How much is flood insurance in md information

Home » Trending » How much is flood insurance in md informationYour How much is flood insurance in md images are available in this site. How much is flood insurance in md are a topic that is being searched for and liked by netizens now. You can Get the How much is flood insurance in md files here. Find and Download all free images.

If you’re looking for how much is flood insurance in md images information related to the how much is flood insurance in md topic, you have come to the ideal blog. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

How Much Is Flood Insurance In Md. Florida is closely followed by maryland and texas, two other states that. Given that so many homes in the u.s. Need help from a flood expert? The biggest factor in the premium is what md flood zone your business is in, followed by how much you want to insure.

How Much Is Flood Insurance In Md Oxbow Levee From escolheoesmalte.blogspot.com

How Much Is Flood Insurance In Md Oxbow Levee From escolheoesmalte.blogspot.com

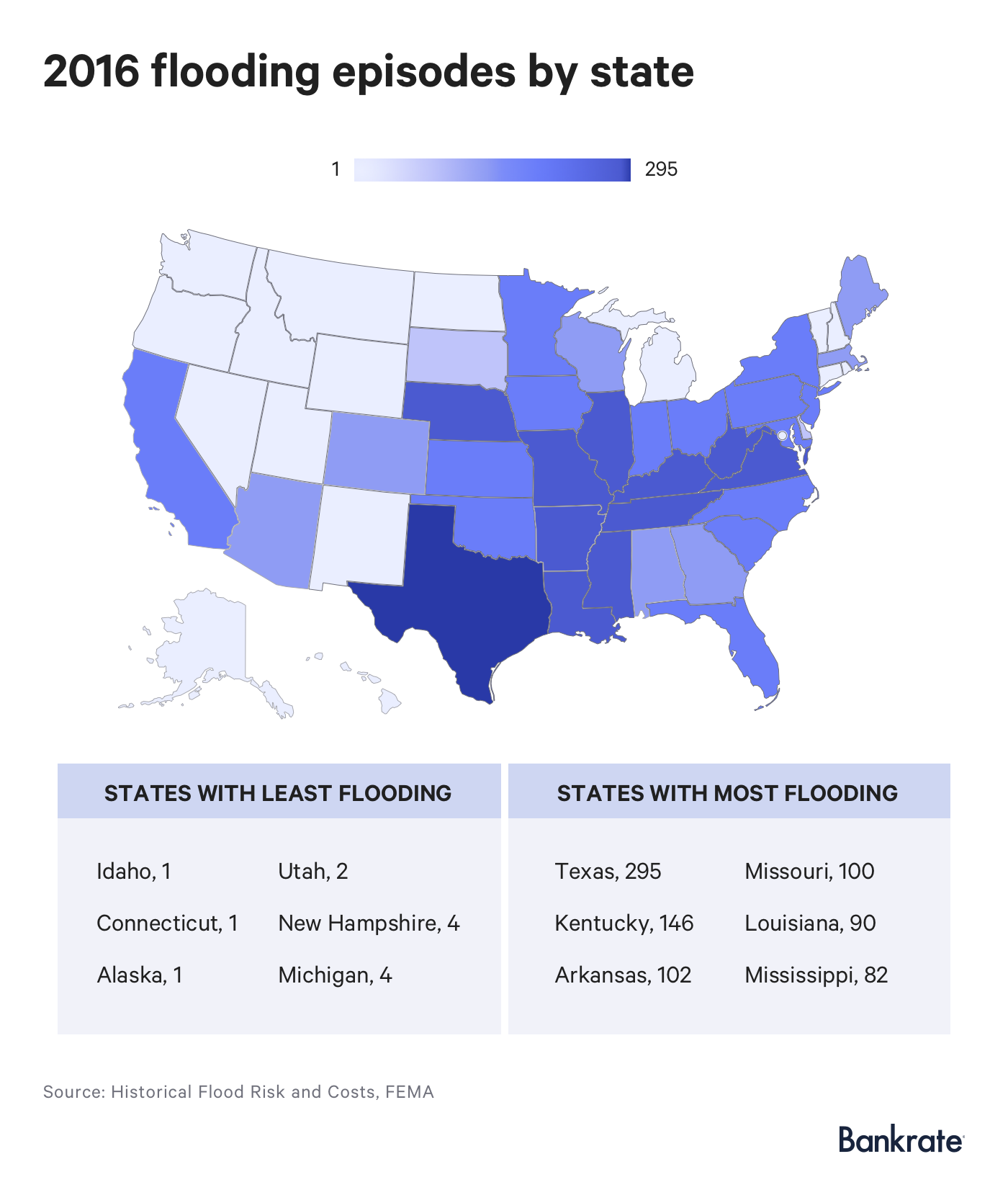

If you live in a flood prone area, you may be wondering how much flood insurance costs, and whether or not you can afford it. The actual amount that will be covered depends on the value of the property and the extent of the loss. Average cost of flood insurance by state. The average expense of the national flood insurance program (nfip) inclusion was $707, as per the most recent information given by the federal emergency management agency (fema). How much can water damage cost me? Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote.

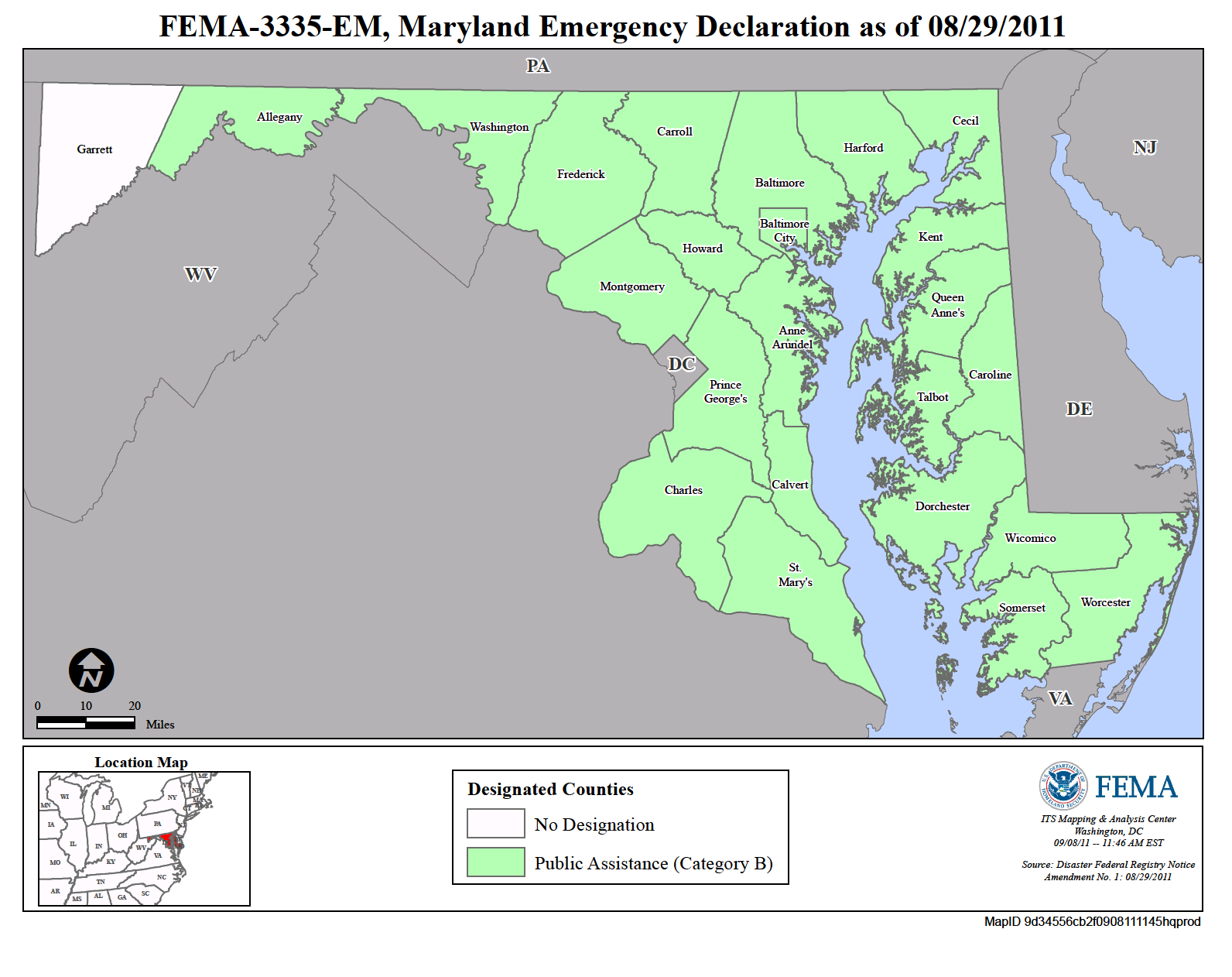

The dfirms are digitally converted flood insurance rates maps that will be compatible with gis (geographic information systems).

