How much does errors and omissions insurance cost Idea

Home » Trending » How much does errors and omissions insurance cost IdeaYour How much does errors and omissions insurance cost images are ready in this website. How much does errors and omissions insurance cost are a topic that is being searched for and liked by netizens today. You can Find and Download the How much does errors and omissions insurance cost files here. Download all royalty-free photos.

If you’re looking for how much does errors and omissions insurance cost pictures information related to the how much does errors and omissions insurance cost keyword, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

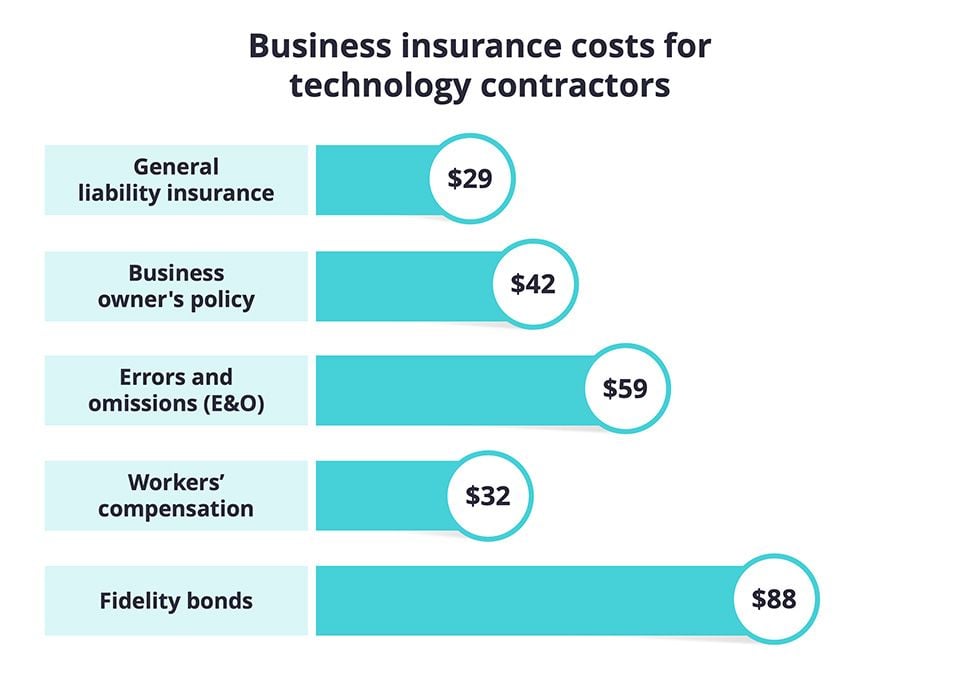

How Much Does Errors And Omissions Insurance Cost. Examples of how much errors and omissions insurance costs. Errors & omissions (e&o) insurance, also known as professional liability insurance, serves to protect your company from financial risks that arise out of any claims of negligence, mistakes, omissions, misrepresentation, and more. How much does an errors and omissions policy cost? What does errors and omissions insurance cost?

How much does errors and omissions insurance cost insurance From greatoutdoorsabq.com

How much does errors and omissions insurance cost insurance From greatoutdoorsabq.com

However, if we try to find the answer, then we can say: Examples of how much errors and omissions insurance costs. If the profession is considered risky, then that plays a major factor in the cost of errors and omissions insurance as well. How much does errors & omissions (e&o) insurance cost architects and engineers? How much does errors & omissions insurance cost? Costs of the business insurance will generally depend on a variety of factors, such as the size of the business, what position you have in the business, and where in the u.s.

Imagine a world where businesses can be managed without worrying about making mistakes.

