How much did insurance companies pay out for hurricane katrina information

Home » Trending » How much did insurance companies pay out for hurricane katrina informationYour How much did insurance companies pay out for hurricane katrina images are available. How much did insurance companies pay out for hurricane katrina are a topic that is being searched for and liked by netizens now. You can Download the How much did insurance companies pay out for hurricane katrina files here. Get all free vectors.

If you’re searching for how much did insurance companies pay out for hurricane katrina images information related to the how much did insurance companies pay out for hurricane katrina topic, you have pay a visit to the right site. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

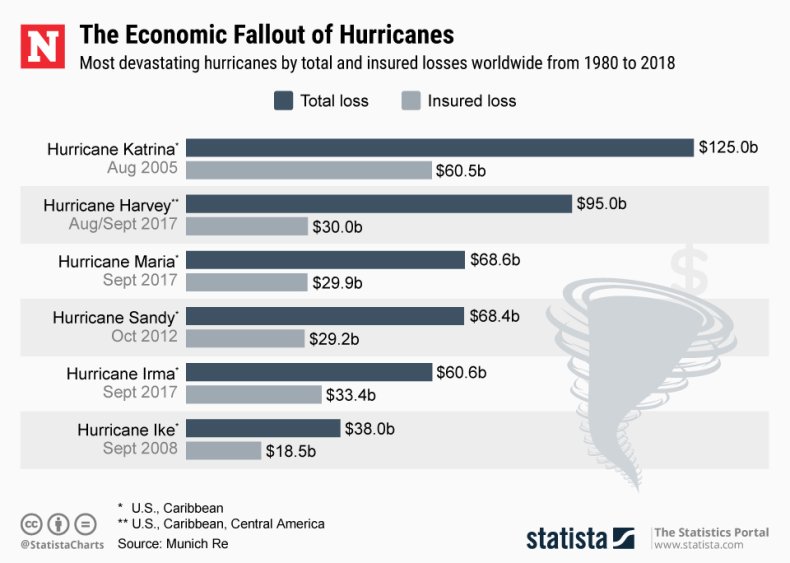

How Much Did Insurance Companies Pay Out For Hurricane Katrina. The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. As homeowners have dealt with insurance fluctuations, the louisiana insurance market has changed considerably since katrina, when private companies paid $25.5 billion in insured losses in the state across all lines of coverage, according to the louisiana department of insurance. According to insurance focused, the first option of the actual cash value option generally cost twenty five percent less than the replacement cost value policy and the replacement cost value on average cost about $400 to $1000. Robert wooley louisiana commissioner of insurance during katrina shares some of the more unusual sights he witnessed in katrinas aftermath and memories of helping insureds find solace in the face.

Things to Do After the Hurricane Has Passed Odd Culture From oddculture.com

Things to Do After the Hurricane Has Passed Odd Culture From oddculture.com

Eight years ago, hurricane katrina made landfall as one of the strongest storms to affect the united states in the last century. Insurance companies have paid an estimated $41.1 billion on 1.7 million different claims for damage to vehicles, homes, and businesses in six states. So the assertion that somehow state farm is not paying on claims is. According to insurance focused, the first option of the actual cash value option generally cost twenty five percent less than the replacement cost value policy and the replacement cost value on average cost about $400 to $1000. Hurricanes rita and wilma followed shortly thereafter. Just what effect did hurricane katrina have on the insurance industry?

Analysis of the impact on the insurance industry 5 insured losses from katrina the direct damage from katrina has multiple components:

Senter had ruled that the anticoncurrent causation provision in the leonard’s policy was “ambiguous” and could not be enforced. Just what effect did hurricane katrina have on the insurance industry? Insurance companies have paid an estimated $41.1 billion on 1.7 million different claims for damage to vehicles, homes, and businesses in six states. This was due to damage caused by the storm. According to industry reports, the insurance industry paid out approximately $41 billion in claims through homeowners and business insurance policies. But after hurricane katrina destroyed much of.

