How much excess car insurance information

Home » Trend » How much excess car insurance informationYour How much excess car insurance images are ready in this website. How much excess car insurance are a topic that is being searched for and liked by netizens now. You can Get the How much excess car insurance files here. Get all royalty-free images.

If you’re looking for how much excess car insurance pictures information related to the how much excess car insurance topic, you have pay a visit to the right site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

How Much Excess Car Insurance. �young driver� excess is applied by some insurers as younger drivers are perceived to be higher risk and more likely to make a claim, with claims often more expensive. You will foot the bill for the first $600 and your insurer will pay the rest of the claim, which in this. A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. When it comes to car insurance policies, the excess is the amount you pay out of your pocket to cover the costs of damage, after which your car insurance company covers the rest of the amount.

How Can Motor Excess Insurance Save You Money? Channel From cib-insurance.co.uk

How Can Motor Excess Insurance Save You Money? Channel From cib-insurance.co.uk

Your excess can be found in your insurance schedule. You usually just get excess insurance when you rent a hire car. Like i said, too many variables and too many assumptions to arrive at a firm time of return. Excess insurance is a type of insurance policy that works alongside your traditional insurance policies. If you hold a third party property damage policy, the excess varies based on your state. You will foot the bill for the first $600 and your insurer will pay the rest of the claim, which in this.

When you buy your car insurance, the insurance company usually sets a basic excess amount or deductible that you have to pay towards your claim.

You make an accident claim for $1,000 and your excess amount is set at $600. An excess is an agreed amount of money that you the client is liable to pay in the event of a car insurance claim being settled. Like i said, too many variables and too many assumptions to arrive at a firm time of return. If you hold a third party property damage policy, the excess varies based on your state. It covers the cost of your excess if you need to make an insurance claim. Many insurers will charge you a proportionate excess (i.e you pay a set percentage of the final claim amount).