The average flood rate rises to $837 in washington, maryland. Rates are based on the level of flood risk posed to the property. Compare how much the average homeowner in each state pays for. A flood insurance policy normally takes 30 days from the date of purchase to go into effect. Your chances of being flooded are much greater than some other risks you face daily. As little as one inch of water damage can lead to a total of $26,807 in damage to a 2500 square foot home.

The federal emergency management agency. People are often surprised to learn that their homeowners insurance doesn’t cover flood damage. States with the lowest average flood insurance costs. Are at risk for flooding and the ensuing financial. The biggest factor in the premium is what md flood zone your business is in, followed by how much you want to insure.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

The average flood claim payout from the national flood insurance program (nfip) in 2019 was $52,000. With more water, the damage costs rise along with it. Flood insurance rates vary, depending on how much coverage you buy, what you need to cover and your property�s flood risk. The average flood rate in st. Flood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

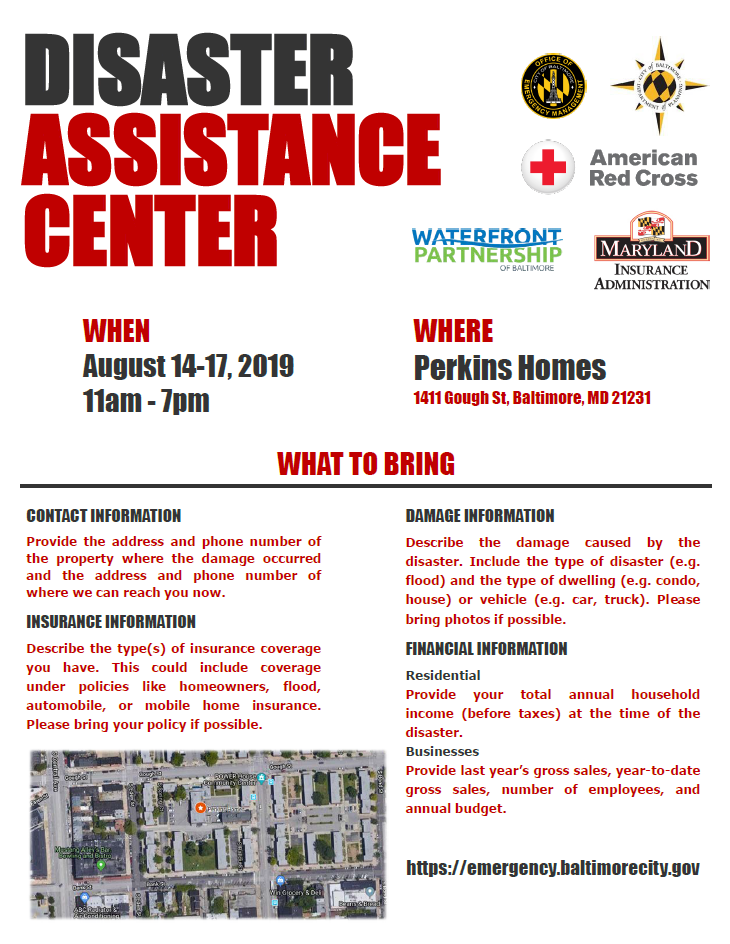

The national flood insurance program (nfip) in maryland defines a flood as a general and temporary condition. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. These insurance policies are regulated by the maryland insurance administration. Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. If a covered peril occurs, such as snowmelt or heavy rains causing rivers, lakes, ponds and streams to flood, maryland flood insurance is the last line of protection.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

One or both of these. The average flood rate in st. openfema. accessed october 21, 2021. If your home or business is in a special hazard flood zone and you have a mortgage, it is a good idea to check with your lender to confirm that the private flood. Based on statistics from the national flood insurance program, floods are the #1 natural disaster in the country.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. Given that so many homes in the u.s. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. People are often surprised to learn that their homeowners insurance doesn’t cover flood damage. How much is flood insurance in md.

