How much is a million dollar life insurance Idea

Home » Trend » How much is a million dollar life insurance IdeaYour How much is a million dollar life insurance images are ready in this website. How much is a million dollar life insurance are a topic that is being searched for and liked by netizens today. You can Download the How much is a million dollar life insurance files here. Download all royalty-free images.

If you’re looking for how much is a million dollar life insurance pictures information connected with to the how much is a million dollar life insurance keyword, you have visit the ideal blog. Our website frequently gives you suggestions for seeking the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

How Much Is A Million Dollar Life Insurance. How much is a million dollar life insurance policy? If you think that purchasing million dollar life insurance policies is expensive and hard to get approved, you are in for a pleasant surprise. If you’re considering such a policy, you have both a high income and some other assets that you are trying to protect. Are you looking for how much is a million dollar life insurance policy for a 50 year old man?then this is the article for you.

MillionDollar Life Insurance Policy Find an Agent From trustedchoice.com

MillionDollar Life Insurance Policy Find an Agent From trustedchoice.com

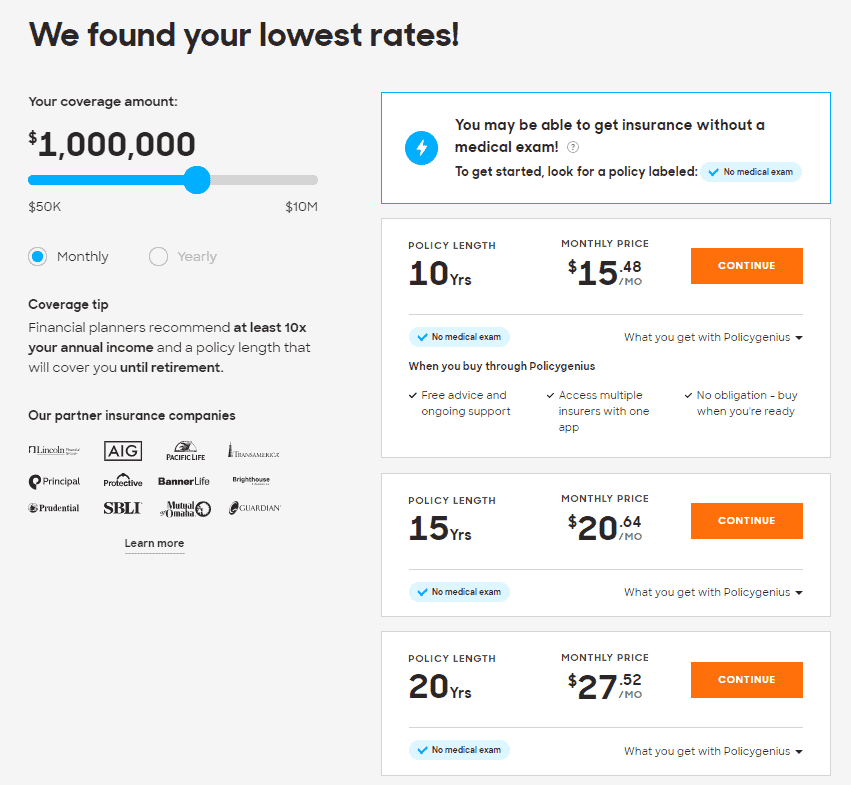

The internet is the best place to search for different policies to see which one works for you. Many experts recommend having at least 10x your annual salary in coverage. So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam. A 35 year old man would typically have to pay around $53 monthly for a million dollar life insurance policy for twenty years. Life insurance is actually cheaper than most people think. — you may find the premium on a $1 million policy is only a little bit higher (1) example pricing for a $1,000,000 life insurance policy for males and females age 40 and 45 ;

— you may find the premium on a $1 million policy is only a little bit higher (1) example pricing for a $1,000,000 life insurance policy for males and females age 40 and 45 ;