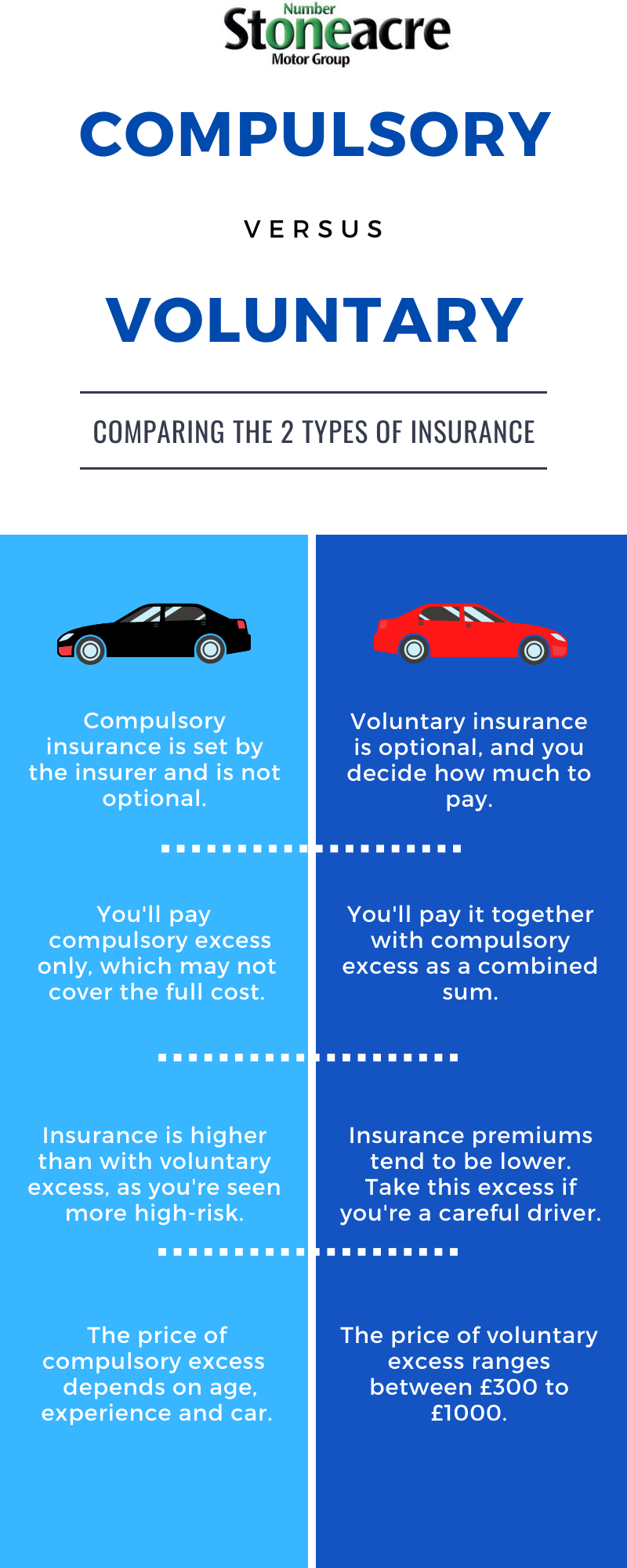

Source: stoneacre.co.uk

Source: stoneacre.co.uk

Many insurers will charge you a proportionate excess (i.e you pay a set percentage of the final claim amount). The standard excess ranges from $600 to $2200 depending on your state and what you selected when you bought or renewed your policy if you hold a comprehensive car insurance policy with us. Excesses mainly exist to deter people from claiming really small damages or. The low excess driver would have paid $400 extra in premiums and a $300 excess for the repairs. So it�s like an insurance policy that will pay off the excess on your car insurance policy.

Source: youtube.com

Source: youtube.com

For example, if you need to pay £250 excess on a car insurance claim following an accident, with excess insurance you can get that £250 back. With car insurance your compulsory excess cost is based on factors like: For example, if you need to pay £250 excess on a car insurance claim following an accident, with excess insurance you can get that £250 back. A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. Excess insurance is a form of insurance that works next to your traditional car insurance policies.

Source: sheengroup.com.au

Source: sheengroup.com.au

A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. You make an accident claim for $1,000 and your excess amount is set at $600. The high excess driver would have just paid the $500 for repairs putting him in front of the low excess driver by $200 after 4 years even with an accident. Excess insurance is a form of insurance that works next to your traditional car insurance policies. So, if your excess is £250 and you make a claim for £1,000, your car insurance provider might keep the first.

Source: youtube.com

Source: youtube.com

You will foot the bill for the first $600 and your insurer will pay the rest of the claim, which in this. It�s not so much of a thing with standard car insurance policies. It reduces costs for the insurer if you’re in an accident. This insurance will pay for your excess in the case of an accident. The total excess is usually comprised of ‘compulsory.

Source: freepricecompare.com

Source: freepricecompare.com

The high excess driver would have just paid the $500 for repairs putting him in front of the low excess driver by $200 after 4 years even with an accident. If you hold a third party property damage policy, the excess varies based on your state. The cost of excess insurance depends on the amount you can claim, as well as whether or not it covers more than one policy. We can help you find a great price on car hire excess insurance, so you know you�re covered should the unthinkable happen. Like the insurance equivalent of those russian nesting dolls.

