How long does it take for life insurance Idea

Home » Trending » How long does it take for life insurance IdeaYour How long does it take for life insurance images are ready. How long does it take for life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the How long does it take for life insurance files here. Get all free photos.

If you’re searching for how long does it take for life insurance pictures information connected with to the how long does it take for life insurance interest, you have pay a visit to the right blog. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

How Long Does It Take For Life Insurance. Until recently, it could take four to eight weeks to get life insurance coverage. Documents required for your claim. Life insurance is a way to save money, and you can borrow from the cash value of the account on a tax deferred basis, but the accrual rate is low and it takes years to build up enough cash value to gain a substantial amount of cash. When you file your claim.

How Long Does It Take To Get Life Insurance Policy Term From termlifeadvice.com

How Long Does It Take To Get Life Insurance Policy Term From termlifeadvice.com

But, on average, how long does it take for life insurance to be distributed? Underwriting is when your provider evaluates your health and lifestyle for potential risk and sets your policy rates. The length of your life insurance policy should correspond to the amount of time you have remaining on your mortgage. This is usually the longest part of the underwriting process. Sometimes known as “fast life insurance,” these are policies you can apply for online and often get a decision on within minutes. With traditional whole life insurance it can take more than 10 years to build cash value.

Working the number of years or term that you buy your life insurance for can be confusing but understanding your reason for the insurance will help.

A claim rarely takes more than 60 days after death to be processed by a life insurance company (assuming they have what they need to pay the claim) if all documents are in order, and a claim is straightforward, it can be processed and money can be paid in as little as 10 to 14 days. Life insurance death benefits are usually paid within 30 days after you submit a claim, according to the american council of life insurers (acli), an industry group. However, if you choose a non med life insurance policy, you can get life insurance in as little as 24 hours. The length of your life insurance policy should correspond to the amount of time you have remaining on your mortgage. When you file your claim. If you were to die without life insurance, your spouse may have a difficult time making the payments on their own.

Source: everquote.com

Source: everquote.com

If you were to die without life insurance, your spouse may have a difficult time making the payments on their own. If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites. But, on average, how long does it take for life insurance to be distributed? Most claims are processed and paid within 30 days of the date of your application. Your spouse relies on your income in order to pay the mortgage each month.

Source: adviseandwise.com

Source: adviseandwise.com

While it doesn�t take long to apply for life insurance online, it can take five to six weeks to go through the underwriting process, get a final policy decision, and have an active life insurance policy. Life insurance is a way to save money, and you can borrow from the cash value of the account on a tax deferred basis, but the accrual rate is low and it takes years to build up enough cash value to gain a substantial amount of cash. But, on average, how long does it take for life insurance to be distributed? Working the number of years or term that you buy your life insurance for can be confusing but understanding your reason for the insurance will help. For example, it’s relatively easy to get a $50,000 term life insurance policy, but it may be challenging to get $1 million in whole life insurance.

Source: basementbashberlin.com

Source: basementbashberlin.com

While that’s still true for traditional policies, a string of insurers now offer instant life insurance. How long the policy was active If you have an active life insurance policy, the company will pay your beneficiaries when you die. The length of your life insurance policy will be personal to you and should be based on the reason you need the cover. However, processing times vary by company.

Source: termlifeadvice.com

Source: termlifeadvice.com

If more than a month has passed (4). Documents required for your claim. The average time it takes to receive the death benefits from the life insurance company can average anywhere from two to eight weeks. Average time it takes to get death benefits from life insurance. However, the higher your death benefit, the more time it can take to get approved.

Source: coverfox.com

Source: coverfox.com

The time it takes to receive the life insurance payout varies, but on average, most people can expect to receive their payment in under 60 days. Life insurance policy locator service frequently asked questions: With traditional whole life insurance it can take more than 10 years to build cash value. For example, it’s relatively easy to get a $50,000 term life insurance policy, but it may be challenging to get $1 million in whole life insurance. No medical exam life insurance [top 10 companies and policies] top 10 best final expense and burial insurance companies;

