How much can you borrow against your life insurance policy Idea

Home » Trend » How much can you borrow against your life insurance policy IdeaYour How much can you borrow against your life insurance policy images are available. How much can you borrow against your life insurance policy are a topic that is being searched for and liked by netizens now. You can Download the How much can you borrow against your life insurance policy files here. Download all free photos and vectors.

If you’re looking for how much can you borrow against your life insurance policy pictures information related to the how much can you borrow against your life insurance policy interest, you have come to the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

How Much Can You Borrow Against Your Life Insurance Policy. If there’s money available to borrow inside your policy, it’s yours to borrow, regardless of your current income or credit report. The third method of accessing the cash value of a life insurance policy is to use the cash value of the policy as collateral for a loan from a financial institution. There usually is not a minimum amount you can borrow. Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against.

How To Borrow Money Against Your Life Insurance Policy From entresuaspalavras.blogspot.com

How To Borrow Money Against Your Life Insurance Policy From entresuaspalavras.blogspot.com

The cost to borrow your money from your policy will vary depending upon which policy loan provision your life insurance policy uses. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. In the early years of the policy, there may be little value, if any, to borrow against. Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against. You do not lose your life insurance and your beneficiaries remain the same. This life insurance policy, also referred to as permanent life insurance, can act like a savings account or home equity line of credit (heloc).

But there are also two other options.

Additionally, if you’ve had the policy for a while, you can end up borrowing a much larger amount that what a bank might lend you. Say you maintain your policy for 15 years and pay in a total of $15,000 in premiums. Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. But there are also two other options. The primary advantage of this approach is that under current tax laws, the loan proceeds can be received tax It can take many years to build up any significant cash value in a permanent life insurance policy.

Source: impresshow.blogspot.com

The cost to borrow your money from your policy will vary depending upon which policy loan provision your life insurance policy uses. Simply put, you’re putting up your policy as collateral. It can take many years to build up any significant cash value in a permanent life insurance policy. For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value. The cost to borrow your money from your policy will vary depending upon which policy loan provision your life insurance policy uses.

Source: thefinancesection.com

Source: thefinancesection.com

There usually is not a minimum amount you can borrow. However, you can often see much better rates than what you’d pay for a bank loan. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value. When you request a loan from your cash value, you’re not really taking out the money you’ve paid into the account. The policy terms will advise you when you can borrow against the policy.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. In other words, the more premiums you pay, the quicker you�ll be able to borrow against your life insurance, but this process could take years. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year. Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. But you could instead take out a life insurance loan for the entire $5,000, and the interest charged on the loan would come out of the $5,000 that is still inside the policy.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. For example, if you have $200,000 of coverage, we can loan you up to $100,000 secured solely by your policy. How much can you borrow from a life insurance policy? Additionally, if you’ve had the policy for a while, you can end up borrowing a much larger amount that what a bank might lend you. It�s up to your insurance provider to decide when you�re able to borrow against it, but in general, you can borrow against a policy as soon as you have built up a cash value.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

First, the insurance company can’t turn down your application for this loan. Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. How much can you borrow from a life insurance policy? The third method of accessing the cash value of a life insurance policy is to use the cash value of the policy as collateral for a loan from a financial institution.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

You normally can repay the loan. Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. The loan cost can be as low as zero up to 350 basis points, so it matters. The third method of accessing the cash value of a life insurance policy is to use the cash value of the policy as collateral for a loan from a financial institution. But you could instead take out a life insurance loan for the entire $5,000, and the interest charged on the loan would come out of the $5,000 that is still inside the policy.

Source: youtuberocks.com

Source: youtuberocks.com

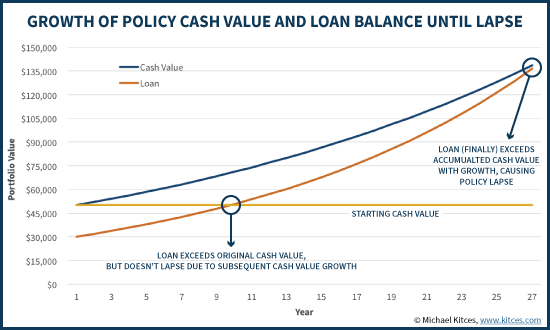

You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year. It�s up to your insurance provider to decide when you�re able to borrow against it, but in general, you can borrow against a policy as soon as you have built up a cash value. The cash value grows to $18,000 and you borrow all of. The loan cost can be as low as zero up to 350 basis points, so it matters. It’s important to note that when you borrow against the cash value of your whole life insurance policy, the loan will accrue interest until the total amount is paid back.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

The rules that govern life insurance policy loans do vary from company to company, however, so it�s important to understand a few basic rules about how much and when specifically you�ll have the option to borrow money against your policy. The third method of accessing the cash value of a life insurance policy is to use the cash value of the policy as collateral for a loan from a financial institution. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year. In other words, the more premiums you pay, the quicker you�ll be able to borrow against your life insurance, but this process could take years. Refer to the cash value chart on the policy print.

