How long do you have to claim life insurance information

Home » Trend » How long do you have to claim life insurance informationYour How long do you have to claim life insurance images are available in this site. How long do you have to claim life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the How long do you have to claim life insurance files here. Get all royalty-free photos.

If you’re searching for how long do you have to claim life insurance images information connected with to the how long do you have to claim life insurance keyword, you have pay a visit to the ideal blog. Our site always gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

How Long Do You Have To Claim Life Insurance. How long do i have to file a claim? Most insurance companies have time limits within which you must submit your claim. If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites. Permanent life insurance policies such as whole life or universal life contracts should be retained as long as the policy is in force or until the claim is settled after your death.

How Long Do You Have to File a Claim for a Car Accident From clovered.com

How Long Do You Have to File a Claim for a Car Accident From clovered.com

When a life insurance claim is not paid within 30 to 60 days from the date you submitted all the necessary documents to the insurance company, your claim may be considered delayed. What documents do you need to file a life insurance claim? You don’t have to file your claim within a specific period after the death of a loved one. As mentioned earlier, processing a claim may take anywhere between a few days to as long as 60 days or more. Stand by until the claim is processed; The contestability period is the time during which the issuing company can fight to invalidate a policy or deny a claim.

The limit usually varies from 90 days to 12 months from the date of the loss or event.

There will be costs coming up that need to be paid, and the life insurance payout will help cover those costs. How long do i have to file a claim? Most insurance companies have time limits within which you must submit your claim. Even though you can claim a life insurance policy anytime, the sooner you do so, the sooner you’ll get the money that is rightfully yours. There will be costs coming up that need to be paid, and the life insurance payout will help cover those costs. When it comes to how soon you need to make your claim, however, there are no rules pertaining to how long you have to cash in on a life insurance policy.

Source: cdn.mind.org.uk

Source: cdn.mind.org.uk

In other words, if your life insurance claim is denied, you have. In other words, if your life insurance claim is denied, you have. The period of contestability also factors into how long you need to have life insurance before you die. There’s no time limit to claim life insurance, so you can file whenever you’re ready. However, life insurance policies accumulate interest until claimed, which means that insurance companies want to pay out on policies as soon as possible.

Source: clovered.com

Source: clovered.com

The contestability period is the time during which the issuing company can fight to invalidate a policy or deny a claim. Stand by until the claim is processed; If you’re the beneficiary on a recently deceased person’s life insurance policy, you need to file a claim for the death benefit. If a payout is due, it can be claimed. There is no time limit when it comes to filing a claim.

Source: bountysomebody.co.uk

Source: bountysomebody.co.uk

You’re in your rights to collect a death benefit at any time after your loved one has passed,. Life insurance period of contestability. That said, your loved one left this money to take care of their loved ones. Unclaimed life insurance benefits | iii. As mentioned earlier, processing a claim may take anywhere between a few days to as long as 60 days or more.

Source: lunarevents.co.uk

Source: lunarevents.co.uk

How long does it take to process a life insurance claim? How long does it take to process a life insurance claim? Overall, your insurance company should pay the claim within 30 days as long as none of these reasons are met. You’re in your rights to collect a death benefit at any time after (5). This is how the process of filing a claim normally works:

