How much is car insurance in wisconsin Idea

Home » Trend » How much is car insurance in wisconsin IdeaYour How much is car insurance in wisconsin images are available in this site. How much is car insurance in wisconsin are a topic that is being searched for and liked by netizens now. You can Find and Download the How much is car insurance in wisconsin files here. Get all free photos.

If you’re looking for how much is car insurance in wisconsin pictures information linked to the how much is car insurance in wisconsin topic, you have pay a visit to the right site. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

How Much Is Car Insurance In Wisconsin. Can you drive without car insurance in wisconsin? Any car insurance policy must include at least the following minimum amounts of coverage: On average, those with poor credit pay an annual rate of $1,977. If you want more coverage, rates increase to $518.

Cheap Car Insurance in Wisconsin From everquote.com

Cheap Car Insurance in Wisconsin From everquote.com

$50,000 total for injury or death to multiple people in a single accident. The average auto insurance premium in wisconsin is $1,040 per year — less than the nationwide average by 27.1%. Yes what are the minimum limits for wisconsin? The following is a breakdown of minimum liability requirements for wisconsin: Is it mandatory to have car insurance in wisconsin? Your liability car insurance will help you pay for bodily injuries or property damage resulting from an accident that you caused.

If you�re looking for car insurance in wisconsin, use our.

Currently, you cannot legally drive without insurance in wisconsin. This means that if you total someone’s vehicle, your $10,000 minimum will be exceeded quickly, leaving you to foot the rest of the bill. The average car insurance cost in wisconsin is $111 per month or $1,335 a year for a full coverage policy. In many states, average rates declined from 2020 to 2021 but in louisiana, rates climbed 19% to an average premium of $2,839. Wisconsin military members, veterans and their families can buy insurance from usaa, which was the overall cheapest option. That’s 149% less than the national mean rate increase after a dui.

Source: forbes.com

Source: forbes.com

On average, those with poor credit pay an annual rate of $1,977. In wisconsin, you can expect to pay approximately $1,045 per year for full coverage car insurance or $359 per year for minimum coverage. Wisconsin military members, veterans and their families can buy insurance from usaa, which was the overall cheapest option. Car insurance premiums take into account an array of factors, such as one�s driving record, credit history, gender, age, and marital status. A dui alone can increase car insurance premiums between 30% and 50%, depending on your exact location and insurance provider.

Source: americaninsurance.com

Source: americaninsurance.com

$25,000 bodily injury per person $50,000 bodily injury per accident $10,000 property damage per accident —or— 25/50/10 dairyland® coverage in wisconsin The best liability coverage for most drivers is 100/300/100, which is $100,000 per person, $300,000 per accident in bodily injury liability and $100,000 per accident in property damage liability. Wisconsin law requires the following minimum liability coverages per accident: Can you drive without car insurance in wisconsin? Wisconsin ranks 39th among the worst states for drivers with bad credit.

Source: zimlon.com

Source: zimlon.com

$25,000 for injury or death, per person. The average cost of car insurance in wisconsin is $396 per year, or $33 per month, for minimum liability. A typical wisconsin driver pays an average $47 a month for minimum car insurance coverage and $108 a month for full coverage, according to the latest quotewizard research. Yes what are the minimum limits for wisconsin? If you�re looking for car insurance in wisconsin, use our.

Source: uber.com

Source: uber.com

For context, the average cost of a new car in the u.s. This means that if you total someone’s vehicle, your $10,000 minimum will be exceeded quickly, leaving you to foot the rest of the bill. For context, the average cost of a new car in the u.s. How much is car insurance in wisconsin? Wisconsin ranks 39th among the worst states for drivers with bad credit.

Source: valuepenguin.com

Source: valuepenguin.com

Any car insurance policy must include at least the following minimum amounts of coverage: This means that if you total someone’s vehicle, your $10,000 minimum will be exceeded quickly, leaving you to foot the rest of the bill. The most expensive average auto insurance coverage for those with poor credit. In wisconsin, a dui violation will lift your annual car insurance cost by an average value of $442. The average cost of full coverage car insurance in wisconsin is $1,271 per year, or about $106 per month, according to nerdwallet’s analysis.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

How much is car insurance in wisconsin a month? $50,000 total for injury or death to multiple people in a single accident. Can you drive without car insurance in wisconsin? The average auto insurance premium in wisconsin is $1,040 per year — less than the nationwide average by 27.1%. On average, those with poor credit pay an annual rate of $1,977.

Source: carinsurancelist.com

Source: carinsurancelist.com

If you want more coverage, rates increase to $518. Any car insurance policy must include at least the following minimum amounts of coverage: Wisconsin law requires the following minimum liability coverages per accident: The average car insurance cost in wisconsin is $111 per month or $1,335 a year for a full coverage policy. Wisconsin military members, veterans and their families can buy insurance from usaa, which was the overall cheapest option.

Source: americaninsurance.com

Source: americaninsurance.com

Car insurance premiums take into account an array of factors, such as one�s driving record, credit history, gender, age, and marital status. In many states, average rates declined from 2020 to 2021 but in louisiana, rates climbed 19% to an average premium of $2,839. This means that if you total someone’s vehicle, your $10,000 minimum will be exceeded quickly, leaving you to foot the rest of the bill. In wisconsin, a dui violation will lift your annual car insurance cost by an average value of $442. Your liability car insurance will help you pay for bodily injuries or property damage resulting from an accident that you caused.

