% of total industry assets, up from 62% in 2020.

Even if the payout for claims is 100% of the premiums collected(which is never the case), the insurance companies can still earn profit by investing the premiums. Broader client market (everyone is a prospect one way or the other) higher commissions, renewal commissions & bonuses; The most profitable insurance to sell auto insurance. Imagine what it would be like to have huge sums of money landing in your bank account even when you are out of the insurance sales profession. To achieve these goals, we expect winning life insurance companies to outperform in three areas in the decade ahead: Second, commission percentages are very high compared to other insurance sales, such as health insurance.

Source: paisahealth.in

Source: paisahealth.in

The chance to fulfill growing customer needs while returning to profitability and growth. Second you can get a varying contract with the insurance carrier. Insurance companies are generally companies who provide insurance services for clients. First, you are compensated for writing policies that get issued. The chance to fulfill growing customer needs while returning to profitability and growth.

Source: finalexpensesalesleads.com

Source: finalexpensesalesleads.com

Imagine what it would be like to have huge sums of money landing in your bank account even when you are out of the insurance sales profession. Relating to life insurance profit margins in order to place the relationship between volume and profits in better perspective. This has been a convenient measure since it also Much like a bank they bring together people with similar needs. Overall, life insurance profitability in most regions declined in recent years, driven by slight declines in many major markets.

Source: pinterest.co.uk

Source: pinterest.co.uk

Second you can get a varying contract with the insurance carrier. First, you are compensated for writing policies that get issued. What is an insurance company? So the most common measure of a life insurance company�s financial year was the statutory earnings from operation. I was working one of the most comfortable secure jobs possible for nearly 8 years at my local sheriff’s department making a stable income.

Source: blogarama.com

Source: blogarama.com

The benefit to them is that they keep some of the interest the money accrued as profit, and that they get to use the money right away on things they might make more money from. Life insurance is more lucrative by any comparison. We believe the life insurance industry faces a pivotal, dual opportunity: The chance to fulfill growing customer needs while returning to profitability and growth. In the united kingdom, for instance, insurers have recently been favoring products that are less capital intensive—but that are also less profitable.

Source: slideshare.net

Source: slideshare.net

It was also a job that you would have to do something incredibly stupid ever to feel as if your position was at. In the united kingdom, for instance, insurers have recently been favoring products that are less capital intensive—but that are also less profitable. This becomes clearer by the following example: Second you can get a varying contract with the insurance carrier. The chance to fulfill growing customer needs while returning to profitability and growth.

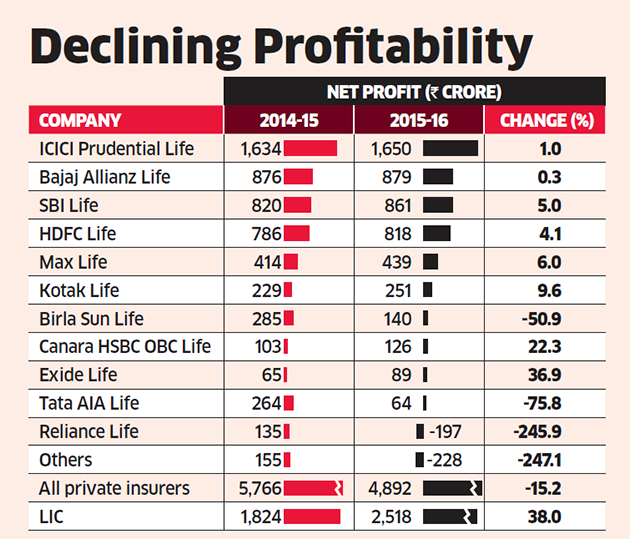

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Much like a bank they bring together people with similar needs. For example, insurer a collects $10,000,000 in premiums for polices issued or renewed in a given year. We believe the life insurance industry faces a pivotal, dual opportunity: Property and casualty insurance companies had an npm of 23.26% ttm. In a survey conducted by eastbridge consulting group, carriers said life insurance is the most profitable of voluntary benefits.

Source: youtube.com

Source: youtube.com

Key profit factors to do this, we must first understand the concepts on which life insurance profits are based. Broader client market (everyone is a prospect one way or the other) higher commissions, renewal commissions & bonuses; Traditionally life assurance companies have reported financial results to shareholders on the basis of the statutory requirements of the insurance companies� legislation. It should not come as a big surprise that auto insurance is the best selling and most profitable insurance product. Overall, life insurance profitability in most regions declined in recent years, driven by slight declines in many major markets.

