How much is flood insurance in nc information

Home » Trend » How much is flood insurance in nc informationYour How much is flood insurance in nc images are available in this site. How much is flood insurance in nc are a topic that is being searched for and liked by netizens today. You can Download the How much is flood insurance in nc files here. Download all free photos.

If you’re searching for how much is flood insurance in nc images information related to the how much is flood insurance in nc interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

How Much Is Flood Insurance In Nc. The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. Therefore, federal flood insurance is available to everyone in craven county. How much flood insurance should i buy in north carolina? The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk.

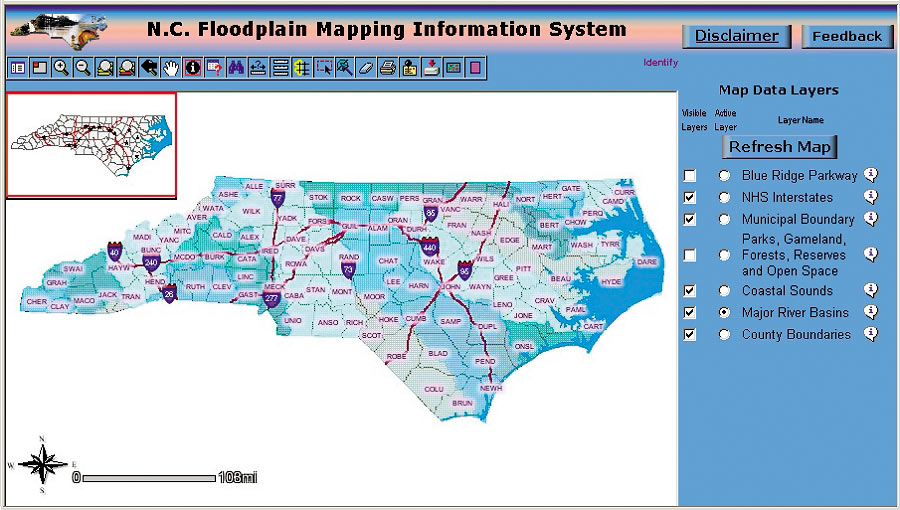

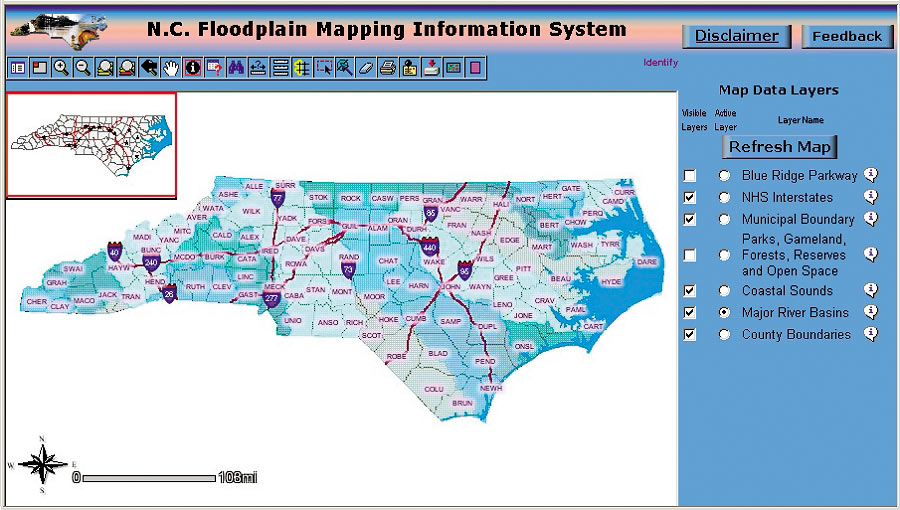

Esri News ArcNews Spring 2002 Issue North Carolina From esri.com

Esri News ArcNews Spring 2002 Issue North Carolina From esri.com

Protect your home and belongings from devastating water damage with flood insurance. In fact pretty much everything east of raleigh is in a flood zone of some sort. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. What determines the cost of flood insurance in zone ae. Costs vary by state, and can be as cheap as $550 a year. But if your home is new construction and is valued at $250,000, your premium cost could be minimal.

