How much is flood insurance in idaho Idea

Home » Trending » How much is flood insurance in idaho IdeaYour How much is flood insurance in idaho images are ready. How much is flood insurance in idaho are a topic that is being searched for and liked by netizens now. You can Get the How much is flood insurance in idaho files here. Get all royalty-free vectors.

If you’re searching for how much is flood insurance in idaho images information related to the how much is flood insurance in idaho interest, you have come to the ideal blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

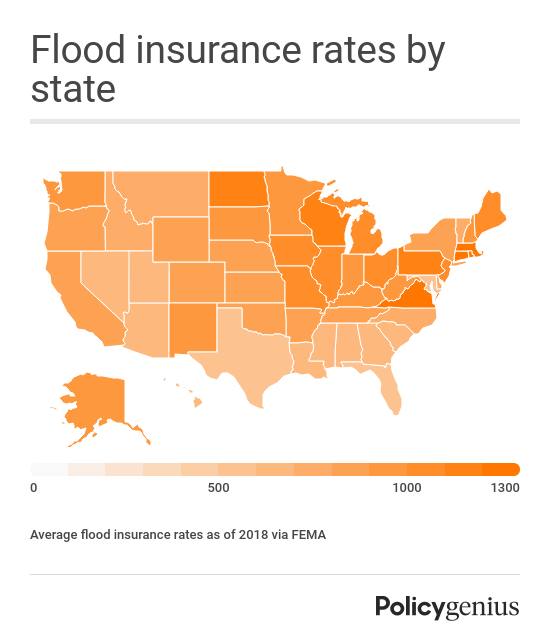

How Much Is Flood Insurance In Idaho. The average cost of home insurance varies and depends on some many factors that is is impossible to estimate without getting a quote for the specific property. A flood insurance policy through the nfip costs around $700 annually, but the cost of your own policy will depend on which flood zone you’re in and the bfe of your property. Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s. How much does flood insurance cost in zone a.

