How much is e and o insurance Idea

Home » Trending » How much is e and o insurance IdeaYour How much is e and o insurance images are available in this site. How much is e and o insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the How much is e and o insurance files here. Get all free photos and vectors.

If you’re looking for how much is e and o insurance images information connected with to the how much is e and o insurance interest, you have visit the right blog. Our website always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

How Much Is E And O Insurance. Learn more about texas e&o for real estate companies. The average amount of coverage, or liability limit, for similar startups is. You can purchase e&o insurance from most licensed insurance agents; The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

What does E&O Insurance Cover? LiabilityCover.ca From liabilitycover.ca

What does E&O Insurance Cover? LiabilityCover.ca From liabilitycover.ca

This is only an estimate. E&o insurance usually renews in the month of october for most agents, which is quickly approaching. This varies based on your needs. The average annual cost of $1,000,000 worth of coverage typically falls between $5,000 and $10,000 for companies with revenue below $50 million a year. In higher revenue brackets, the cost of directors and officers coverage varies in part due to risks. Today, it’s more typical to see.

The median cost of professional liability insurance is about $145 per month for architects, or $1,730 annually.

But be sure to read the entire policy, for the premium and. Some companies, however, want nsas they hire to carry more coverage. The median cost of professional liability insurance is about $145 per month for architects, or $1,730 annually. Compare errors and omissions insurance quotes for your company get free quotes Not all e&o policies are priced the same, or have the same definitions or coverages, so we wanted to inform you about this necessary coverage that many agents don’t pay attention to…until it’s too late. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Similar startups with liability limits less than $1m typically have an average premium of. Find here detailed information about errors and. E&o insurance usually renews in the month of october for most agents, which is quickly approaching. In higher revenue brackets, the cost of directors and officers coverage varies in part due to risks. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year.

Source: designjewelrys.blogspot.com

Source: designjewelrys.blogspot.com

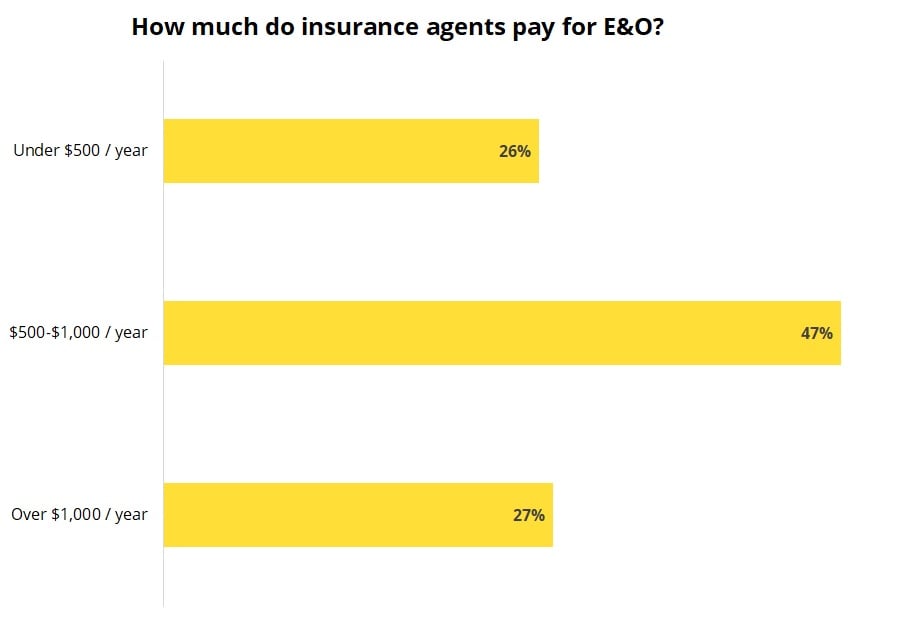

You can purchase e&o insurance from most licensed insurance agents; New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. Most small businesses pay an annual premium between $500 and $1,000 for e&o insurance. The price per $1m of d&o coverage further decreases as you purchase higher coverage limits. The average e&o premium for startups with employees, in funding and in estimated annual revenue is.

