How much does home insurance cost ontario information

Home » Trend » How much does home insurance cost ontario informationYour How much does home insurance cost ontario images are available. How much does home insurance cost ontario are a topic that is being searched for and liked by netizens now. You can Get the How much does home insurance cost ontario files here. Download all royalty-free photos and vectors.

If you’re searching for how much does home insurance cost ontario images information connected with to the how much does home insurance cost ontario interest, you have come to the right site. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

How Much Does Home Insurance Cost Ontario. The cost of car insurance is different for everyone, so it can be difficult to know whether or not you’re paying a good price within your circumstances. London is about $1,400 annually. When this happens, your home may be considered vacant, and your existing home insurance might be voided. $25 per month for mortgage life insurance

Average Cost Of Homeowners Insurance Per Square Foot From budapestsightseeing.org

Average Cost Of Homeowners Insurance Per Square Foot From budapestsightseeing.org

In ontario, residential landlord premiums average around $900/year for a house and $400/year for a condo/apartment. Price and coverage are her main concerns. A calculator is a rough estimator of home insurance payments. She and her partner have many costs coming up with a new house and baby, and they rely on both their incomes to cover their living expenses. This is only an average price, so you could pay more or less depending on your industry and personal operations. How much does landlord insurance cost in ontario?

The $19,000 premium can be added to your mortgage or paid in cash immediately as well.