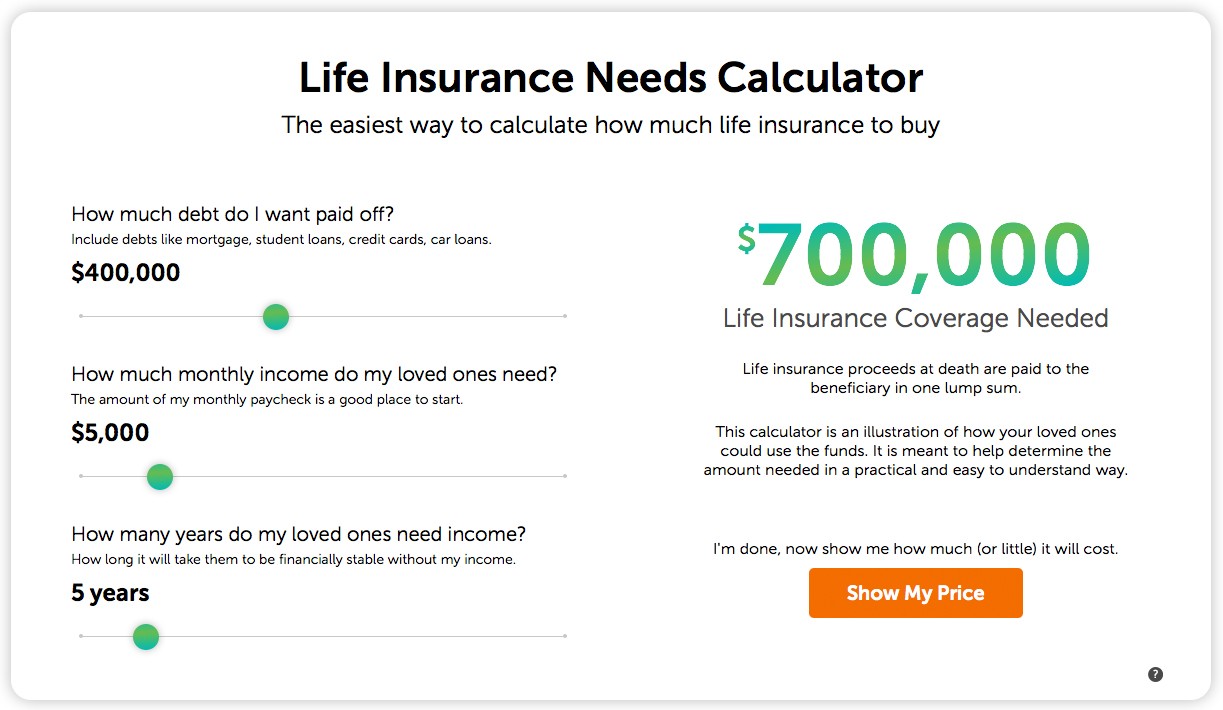

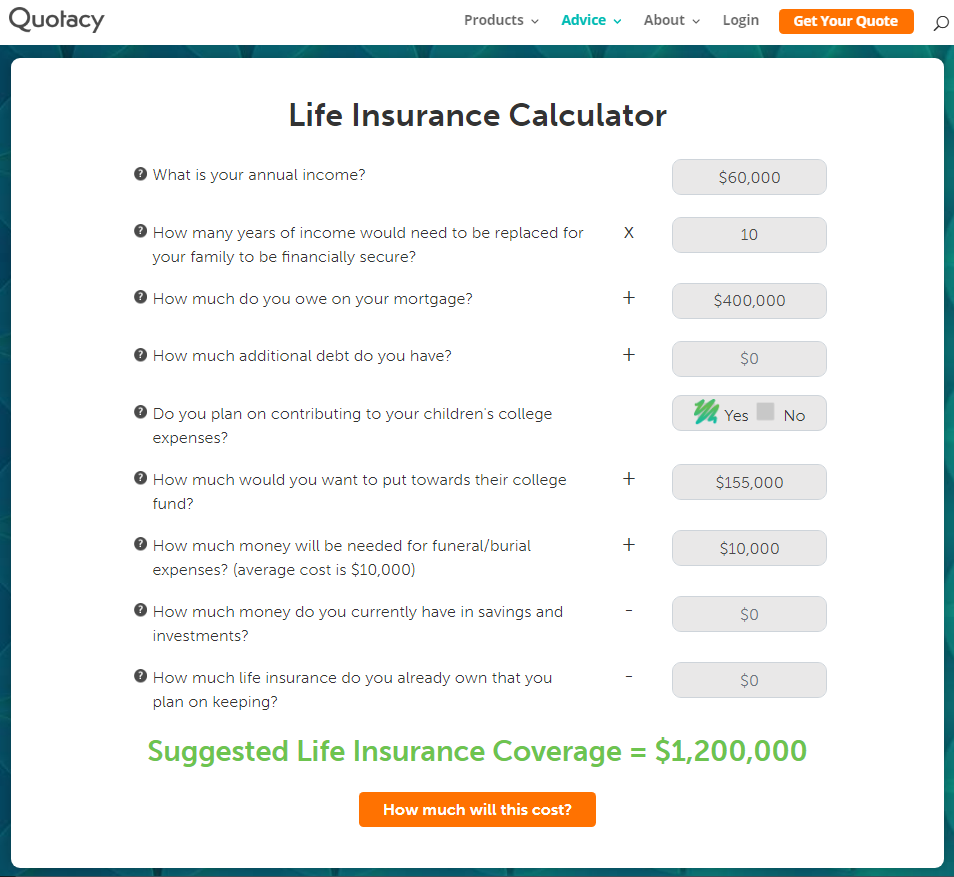

The internet is the best place to search for different policies to see which one works for you. You can also use the dime formula as a starting point in calculating your life insurance needs. $1 million in coverage can go a long way towards protecting your family should something unexpected happen to you. The life insurance rates for a 50 year old are very affordable, even inexpensive as i will show in the table below. Your beneficiaries is guaranteed to receive $5 million death benefit, tax free, when you pass away, which is a 2.9x return on investment, which can appear not too bad. How much is a million dollar life insurance policy?

Source: insurechance.com

Source: insurechance.com

A million dollars in no exam life insurance might seem like a ton of money. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need. Many experts recommend having at least 10x your annual salary in coverage. As you can see, the costs go up significantly as you age. This refers to the face value of your policy.

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

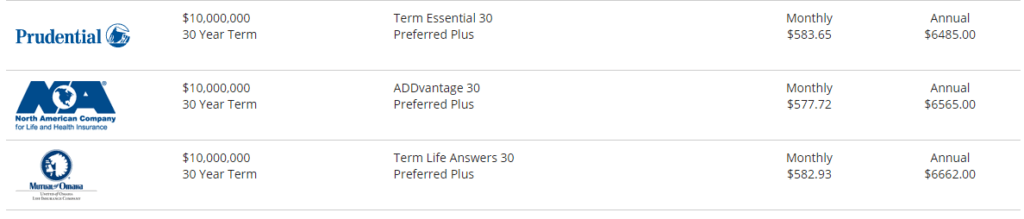

Your beneficiaries is guaranteed to receive $5 million death benefit, tax free, when you pass away, which is a 2.9x return on investment, which can appear not too bad. However this is not a fixed rate. The main reason to invest in a $10 million dollar policy is to pass this wealth onto your heirs. A million dollar life insurance policy sounds like a lot of coverage, but it’s actually not enough for most people because it only pays out $1,000,000 at death instead of the full amount on an annual basis. The insurance amount is often altered by factors such as gender, age, and health.

Source: trustedchoice.com

Source: trustedchoice.com

A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. A 35 year old man would typically have to pay around $53 monthly for a million dollar life insurance policy for twenty years. However this is not a fixed rate. So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Guaranteed issue life insurance $1m cost. If you think that purchasing million dollar life insurance policies is expensive and hard to get approved, you are in for a pleasant surprise. A ten million dollar life insurance policy may seem like a lot of money. If you’re considering such a policy, you have both a high income and some other assets that you are trying to protect.

Source: enalgunlugardemioscuramente.blogspot.com

Source: enalgunlugardemioscuramente.blogspot.com

As you can see in the tables above, even for individuals in their 40s, one million dollars’ worth of term life insurance is not that expensive considering how much your loved ones would receive if you died too soon. How much is a million dollar life insurance policy? The insurance amount is often altered by factors such as gender, age, and health. Guaranteed issue life insurance $1m cost. This refers to the face value of your policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

How much is a million dollar life insurance policy? A ten million dollar life insurance policy may seem like a lot of money. The best companies include banner life, protective, and lincoln financial. So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need.