Source: escolheoesmalte.blogspot.com

Most standard homeowners’ policies do not cover flood damage. The dfirms are digitally converted flood insurance rates maps that will be compatible with gis (geographic information systems). For example, the average annual coverage cost through the national flood insurance program is low—between $600 and $700 (less than $60 a month). Floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. The biggest factor in the premium is what md flood zone your business is in, followed by how much you want to insure.

Source: npa1.org

Compare how much the average homeowner in each state pays for. Need help from a flood expert? The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. One or both of these. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote.

Source: dsignwesome.blogspot.com

Source: dsignwesome.blogspot.com

States with the lowest average flood insurance costs. Cost depends on a number of factors, like how much insurance is purchased, what it covers, and the property’s flood risk. The average flood claim payout from the national flood insurance program (nfip) in 2019 was $52,000. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. How much can water damage cost me?

Cost depends on a number of factors, like how much insurance is purchased, what it covers, and the property’s flood risk. Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. Floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. Floods cost america, on average, $8.2 billion each year (according to 2015. However, it can lead to loss of life or damaged property due to water or mudflow.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

$655 is the average flood rate in talbot, maryland. Rates are based on the level of flood risk posed to the property. Most standard homeowners’ policies do not cover flood damage. Flood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters. Remember that nfip arrangements have the greatest inclusion breaking point of $250,000 for your home and $100,000 for the stuff in your home.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. For protection against damage caused by flooding, you will need to purchase a separate flood policy. Based on statistics from the national flood insurance program, floods are the #1 natural disaster in the country. Most standard homeowners’ policies do not cover flood damage. 1% of policyholders (624 policies) will see an increase of greater than.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

Flood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters. Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. People are often surprised to learn that their homeowners insurance doesn’t cover flood damage. Talbot has 1,614 flood policies in effect with $1,057,707 in flood premium. The average flood rate rises to $837 in washington, maryland.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

Of course, if your property has increased flood risk, you can�t really afford not to have flood insurance, and furthermore your lender may require you. Compare how much the average homeowner in each state pays for. States with the lowest average flood insurance costs. Average cost of flood insurance by state. The federal emergency management agency.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

Compare how much the average homeowner in each state pays for. Need help from a flood expert? Cost depends on a number of factors, like how much insurance is purchased, what it covers, and the property’s flood risk. How much does flood insurance cost? Are at risk for flooding and the ensuing financial.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

For example, the average annual coverage cost through the national flood insurance program is low—between $600 and $700 (less than $60 a month). It can be more in higher risk areas. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). Also, you can get a national flood insurance program that will cover as much as $100,000 in personal possessions.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

Are at risk for flooding and the ensuing financial. How much is flood insurance in md. Since flooding is the most common natural disaster in the u.s., it’s imperative that everyone in maryland keeps adequate flood insurance to protect their property and belongings. Remember that nfip arrangements have the greatest inclusion breaking point of $250,000 for your home and $100,000 for the stuff in your home. For protection against damage caused by flooding, you will need to purchase a separate flood policy.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

How much can water damage cost me? With more water, the damage costs rise along with it. For example, the average annual coverage cost through the national flood insurance program is low—between $600 and $700 (less than $60 a month). It can be more in higher risk areas. People are often surprised to learn that their homeowners insurance doesn’t cover flood damage.

Source: bandrdesign.com

Source: bandrdesign.com

For example, the average annual coverage cost through the national flood insurance program is low—between $600 and $700 (less than $60 a month). Depending on the type of policy (s) you purchase, flood insurance purchased through the federally regulated national flood insurance program (nfip) covers building property damage up to $250,000, personal property up to $100,000, or both. A flood insurance policy normally takes 30 days from the date of purchase to go into effect. If a covered peril occurs, such as snowmelt or heavy rains causing rivers, lakes, ponds and streams to flood, maryland flood insurance is the last line of protection. openfema. accessed october 21, 2021.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is flood insurance in md by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.