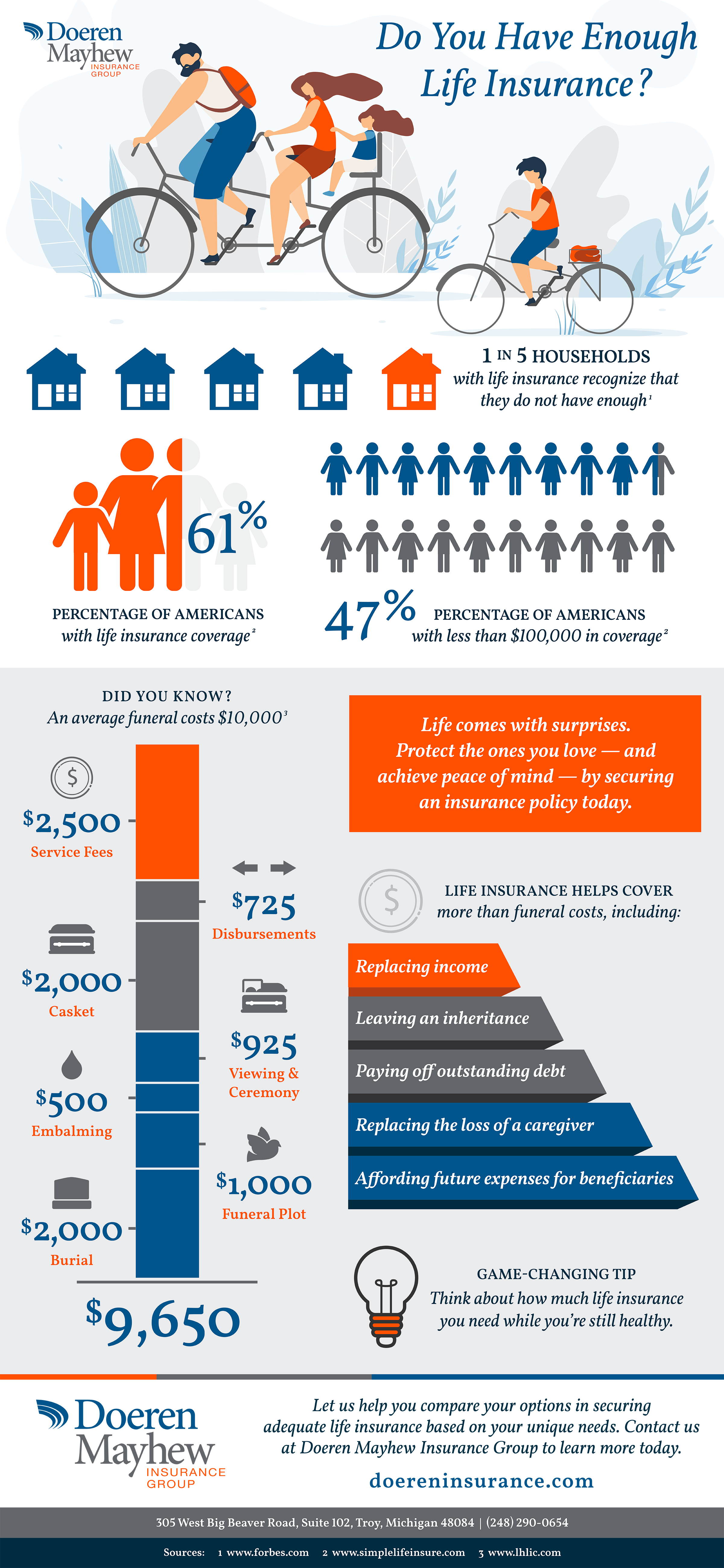

Source: doereninsurance.com

Source: doereninsurance.com

If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites. However, the average amount of time before your life insurance kicks in is one to two years. Life insurance death benefits are usually paid within 30 days after you submit a claim, according to the american council of life insurers (acli), an industry group. The period of contestability also factors into how long you need to have life insurance before you die. If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites.

Source: ictsd.org

Source: ictsd.org

Overall, your insurance company should pay the claim within 30 days as long as none of these reasons are met. There is no time limit when it comes to filing a claim. Dec 2, 2020 — there’s no timeframe for a life insurance claim. If a payout is due, it can be claimed. When it comes to what you have to do, many life insurance companies contact beneficiaries to issue the.

Source: telegraph.co.uk

Source: telegraph.co.uk

For example, if you determined you have 23 years until you retire, 19 years until you pay off your mortgage and 13 years until your youngest child is no longer financially dependent upon you, then your highest number is 23. In most states, including new jersey and pennsylvania, the statute of limitations is two years. How long do you have to make a life insurance claim? While the events surrounding the claim are tragic, life insurance companies see this as an opportunity to really shine and will take steps to make the process fast. While insurance companies are incentivized to pay claims promptly, there are still a variety of reasons they apply to delay a claim.

Source: daveramsey.com

Source: daveramsey.com

There is no time limit when it comes to filing a claim. If you don’t, you probably won’t see the money and you definitely won’t be alone: For example, if you determined you have 23 years until you retire, 19 years until you pay off your mortgage and 13 years until your youngest child is no longer financially dependent upon you, then your highest number is 23. How long do you have to make a life insurance claim? How long do you have to pay into life insurance to collect?

Source: partners4prosperity.com

Source: partners4prosperity.com

That said, your loved one left this money to take care of their loved ones. Dec 2, 2020 — there’s no timeframe for a life insurance claim. Unclaimed life insurance benefits total at least $1 billion each year. The contestability period is the time during which the issuing company can fight to invalidate a policy or deny a claim. In other words, if your life insurance claim is denied, you have two years from the date of death to pursue legal action against the insurance company.

Source: rankeagle.co.uk

Source: rankeagle.co.uk

You’re in your rights to collect a death benefit at any time after (5). There will be costs coming up that need to be paid, and the life insurance payout will help cover those costs. How long do you have to make a life insurance claim? What documents do you need to file a life insurance claim? As mentioned earlier, processing a claim may take anywhere between a few days to as long as 60 days or more.