Source: thefinancesection.com

Source: thefinancesection.com

How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. Term life insurance policies do not come with a cash value account, so policyholders can’t borrow money from their insurer against. As you pay premiums for your cash value life insurance policy (this would be a whole or universal life insurance policy ), a portion of your premium is also going to go toward the cash value. When you take out a policy loan, you�re not removing money from the cash value of your account. When you borrow money from your life insurance policy, you’re essentially borrowing against the accrued cash value in that policy and you can only borrow up to a certain amount.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

You normally can repay the loan. The cost to borrow your money from your policy will vary depending upon which policy loan provision your life insurance policy uses. But there are also two other options. It becomes even more critical when you’re using life insurance as a supplemental retirement income vehicle. But you could instead take out a life insurance loan for the entire $5,000, and the interest charged on the loan would come out of the $5,000 that is still inside the policy.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Wondering, “how much can i borrow from my life insurance policy?” the amount you can borrow against life insurance depends on the size of your policy and how much you’ve paid into it so far. In other words, the more premiums you pay, the quicker you�ll be able to borrow against your life insurance, but this process could take years. When you request a loan from your cash value, you’re not really taking out the money you’ve paid into the account. Borrowing against a policy’s cash value is a sweet deal in multiple ways. Simply put, you’re putting up your policy as collateral.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. The third method of accessing the cash value of a life insurance policy is to use the cash value of the policy as collateral for a loan from a financial institution. Additionally, if you’ve had the policy for a while, you can end up borrowing a much larger amount that what a bank might lend you. When you request a loan from your cash value, you’re not really taking out the money you’ve paid into the account. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

It’s important to note that when you borrow against the cash value of your whole life insurance policy, the loan will accrue interest until the total amount is paid back. There usually is not a minimum amount you can borrow. For example, if you have $200,000 of coverage, we can loan you up to $100,000 secured solely by your policy. X research source as for term life policies, these are not loan sources since they don’t have a cash value that can be borrowed. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year.

Source: insure.com

Source: insure.com

When you borrow money from your life insurance policy, you’re essentially borrowing against the accrued cash value in that policy and you can only borrow up to a certain amount. Yes, it is possible to borrow against your life insurance policy. For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value. The cash value grows to $18,000 and you borrow all of. The loan cost can be as low as zero up to 350 basis points, so it matters.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. In other words, the more premiums you pay, the quicker you�ll be able to borrow against your life insurance, but this process could take years. The primary advantage of this approach is that under current tax laws, the loan proceeds can be received tax When you take out a policy loan, you�re not removing money from the cash value of your account. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year.

Source: impresshow.blogspot.com

Source: impresshow.blogspot.com

You normally can repay the loan. For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value. You can only borrow against a permanent or whole life insurance policy. But you could instead take out a life insurance loan for the entire $5,000, and the interest charged on the loan would come out of the $5,000 that is still inside the policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Therefore, the lender is unlikely to check your income and credit score. You do not lose your life insurance and your beneficiaries remain the same. The primary advantage of this approach is that under current tax laws, the loan proceeds can be received tax As you pay your premium, you build up funds within your. X research source as for term life policies, these are not loan sources since they don’t have a cash value that can be borrowed.

Source: entresuaspalavras.blogspot.com

Source: entresuaspalavras.blogspot.com

For example, if you have $200,000 of coverage, we can loan you up to $100,000 secured solely by your policy. When you borrow money from your life insurance policy, you’re essentially borrowing against the accrued cash value in that policy and you can only borrow up to a certain amount. When you take out a policy loan, you�re not removing money from the cash value of your account. Your policy is likely to have sufficient cash value to borrow against typically after the 10 th year the policy is in force,” says richard reich,. The loan cost can be as low as zero up to 350 basis points, so it matters.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much can you borrow against your life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.