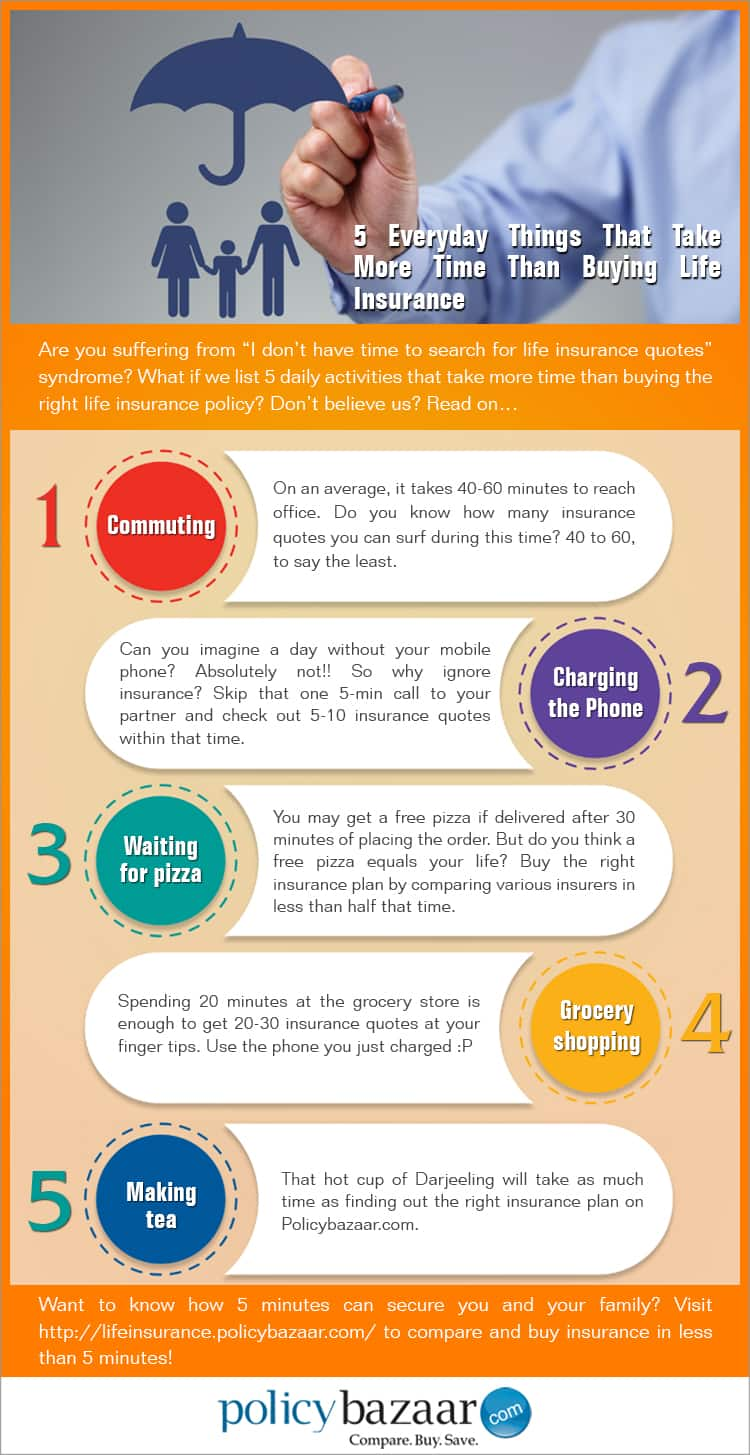

Source: policybazaar.com

Source: policybazaar.com

Most insurance companies will issue the death benefit within two weeks of the policyholder’s death. There are two primary options when choosing life insurance: Top 23 best life insurance companies in the u.s. With traditional whole life insurance it can take more than 10 years to build cash value. Most claims are processed and paid within 30 days of the date of your application.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

How long does it take to get life insurance? When you file your claim. Average time it takes to get death benefits from life insurance. How long does it take for life insurance to pay out? Unless your claim is contested, in the majority of cases, insurers must pay claims within 30 to 60 days after they receive all the documents that they have requested.

Source: miwaylife.co.za

Source: miwaylife.co.za

How long does it take to process a life insurance policy. This is usually the longest part of the underwriting process. 5 days ago — it usually takes life insurance companies anywhere from 30 to 60 days to process a claim. Underwriting is when your provider evaluates your health and lifestyle for potential risk and sets your policy rates. While it doesn�t take long to apply for life insurance online, it can take five to six weeks to go through the underwriting process, get a final policy decision, and have an active life insurance policy.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

This is usually the longest part of the underwriting process. The average time it takes to receive the death benefits from the life insurance company can average anywhere from two to eight weeks. With that said, such a permanent life insurance policy can provide a tremendous benefit if it is taken out while. If you still have 25 years left until your house is all paid off, you. If you were to die without life insurance, your spouse may have a difficult time making the payments on their own.