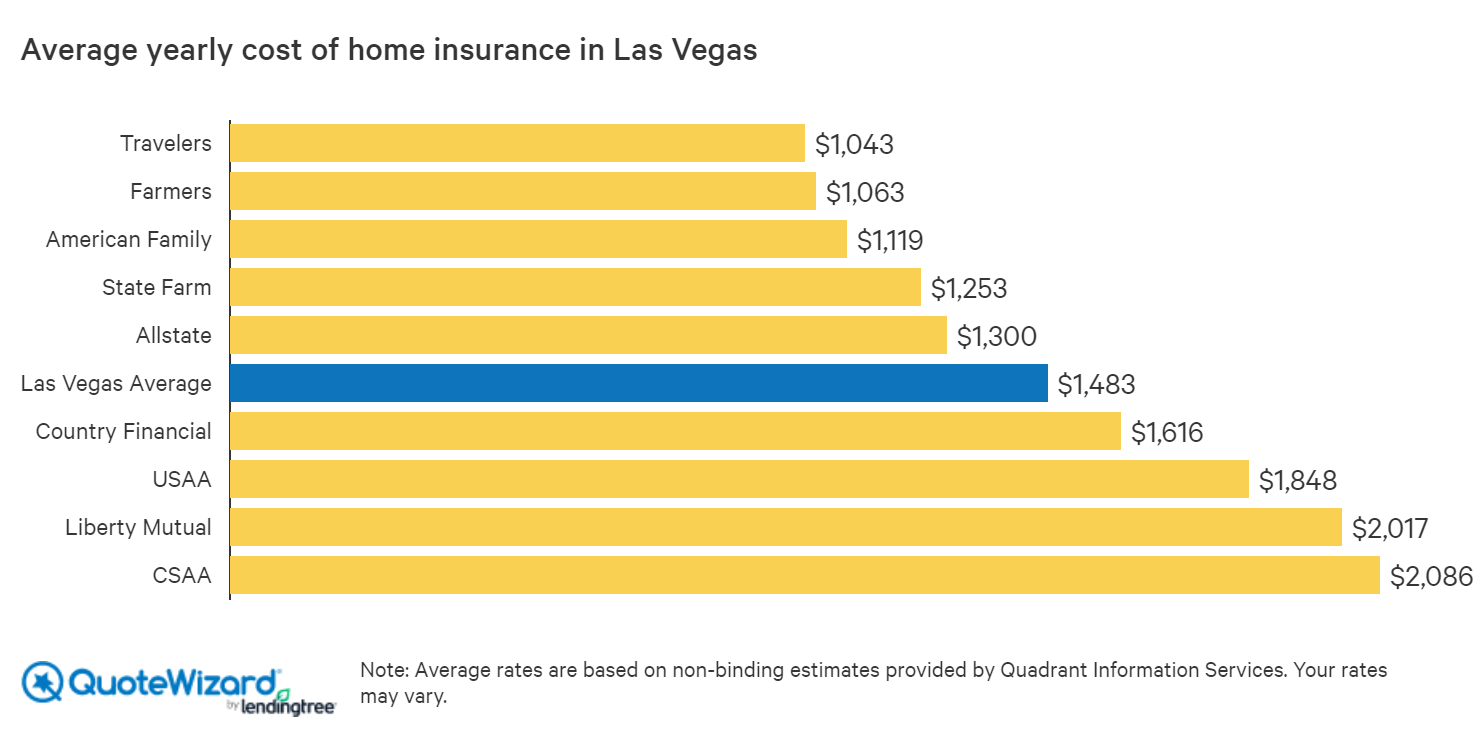

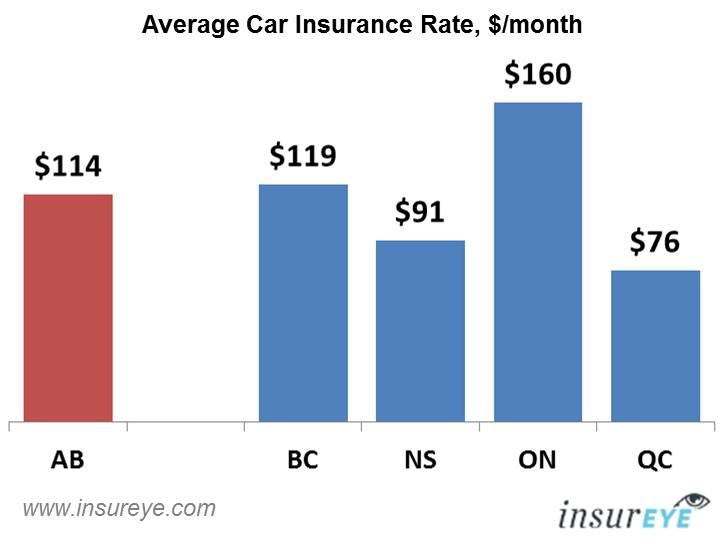

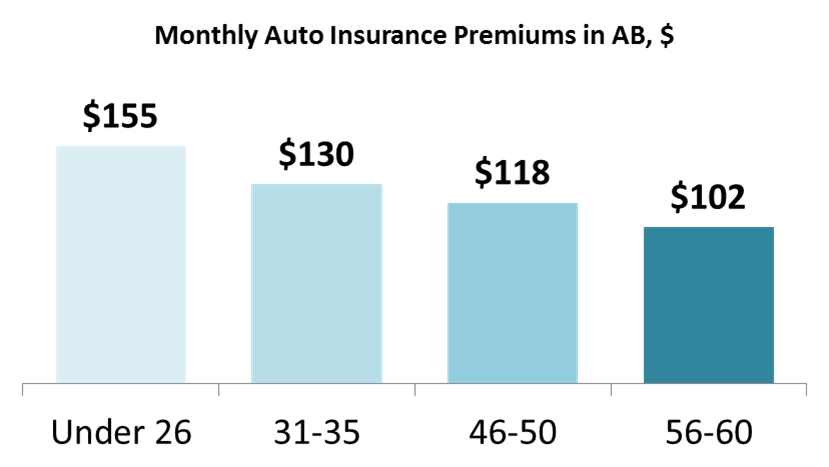

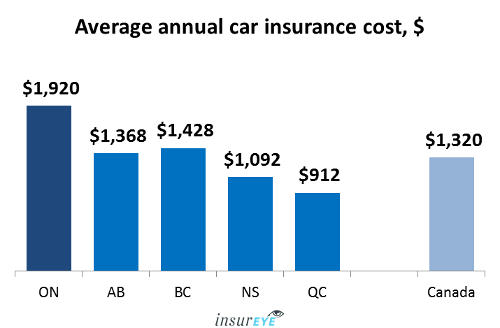

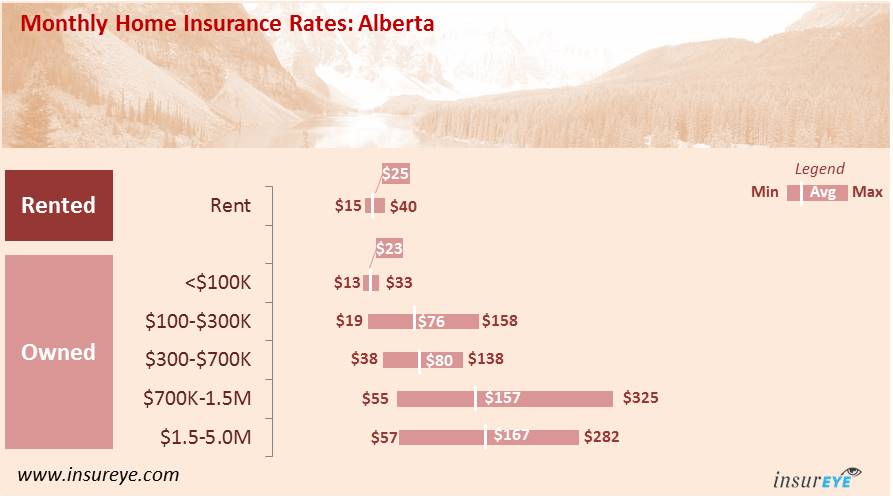

This averages out to just over $104 per month. In alberta, the average monthly premium is higher at $78. Average tenant insurance cost in ontario. The average cost of car insurance in ontario by age, month, and year. The price range for small business insurance in ontario is dependent on a number of factors. On average, the cost of home insurance in ontario is $1250 per year, or just over a hundred bucks a month.

Source: insureye.com

Source: insureye.com

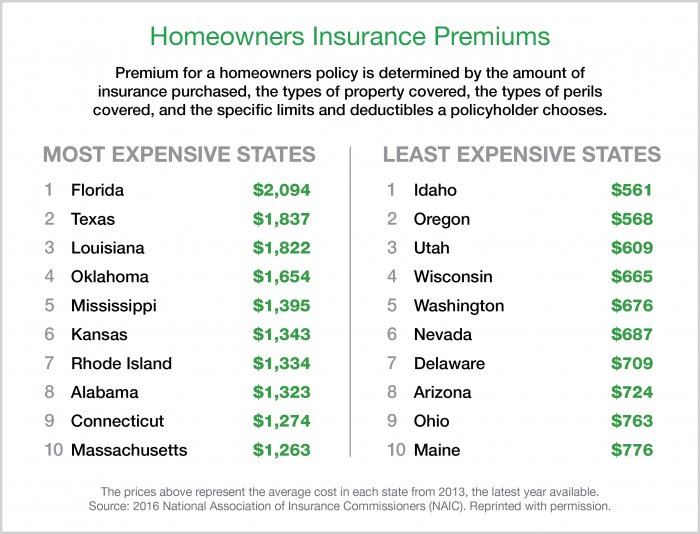

The average homeowners insurance cost in the united states in 2022 is $1,393 per year for a policy with $250,000 in dwelling coverage. This is a 6% increase from 2021’s average price of $1,312. Monica needs $250,000 in coverage. The cost is around $200 per year or $17 per. Ontario hst on the premium will be $1,520, which will need to be paid immediately.

She and her partner have many costs coming up with a new house and baby, and they rely on both their incomes to cover their living expenses. As an easy example, a policy with a 125% replacement cost on a home with a replacement cost calculated at $100,000 is $125,000. Home insurance may help protect your home and its contents in case of theft, loss or damage to the inside and outside of your home or property. Our home coverage includes our million dollar solution and covers all risks, personal liability and much more. The cost of car insurance is different for everyone, so it can be difficult to know whether or not you’re paying a good price within your circumstances.

