How long is individual medical expense insurance normally written for Idea

Home » Trend » How long is individual medical expense insurance normally written for IdeaYour How long is individual medical expense insurance normally written for images are available in this site. How long is individual medical expense insurance normally written for are a topic that is being searched for and liked by netizens today. You can Get the How long is individual medical expense insurance normally written for files here. Download all free images.

If you’re looking for how long is individual medical expense insurance normally written for pictures information related to the how long is individual medical expense insurance normally written for topic, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

How Long Is Individual Medical Expense Insurance Normally Written For. An individual, who is and continues to be a resident of alabama, and who has 18 months of prior continuous coverage, but is not longer able to obtain coverage, shall be eligible for health expense coverage under. Deductibles under the group plan usually run from $250 to $500; More commonly, room and board expenses are paid on a reimbursement basis. Suppose you report $70,000 in agi and have $15,000 in medical expenses.

COBRA Health Insurance That Works When You�re Not From healthmarkets.com

COBRA Health Insurance That Works When You�re Not From healthmarkets.com

For example, if you had an agi of $100,000 and health insurance premiums of $7,000, you would not be able to deduct because the premiums did not exceed 7.5% of your net agi ($100,000 x 7.5% = $7,500 threshold). The deductible is the dollar amount that you must pay out of pocket before your health insurance begins paying for covered medical expenses. Roger writes his company and notifies them that he has become disabled. Such contracts may contain internal limits and are normally subject to coinsurance. She is still able to reside in her home while receiving primary care, as opposed to moving into a nursing home. Deductibles under the group plan usually run from $250 to $500;

Deductibles under the group plan usually run from $250 to $500;

When you purchase an individual plan on the health insurance marketplace, and sometimes even if you’re choosing a plan offered by your employer, you will need to choose a deductible amount for your plan. Accident and health insurance claim handling is made more convenient to the insured by utilizing. Under the uniform required provisions, proof of loss under a health insurance policy normally should be filed within 90 days of a loss. The major medical deductible carryover period normally applies to expenses incurred during the last ___ months of the plan year. Healthcare system up to $16.9 billion in 2020. Typically, the maximum number of days is from 90 to 365.

Source: blogadda.com

Source: blogadda.com

Groups can provide a much broader base of coverage and provide a lower deductible. Roger writes his company and notifies them that he has become disabled. But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. The health insurance premiums paid for each partner in a partnership is considered to be. Group major medical plans differ from individual major medical plans with respect to the benefits.

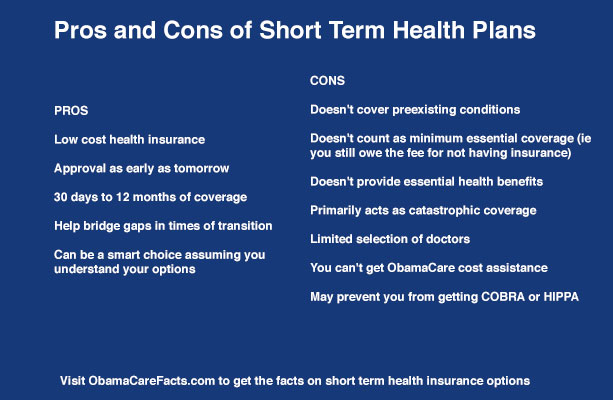

Source: obamacarefacts.com

Source: obamacarefacts.com

Proceeds of the viatical settlement contract could be subject to the claims of. Proceeds of the viatical settlement contract could be subject to the claims of. But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. More commonly, room and board expenses are paid on a reimbursement basis. For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. Proceeds of the viatical settlement contract could be subject to the claims of. More commonly, room and board expenses are paid on a reimbursement basis. An individual, who is and continues to be a resident of alabama, and who has 18 months of prior continuous coverage, but is not longer able to obtain coverage, shall be eligible for health expense coverage under. Group major medical plans differ from individual major medical plans with respect to the benefits.

Source: obamacarefacts.com

Source: obamacarefacts.com

For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%). Such contracts may contain internal limits and are normally subject to coinsurance. For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%). In the event of loss, business overhead insurance will pay for. Groups can provide a much broader base of coverage and provide a lower deductible.

Source: medsumlegal.com

Source: medsumlegal.com

She is still able to reside in her home while receiving primary care, as opposed to moving into a nursing home. Proceeds of the viatical settlement contract could be subject to the claims of. For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%). But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. More commonly, room and board expenses are paid on a reimbursement basis.

An individual, who is and continues to be a resident of alabama, and who has 18 months of prior continuous coverage, but is not longer able to obtain coverage, shall be eligible for health expense coverage under. Custodial care major medical plans typically exclude coverage for which of the following benefits? The major medical deductible carryover period normally applies to expenses incurred during the last ___ months of the plan year. Group major medical plans differ from individual major medical plans with respect to the benefits. When you purchase an individual plan on the health insurance marketplace, and sometimes even if you’re choosing a plan offered by your employer, you will need to choose a deductible amount for your plan.

Source: very-well-family.blogspot.com

Source: very-well-family.blogspot.com

Deductibles under the group plan usually run from $250 to $500; Group major medical plans differ from individual major medical plans with respect to the benefits. Such contracts may contain internal limits and are normally subject to coinsurance. If you itemize deductions, you can only deduct medical expenses that exceed 7.5% of your annual adjusted gross income (agi). Deductibles under the group plan usually run from $250 to $500;

Source: tehcpa.net

Source: tehcpa.net

When you purchase an individual plan on the health insurance marketplace, and sometimes even if you’re choosing a plan offered by your employer, you will need to choose a deductible amount for your plan. First, multiply your agi by 7.5% to calculate your medical expense threshold. Room and board rates vary by geographic location, but it is not unusual to find room and board rates ranging from $300 to $500 per day or more. Accident and health insurance claim handling is made more convenient to the insured by utilizing. Custodial care major medical plans typically exclude coverage for which of the following benefits?