Source: carsurer.com

Source: carsurer.com

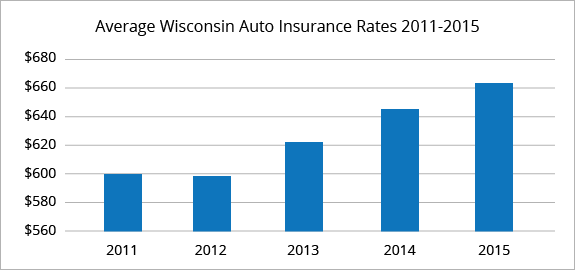

The average auto insurance premium in wisconsin is $1,040 per year — less than the nationwide average by 27.1%. In wisconsin, you can expect your rate to go up by an average of 163 percent when adding a driver age 16 to your coverage. The following is a breakdown of minimum liability requirements for wisconsin: A typical wisconsin driver pays an average $47 a month for minimum car insurance coverage and $108 a month for full coverage, according to the latest quotewizard research. Wisconsin law requires the following minimum liability coverages per accident:

Source: slideshare.net

Source: slideshare.net

A dui alone can increase car insurance premiums between 30% and 50%, depending on your exact location and insurance provider. In wisconsin, you can expect to pay approximately $1,045 per year for full coverage car insurance or $359 per year for minimum coverage. The average auto insurance premium in wisconsin is $1,040 per year — less than the nationwide average by 27.1%. In wisconsin, the average car insurance rate is $998. Is it mandatory to have car insurance in wisconsin?

Source: forbes.com

Source: forbes.com

In wisconsin, the average car insurance rate is $998. The average auto insurance premium in wisconsin is $1,040 per year — less than the nationwide average by 27.1%. Average insurance rates can differ from provider to provider. Can you drive without car insurance in wisconsin? $25,000 bodily injury per person $50,000 bodily injury per accident $10,000 property damage per accident —or— 25/50/10 dairyland® coverage in wisconsin

Source: general.com

Source: general.com

Can you drive without car insurance in wisconsin? $50,000 total for injury or death to multiple people in a single accident. A dui alone can increase car insurance premiums between 30% and 50%, depending on your exact location and insurance provider. Average insurance rates can differ from provider to provider. $25,000 for injury or death, per person.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

On average, those with poor credit pay an annual rate of $1,977. The average cost of full coverage car insurance in wisconsin is $1,271 per year, or about $106 per month, according to nerdwallet’s analysis. If you�re looking for car insurance in wisconsin, use our. Wisconsin’s property damage limit is substantially lower than most states, at only $10,000. $50,000 total for injury or death to multiple people in a single accident.

Source: slideshare.net

Source: slideshare.net

Yes what are the minimum limits for wisconsin? Wisconsin law requires the following minimum liability coverages per accident: The average cost of car insurance in wisconsin is $396 per year, or $33 per month, for minimum liability. In many states, average rates declined from 2020 to 2021 but in louisiana, rates climbed 19% to an average premium of $2,839. The following is a breakdown of minimum liability requirements for wisconsin:

Source: everquote.com

Source: everquote.com

Car insurance in louisiana is now three times more expensive than in maine. The most expensive average auto insurance coverage for those with poor credit. Can you drive without car insurance in wisconsin? Wisconsin military members, veterans and their families can buy insurance from usaa, which was the overall cheapest option. In wisconsin, the average annual cost of car insurance is $1,186 for full coverage, or about $99 monthly, almost $500 less than the national average of $1,674 for full coverage.

Source: slideshare.net

Source: slideshare.net

In wisconsin, the average annual cost of car insurance is $1,186 for full coverage, or about $99 monthly, almost $500 less than the national average of $1,674 for full coverage. In many states, average rates declined from 2020 to 2021 but in louisiana, rates climbed 19% to an average premium of $2,839. The average car insurance cost in wisconsin is $111 per month or $1,335 a year for a full coverage policy. A typical wisconsin driver pays an average $47 a month for minimum car insurance coverage and $108 a month for full coverage, according to the latest quotewizard research. Wisconsin law requires the following minimum liability coverages per accident:

Source: quotewizard.com

Source: quotewizard.com

In wisconsin, the average annual cost of car insurance is $1,186 for full coverage, or about $99 monthly, almost $500 less than the national average of $1,674 for full coverage. Young drivers typically pay high rates for auto insurance due to their inexperience behind the wheel. The average car insurance cost in wisconsin is $111 per month or $1,335 a year for a full coverage policy. Car insurance requirements in wisconsin. Your liability car insurance will help you pay for bodily injuries or property damage resulting from an accident that you caused.

Source: slideshare.net

Source: slideshare.net

Maine has the cheapest car insurance. Your auto insurance premiums are impacted by more than just state lines. State requirements are often much lower than the amount necessary to protect you financially in the event of an accident. A dui alone can increase car insurance premiums between 30% and 50%, depending on your exact location and insurance provider. In many states, average rates declined from 2020 to 2021 but in louisiana, rates climbed 19% to an average premium of $2,839.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is car insurance in wisconsin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.