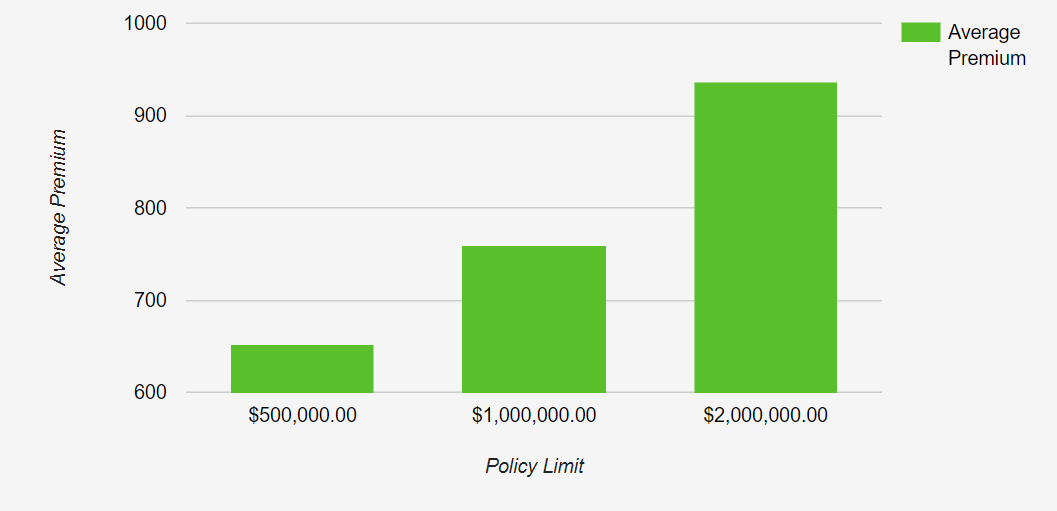

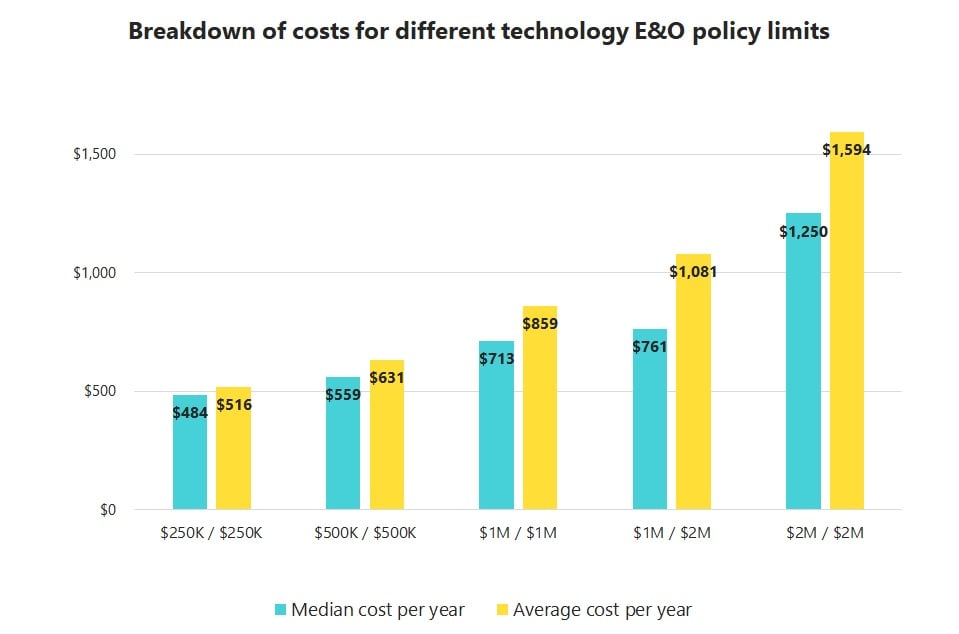

The following factors are typically taken into consideration when determining the cost of. Any profession that’s responsible for the integrity of a building needs errors and omissions insurance.if a measurement is just a tiny bit off, the whole structure is weakened, and this. The price of an errors and omissions insurance policy depends on your level of risk. The average cost of errors and omissions insurance. Errors and omissions policies come with a range of typical coverage limits, as per the following: Costs of the business insurance will generally depend on a variety of factors, such as the size of the business, what position you have in the business, and where in the u.s.