Source: searchinsider.net

Source: searchinsider.net

Most insurance companies will issue the death benefit within two weeks of the policyholder’s death. Your spouse relies on your income in order to pay the mortgage each month. A claim rarely takes more than 60 days after death to be processed by a life insurance company (assuming they have what they need to pay the claim) if all documents are in order, and a claim is straightforward, it can be processed and money can be paid in as little as 10 to 14 days. If you still have 25 years left until your house is all paid off, you. Most insurance companies will issue the death benefit within two weeks of the policyholder’s death.

Source: schlawpc.com

Source: schlawpc.com

If you have an active life insurance policy, the company will pay your beneficiaries when you die. The time it takes to receive the life insurance payout varies, but on average, most people can expect to receive their payment in under 60 days. With accelerated underwriting, it is even possible to get life insurance instantly. Life insurance policy locator service frequently asked questions: But here, we show you how to do it in 5 years.

Source: motherhoodtherealdeal.com

Source: motherhoodtherealdeal.com

How long does it take to process a life insurance policy. How soon the benefits will be paid depends on how fast you submit claim paperwork, laws governing the claim, and the insurance company’s processing time. Top 23 best life insurance companies in the u.s. How long the policy was active When you file your claim.

Source: telegraph.co.uk

Source: telegraph.co.uk

Until recently, it could take four to eight weeks to get life insurance coverage. Unless your claim is contested, in the majority of cases, insurers must pay claims within 30 to 60 days after they receive all the documents that they have requested. The average life insurance payout can take as little as two weeks, up to two months, to receive the death benefit. Most insurance companies will issue the death benefit within two weeks of the policyholder’s death. How long does it take to get life insurance money?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Most insurance companies will issue the death benefit within two weeks of the policyholder’s death. If you still have 25 years left until your house is all paid off, you. Life insurance claims may take longer but usually not more than 60 days after the insured has passed away. How soon the benefits will be paid depends on how fast you submit claim paperwork, laws governing the claim, and the insurance company’s processing time. But here, we show you how to do it in 5 years.

