How much is car insurance in south carolina information

Home » Trending » How much is car insurance in south carolina informationYour How much is car insurance in south carolina images are available in this site. How much is car insurance in south carolina are a topic that is being searched for and liked by netizens now. You can Download the How much is car insurance in south carolina files here. Find and Download all free vectors.

If you’re looking for how much is car insurance in south carolina pictures information connected with to the how much is car insurance in south carolina topic, you have pay a visit to the ideal site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

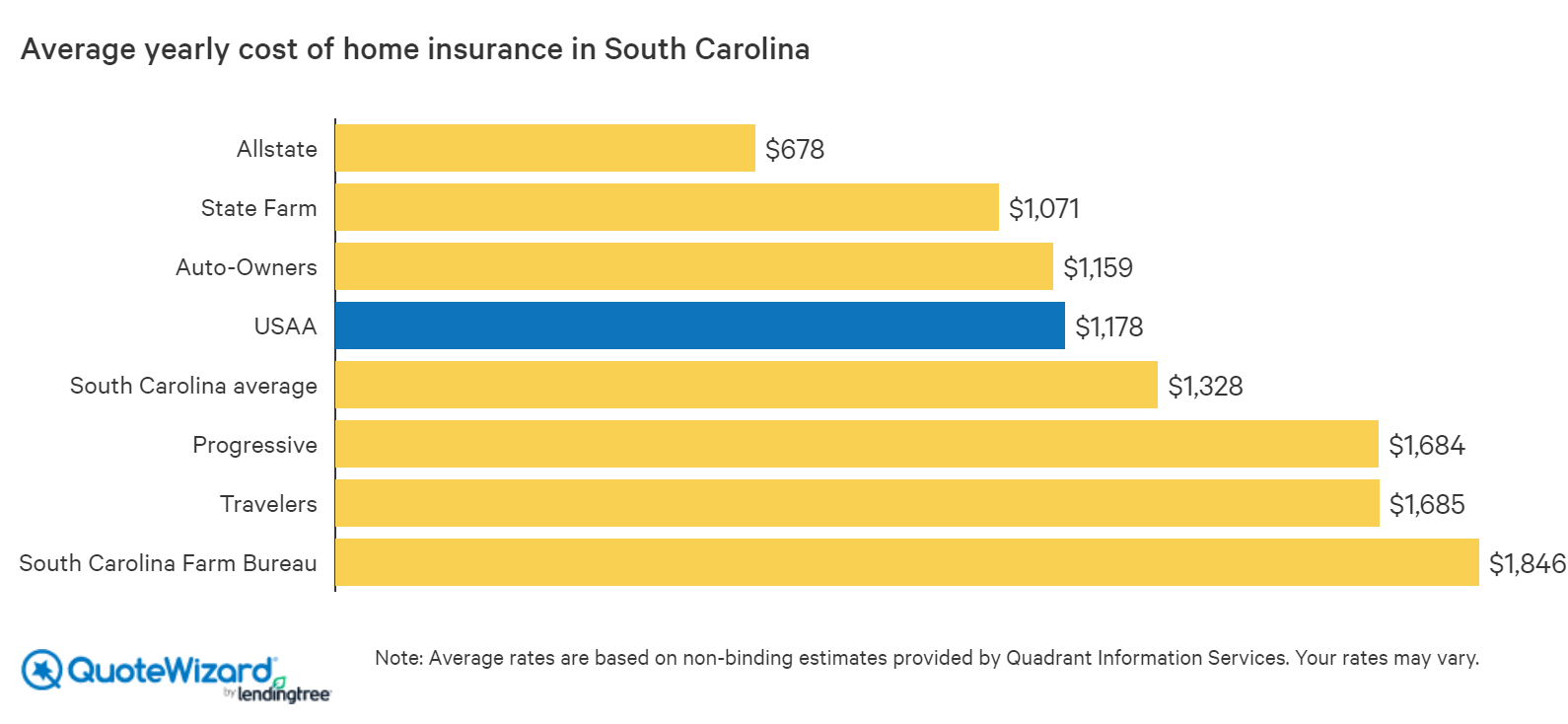

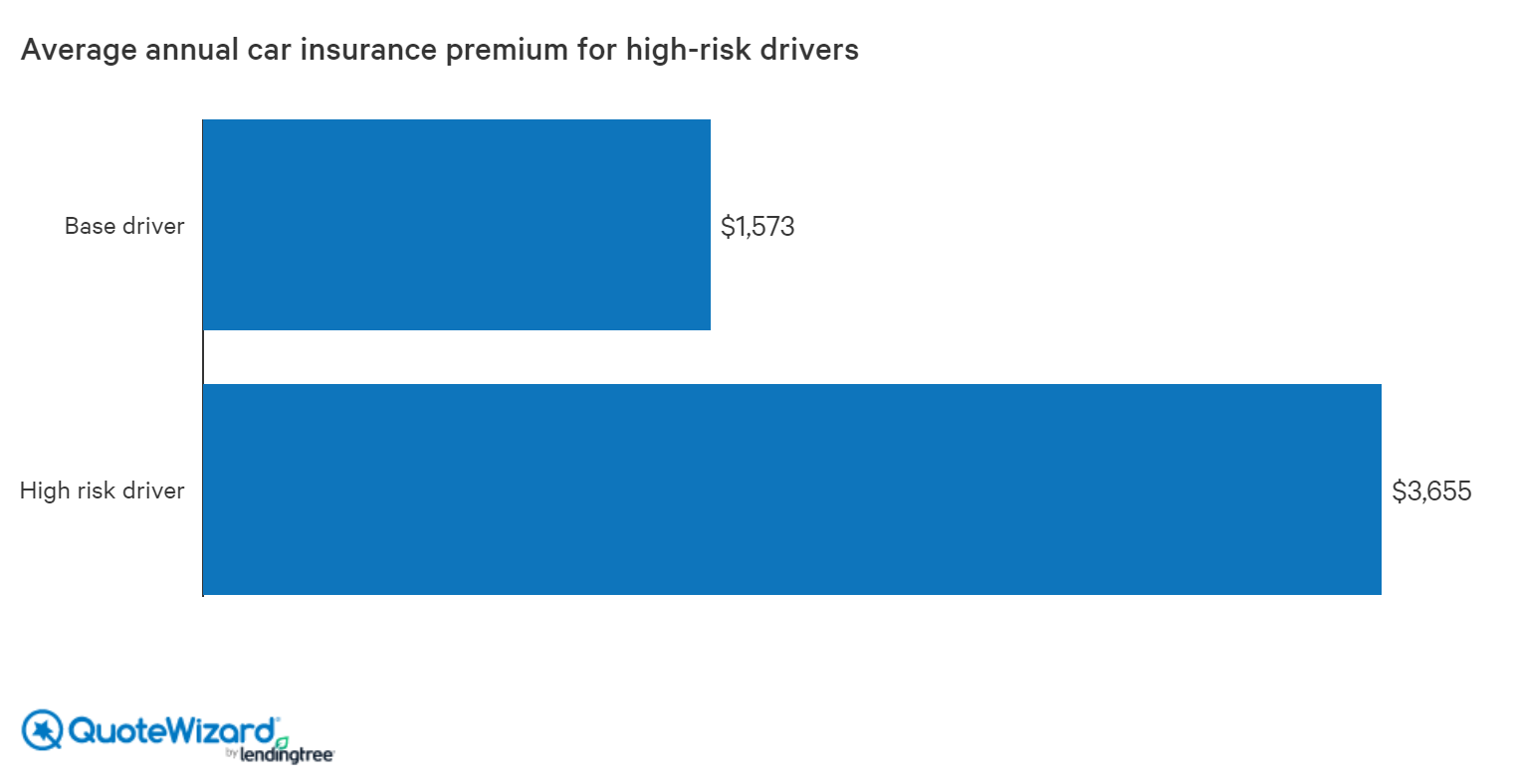

How Much Is Car Insurance In South Carolina. However, minimum coverage in south. $100,000 bodily injury per person Car insurance in south carolina is about the