Source: bizinsure.com

Source: bizinsure.com

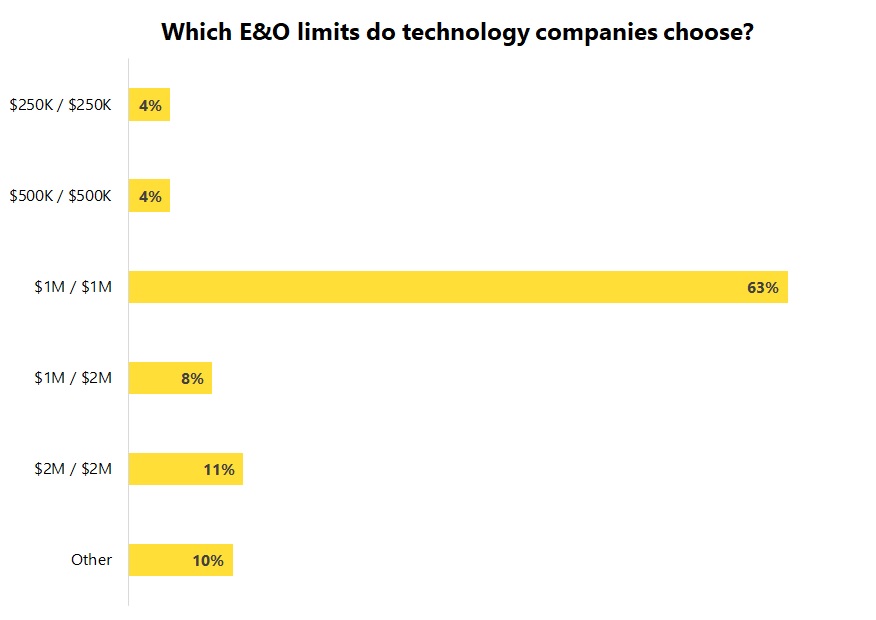

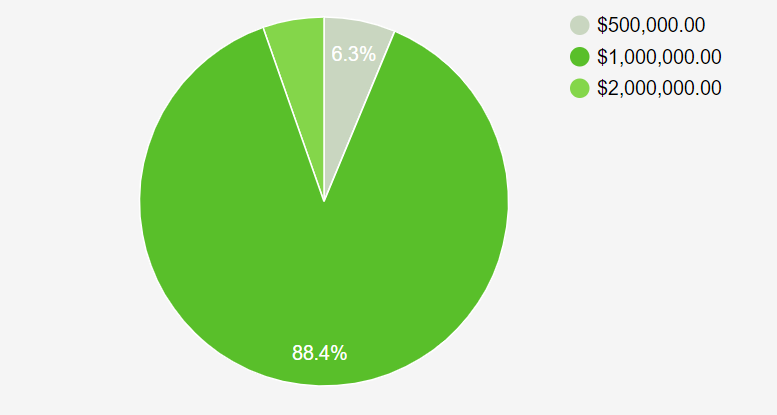

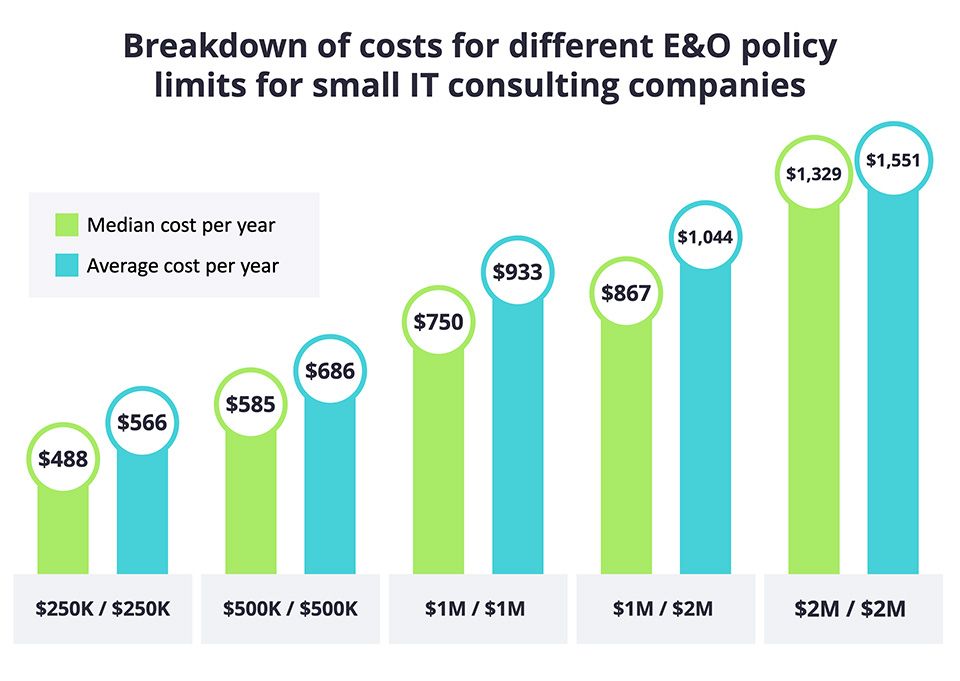

So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business. How much does errors & omissions (e&o) insurance cost architects and engineers? If you provide professional services that affect a client’s profits, choosing higher limits could be. You shouldn’t let a costlier price put you off if your business wouldn’t be sufficiently covered without a $2 million.