Typically, the cost of flood insurance in north carolina can.

The north carolina department of insurance is also available to help consumers with insurance related questions. The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. How much does flood insurance cost? In fact pretty much everything east of raleigh is in a flood zone of some sort. Contact ncdoi employee directory careers at ncdoi calendar

Source: esri.com

Source: esri.com

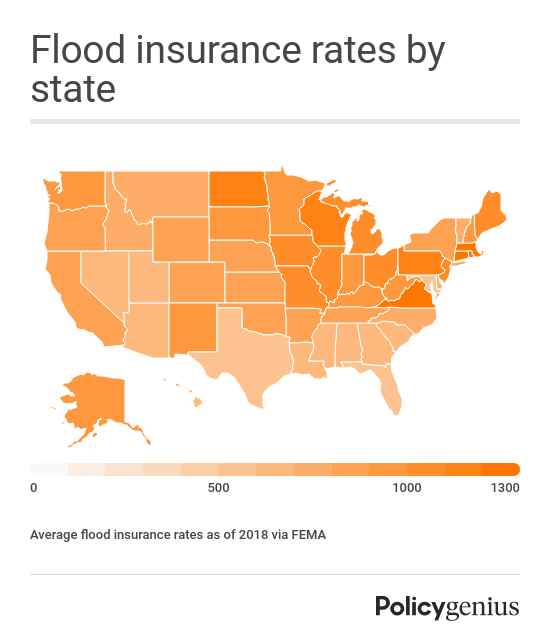

These are generally because most of the structures have a negative base flood elevation. Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). This insurance covers damage to your home’s foundation and equipment, including the. Average cost of flood insurance by state. Typically, the cost of flood insurance in north carolina can.

Source: oakcityinsurancellc.com

Source: oakcityinsurancellc.com

The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. Flood zone ae also referred to as the 100 year flood zone has the highest premiums other than coastal areas. There are different types of flood zones ranging from areas that f is not required (low to no premiums) to areas that are dangerously close to being swept away by the ocean (high premiums). Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. There are 76 communities in north carolina that qualify for discounts because they use a community rating system.

Source: dickeymccay.com

Source: dickeymccay.com

Flood insurance costs are based on: Fema creates flood insurance rate maps (firms) for each community across the united states. In our research, we found the average cost of flood insurance for north carolina homeowners to be $718 per year. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. In fact pretty much everything east of raleigh is in a flood zone of some sort.

Source: outerbanksproperty.org

Source: outerbanksproperty.org

Protect your home and belongings from devastating water damage with flood insurance. Average cost of flood insurance by state. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip). What determines the cost of flood insurance in zone ae.

Source: valuepenguin.com

Source: valuepenguin.com

The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. There are 76 communities in north carolina that qualify for discounts because they use a community rating system. In fact pretty much everything east of raleigh is in a flood zone of some sort. Compare how much the average homeowner in each state pays for. Flood zonesyearly flood insurance rateall a and v zones (sfhas)$962moderate to low flood hazard areas$4857 jui.

Source: policygenius.com

Source: policygenius.com

How much does flood insurance cost? Flood zone ae also referred to as the 100 year flood zone has the highest premiums other than coastal areas. According to personal finance data website valuepenguin, the average cost of flood insurance for north carolina homeowners is $718 every year. What determines the cost of flood insurance in zone ae. Homeowners can purchase a maximum of $250,000 in structural coverage, while businesses have a limit of $500,000.

Source: betterflood.com

Source: betterflood.com

Free quotes, secure form, no spam. Therefore, federal flood insurance is available to everyone in craven county. There are 76 communities in north carolina that qualify for discounts because they use a community rating system. Among cities we surveyed, raleigh had the highest rates, with an average premium of $944 per year. The average cost of flood insurance in 2021 is $958 per year, or $80 a month, through the national flood insurance program (nfip)….cost of flood insurance in sfhas.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

Typically, the cost of flood insurance in north carolina can. Compare how much the average homeowner in each state pays for. In fact pretty much everything east of raleigh is in a flood zone of some sort. Protect your home and belongings from devastating water damage with flood insurance. How much does north carolina flood insurance cost?