Source: actuarialeye.com

Source: actuarialeye.com

If you were to go out and write 10 policies today that all got issued you would get paid. Property and casualty insurance companies had an npm of 23.26% ttm. Income tax charged for life insurance business has been kept relatively low, as little as 8%, as opposed to other nature of businesses, at about 24%, according to the income tax act 1967. You probably know that there are a huge number of car owners in the country with the numbers increasing each day. For example, insurer a collects $10,000,000 in premiums for polices issued or renewed in a given year.

Source: pinterest.com

Source: pinterest.com

The chance to fulfill growing customer needs while returning to profitability and growth. Insurance companies are generally companies who provide insurance services for clients. A life insurance company is like a bank in that it makes a profit from the services that it provides. In a survey conducted by eastbridge consulting group, carriers said life insurance is the most profitable of voluntary benefits. Property and casualty insurance companies had an npm of 23.26% ttm.

Source: riskinfo.com.au

Source: riskinfo.com.au

Even if the payout for claims is 100% of the premiums collected(which is never the case), the insurance companies can still earn profit by investing the premiums. Even if the payout for claims is 100% of the premiums collected(which is never the case), the insurance companies can still earn profit by investing the premiums. Insurance companies are generally companies who provide insurance services for clients. As of q2 2021, life insurance companies had a net profit margin (npm) of 4.1% for the trailing 12 months (ttm). The chance to fulfill growing customer needs while returning to profitability and growth.

Source: youtube.com

Source: youtube.com

State regulators assure that companies admitted in their states are not making “inordinate” profits. In the united kingdom, for instance, insurers have recently been favoring products that are less capital intensive—but that are also less profitable. I was working one of the most comfortable secure jobs possible for nearly 8 years at my local sheriff’s department making a stable income. First, you are compensated for writing policies that get issued. State regulators assure that companies admitted in their states are not making “inordinate” profits.

Source: walmart.com

Source: walmart.com

In fact, it’s so unprofitable that companies have gone bankrupt from it. A life insurance company is like a bank in that it makes a profit from the services that it provides. Some insurance companies, depending on the year, can make money from underwriting income. Income tax charged for life insurance business has been kept relatively low, as little as 8%, as opposed to other nature of businesses, at about 24%, according to the income tax act 1967. Even if the payout for claims is 100% of the premiums collected(which is never the case), the insurance companies can still earn profit by investing the premiums.

Source: raindx.com

Source: raindx.com

In fact, it’s so unprofitable that companies have gone bankrupt from it. Even if the payout for claims is 100% of the premiums collected(which is never the case), the insurance companies can still earn profit by investing the premiums. They provide services to determine how to share the risk that affects all. So the most common measure of a life insurance company�s financial year was the statutory earnings from operation. What is an insurance company?

Source: foxstylo.com

Source: foxstylo.com

Life insurance is more lucrative by any comparison. Key profit factors to do this, we must first understand the concepts on which life insurance profits are based. So the most common measure of a life insurance company�s financial year was the statutory earnings from operation. Much like a bank they bring together people with similar needs. Life insurance is more lucrative by any comparison.

Source: youtube.com

Source: youtube.com

Life insurance sales is a business opportunity. A life insurance company is like a bank in that it makes a profit from the services that it provides. They provide services to determine how to share the risk that affects all. Traditionally life assurance companies have reported financial results to shareholders on the basis of the statutory requirements of the insurance companies� legislation. Insurance companies are generally companies who provide insurance services for clients.

Source: youtube.com

Source: youtube.com

This becomes clearer by the following example: Property and casualty insurance companies had an npm of 23.26% ttm. This will increase the value of your practice, even as you enter a more passive phase. Some insurance companies, depending on the year, can make money from underwriting income. In its very simplest form, you pay in and the insurance company pays it back out when you die, with interest.

Source: quora.com

I was working one of the most comfortable secure jobs possible for nearly 8 years at my local sheriff’s department making a stable income. Some insurance companies, depending on the year, can make money from underwriting income. First, you are compensated for writing policies that get issued. Much like a bank they bring together people with similar needs. The benefit to them is that they keep some of the interest the money accrued as profit, and that they get to use the money right away on things they might make more money from.

Source: youtube.com

Source: youtube.com

The report added that the life insurance industry remains reasonably concentrated, with the top five life insurers accounting for 68% of total industry assets, up from 62% in 2020. This will increase the value of your practice, even as you enter a more passive phase. In a survey conducted by eastbridge consulting group, carriers said life insurance is the most profitable of voluntary benefits. In its very simplest form, you pay in and the insurance company pays it back out when you die, with interest. If you were to go out and write 10 policies today that all got issued you would get paid.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how is life insurance profitable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.