Source: budapestsightseeing.org

Source: budapestsightseeing.org

This type of insurance will help protect danielle from financial loss if she’s sued due to errors, omissions or negligence in her work. So a home insured for 125% of replacement cost is insured for the actual calculated cost plus 25% of that amount. Damage or loss to your. This averages out to just over $104 per month. On average, the cost of home insurance in ontario is $1250 per year, or just over a hundred bucks a month.

Source: insureye.com

Source: insureye.com

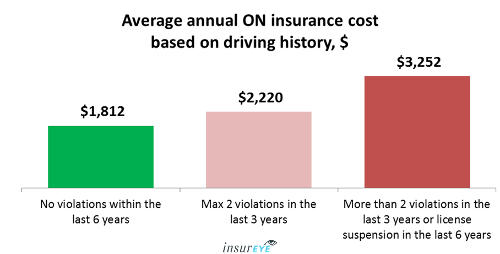

Rates can vary significantly by driver age, driving record and insurance history. While your exact rate will depend on the extent of your coverage (does it cover a whole list of risks or only the common ones), the upper limit of your contents insurance (which typically ranges from $30,000 to $100,000), and other factors related to your apartment such as age, location, and the amount of people living there; A dollar amount equal to the cost to rebuild your home insured for $750 000 which is equal to $250 per square foot rebuild cost b) other buildings b : Monica needs $250,000 in coverage. So a home insured for 125% of replacement cost is insured for the actual calculated cost plus 25% of that amount.

Source: insureye.com

Source: insureye.com

A calculator is a rough estimator of home insurance payments. Many small business owners will pay between $500 and $2,000 every year for their insurance. That extra $25,000 can make up for increases in the price of lumber, for example, or new building codes. Expect to pay about 20% more than you would if you were occupying the space yourself. Hamilton is approximately $1,600 annually.

Source: bridgeportbenedumfestival.com

So a home insured for 125% of replacement cost is insured for the actual calculated cost plus 25% of that amount. Expect to pay about 20% more than you would if you were occupying the space yourself. A dollar amount equal to the cost to rebuild your home insured for $750 000 which is equal to $250 per square foot rebuild cost b) other buildings b : For example, making a 5% down payment on a $500,000 home in ontario will result in a cmhc insurance premium of $19,000. The $19,000 premium can be added to your mortgage or paid in cash immediately as well.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Home insurance covers damage or loss to the dwelling (actual building) you live in, be it a house, apartment or condo. London is about $1,400 annually. A dollar amount equal to the cost to rebuild your home insured for $750 000 which is equal to $250 per square foot rebuild cost b) other buildings b : So how much is car insurance in ontario? That extra $25,000 can make up for increases in the price of lumber, for example, or new building codes.

Source: dipsegovia.info

Source: dipsegovia.info

$25 per month for mortgage life insurance London is about $1,400 annually. Many small business owners will pay between $500 and $2,000 every year for their insurance. The cost is around $200 per year or $17 per. The average home insurance cost in ontario is approximately $1250 per year.