Source: theminoritymindset.com

Source: theminoritymindset.com

Plus, these policies have higher rates than more affordable policies that offer lower amounts or term lengths. Plus, these policies have higher rates than more affordable policies that offer lower amounts or term lengths. Are you looking for how much is a million dollar life insurance policy for a 50 year old man?then this is the article for you. Your life insurance policy’s face value, which is the dollar amount that looking at four policy amounts ($100k, $250k, $500k, and $1 million) (10). If you think that purchasing million dollar life insurance policies is expensive and hard to get approved, you are in for a pleasant surprise.

Source: trustedchoice.com

Source: trustedchoice.com

The life insurance rates for a 50 year old are very affordable, even inexpensive as i will show in the table below. You can also use the dime formula as a starting point in calculating your life insurance needs. *most carriers reduce the premium between 2% to 5% for annual premium. The insurance amount is often altered by factors such as gender, age, and health. A million dollars in no exam life insurance might seem like a ton of money.

Source: pinnaclequote.com

Source: pinnaclequote.com

A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. They say 50 is the new 40 or even 30 and many life insurance companies seem to agree. This can be a smooth process if you apply with the most applicable carrier and have an experienced agent helping you. However this is not a fixed rate. How much is a million dollar life insurance policy?

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

The main reason to invest in a $10 million dollar policy is to pass this wealth onto your heirs. A 35 year old man would typically have to pay around $53 monthly for a million dollar life insurance policy for twenty years. This can be a smooth process if you apply with the most applicable carrier and have an experienced agent helping you. A million dollar life insurance policy sounds like a lot of coverage, but it’s actually not enough for most people because it only pays out $1,000,000 at death instead of the full amount on an annual basis. A male in the same group can pay under $90/month.

Source: quotacy.com

Source: quotacy.com

This can be a smooth process if you apply with the most applicable carrier and have an experienced agent helping you. Do you really need a million dollar term life insurance policy? The cheapest $5 million whole life insurance policy is from penn mutual at $57,600 annual premium for 30 years. — you may find the premium on a $1 million policy is only a little bit higher (1) example pricing for a $1,000,000 life insurance policy for males and females age 40 and 45 ; In fact, most americans think a term life policy costs triple or more the actual cost.

Source: lifeinsurancehelpdesk.com

Source: lifeinsurancehelpdesk.com

*most carriers reduce the premium between 2% to 5% for annual premium. They say 50 is the new 40 or even 30 and many life insurance companies seem to agree. A 35 year old man would typically have to pay around $53 monthly for a million dollar life insurance policy for twenty years. Plus, these policies have higher rates than more affordable policies that offer lower amounts or term lengths. *most carriers reduce the premium between 2% to 5% for annual premium.

Source: pinterest.com

Source: pinterest.com

Are you looking for how much is a million dollar life insurance policy for a 50 year old man?then this is the article for you. Because this whole life is paid upfront, many companies will not require a medical exam. However, if you make anywhere between $50,000 to $100,000 a year its actually about how much your family is going to need if you pass away unexpectedly. Your life insurance policy’s face value, which is the dollar amount that looking at four policy amounts ($100k, $250k, $500k, and $1 million) (10). How much is a million dollar life insurance policy?

Source: insurechance.com

Source: insurechance.com

A million dollar life insurance policy sounds like a lot of coverage, but it’s actually not enough for most people because it only pays out $1,000,000 at death instead of the full amount on an annual basis. Are you looking for how much is a million dollar life insurance policy for a 50 year old man?then this is the article for you. The insurance amount is often altered by factors such as gender, age, and health. A 35 year old man would typically have to pay around $53 monthly for a million dollar life insurance policy for twenty years. So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam.

Source: noeimage.org

Source: noeimage.org

Because this whole life is paid upfront, many companies will not require a medical exam. A million dollars in no exam life insurance might seem like a ton of money. Guaranteed issue life insurance $1m cost. Life insurance is actually cheaper than most people think. Your beneficiaries is guaranteed to receive $5 million death benefit, tax free, when you pass away, which is a 2.9x return on investment, which can appear not too bad.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is a million dollar life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.