Source: liabilitycover.ca

Source: liabilitycover.ca

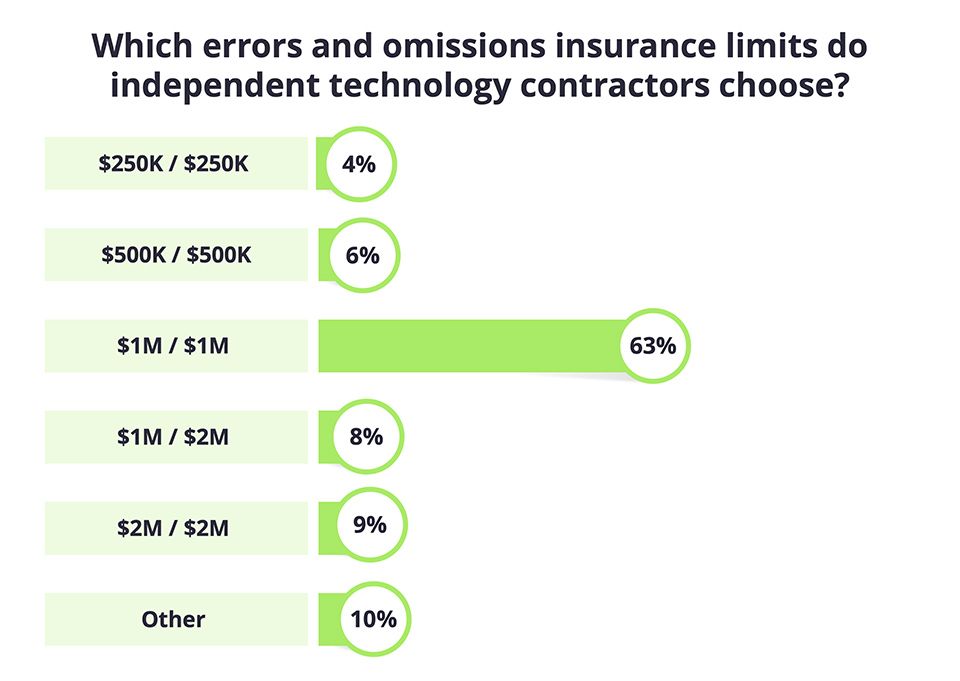

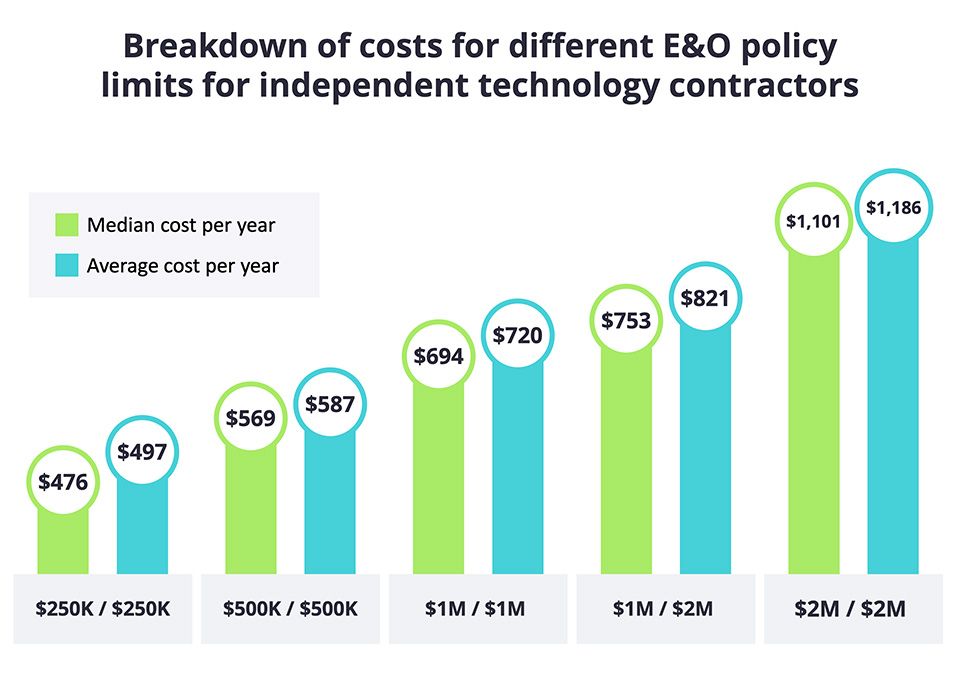

How much e&o insurance do i need? Tech e&o insurance costs vary from an average of roughly $730 per year to more than $1,400. Most small business owners (51%) pay between $500 and $1,000 per year for their e&o policy, and 18% pay less than $500. Average costs for e&o coverage are usually $500 to $1,000 per employee, per year. Similar startups with liability limits less than $1m typically have an average premium of.

Source: designjewelrys.blogspot.com

Source: designjewelrys.blogspot.com

How much e&o insurance do i need? The days of $1,500 errors and omissions insurance with a $5,000 deductible are quickly coming to an end. But be sure to read the entire policy, for the premium and. For example, a real estate agent might need to purchase a real estate e&o policy and provide a certificate of insurance before signing on with a broker. When we get quotes online from the best 4 insurance companies that we recommend below, notary e&o insurance costs are in the range of $30 to $104 a month.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

The average amount of coverage, or liability limit, for similar startups is. Compare errors and omissions insurance quotes for your company get free quotes This meets the state�s guidelines with no additional charge to you. E&o insurance usually renews in the month of october for most agents, which is quickly approaching. The standard recommended by the signing professionals workgroup is $25,000.