Source: newsweek.com

Source: newsweek.com

Senter ruled that nationwide was not responsible to pay for damage from katrina’s storm surge, however, he did order the insurer to pay the couple an additional $1,228 for wind damage. Overall insured losses for damage to homes, vehicles and businesses damaged in 2005 by hurricanes katrina, rita, wilma and dennis are estimated at $57 billion. The chart below shows the 10 most significant floods based on national flood insurance program (nfip) payouts from 1978 to january 31, 2019 (latest data available). Insurance industry analysts say katrina was the biggest single insured loss event in history. Why it’s an industry a grand total of 725,000 insurance claims were made after hurricane katrina , an in an article written by the new york times, it was learned that private insurers paid less than $900 million in coverage to their clients than they were owed.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

How much did it cost to repair the damage from hurricane katrina? How much did it cost to repair the damage from hurricane katrina? The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. Evidence provided by the rigsby sisters proved that the company filed a false report in order to avoid paying the homeowner instead of the federal government’s national flood insurance program (nfip). Now, a judge has ordered state farm to reimburse the nfip for a sum of $250,000, and potentially more once additional damages are determined.

Source: pinterest.com

Source: pinterest.com

“9/11 was the largest loss in the history of insurance until hurricane katrina in 2005 when insurers paid claims totaling more than $40 billion to. Private insurance companies balked on payments: Eight years ago, hurricane katrina made landfall as one of the strongest storms to affect the united states in the last century. Insurers have paid out nearly $15.5 billion in homeowners insurance claims to hurricane victims in. But after hurricane katrina destroyed much of.

Source: beforeiforget.co.uk

Source: beforeiforget.co.uk

Evidence provided by the rigsby sisters proved that the company filed a false report in order to avoid paying the homeowner instead of the federal government’s national flood insurance program (nfip). Senter ruled that nationwide was not responsible to pay for damage from katrina’s storm surge, however, he did order the insurer to pay the couple an additional $1,228 for wind damage. Why it’s an industry a grand total of 725,000 insurance claims were made after hurricane katrina , an in an article written by the new york times, it was learned that private insurers paid less than $900 million in coverage to their clients than they were owed. Attridge said nationwide has paid out $230 million for 21,000 claims in mississippi since katrina and an additional $220 million for its handling of. Insured losses from the three storms taken together were estimated by insurance companies to total $57 billion, not including $17 billion in claims paid by the.

Source: publicadjustermiamifl.com

Source: publicadjustermiamifl.com

Following hurricane rita, insurers paid out $3.4 billion in losses resulting from more than 200,000 claims. Private insurance companies balked on payments: Overall insured losses for damage to homes, vehicles and businesses damaged in 2005 by hurricanes katrina, rita, wilma and dennis are estimated at $57 billion. In addition, there are extensive indirect Insurance companies have paid an estimated $41.1 billion on 1.7 million different claims for damage to vehicles, homes, and businesses in six states.

Source: privatewindstorm.com

Source: privatewindstorm.com

Hurricane katrina in 2005 was the worst u.s flood event based on the amount paid to nfip policyholders, $16.2 billion, paid to 167,000 policyholders. “9/11 was the largest loss in the history of insurance until hurricane katrina in 2005 when insurers paid claims totaling more than $40 billion to. So the assertion that somehow state farm is not paying on claims is. Private insurance companies balked on payments: The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion.

Source: dallasnews.com

Source: dallasnews.com

David charles, an insurance adjuster who represents homeowners, says he had always loved his job and never had any problems with insurance companies. The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. The chart below shows the 10 most significant floods based on national flood insurance program (nfip) payouts from 1978 to january 31, 2019 (latest data available). Hurricane katrina caused more than $25 billion in insured losses resulting from more than 725,000 claims in louisiana. Following hurricane rita, insurers paid out $3.4 billion in losses resulting from more than 200,000 claims.

Source: tricounty-iowa.com

Source: tricounty-iowa.com

Hurricanes rita and wilma followed shortly thereafter. Insurance companies may have paid out $11 billion to louisianians in the two years since hurricane katrina, but they have also become a. Insurance claims after hurricane katrina. Senter had ruled that the anticoncurrent causation provision in the leonard’s policy was “ambiguous” and could not be enforced. Hurricanes rita and wilma followed shortly thereafter.