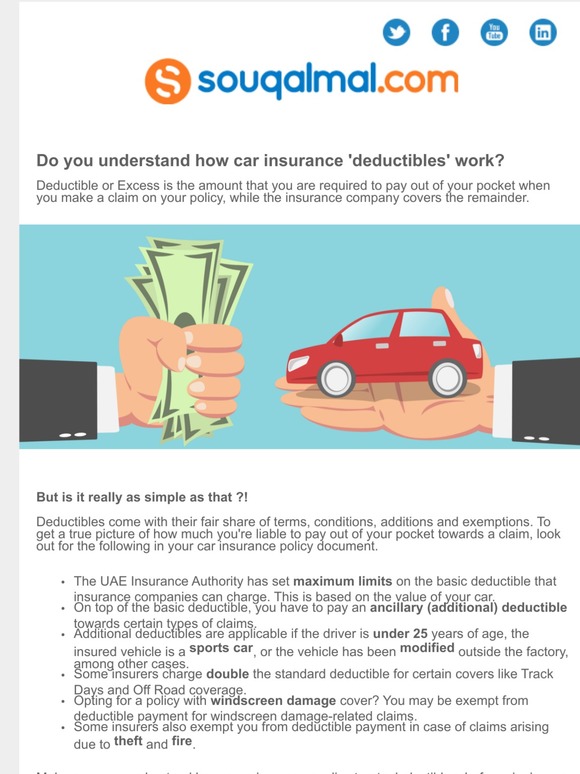

Source: milled.com

Source: milled.com

The high excess driver would have just paid the $500 for repairs putting him in front of the low excess driver by $200 after 4 years even with an accident. To keep the explanation brief, voluntary excess is an amount that you would have to pay to your insurer when you make a claim in addition to the compulsory excess. It will cover the cost of the excess you pay if you make a claim against your car insurance. You make an accident claim for $1,000 and your excess amount is set at $600. Like the insurance equivalent of those russian nesting dolls.

Source: adrianflux.co.uk

Source: adrianflux.co.uk

It can be more than the cost of repairs. Excesses mainly exist to deter people from claiming really small damages or. With car insurance your compulsory excess cost is based on factors like: Excess insurance is a form of insurance that works next to your traditional car insurance policies. It can be more than the cost of repairs.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

You will foot the bill for the first $600 and your insurer will pay the rest of the claim, which in this. With our motor insurance policies your excess depends firstly on the type of cover you’re paying for. For example, if you choose an excess of $895, and the person driving your car is under 25 ($600). You will foot the bill for the first $600 and your insurer will pay the rest of the claim, which in this. The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer.

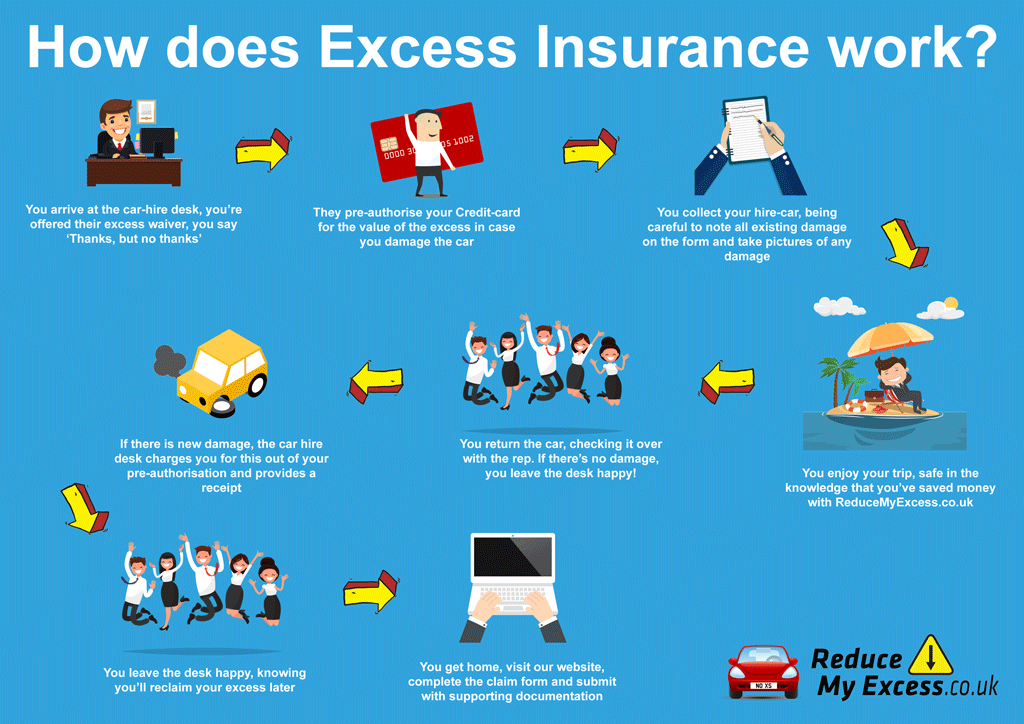

Source: reducemyexcess.co.uk

Source: reducemyexcess.co.uk

To keep the explanation brief, voluntary excess is an amount that you would have to pay to your insurer when you make a claim in addition to the compulsory excess. The total excess is usually comprised of ‘compulsory. The low excess driver would have paid $400 extra in premiums and a $300 excess for the repairs. Some insurers charge different excesses, depending on the nature of your claim (i.e. This insurance will pay for your excess in the case of an accident.