Source: techinsurance.com

Source: techinsurance.com

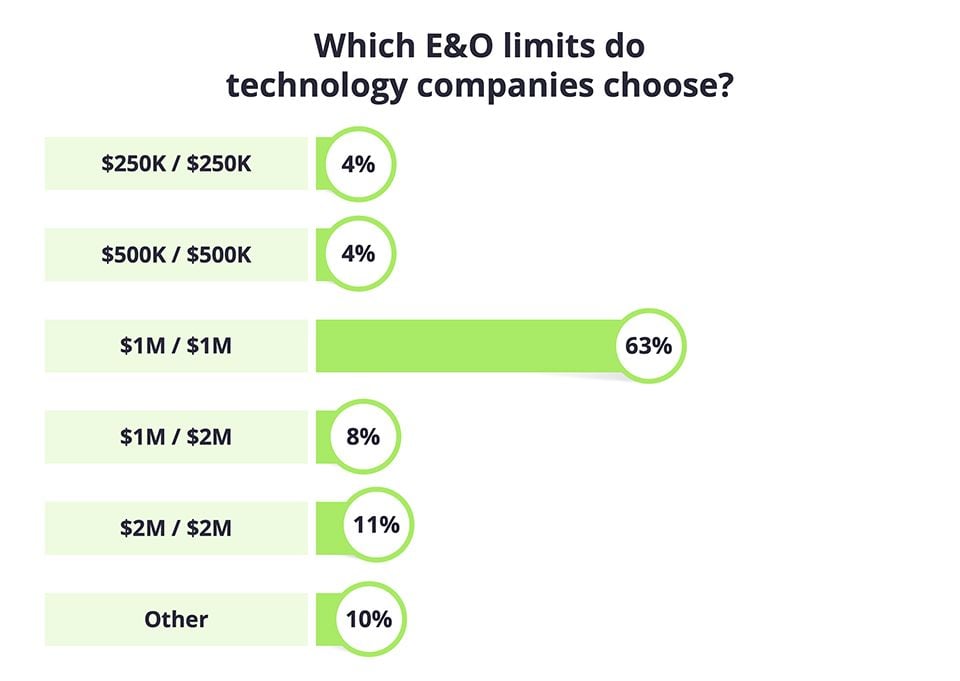

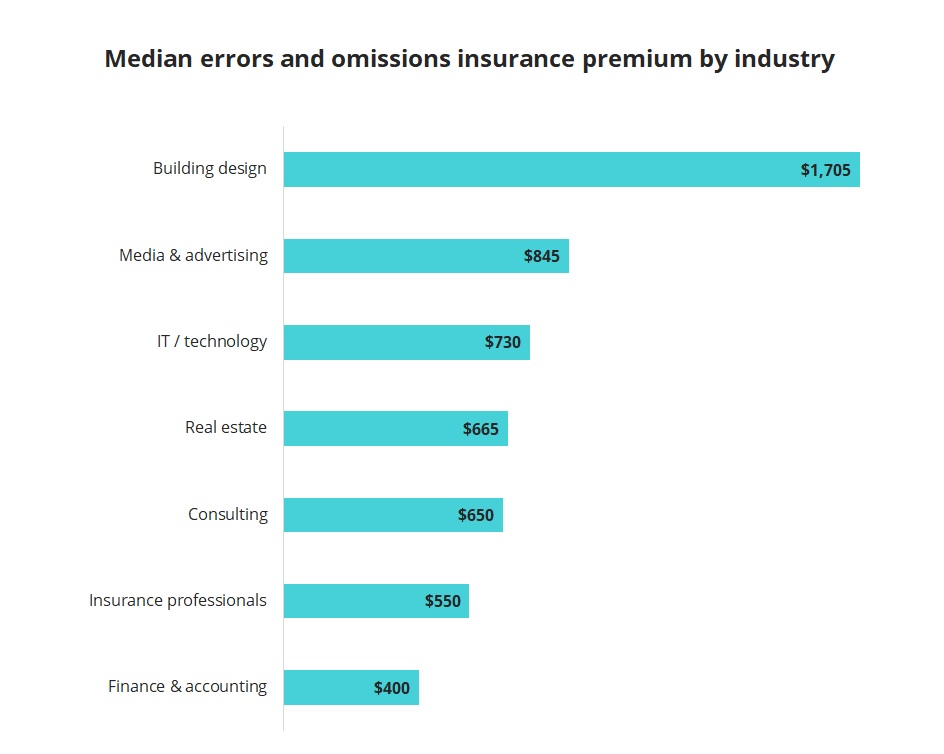

How much does errors & omissions (e&o) insurance cost architects and engineers? Insurance business magazine also estimated that the average cost to a professional of resolving such claims was. However, if we try to find the answer, then we can say: Errors and omissions insurance for life agent, cheap errors and omissions insurance, cost of e&o insurance coverage, how much is errors and omissions insurance, e and o insurance cost, liability insurance errors and omissions, how much is e&o insurance, insurance agents errors