Source: travelvos.blogspot.com

Source: travelvos.blogspot.com

We paid out $3.5 billion to our policy holders on the gulf coast. Following hurricane rita, insurers paid out $3.4 billion in losses resulting from more than 200,000 claims. Overall insured losses for damage to homes, vehicles and businesses damaged in 2005 by hurricanes katrina, rita, wilma and dennis are estimated at $57 billion. Insurance industry analysts say katrina was the biggest single insured loss event in history. In addition, there are extensive indirect

Source: oddculture.com

Source: oddculture.com

Senter had ruled that the anticoncurrent causation provision in the leonard’s policy was “ambiguous” and could not be enforced. David charles, an insurance adjuster who represents homeowners, says he had always loved his job and never had any problems with insurance companies. Eight years ago, hurricane katrina made landfall as one of the strongest storms to affect the united states in the last century. So the assertion that somehow state farm is not paying on claims is. How much did it cost to repair the damage from hurricane katrina?

Source: nytimes.com

Source: nytimes.com

How much did it cost to repair the damage from hurricane katrina? Insurance industry analysts say katrina was the biggest single insured loss event in history. A total of 3.3 million claims are expected. We paid out $3.5 billion to our policy holders on the gulf coast. The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion.

Source: peppercory.blogspot.com

Source: peppercory.blogspot.com

Attridge said nationwide has paid out $230 million for 21,000 claims in mississippi since katrina and an additional $220 million for its handling of. Hurricane katrina caused more than $25 billion in insured losses resulting from more than 725,000 claims in louisiana. Two years after the storm, the new york times reported that insurers had paid out an estimated $900 million less in coverage to the approximately 160,000 families who lost their homes in katrina than the state of louisiana believed those families were owed. Key data on the insurance industry and hurricane katrina recovery. Eight years ago, hurricane katrina made landfall as one of the strongest storms to affect the united states in the last century.

Source: insuranceglitz.com

Source: insuranceglitz.com

This was due to damage caused by the storm. The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. Insurance industry analysts say katrina was the biggest single insured loss event in history. Overall insured losses for damage to homes, vehicles and businesses damaged in 2005 by hurricanes katrina, rita, wilma and dennis are estimated at $57 billion. We paid out $3.5 billion to our policy holders on the gulf coast.

It caused more than $41 billion in insured property. Robert wooley louisiana commissioner of insurance during katrina shares some of the more unusual sights he witnessed in katrinas aftermath and memories of helping insureds find solace in the face. Senter ruled that nationwide was not responsible to pay for damage from katrina’s storm surge, however, he did order the insurer to pay the couple an additional $1,228 for wind damage. So the assertion that somehow state farm is not paying on claims is. Two years after the storm, the new york times reported that insurers had paid out an estimated $900 million less in coverage to the approximately 160,000 families who lost their homes in katrina than the state of louisiana believed those families were owed.

Source: insurancejournal.com

Source: insurancejournal.com

The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. David charles, an insurance adjuster who represents homeowners, says he had always loved his job and never had any problems with insurance companies. We paid out $3.5 billion to our policy holders on the gulf coast. Just what effect did hurricane katrina have on the insurance industry? It caused more than $41 billion in insured property.

Source: dailymail.co.uk

Source: dailymail.co.uk

Insurance companies have paid an estimated $41.1 billion on 1.7 million different claims for damage to vehicles, homes, and businesses in six states. Insurance companies have paid an estimated $41.1 billion on 1.7 million different claims for damage to vehicles, homes, and businesses in six states. Overall insured losses for damage to homes, vehicles and businesses damaged in 2005 by hurricanes katrina, rita, wilma and dennis are estimated at $57 billion. The overall cost to repair or replace the bridges damaged during the hurricane is estimated at over $1 billion. Senter had ruled that the anticoncurrent causation provision in the leonard’s policy was “ambiguous” and could not be enforced.

Source: fairyesfox.com

Source: fairyesfox.com

Senter had ruled that the anticoncurrent causation provision in the leonard’s policy was “ambiguous” and could not be enforced. According to industry reports, the insurance industry paid out approximately $41 billion in claims through homeowners and business insurance policies. How much did it cost to repair the damage from hurricane katrina? A total of 3.3 million claims are expected. Insurance industry analysts say katrina was the biggest single insured loss event in history.

Source: bittersoutherner.com

Source: bittersoutherner.com

According to insurance focused, the first option of the actual cash value option generally cost twenty five percent less than the replacement cost value policy and the replacement cost value on average cost about $400 to $1000. Private insurance companies balked on payments: Just what effect did hurricane katrina have on the insurance industry? In addition, there are extensive indirect It caused more than $41 billion in insured property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much did insurance companies pay out for hurricane katrina by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.