Source: designjewelrys.blogspot.com

Source: designjewelrys.blogspot.com

An extra forty dollars on your purchase protects you for four years—ten dollars a year,.027 cents a day, for peace of mind. Not all e&o policies are priced the same, or have the same definitions or coverages, so we wanted to inform you about this necessary coverage that many agents don’t pay attention to…until it’s too late. The median cost of professional liability insurance is about $145 per month for architects, or $1,730 annually. If the notary is not careless, doesn�t miss deadlines or lose packages, then what is the reason? Errors and omissions (e&o) insurance cost are about $1,735 (for a business with 10 or fewer employees).

Source: liabilitycover.ca

Source: liabilitycover.ca

The average annual cost of $1,000,000 worth of coverage typically falls between $5,000 and $10,000 for companies with revenue below $50 million a year. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. Similar startups with liability limits less than $1m typically have an average premium of. The average e&o premium for startups with employees, in funding and in estimated annual revenue is. Find here detailed information about errors and.

Source: grahaminsuranceinc.com

Source: grahaminsuranceinc.com

Some companies, however, want nsas they hire to carry more coverage. This is only an estimate. Compare errors and omissions insurance quotes for your company get free quotes Learn more about texas e&o for real estate companies. You can purchase e&o insurance from most licensed insurance agents;

Source: techinsurance.com

Source: techinsurance.com

Errors and omissions insurance typically covers costs up to a predetermined dollar amount. Average costs for e&o coverage are usually $500 to $1,000 per employee, per year. The average amount of coverage, or liability limit, for similar startups is. How much does a colorado e&o policy cost? Learn more about texas e&o for real estate companies.

Source: designjewelrys.blogspot.com

Source: designjewelrys.blogspot.com

This is only an estimate. This varies based on your needs. E&o insurance is typically customized to meet specific needs of a business or industry. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. In colorado, e&o insurance for a mortgage loan originator license has a minimum coverage of $100,000 per occurrence and a minimum aggregate limit of $300,000.

Source: blog.suretysolutions.com

Source: blog.suretysolutions.com

The amount a company pays depends on various factors, including: When we get quotes online from the best 4 insurance companies that we recommend below, notary e&o insurance costs are in the range of $30 to $104 a month. The average annual cost of $1,000,000 worth of coverage typically falls between $5,000 and $10,000 for companies with revenue below $50 million a year. But be sure to read the entire policy, for the premium and. An extra forty dollars on your purchase protects you for four years—ten dollars a year,.027 cents a day, for peace of mind.

Source: techinsurance.com

Source: techinsurance.com

New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. The median cost of professional liability insurance is about $145 per month for architects, or $1,730 annually. Instant proof of e and o insurance Not all e&o policies are priced the same, or have the same definitions or coverages, so we wanted to inform you about this necessary coverage that many agents don’t pay attention to…until it’s too late. Average costs for e&o coverage are usually $500 to $1,000 per employee, per year.

Source: fashion-paulaola.blogspot.com

Source: fashion-paulaola.blogspot.com

Compare errors and omissions insurance quotes for your company get free quotes You can purchase e&o insurance from most licensed insurance agents; Errors and omissions insurance typically covers costs up to a predetermined dollar amount. The average e&o premium for startups with employees, in funding and in estimated annual revenue is. The average amount of coverage, or liability limit, for similar startups is.

Source: bravopolicy.com

This varies based on your needs. Find here detailed information about errors and. Similar startups with liability limits less than $1m typically have an average premium of. The cost of e&o insurance, however, depends,. An extra forty dollars on your purchase protects you for four years—ten dollars a year,.027 cents a day, for peace of mind.

Source: bravopolicy.com

Source: bravopolicy.com

Today, it’s more typical to see. This varies based on your needs. Instant proof of e and o insurance We analyzed data from more than 5000 customers showed, the average yearly cost of errors & omissions (e&o) insurance for a small business is $767.24. The average amount of coverage, or liability limit, for similar startups is.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Tech e&o insurance costs vary from an average of roughly $730 per year to more than $1,400. We analyzed data from more than 5000 customers showed, the average yearly cost of errors & omissions (e&o) insurance for a small business is $767.24. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. Compare errors and omissions insurance quotes for your company get free quotes

Source: proinsgrp.com

Source: proinsgrp.com

The days of $1,500 errors and omissions insurance with a $5,000 deductible are quickly coming to an end. Compare errors and omissions insurance quotes for your company get free quotes Errors and omissions (e&o) insurance cost are about $1,735 (for a business with 10 or fewer employees). Most small business owners (51%) pay between $500 and $1,000 per year for their e&o policy, and 18% pay less than $500. Tech e&o insurance costs vary from an average of roughly $730 per year to more than $1,400.

Source: spectora.com

Source: spectora.com

Instant proof of e and o insurance The price per $1m of d&o coverage further decreases as you purchase higher coverage limits. When we get quotes online from the best 4 insurance companies that we recommend below, notary e&o insurance costs are in the range of $30 to $104 a month. As a yearly median cost this is $600. Tech e&o insurance costs vary from an average of roughly $730 per year to more than $1,400.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is e and o insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.