omissions coverage pir sohawa, shakarparian, pakistan once your car, make injury would file for small. The median cost of technology e&o insurance is about $60 per month, or $730 annually.

Source: bizinsure.com

Source: bizinsure.com

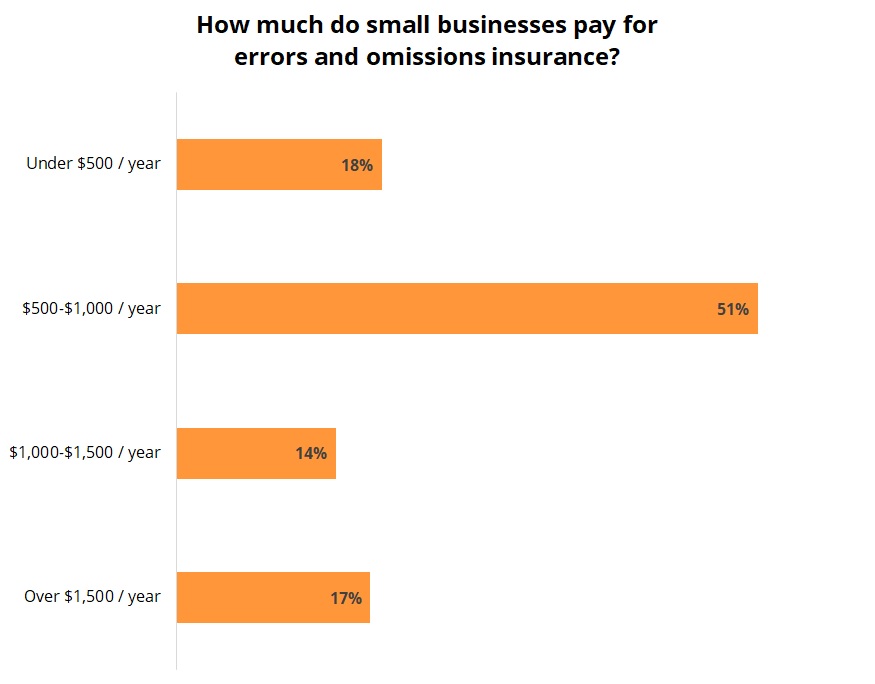

If we talk about how much errors and omissions insurance cost, it would be slightly difficult to find the cost of it. The average cost of errors and omissions insurance. Regardless of policy limits, the median monthly cost of errors and omissions coverage is $59 ($713 annually). Posted by admin january 18, 2022. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Source: bizinsure.com

