How much does 2 points affect insurance in nj Idea

Home » Trending » How much does 2 points affect insurance in nj IdeaYour How much does 2 points affect insurance in nj images are available in this site. How much does 2 points affect insurance in nj are a topic that is being searched for and liked by netizens now. You can Find and Download the How much does 2 points affect insurance in nj files here. Get all royalty-free photos.

If you’re looking for how much does 2 points affect insurance in nj images information linked to the how much does 2 points affect insurance in nj interest, you have come to the ideal blog. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

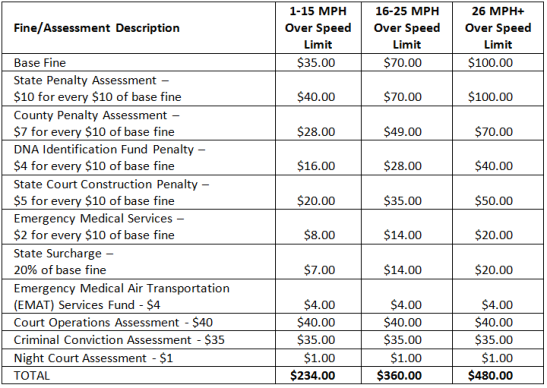

How Much Does 2 Points Affect Insurance In Nj. Both the state you live in as well as what insurance company you use will impact the increase in your premium. Your car insurance rates will go up 22% to 30%, on average, after a speeding ticket, according to a carinsurance.com rate analysis. Two points will increase a driver’s insurance costs by roughly 20% to 100%, depending on the state, insurance company and type of violation. In this article, we’ll explain:

How Much Does It Cost To Raise A Child — History From 1960 From bumpreveal.com

How Much Does It Cost To Raise A Child — History From 1960 From bumpreveal.com

Do speeding or parking tickets affect insurance rates? The increase can range from $100 to $400 a year, depending on the infractions. It usually takes at least 4 points on your driver’s record for the insurance company to sit up and take notice because 4 points or higher implies a speeding habit. At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate. If you are looking for car insurance, or if your rates have been raised due to points and you want to find another company, you can use an online comparison tool. Both the state you live in as well as what insurance company you use will impact the increase in your premium.

These surcharges will most likely result in an increase in the cost of your auto insurance.

Not necessarily because car insurance companies pay attention to the points that your state’s. Points tied to an insurance provider can affect rates or premiums, though. Two points will increase a driver’s insurance costs by roughly 20% to 100%, depending on the state, insurance company and type of violation. He is a ticket lawyer practicing in all new jersey municipal courts. In this article, we’ll explain: Let�s take for example a speeding ticket.

Source: how-can-i-help-them.org

Source: how-can-i-help-them.org

The 2 point reduction defensive driving course can also help reduce your nj car insurance rate. The 2 point reduction defensive driving course can also help reduce your nj car insurance rate. 55 rows take an online defensive driving course and get a reduction in your new jersey car. How much does 3 points affect insurance premiums? At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate.

Source: mortgage.info

Source: mortgage.info

A fine of $50 to $200, and; At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate. In this article, we’ll explain: The 2 point reduction defensive driving course can also help reduce your nj car insurance rate. Getting points on your driver’s license as a result of a traffic violation typically leads to an increase in car insurance costs.

Source: myimprov.com

Source: myimprov.com

The more points you accumulate, the more likely you are to lose your driver’s license , and the higher the risk you pose to your car insurance company. If it�s your first speeding ticket or violation, however, it may not affect your insurance at all. It depends on how your state and insurer treat the violation. Court costs of about $33. In this article, we’ll explain:

Source: trapshooters.com

Court costs of about $33. Let�s take for example a speeding ticket. Two points will increase a driver’s insurance costs by roughly 20% to 100%, depending on the state, insurance company and type of violation. In many cases when a driver is convicted of a moving violation, insurance companies can also assign points and impose surcharges on their policies. At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate.

Source: economist.com

Source: economist.com

Below are a few examples of how driver�s license points can impact insurance rates in some states. The different kinds of driver’s license points. Do speeding or parking tickets affect insurance rates? For example, if you cause an accident, not only may it result in points being added to your record, but it’ll probably prompt your premium to go up, too. It usually takes at least 4 points on your driver’s record for the insurance company to sit up and take notice because 4 points or higher implies a speeding habit.