same as the national average, which is around $1,500 annually for full coverage and about $600 per year for minimum coverage. According to bankrate, south carolina drivers pay, on average, $1361 a year for car insurance.

South Carolina Drivers Have the Most Expensive Car From valuepenguin.com

South Carolina Drivers Have the Most Expensive Car From valuepenguin.com

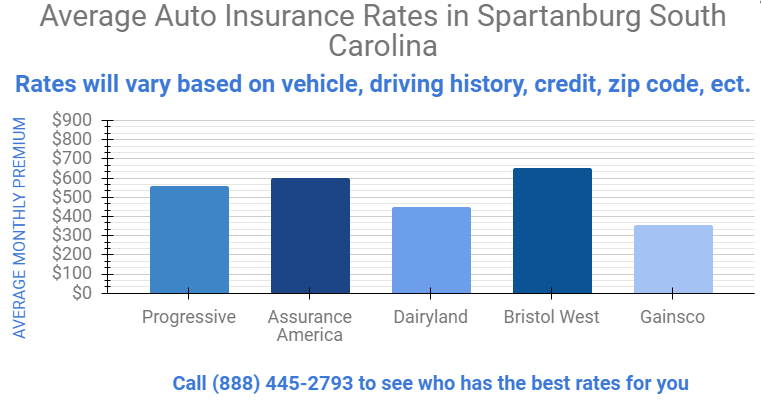

Average monthly car insurance premium. Car insurance in south carolina is slightly less costly than the national average. In south carolina, a speeding ticket increases auto insurance premiums by an average of 19%, according to bankrate’s 2021 study of quoted annual premiums. South carolinians pay lower rates because there. However, the average cost for a full coverage policy is the 35th most expensive in the country. The most expensive car insurance company in south carolina for minimum coverage is nationwide, with an.