Source: bizinsure.com

What does errors and omissions insurance cost? Insurance business magazine also estimated that the average cost to a professional of resolving such claims was. The size of the business is a contributing factor. The cost of your policy depends on how much e&o/ professional liability insurance coverage you buy. According to insurance business magazine, as many as one in seven insurance workers will face an issue related to e&o claims at least once during their professional career.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

According to insurance business magazine, as many as one in seven insurance workers will face an issue related to e&o claims at least once during their professional career. If the profession is considered risky, then that plays a major factor in the cost of errors and omissions insurance as well. Despite the increased cost, your company might need a higher limit. The cost of your policy depends on how much e&o/ professional liability insurance coverage you buy. Factors affecting the cost of errors & omissions insurance.

Source: techinsurance.com

Source: techinsurance.com

Average costs for e&o coverage are usually $500 to $1,000 per employee, per year. Imagine a world where businesses can be managed without worrying about making mistakes. Examples of how much errors and omissions insurance costs. The size of the business, the location of the business and the number of employees also influence how much a policy will cost. When it comes to trying to determine the cost for errors and omissions insurance, there is no set price for every business.

Source: tour-oxygene.com

Source: tour-oxygene.com

Insurance business magazine also estimated that the average cost to a professional of resolving such claims was. Protects your business against costly legal and settlement expenses from mistakes, oversights, and errors during your own inspections and those of subcontractors. Any profession that’s responsible for the integrity of a building needs errors and omissions insurance.if a measurement is just a tiny bit off, the whole structure is weakened, and this. How much does errors and omissions insurance cost? The median cost associated with errors and omissions business insurance falls between $860 and $1,939, with an average cost of $956 to $2,652 per year.

Source: techinsurance.com

Source: techinsurance.com

Insurance business magazine also estimated that the average cost to a professional of resolving such claims was. What does errors and omissions insurance cost? Don’t forget that other factors, like. Errors and omissions insurance, also known as professional liability insurance, provides financial protection against work mistakes that negatively impact clients. However, if we try to find the answer, then we can say:

Source: educationofusafull.blogspot.com

Source: educationofusafull.blogspot.com

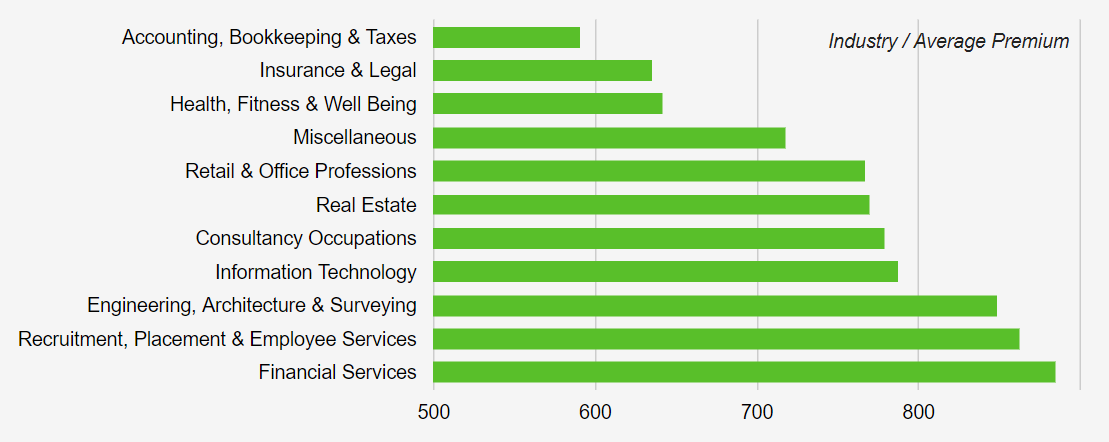

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. How much does an errors and omissions policy cost? At bizinsure, we analyzed data from more than 5000 of our customers showed that regardless of the industry or policy limits, the average yearly cost of errors & omissions insurance for a small business is $767.24.as a yearly median cost this is $600. Factors affecting the cost of errors & omissions insurance. Despite the increased cost, your company might need a higher limit.