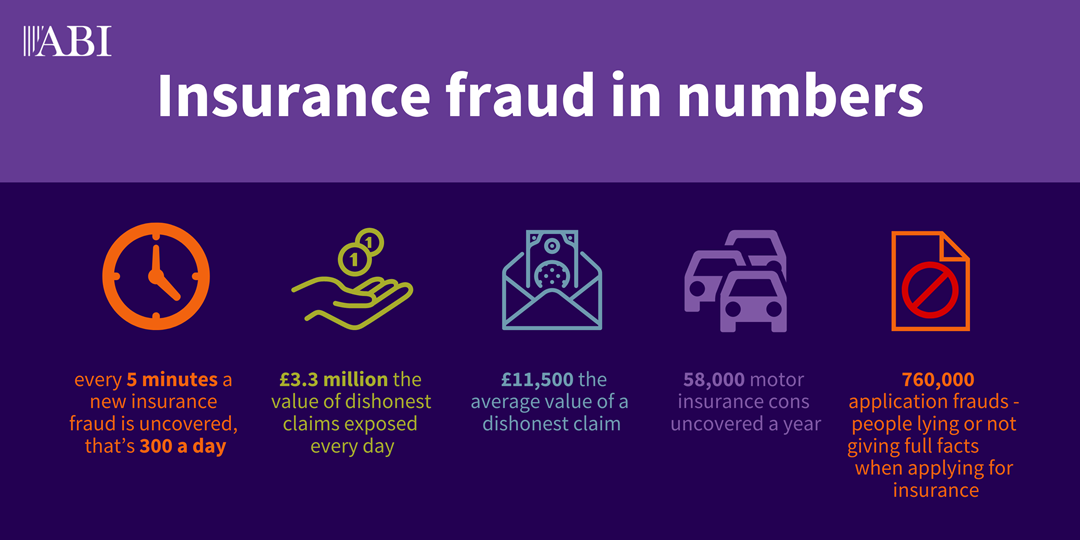

Source: abi.org.uk

Source: abi.org.uk

However, the average amount of time before your life insurance kicks in is one to two years. There will be costs coming up that need to be paid, and the life insurance payout will help cover those costs. There�s no set deadline for how long you have to file a life insurance claim but the sooner you do so, the better. How long do i have to file a claim? How long do you have to make a life insurance claim?

Source: appleroofingllc.com

Source: appleroofingllc.com

How long do i have to file a claim? You’re in your rights to collect a death benefit at any time after your loved one has passed,. How long do claims take? In most states, including new jersey and pennsylvania, the statute of limitations is two years. When it comes to what you have to do, many life insurance companies contact beneficiaries to issue the.

Source: must-have-dental.com

Source: must-have-dental.com

What documents do you need to file a life insurance claim? If a payout is due, it can be claimed. What documents do you need to file a life insurance claim? The period of contestability also factors into how long you need to have life insurance before you die. How long do claims take?

Source: nstlaw.com

Source: nstlaw.com

If a payout is due, it can be claimed. There’s no time limit to claim life insurance, so you can file whenever you’re ready. Once you’ve rounded up all your documents, you’ll need to get in touch with the insurance company that issued the life insurance policy to notify them of the death and file your claim. How long do claims take? Stand by until the claim is processed;

When it comes to how soon you need to make your claim, however, there are no rules pertaining to how long you have to cash in on a life insurance policy. If you think that all you have to do is file your life insurance claim and in 30 days you’ll have your money, you’re very likely to be wrong.) the center for life insurance disputes. Most insurance companies have time limits within which you must submit your claim. If you don’t, you probably won’t see the money and you definitely won’t be alone: Check your policy’s terms and conditions for the time limit.

Source: basementbashberlin.com

Source: basementbashberlin.com

Unclaimed life insurance benefits total at least $1 billion each year. This is how the process of filing a claim normally works: If you think that all you have to do is file your life insurance claim and in 30 days you’ll have your money, you’re very likely to be wrong.) the center for life insurance disputes. Check your policy’s terms and conditions for the time limit. The average waiting period is a few years some policies will have you eligible for a death benefit immediately, while others will make you wait four or five years before it takes effect.

Source: howto.tungchinguyen.com

Source: howto.tungchinguyen.com

How long do you have to pay into life insurance to collect? You’re in your rights to collect a death benefit at any time after (5). If you’re the beneficiary on a recently deceased person’s life insurance policy, you need to file a claim for the death benefit. This is because life insurance claims can take time, especially if. In other words, if your life insurance claim is denied, you have two years from the date of death to pursue legal action against the insurance company.

Source: appleroofingllc.com

Source: appleroofingllc.com

In most states, including new jersey and pennsylvania, the statute of limitations is two years. Once the claim is paid there is no longer a need for the policy, and if you cancel the policy with no intention of reinstatement you can shred it. That said, your loved one left this money to take care of their loved ones. The average waiting period is a few years some policies will have you eligible for a death benefit immediately, while others will make you wait four or five years before it takes effect. In other words, if your life insurance claim is denied, you have two years from the date of death to pursue legal action against the insurance company.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how long do you have to claim life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.