Source: onmilwaukee.com

Source: onmilwaukee.com

Both the state you live in as well as what insurance company you use will impact the increase in your premium. The scale used and the number of points for a particular violation vary by state and insurer. Not necessarily because car insurance companies pay attention to the points that your state’s. In many cases when a driver is convicted of a moving violation, insurance companies can also assign points and impose surcharges on their policies. Points tied to an insurance provider can affect rates or premiums, though.

Source: infinitelifeextension.com

Source: infinitelifeextension.com

These points will show up on your new jersey driving record. Do speeding or parking tickets affect insurance rates? The points go on your driving record and stay for specified periods of time (determined by your state and by the violation). For example, a 4 point charge in the past 12 months for a driver in new jersey could lead to an estimated increase of 30% increases for bodily injury , 25% increase on collision. What that impact might be varies among insurance companies.

Source: compare.com

Source: compare.com

Let�s take for example a speeding ticket. The increase can range from $100 to $400 a year, depending on the infractions. In most cases, the court will levy the minimum fine, so you are looking at $83 plus 2 points for that speeding ticket. Losing a safe driving discount will increase your rate by another 34% in. Your car insurance rates will go up 22% to 30%, on average, after a speeding ticket, according to a carinsurance.com rate analysis.

Source: social-network-daily-journal.com

Source: social-network-daily-journal.com

Points tied to an insurance provider can affect rates or premiums, though. Let�s take for example a speeding ticket. At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate. The 2 point reduction defensive driving course can also help reduce your nj car insurance rate. In most cases, the court will levy the minimum fine, so you are looking at $83 plus 2 points for that speeding ticket.

Source: bumpreveal.com

Source: bumpreveal.com

Points tied to an insurance provider can affect rates or premiums, though. There is no accurate way to answer this question, other than to say, it varies. In this article, we’ll explain: Although motor vehicle points have been in existence since about 1952, insurance eligibility points have been around only since 1990, when the fair automobile insurance reform act was signed into law by gov. In california, average insurance rates are around $1570.

Source: tele-medical-health-hipaa-dicom-hl7-pacs.com

Source: tele-medical-health-hipaa-dicom-hl7-pacs.com

In most cases, the court will levy the minimum fine, so you are looking at $83 plus 2 points for that speeding ticket. What that impact might be varies among insurance companies. For example, a 4 point charge in the past 12 months for a driver in new jersey could lead to an estimated increase of 30% increases for bodily injury , 25% increase on collision. Get a 2 point reduction. Two points might even be the minimum number of points you can get.

Source: how-can-i-help-them.org

Source: how-can-i-help-them.org

At progressive and most other insurers, a speeding ticket or other moving violation could raise your insurance rate. These surcharges will most likely result in an increase in the cost of your auto insurance. In this article, we’ll explain: Accruing too many driver’s license points may lead to losing your license. How much does 3 points affect insurance premiums?

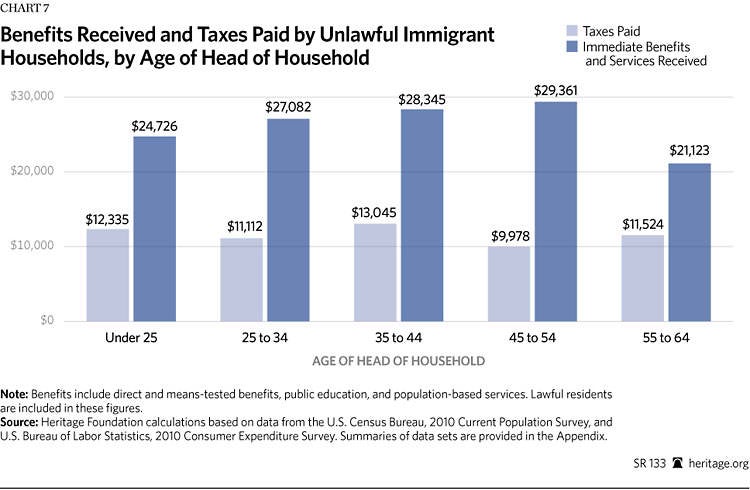

Source: heritage.org

Source: heritage.org

It usually takes at least 4 points on your driver’s record for the insurance company to sit up and take notice because 4 points or higher implies a speeding habit. In most cases, the court will levy the minimum fine, so you are looking at $83 plus 2 points for that speeding ticket. The increase can range from $100 to $400 a year, depending on the infractions. The different kinds of driver’s license points. What that impact might be varies among insurance companies.