Source: proinsgrp.com

Source: proinsgrp.com

Any profession that’s responsible for the integrity of a building needs errors and omissions insurance.if a measurement is just a tiny bit off, the whole structure is weakened, and this. Despite the increased cost, your company might need a higher limit. Average costs for e&o coverage are usually $500 to $1,000 per employee, per year. Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business. At bizinsure, we analyzed data from more than 5000 of our customers showed that regardless of the industry or policy limits, the average yearly cost of errors & omissions insurance for a small business is $767.24.as a yearly median cost this is $600.

Source: educationofusafull.blogspot.com

Source: educationofusafull.blogspot.com

Costs of the business insurance will generally depend on a variety of factors, such as the size of the business, what position you have in the business, and where in the u.s. For an errors and omissions insurance policy with a limit of $100,000, you can anticipate spending on average $250 annually. At bizinsure, we analyzed data from more than 5000 of our customers showed that regardless of the industry or policy limits, the average yearly cost of errors & omissions insurance for a small business is $767.24.as a yearly median cost this is $600. You can get a professional liability insurance quote with embroker in under 10 minutes. If you provide professional services that affect a client’s profits, choosing higher limits could be.

Source: tempestadealmaletraseimagens.blogspot.com

Source: tempestadealmaletraseimagens.blogspot.com

The median cost of technology e&o insurance is about $60 per month, or $730 annually. Pays for damages from accidents that occur while traveling to a job site while driving a company vehicle. The cost of your policy depends on how much e&o/ professional liability insurance coverage you buy. Errors and omissions (e&o) insurance is a form of liability insurance that can protect your business in the event that you are sued for errors or omissions in your services. Examples of how much errors and omissions insurance costs.

Source: insureon.com

Source: insureon.com

This is only an estimate. Errors and omissions insurance for life agent, cheap errors and omissions insurance, cost of e&o insurance coverage, how much is errors and omissions insurance, e and o insurance cost, liability insurance errors and omissions, how much is e&o insurance, insurance agents errors omissions coverage pir sohawa, shakarparian, pakistan once your car, make injury would file for small. How much does errors and omissions insurance cost? How much does errors and omissions insurance cost? If you provide professional services that affect a client’s profits, choosing higher limits could be.

Source: insureon.com

Source: insureon.com

With e&o insurance, both employers and employees are covered against a wide range of costly expenses, such as legal fees and settlements.when comparing e&o policies, many business. Pays for damages from accidents that occur while traveling to a job site while driving a company vehicle. If we talk about how much errors and omissions insurance cost, it would be slightly difficult to find the cost of it. Errors and omissions insurance, also known as professional liability insurance, provides financial protection against work mistakes that negatively impact clients. The average errors and omissions insurance cost depends on the type of business and the amount of coverage.

Source: educationofusafull.blogspot.com

Source: educationofusafull.blogspot.com

The median cost of errors and omissions insurance for real estate businesses is about $55 per month, or $665 annually. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. How much does an errors and omissions policy cost? The average cost of errors and omissions insurance.

Source: techinsurance.com

Source: techinsurance.com

Errors and omissions (e&o) insurance covers claims against a business that arise from negligence, errors, omissions, or mistakes it allegedly made while providing advice or a service. If you provide professional services that affect a client’s profits, choosing higher limits could be. This is only an estimate. Don’t forget that other factors, like. The median cost of errors and omissions insurance for real estate businesses is about $55 per month, or $665 annually.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

How much does an errors and omissions policy cost? Errors and omissions (e&o) insurance is a form of liability insurance that can protect your business in the event that you are sued for errors or omissions in your services. The following factors are typically taken into consideration when determining the cost of. With e&o insurance, both employers and employees are covered against a wide range of costly expenses, such as legal fees and settlements.when comparing e&o policies, many business. Posted by admin january 18, 2022.

Source: educationofusafull.blogspot.com

Source: educationofusafull.blogspot.com

Most small business owners (51%) pay between $500 and $1,000 per year for their. Posted by admin january 18, 2022. When it comes to trying to determine the cost for errors and omissions insurance, there is no set price for every business. Also known as professional liability insurance, e&o insurance pays for damages or settlements paid to claimants as well as the cost of defending your business. Insurance business magazine also estimated that the average cost to a professional of resolving such claims was.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much does errors and omissions insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.