Flood Insurance Home Insurance Findlay, OH From trwilliamsinsurance.com

Flood Insurance Home Insurance Findlay, OH From trwilliamsinsurance.com

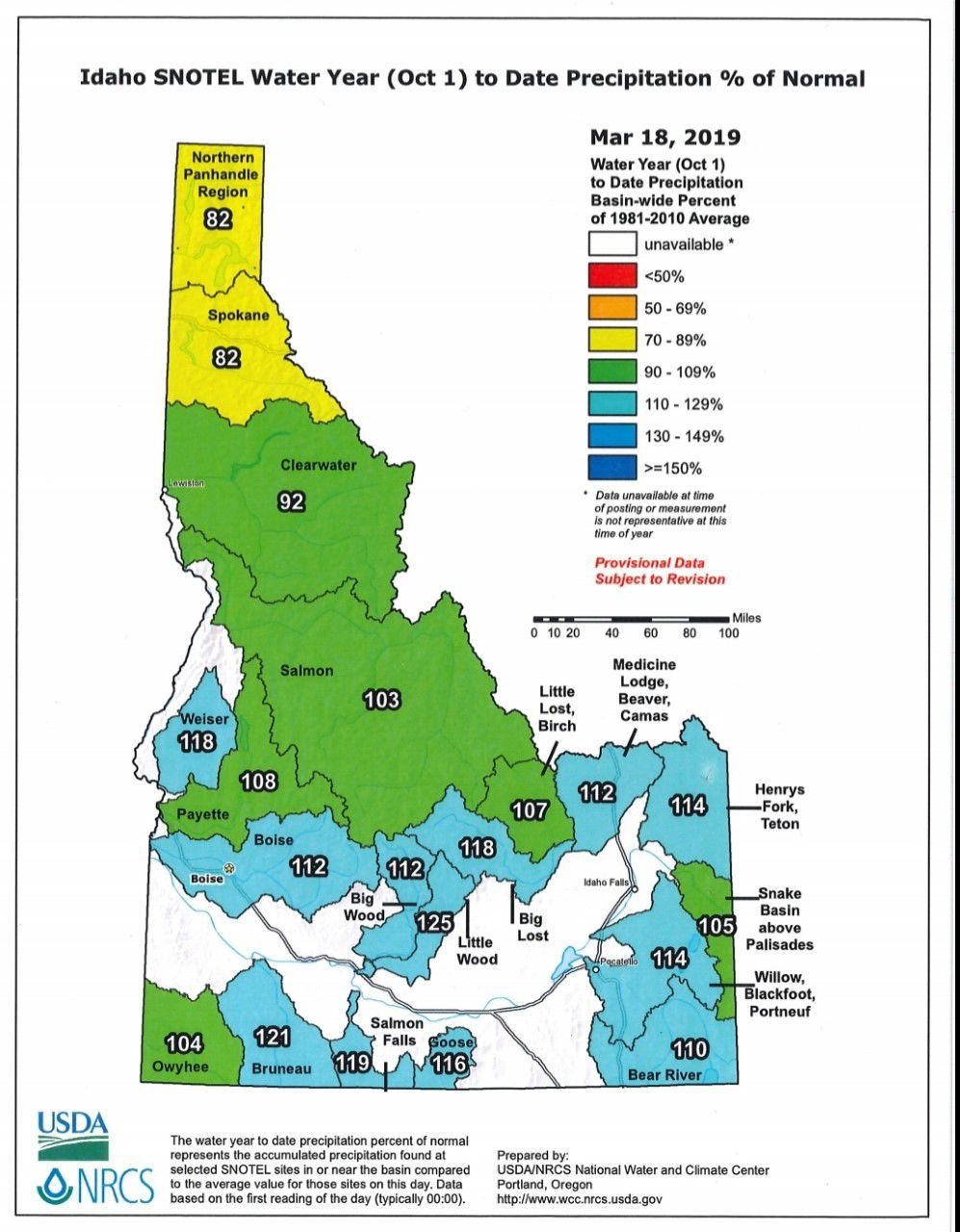

Insurance for homes in this flood zone range anywhere from $1,000 to $10,000. A flood insurance policy through the nfip costs around $700 annually, but the cost of your own policy will depend on which flood zone you’re in and the bfe of your property. The average cost of home insurance varies and depends on some many factors that is is impossible to estimate without getting a quote for the specific property. Though idaho is hundreds miles from the ocean and has never felt the impact of a hurricane, we know firsthand the damage that can be done by floods.many cities, such as boise, twin falls, weiser and hailey, are still picking up the pieces after spring floods in 2017 damaged houses and. The national flood insurance program offers federally backed insurance for property owners in communities throughout idaho who participate in the program, and have agreed to adopt or enforce ordinances that meet fema minimum building requirements in special flood hazard areas (sfha). Ada, idaho has 325 effective policies with $174,308 in written premiums.

But if you want the cheapest rates end you can expect to pay around $300 annually.

We want to cover what will stay and what will be different once this update kicks in on october 1st, 2021. This type of history is bound to impact flood insurance with the federal government, so we want to unpack the good, the bad, and the ugly changes for the cost of flood insurance in idaho with the risk rating 2.0. Most homeowners insurance does not cover flood damage. The average flood policy rate is $536 for ada, idaho. 3023 e copper point dr ste. There is no need for your home to be located within a high risk zone if you’re.

Source: idahonews.com

Source: idahonews.com

This type of history is bound to impact flood insurance with the federal government, so we want to unpack the good, the bad, and the ugly changes for the cost of flood insurance in idaho with the risk rating 2.0. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. The cost of flood insurance is based on a number of factors including the depth of flooding and the value of the affected property. Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30. Flood insurance in idaho boise has the most flood policies in the state with 820 active policies.

Source: woodriverinsurance.com

Source: woodriverinsurance.com

The cost of flood insurance is based on a number of factors including the depth of flooding and the value of the affected property. For example, an elevated risk — the “ae” zones — are able to get flood insurance via fema for close to $533 per year for properties four. Free quotes, secure form, no spam. This type of history is bound to impact flood insurance with the federal government, so we want to unpack the good, the bad, and the ugly changes for the cost of flood insurance in idaho with the risk rating 2.0. The average flood policy rate is $536 for ada, idaho.

Source: boisestatepublicradio.org

Source: boisestatepublicradio.org

203 meridian, id 83642 phone: In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. The average cost per policy in idaho through the nfip is $656.65. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected.

Source: topsdecor.com

Source: topsdecor.com

How much does flood insurance cost in zone a. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. How much does flood insurance cost in zone a. The nfip lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. For example, an elevated risk — the “ae” zones — are able to get flood insurance via fema for close to $533 per year for properties four.

Source: wrightfloodadvice.org

Source: wrightfloodadvice.org

3023 e copper point dr ste. The national flood insurance program offers federally backed insurance for property owners in communities throughout idaho who participate in the program, and have agreed to adopt or enforce ordinances that meet fema minimum building requirements in special flood hazard areas (sfha). Private flood insurance companies provide coverage for your building property and your personal property, while nfip flood insurance requires you to buy these two coverages separately. But if you want the cheapest rates end you can expect to pay around $300 annually. 3023 e copper point dr ste.

Source: idahoinsuranceforless.com

Source: idahoinsuranceforless.com

Flood insurance in idaho boise has the most flood policies in the state with 820 active policies. The nfip lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. Management involves reviewing city ordinances created to deal with floodplain problems, assisting communities to adopt floodplain ordinances and qualify for the nfip, which makes it possible for citizens to qualify for fema. Costs vary by state, and can be as cheap as $550 a year. Private flood insurance companies provide coverage for your building property and your personal property, while nfip flood insurance requires you to buy these two coverages separately.