How much is car insurance in sc?

$50,000 for bodily injury or death per accident. Car insurance in south carolina is about the same as the national average, which is around $1,500 annually for full coverage and about $600 per year for minimum coverage. Generally, car insurance is more costly for young drivers and teens, as auto insurance companies see inexperienced motorists as less responsible. Many or all of the products featured here are. Getting your south carolina insurance license is the first step to becoming an insurance agent in south carolina.whether you’re interested in selling property and casualty. However, the average cost for a full coverage policy is the 35th most expensive in the country.

The average cost for a minimum coverage car insurance policy in south carolina is relatively expensive, as it ranks as the 17th most expensive state, with rates averaging $752 per year. If you or a family member are in the military, usaa offers another affordable option at an average of $500 per year. South carolinians pay lower rates because there. Comprehensive coverage pays for damage to your auto from most other causes, including fire, vandalism, flooding, theft, falling objects, and collision with animals. Here are some of the parameters of our insurance coverage in south carolina:

Source: everquote.com

Source: everquote.com

The difference in price is significant, as minimum coverage only pays for damage you do to others and their property. Is it illegal to drive without insurance in sc? South carolinians pay lower rates because there. South carolina requires vehicle owners to carry liability auto insurance that meets at least the following minimums: Many or all of the products featured here are.

Source: valuepenguin.com

Source: valuepenguin.com

In south carolina, a speeding ticket increases auto insurance premiums by an average of 19%, according to bankrate’s 2021 study of quoted annual premiums. If you or a family member are in the military, usaa offers another affordable option at an average of $500 per year. Comprehensive coverage pays for damage to your auto from most other causes, including fire, vandalism, flooding, theft, falling objects, and collision with animals. The most expensive car insurance company in south carolina for minimum coverage is nationwide, with an. Generally, car insurance is more costly for young drivers and teens, as auto insurance companies see inexperienced motorists as less responsible.

Source: quotewizard.com

Source: quotewizard.com

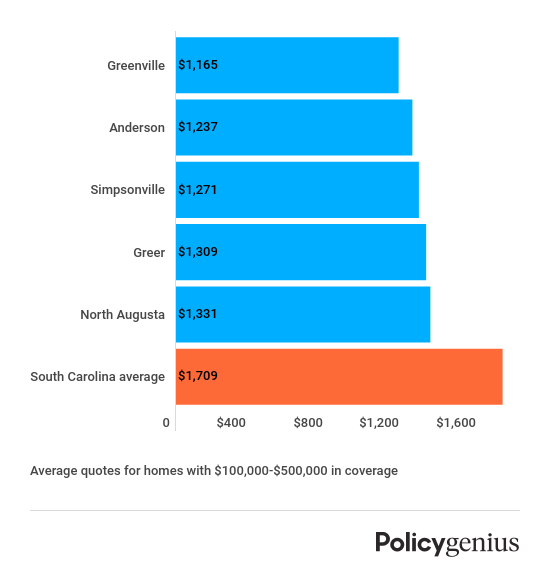

In south carolina, a speeding ticket increases auto insurance premiums by an average of 19%, according to bankrate’s 2021 study of quoted annual premiums. How much is car insurance in sc? Looking at the chart above, you can see it�s around $7 a month cheaper to insure your vehicle in myrtle beach than it is in the rest of south carolina. On the other hand, drivers in myrtle beach may pay higher rates than the rest of the country. Comprehensive coverage pays for damage to your auto from most other causes, including fire, vandalism, flooding, theft, falling objects, and collision with animals.

Source: everquote.com

Source: everquote.com

Car insurance in south carolina is about the same as the national average, which is around $1,500 annually for full coverage and about $600 per year for minimum coverage. Getting your south carolina insurance license is the first step to becoming an insurance agent in south carolina.whether you’re interested in selling property and casualty. $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured. You can always opt for higher limits if you want more coverage. The most expensive car insurance company in south carolina for minimum coverage is nationwide, with an.

Source: doughroller.net

Source: doughroller.net

Generally, car insurance is more costly for young drivers and teens, as auto insurance companies see inexperienced motorists as less responsible. Info@doi.sc.gov click to submit a message $100,000 bodily injury per person Generally, car insurance is more costly for young drivers and teens, as auto insurance companies see inexperienced motorists as less responsible. While south carolina drivers pay, on average, $1,512 annually for full coverage, the average cost of full coverage car insurance in the u.s.