Source: express.co.uk

Source: express.co.uk

Many insurers will charge you a proportionate excess (i.e you pay a set percentage of the final claim amount). For single policy excess insurance, costs start at about £30 a year. �young driver� excess is applied by some insurers as younger drivers are perceived to be higher risk and more likely to make a claim, with claims often more expensive. In a nutshell, your excess is a fixed amount that you have to fork out if you make a claim. So it�s like an insurance policy that will pay off the excess on your car insurance policy.

Source: pinterest.com

Source: pinterest.com

For single policy excess insurance, costs start at about £30 a year. It covers the cost of your excess if you need to make an insurance claim. The low excess driver would have paid $400 extra in premiums and a $300 excess for the repairs. �young driver� excess is applied by some insurers as younger drivers are perceived to be higher risk and more likely to make a claim, with claims often more expensive. This means that whenever you claim against your car insurance, you will always have to pay an excess amount.

Source: insurance4u-insurance.blogspot.com

Source: insurance4u-insurance.blogspot.com

In the event of an accident, hire car excess insurance covers the first part of any claim, otherwise known as the “excess”. It�s a completely separate insurance policy to your main one. For example, if your standard excess is $500 and your repair claim is $2000, that means you�ll have to pay $500, while your. The total excess is usually comprised of ‘compulsory. The amount of the excess varies from one rental provider to the other, however it is usually between £500 and £2,000 per vehicle.

Source: elliottinsurance.com.au

Source: elliottinsurance.com.au

When you buy your car insurance, the insurance company usually sets a basic excess amount or deductible that you have to pay towards your claim. In the event of an accident, hire car excess insurance covers the first part of any claim, otherwise known as the “excess”. For example, if your standard excess is $500 and your repair claim is $2000, that means you�ll have to pay $500, while your. For example, if you choose an excess of $895, and the person driving your car is under 25 ($600). You make an accident claim for $1,000 and your excess amount is set at $600.

Source: theguardian.com

Source: theguardian.com

Your excess can be found in your insurance schedule. So it�s like an insurance policy that will pay off the excess on your car insurance policy. If your excess on your car is r3,000.00, and the damages amount to r50,000.00 the insurer will pay the remaining r47,000.00 once you the client has paid your excess to the repairer. This insurance will pay for your excess in the case of an accident. Excesses mainly exist to deter people from claiming really small damages or.

Source: milled.com

Source: milled.com

A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. If your excess on your car is r3,000.00, and the damages amount to r50,000.00 the insurer will pay the remaining r47,000.00 once you the client has paid your excess to the repairer. It covers the cost of your excess if you need to make an insurance claim. �young driver� excess is applied by some insurers as younger drivers are perceived to be higher risk and more likely to make a claim, with claims often more expensive.

Source: ingenie.com

Source: ingenie.com

The high excess driver would have just paid the $500 for repairs putting him in front of the low excess driver by $200 after 4 years even with an accident. If you hold a third party property policy, the excess varies based on your state. It covers the cost of your excess if you need to make an insurance claim. Your excess can be found in your insurance schedule. This insurance will pay for your excess in the case of an accident.

Source: cib-insurance.co.uk

Source: cib-insurance.co.uk

A voluntary excess means that you’re paying a higher excess to enjoy a lower monthly insurance premium. If you hold a third party property policy, the excess varies based on your state. The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer. For example, if damage to your car costs £1,000 and your excess is £300, you will pay £300 and your insurer will pay £700, or if your excess is £400, your insurer would pay £600. It will cover the cost of the excess you pay if you make a claim against your car insurance.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

You usually just get excess insurance when you rent a hire car. Excesses mainly exist to deter people from claiming really small damages or. The amount of the excess varies from one rental provider to the other, however it is usually between £500 and £2,000 per vehicle. First off, let’s understand what an excess really is. It�s a completely separate insurance policy to your main one.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much excess car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.