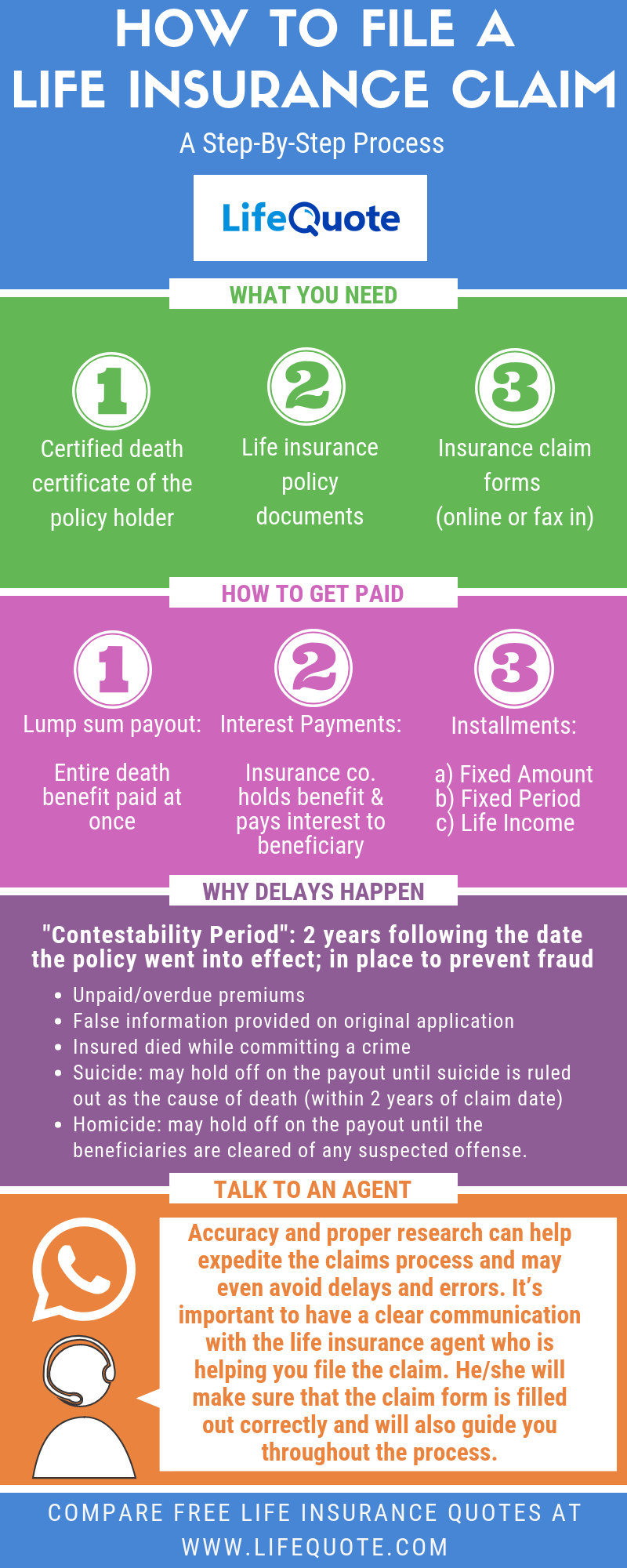

Source: lifequote.com

Source: lifequote.com

Payout timing can depend on how quickly you file a claim with the insurer and fill out all of the right forms. Working the number of years or term that you buy your life insurance for can be confusing but understanding your reason for the insurance will help. The length of your life insurance policy will be personal to you and should be based on the reason you need the cover. You may have to wait up to 30 days for a payout, but you will usually receive it much sooner. Life insurance policy locator service frequently asked questions:

Source: partners4prosperity.com

Source: partners4prosperity.com

Underwriting is when your provider evaluates your health and lifestyle for potential risk and sets your policy rates. Most claims are processed and paid within 30 days of the date of your application. The average life insurance payout can take as little as two weeks, up to two months, to receive the death benefit. The length of your life insurance policy should correspond to the amount of time you have remaining on your mortgage. This is usually the longest part of the underwriting process.

Source: issuu.com

Source: issuu.com

If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites. When a claim is submitted, miwaylife will pay out the funeral portion of the policyholder’s life insurance within 48 hours, meaning that the remaining loved ones can hold a dignified funeral immediately without worrying about the financial implications. 5 days ago — it usually takes life insurance companies anywhere from 30 to 60 days to process a claim. Unless your claim is contested, in the majority of cases, insurers must pay claims within 30 to 60 days after they receive all the documents that they have requested. While that’s still true for traditional policies, a string of insurers now offer instant life insurance.

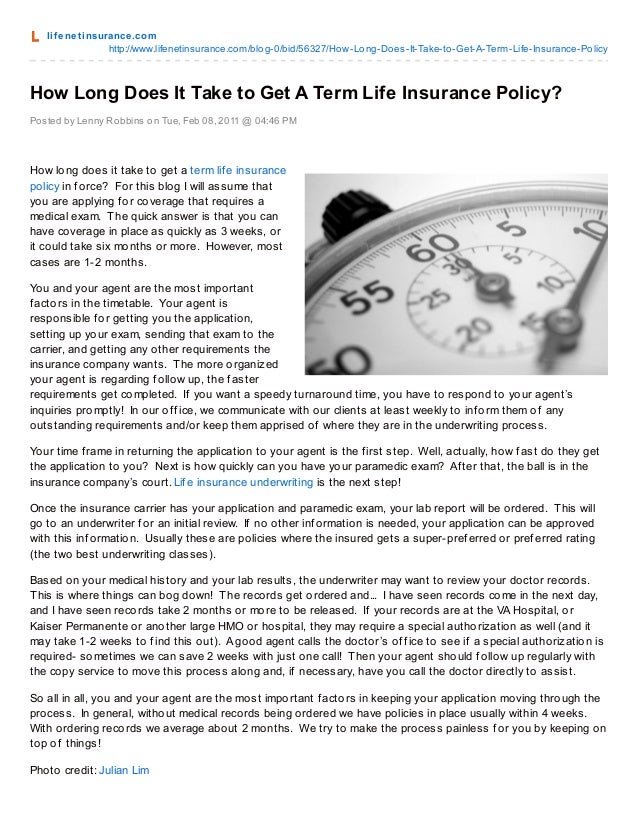

Source: slideshare.net

Source: slideshare.net

A claim rarely takes more than 60 days after death to be processed by a life insurance company (assuming they have what they need to pay the claim) if all documents are in order, and a claim is straightforward, it can be processed and money can be paid in as little as 10 to 14 days. Payout timing can depend on how quickly you file a claim with the insurer and fill out all of the right forms. However, the timeline depends on several factors. How long should i have life insurance for my mortgage? Life insurance death benefits are usually paid within 30 days after you submit a claim, according to the american council of life insurers (acli), an industry group.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how long does it take for life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.