Source: myimprov.com

Source: myimprov.com

What that impact might be varies among insurance companies. A fine of $50 to $200, and; Accruing too many driver’s license points may lead to losing your license. Most clients are concerned about the imposition of motor vehicle points because an assessment of points on your record can lead to an increased likelihood of. The scale used and the number of points for a particular violation vary by state and insurer.

Source: ahix.com

Source: ahix.com

Both the state you live in as well as what insurance company you use will impact the increase in your premium. Let�s take for example a speeding ticket. Points tied to an insurance provider can affect rates or premiums, though. The most immediate consequence of these points, however many, is a potential negative impact on the ticketed driver’s auto insurance costs. Below are a few examples of how driver�s license points can impact insurance rates in some states.

Source: gunnmowery.com

Source: gunnmowery.com

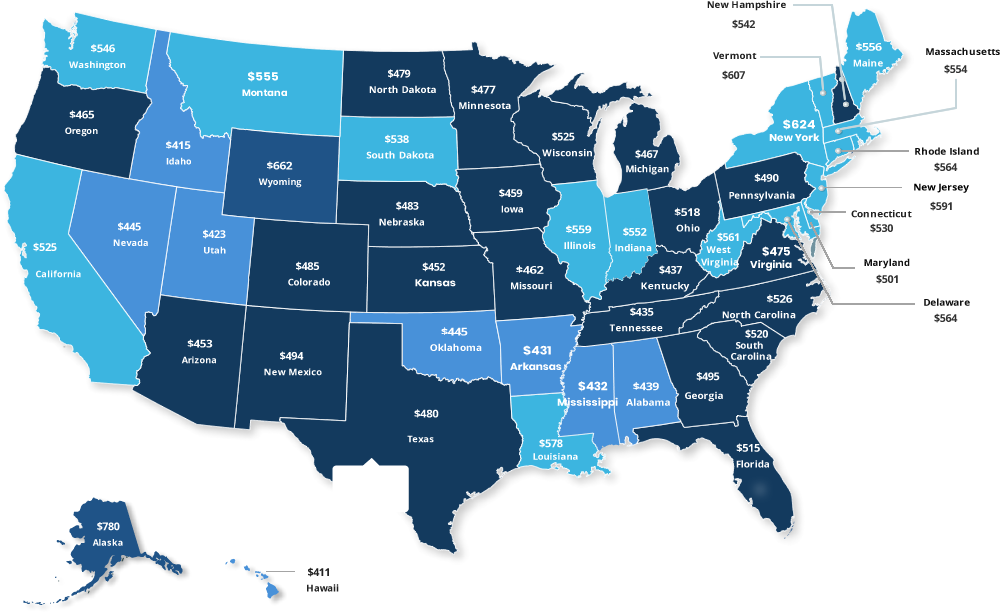

The scale used and the number of points for a particular violation vary by state and insurer. In new jersey, traffic tickets can involve an assessment of motor vehicle points, payment of fines, suspension of driving privileges, surcharges and court costs (or a combination thereof). Car insurance with points on your license in new york state. Not necessarily because car insurance companies pay attention to the points that your state’s. It usually takes at least 4 points on your driver’s record for the insurance company to sit up and take notice because 4 points or higher implies a speeding habit.

Source: tele-medical-health-hipaa-dicom-hl7-pacs.org

Source: tele-medical-health-hipaa-dicom-hl7-pacs.org

It depends on how your state and insurer treat the violation. We analyzed quotes from several insurers and found that having two points on your driver�s license could lead to a 180% increase in auto insurance rates. Two points might even be the minimum number of points you can get. Points tied to an insurance provider can affect rates or premiums, though. Reckless driving can lead to penalty points on your license, and it can also lead to higher auto insurance costs.

Source: howcanihelpthem.com

Source: howcanihelpthem.com

In california, average insurance rates are around $1570. The more points you accumulate, the more likely you are to lose your driver’s license , and the higher the risk you pose to your car insurance company. If you are looking for car insurance, or if your rates have been raised due to points and you want to find another company, you can use an online comparison tool. 55 rows take an online defensive driving course and get a reduction in your new jersey car. What that impact might be varies among insurance companies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much does 2 points affect insurance in nj by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.