Source: valuepenguin.com

Source: valuepenguin.com

Getting your south carolina insurance license is the first step to becoming an insurance agent in south carolina.whether you’re interested in selling property and casualty. South carolina requires vehicle owners to carry liability auto insurance that meets at least the following minimums: In south carolina, a speeding ticket increases auto insurance premiums by an average of 19%, according to bankrate’s 2021 study of quoted annual premiums. According to bankrate, south carolina drivers pay, on average, $1361 a year for car insurance. Car insurance costs an average of $70 per month in california.

Source: onlineautoinsurance.com

Source: onlineautoinsurance.com

According to bankrate, south carolina drivers pay, on average, $1361 a year for car insurance. Our study indicates that south carolina drivers pay an average of $1,540 a year for car insurance, 14% more than the national average. Car insurance in south carolina is slightly less costly than the national average. Generally, car insurance is more costly for young drivers and teens, as auto insurance companies see inexperienced motorists as less responsible. Average monthly car insurance premium.

Source: learnandserve.org

Source: learnandserve.org

You can always opt for higher limits if you want more coverage. How much is car insurance in sc? Many or all of the products featured here are. $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle. The average car insurance cost in south carolina is $137 per month or $1,653 a year for a full coverage policy.

Source: quotewizard.com

Source: quotewizard.com

Car insurance in south carolina is slightly less costly than the national average. Getting your south carolina insurance license is the first step to becoming an insurance agent in south carolina.whether you’re interested in selling property and casualty. In south carolina, you must have the following minimum uninsured motorist coverage: Car insurance in the u.s. The cost of car insurance is steadily increasing, too, both in south carolina and nationwide.

Source: everquote.com

Source: everquote.com

The average cost of car insurance in california is 17% higher than the national average auto insurance premium, and california ranks 38 out of 50 for the most affordable car insurance rates in the u.s. Getting your south carolina insurance license is the first step to becoming an insurance agent in south carolina.whether you’re interested in selling property and casualty. Comprehensive coverage pays for damage to your auto from most other causes, including fire, vandalism, flooding, theft, falling objects, and collision with animals. How much is car insurance in sc? According to bankrate, south carolina drivers pay, on average, $1361 a year for car insurance.

Source: policygenius.com

Source: policygenius.com

While south carolina drivers pay, on average, $1,512 annually for full coverage, the average cost of full coverage car insurance in the u.s. While south carolina drivers pay, on average, $1,512 annually for full coverage, the average cost of full coverage car insurance in the u.s. On the other hand, drivers in myrtle beach may pay higher rates than the rest of the country. Our study indicates that south carolina drivers pay an average of $1,540 a year for car insurance, 14% more than the national average. In south carolina, you must have the following minimum uninsured motorist coverage:

Source: quotewizard.com

Source: quotewizard.com

Car insurance in the u.s. You can always opt for higher limits if you want more coverage. Info@doi.sc.gov click to submit a message However, the average cost for a full coverage policy is the 35th most expensive in the country. $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured.

Info@doi.sc.gov click to submit a message You can always opt for higher limits if you want more coverage. Average monthly car insurance premium. The cost of car insurance is steadily increasing, too, both in south carolina and nationwide. On the other hand, drivers in myrtle beach may pay higher rates than the rest of the country.

Source: everquote.com

Source: everquote.com

$25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle. That�s 4.6 percent less than the national average. However, the average cost for a full coverage policy is the 35th most expensive in the country. How much is car insurance in sc? According to bankrate, south carolina drivers pay, on average, $1361 a year for car insurance.

Source: nerdwallet.com

Source: nerdwallet.com

If you or a family member are in the military, usaa offers another affordable option at an average of $500 per year. Car insurance in the u.s. $50,000 for bodily injury or death per accident. Average monthly car insurance premium. Our study indicates that south carolina drivers pay an average of $1,540 a year for car insurance, 14% more than the national average.

Source: smartfinancial.com

Source: smartfinancial.com

Looking at the chart above, you can see it�s around $7 a month cheaper to insure your vehicle in myrtle beach than it is in the rest of south carolina. Looking at the chart above, you can see it�s around $7 a month cheaper to insure your vehicle in myrtle beach than it is in the rest of south carolina. $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle. However, the average cost for a full coverage policy is the 35th most expensive in the country. Comprehensive coverage pays for damage to your auto from most other causes, including fire, vandalism, flooding, theft, falling objects, and collision with animals.

Source: carinsurancelist.com

Source: carinsurancelist.com

In south carolina, a speeding ticket increases auto insurance premiums by an average of 19%, according to bankrate’s 2021 study of quoted annual premiums. Car insurance in the u.s. Car insurance in south carolina is slightly less costly than the national average. Info@doi.sc.gov click to submit a message $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is car insurance in south carolina by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.