Source: aetna.com

Source: aetna.com

Whereas it�s not unusual for individual plans to contain deductibles that run $1,000 or more. If a sickness and accident insurance claim form is not supplied to the insured within 15 days after the notice of claim, the insured may comply with the. Room and board rates vary by geographic location, but it is not unusual to find room and board rates ranging from $300 to $500 per day or more. But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. An individual, who is and continues to be a resident of alabama, and who has 18 months of prior continuous coverage, but is not longer able to obtain coverage, shall be eligible for health expense coverage under.

Source: etrustedadvisor.com

Source: etrustedadvisor.com

Deductibles under the group plan usually run from $250 to $500; If you itemize deductions, you can only deduct medical expenses that exceed 7.5% of your annual adjusted gross income (agi). Deductibles under the group plan usually run from $250 to $500; Group major medical plans differ from individual major medical plans with respect to the benefits. The deductible is the dollar amount that you must pay out of pocket before your health insurance begins paying for covered medical expenses.

Source: clearlysurely.com

Source: clearlysurely.com

Room and board rates vary by geographic location, but it is not unusual to find room and board rates ranging from $300 to $500 per day or more. She is still able to reside in her home while receiving primary care, as opposed to moving into a nursing home. The health insurance premiums paid for each partner in a partnership is considered to be. First, multiply your agi by 7.5% to calculate your medical expense threshold. Suppose you report $70,000 in agi and have $15,000 in medical expenses.

Source: consumersadvocate.org

Source: consumersadvocate.org

The deductible is the dollar amount that you must pay out of pocket before your health insurance begins paying for covered medical expenses. In the event of loss, business overhead insurance will pay for. For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%). Accident and health insurance claim handling is made more convenient to the insured by utilizing. The health insurance premiums paid for each partner in a partnership is considered to be.

Source: patriotsoftware.com

Source: patriotsoftware.com

First, multiply your agi by 7.5% to calculate your medical expense threshold. Typically, the maximum number of days is from 90 to 365. Suppose you report $70,000 in agi and have $15,000 in medical expenses. Major medical expense insurance a form of health insurance that provides benefits for most types of medical expense up to a high maximum benefit, such as $250,000 or higher after a substantial deductible, such as $500 or more. First, multiply your agi by 7.5% to calculate your medical expense threshold.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%). Groups can provide a much broader base of coverage and provide a lower deductible. Typically, the maximum number of days is from 90 to 365. If you itemize deductions, you can only deduct medical expenses that exceed 7.5% of your annual adjusted gross income (agi). Suppose you report $70,000 in agi and have $15,000 in medical expenses.

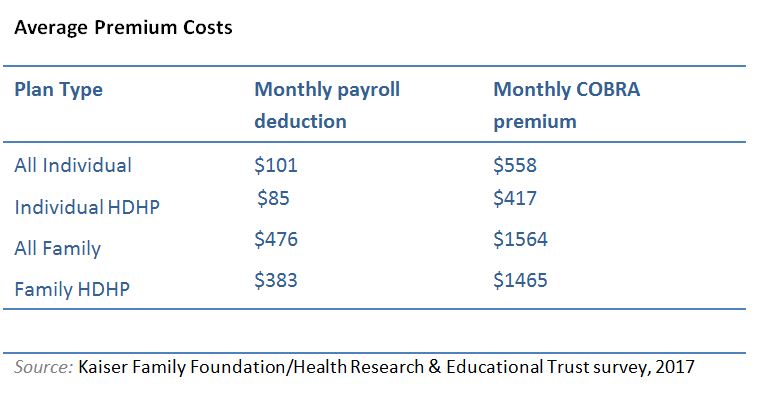

Source: healthmarkets.com

Source: healthmarkets.com

The major medical deductible carryover period normally applies to expenses incurred during the last ___ months of the plan year. For example, if you had an agi of $100,000 and health insurance premiums of $7,000, you would not be able to deduct because the premiums did not exceed 7.5% of your net agi ($100,000 x 7.5% = $7,500 threshold). An individual, who is and continues to be a resident of alabama, and who has 18 months of prior continuous coverage, but is not longer able to obtain coverage, shall be eligible for health expense coverage under. Under the uniform required provisions, proof of loss under a health insurance policy normally should be filed within 90 days of a loss. In the event of loss, business overhead insurance will pay for.

Source: healthmarkets.com

Source: healthmarkets.com

Suppose you report $70,000 in agi and have $15,000 in medical expenses. Group major medical plans differ from individual major medical plans with respect to the benefits. Suppose you report $70,000 in agi and have $15,000 in medical expenses. First, multiply your agi by 7.5% to calculate your medical expense threshold. For example, if your agi is $50,000 for the year and you spent $6,000 in medical care then the limit on what you can deduct is any expense over $3,750 ($50,000 x 7.5%).

Source: treatsinc.org

Source: treatsinc.org

All individual health insurance policies must include a notice of claim provision requiring that a written notice of claim must be given to the insurer within how long after the occurrence of the loss? Deductibles under the group plan usually run from $250 to $500; Such contracts may contain internal limits and are normally subject to coinsurance. But suppose you had another $2,000 in medical expenses along with your $7,000 in health insurance premiums. Custodial care major medical plans typically exclude coverage for which of the following benefits?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how long is individual medical expense insurance normally written for by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.