Source: haddockins.com

Source: haddockins.com

Get flood prices and estimates for boise. 203 meridian, id 83642 phone: It’s highly recommended to get flood insurance if your home is in this zone. This type of history is bound to impact flood insurance with the federal government, so we want to unpack the good, the bad, and the ugly changes for the cost of flood insurance in idaho with the risk rating 2.0. How much does flood insurance cost in zone a.

Source: news.cuna.org

Source: news.cuna.org

This difference affects cost because nfip insurance requires you to pay your deductible twice—once for building coverage and once for personal property coverage when. We want to cover what will stay and what will be different once this update kicks in on october 1st, 2021. 203 meridian, id 83642 phone: A $200 policy for a home 100 miles off the coast is a little cost to pay when you consider the capability of category 5 typhoon to flood your home. Private flood insurance companies provide coverage for your building property and your personal property, while nfip flood insurance requires you to buy these two coverages separately.

Source: medium.com

A $200 policy for a home 100 miles off the coast is a little cost to pay when you consider the capability of category 5 typhoon to flood your home. 3023 e copper point dr ste. How much is flood insurance in idaho? Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. Flood zones with the highest risk are classified as special flood hazard areas, or sfhas, and include both a and v zones.

Source: idahoinsuranceforless.com

Source: idahoinsuranceforless.com

The average cost per policy in idaho through the nfip is $656.65. 3023 e copper point dr ste. How much does flood insurance cost? But if you want the cheapest rates end you can expect to pay around $300 annually. If your flood insurance is set to increase under the new guidelines, there are several actions you can take to get your rates back down

Source: trwilliamsinsurance.com

Source: trwilliamsinsurance.com

Most homeowners insurance does not cover flood damage. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. Insurance for homes in this flood zone range anywhere from $1,000 to $10,000. 3023 e copper point dr ste. We want to cover what will stay and what will be different once this update kicks in on october 1st, 2021.

Source: memorial-insurance.com

Source: memorial-insurance.com

A flood insurance policy through the nfip costs around $700 annually, but the cost of your own policy will depend on which flood zone you’re in and the bfe of your property. Private flood insurance companies provide coverage for your building property and your personal property, while nfip flood insurance requires you to buy these two coverages separately. Costs vary by state, and can be as cheap as $550 a year. The average flood policy rate is $536 for ada, idaho. Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30.

Source: smallbusinessbrain.com

Source: smallbusinessbrain.com

The cost of flood insurance is based on a number of factors including the depth of flooding and the value of the affected property. The low average additionally features the extraordinary worth one can discover in a flood insurance policy. Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s. The national flood insurance program offers federally backed insurance for property owners in communities throughout idaho who participate in the program, and have agreed to adopt or enforce ordinances that meet fema minimum building requirements in special flood hazard areas (sfha). How much does flood insurance cost in zone a.

Source: slideshare.net

Source: slideshare.net

The average annual flood insurance policy can cost anywhere from as little as $50 to as much as $2,000 or more per year. A $200 policy for a home 100 miles off the coast is a little cost to pay when you consider the capability of category 5 typhoon to flood your home. This difference affects cost because nfip insurance requires you to pay your deductible twice—once for building coverage and once for personal property coverage when. The cost of flood insurance is based on a number of factors including the depth of flooding and the value of the affected property. The low average additionally features the extraordinary worth one can discover in a flood insurance policy.

Source: wsj.com

Source: wsj.com

The low average additionally features the extraordinary worth one can discover in a flood insurance policy. How much is flood insurance in idaho? Most homeowners insurance does not cover flood damage. Flood insurance in idaho boise has the most flood policies in the state with 820 active policies. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage.

Source: blogs.lse.ac.uk

Source: blogs.lse.ac.uk

How much is flood insurance in idaho? The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip). Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30. If your flood insurance is set to increase under the new guidelines, there are several actions you can take to get your rates back down It’s highly recommended to get flood insurance if your home is in this zone.

Source: idahohousing.com

Source: idahohousing.com

Most homeowners insurance does not cover flood damage. Insurance for homes in this flood zone range anywhere from $1,000 to $10,000. Flood insurance in idaho boise has the most flood policies in the state with 820 active policies. Since there are so many factors, it’s often hard to give an exact estimate. This type of history is bound to impact flood insurance with the federal government, so we want to unpack the good, the bad, and the ugly changes for the cost of flood insurance in idaho with the risk rating 2.0.

Source: rexburgstandardjournal.com

Source: rexburgstandardjournal.com

How much does flood insurance cost in zone a. If your flood insurance is set to increase under the new guidelines, there are several actions you can take to get your rates back down The average annual flood insurance policy can cost anywhere from as little as $50 to as much as $2,000 or more per year. How much does flood insurance cost in zone a. The cost of flood insurance is based on a number of factors including the depth of flooding and the value of the affected property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is flood insurance in idaho by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.