Source: motorcycle.tntuservices.com

Source: motorcycle.tntuservices.com

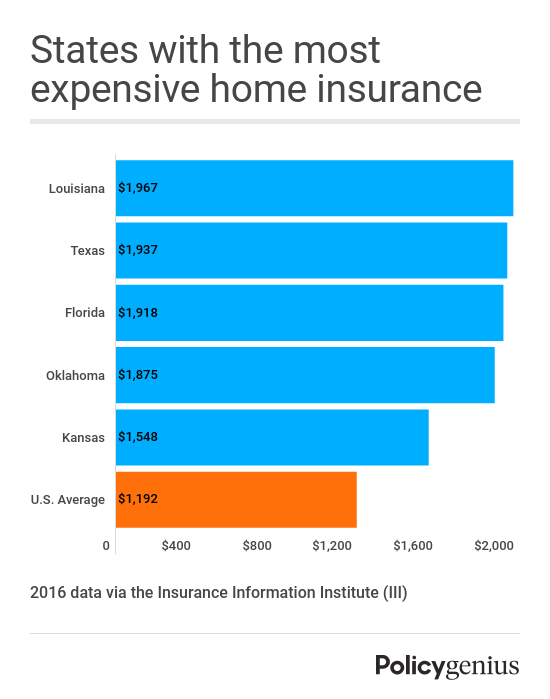

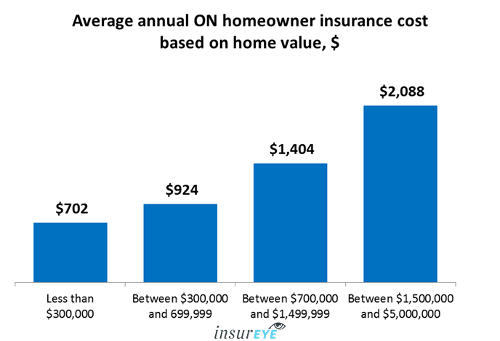

The average homeowners insurance cost in the united states in 2022 is $1,393 per year for a policy with $250,000 in dwelling coverage. The average homeowners insurance cost in the united states in 2022 is $1,393 per year for a policy with $250,000 in dwelling coverage. Ontario tenants, on the other hand, pay $210 per year or just shy of $20 per month. However, depending on your home value and location, you can expect to pay anywhere from $700 to $2000 or more annually for house insurance. The price range for small business insurance in ontario is dependent on a number of factors.

Source: budapestsightseeing.org

Source: budapestsightseeing.org

These are known as insured perils, and standard home insurance policies apply these to your dwelling and contents. How much you insure your home for is usually different for different people. Price and coverage are her main concerns. You would be responsible for any amount that went over that amount, so with that being said you probably want. Expect to pay about 20% more than you would if you were occupying the space yourself.

Source: insureye.com

Source: insureye.com

Our quoter will take into account the value of your home and its contents, your location, square footage, and other factors that contribute to your home insurance costs. Damage or loss to your. This is only an average price, so you could pay more or less depending on your industry and personal operations. A dollar amount equal to the cost to rebuild your home insured for $750 000 which is equal to $250 per square foot rebuild cost b) other buildings b : The cost of car insurance is different for everyone, so it can be difficult to know whether or not you’re paying a good price within your circumstances.

Source: militaryfoldingknivesfast.blogspot.com

Source: militaryfoldingknivesfast.blogspot.com

For example, making a 5% down payment on a $500,000 home in ontario will result in a cmhc insurance premium of $19,000. The average home insurance cost in ontario is approximately $1250 per year. In alberta, the average monthly premium is higher at $78. The average cost of car insurance in ontario by age, month, and year. So how much is car insurance in ontario?