Source: insurancejournal.com

Source: insurancejournal.com

This insurance covers damage to your home’s foundation and equipment, including the. Call your insurance agent regarding these rates and other information specific to your policy. This insurance covers damage to your home’s foundation and equipment, including the. Posted on august 30, 2020 august 30, 2020 by admin it is not always possible to determine the amount of damage floods can cause on your brevard, nc residential, or commercial property. There are different types of flood zones ranging from areas that f is not required (low to no premiums) to areas that are dangerously close to being swept away by the ocean (high premiums).

Source: cbsnews.com

Source: cbsnews.com

The north carolina department of insurance is also available to help consumers with insurance related questions. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. Free quotes, secure form, no spam. How much flood insurance should i buy in north carolina? So what determines the premiums of these zones?

Source: pewtrusts.org

Source: pewtrusts.org

Average cost of flood insurance by state. Don�t panic, it is not as bad as it seems. This article will detail how flood insurance rates are determined, and help you find ways to save on flood insurance cost. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip). There are 76 communities in north carolina that qualify for discounts because they use a community rating system.

Source: northcarolinafloodinsurance.org

Source: northcarolinafloodinsurance.org

Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). Flood insurance costs are based on: Average cost of flood insurance by state. Under the crs, the flood insurance premiums of a community’s residents and businesses are discounted to reflect that community’s work to reduce flood damage to existing buildings, manage development in areas not mapped by the nfip, protect new buildings beyond the minimum nfip protection level, preserve and/or restore natural functions of floodplains, help. The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. Compare how much the average homeowner in each state pays for. How much does flood insurance cost? Among cities we surveyed, raleigh had the highest rates, with an average premium of $944 per year.

Source: insuranceclaimlawyerblog.com

Source: insuranceclaimlawyerblog.com

How much flood insurance should i buy in north carolina? Costs vary by state, and can be as cheap as $550 a year. According to personal finance data website valuepenguin, the average cost of flood insurance for north carolina homeowners is $718 every year. But if your home is new construction and is valued at $250,000, your premium cost could be minimal. Rates for coverage are standard across the united states.

Source: betterflood.com

Source: betterflood.com

Call your insurance agent regarding these rates and other information specific to your policy. Free quotes, secure form, no spam. The average cost for $100,000 of coverage in north carolina is $370 per year. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip). Protect your home and belongings from devastating water damage with flood insurance.

How much does north carolina flood insurance cost? Among cities we surveyed, raleigh had the highest rates, with an average premium of $944 per year. Fema creates flood insurance rate maps (firms) for each community across the united states. Flood zonesyearly flood insurance rateall a and v zones (sfhas)$962moderate to low flood hazard areas$4857 jui. In our research, we found the average cost of flood insurance for north carolina homeowners to be $718 per year.

Source: renttoownnc.net

Source: renttoownnc.net

Under the crs, the flood insurance premiums of a community’s residents and businesses are discounted to reflect that community’s work to reduce flood damage to existing buildings, manage development in areas not mapped by the nfip, protect new buildings beyond the minimum nfip protection level, preserve and/or restore natural functions of floodplains, help. How much does flood insurance cost? Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these north carolina flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Under the crs, the flood insurance premiums of a community’s residents and businesses are discounted to reflect that community’s work to reduce flood damage to existing buildings, manage development in areas not mapped by the nfip, protect new buildings beyond the minimum nfip protection level, preserve and/or restore natural functions of floodplains, help. You definitely want to feel confident your home and belongings are covered during hurricane season.

Source: northcarolinafloodinsurance.org

Source: northcarolinafloodinsurance.org

Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these north carolina flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. How much does flood insurance cost? How much does flood insurance cost in durham, nc? So what determines the premiums of these zones? Average cost of flood insurance by state.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is flood insurance in nc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.