Source: vhomeinsurance.com

Source: vhomeinsurance.com

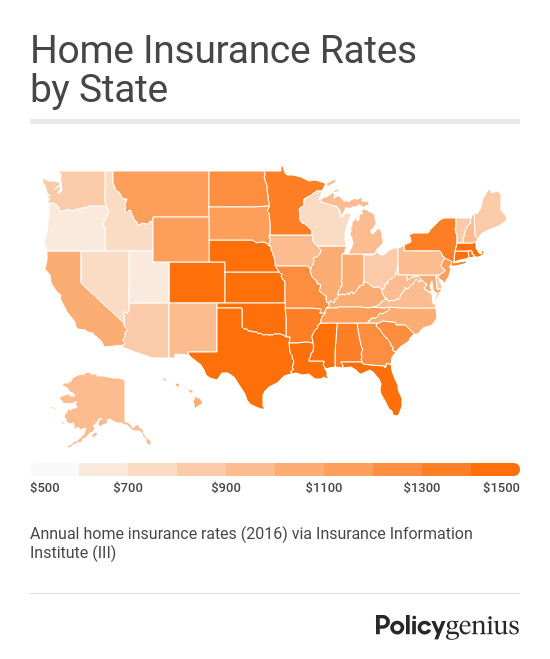

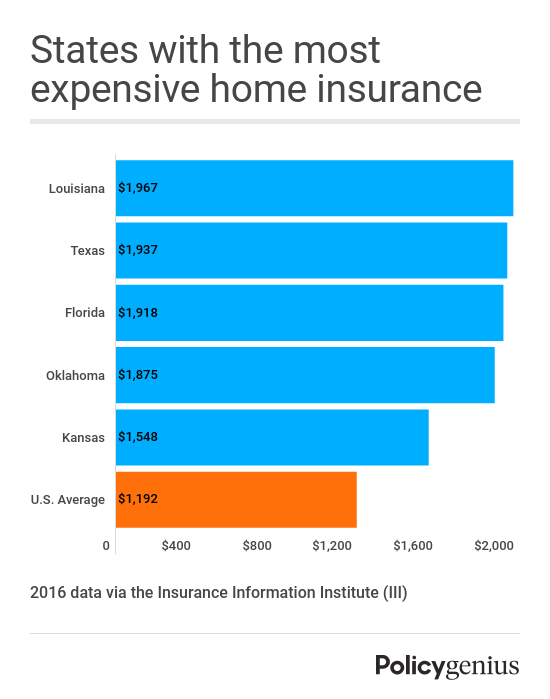

That extra $25,000 can make up for increases in the price of lumber, for example, or new building codes. These are known as insured perils, and standard home insurance policies apply these to your dwelling and contents. Home insurance may help protect your home and its contents in case of theft, loss or damage to the inside and outside of your home or property. Ottawa is about $1,150 annually. Comparing ontario’s average to the rest of canada.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

This is only an average price, so you could pay more or less depending on your industry and personal operations. Our home coverage includes our million dollar solution and covers all risks, personal liability and much more. Ontario hst on the premium will be $1,520, which will need to be paid immediately. Price and coverage are her main concerns. Rates can vary significantly by driver age, driving record and insurance history.

Source: insureye.com

Source: insureye.com

A calculator is a rough estimator of home insurance payments. London is about $1,400 annually. Our home coverage includes our million dollar solution and covers all risks, personal liability and much more. How much you insure your home for is usually different for different people. Home insurance may help protect your home and its contents in case of theft, loss or damage to the inside and outside of your home or property.

Source: ratehub.ca

Source: ratehub.ca

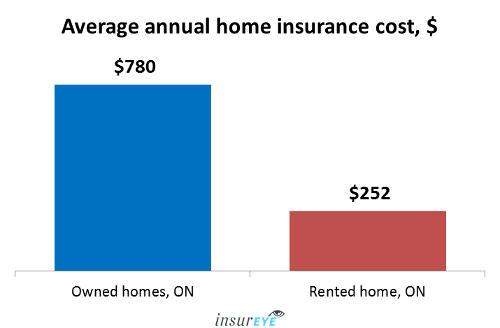

Tenant insurance in ontario costs an average of $20 to $30 per month, but averages can be misleading when it comes to any property insurance product. A calculator is a rough estimator of home insurance payments. Mississauga is over $2,000 annually. Structures on your property that aren’t part of the main home, such as the tools shed, detached garage, or. In other words, homeowners pay nearly six times as much as tenants to protect their abodes and their stuff.

Price and coverage are her main concerns. That extra $25,000 can make up for increases in the price of lumber, for example, or new building codes. Home insurance covers damage or loss to the dwelling (actual building) you live in, be it a house, apartment or condo. How much does landlord insurance cost in ontario? She needs to know how much mortgage life insurance is going to cost per month.

Source: insureye.com

Source: insureye.com

This averages out to just over $104 per month. According to the iii, a homeowners insurance policy might cover up to $100,000 to $300,000 in damages for personal liability. According to insureye, the average monthly insurance cost for a home valued between $100,000 and $700,000 in ontario is $74.50. How much you insure your home for is usually different for different people. In ontario, residential landlord premiums average around $900/year for a house and $400/year for a condo/apartment.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much does home insurance cost ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.