How much is flood insurance in oklahoma information

Home » Trending » How much is flood insurance in oklahoma informationYour How much is flood insurance in oklahoma images are ready. How much is flood insurance in oklahoma are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is flood insurance in oklahoma files here. Download all royalty-free photos.

If you’re looking for how much is flood insurance in oklahoma images information linked to the how much is flood insurance in oklahoma interest, you have pay a visit to the right blog. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

How Much Is Flood Insurance In Oklahoma. Is there help for the residents of oklahoma? It is sold by the federal government, through local insurance agents. A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to. Iwantinsurance.com is your one stop shop for flood insurance quotes and agents.

Homeowners Insurance in Oklahoma From everquote.com

Homeowners Insurance in Oklahoma From everquote.com

It is sold by the federal government, through local insurance agents. The federal emergency management agency (fema) is rolling out changes when it comes to flood insurance rates across all states in the country. When flood insurance is required. A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to. In 2019, the arkansas river that runs through oklahoma reached its highest water level ever recorded, causing weeks of flooding to farm lands, closing schools and leaving destruction in it�s wake.don�t wait until a rainstorm or hurricane is looming on the horizon or flooding is in the forecast to look into flood insurance. The national flood insurance program (nfip), instituted by congress in 1968, provides flood insurance policies to homeowners, business owners and renters in communities that participate in the program.

Fema is updating the national flood insurance program’s (nfip) risk rating technology to enable fema to deliver rates that are actuarily sound, (19).

Today, we will unpack these changes coming to oklahoma and how they can impact your flood insurance in the future. Discover how much it costs, what it covers, and how to get (7). Today, we want to talk about what the recent community rating system (crs) score change in tulsa. Then you have come to the right place. People are often surprised to learn that their homeowners insurance doesn’t cover flood damage. Compare how much the average homeowner in each state pays for.

Source: black-white-and-grey-angels.blogspot.com

Source: black-white-and-grey-angels.blogspot.com

Today, we will unpack these changes coming to oklahoma and how they can impact your flood insurance in the future. For homes in zone x, there is little to moderate chance of flooding at only 0.2 to 1% annually. Of course, if your property has increased flood risk, you can�t really afford not to have flood insurance, and furthermore your lender may require you. How many people in texas and oklahoma have flood insurance coverage and how much does it cost them? Fema is updating the national flood insurance program’s (nfip) risk rating technology to enable fema to deliver rates that are actuarily sound, (19).

Source: betterflood.com

Source: betterflood.com

In wagoner, oklahoma the average flood rate is $841. Of course, if your property has increased flood risk, you can�t really afford not to have flood insurance, and furthermore your lender may require you. Discover how much it costs, what it covers, and how to get (7). Aarvin insurance services is an independent agency in oklahoma city, ok. Guide for homeowners in 2021.

Source: kfor.com

Source: kfor.com

Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s. This includes 115 active flood policies with $118,316 in written flood premiums. Flood insurance helps protect you from financial devastation if your home and possessions are damaged by flooding. A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk.

Source: dobbsbraddock.com

Source: dobbsbraddock.com

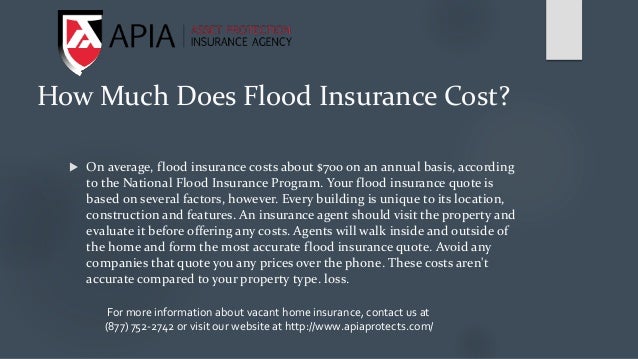

A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to. Flood insurance costs an average of $700 per year, according to fema. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. Today, we will unpack these changes coming to oklahoma and how they can impact your flood insurance in the future. Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s.

Source: slideshare.net

Source: slideshare.net

Average cost of flood insurance by state. For homes in zone x, there is little to moderate chance of flooding at only 0.2 to 1% annually. If you’re not sure which area your. This includes 115 active flood policies with $118,316 in written flood premiums. A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to.

Source: slideshare.net

Source: slideshare.net

People are often surprised to learn that their homeowners insurance doesn’t cover flood damage. Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). This includes 115 active flood policies with $118,316 in written flood premiums. Guide for homeowners in 2021. It is sold by the federal government, through local insurance agents.

Source: everquote.com

Source: everquote.com

[1] why you can trust our sources. This includes 115 active flood policies with $118,316 in written flood premiums. Of course, if your property has increased flood risk, you can�t really afford not to have flood insurance, and furthermore your lender may require you. When flood insurance is required. Ron eveligh, cincinnati insurance board director, says a flood policy costs about $500 a year for $250,000 of coverage.

Source: servproofsouthoklahomacity.com

Source: servproofsouthoklahomacity.com

How much is flood insurance in oklahoma. Ron eveligh, cincinnati insurance board director, says a flood policy costs about $500 a year for $250,000 of coverage. Today, we want to talk about what the recent community rating system (crs) score change in tulsa. The total number of written flood premiums in tulsa is $287,151. If you live in a flood prone area, you may be wondering how much flood insurance costs, and whether or not you can afford it.

Source: ktul.com

Source: ktul.com

Be that as it may, few out of every odd state and local area approach nfip insurance. Discover how much it costs, what it covers, and how to get (7). Aug 25, 2021 — oklahoma flood insurance can protect your family and home from devastating loss. A $200 policy for a home 100 miles off the coast is a little cost to pay when you consider the capability of category 5 typhoon to flood your home. Then you have come to the right place.

Source: youtube.com

Source: youtube.com

Private flood insurance is an option in contrast to utilizing the nfip. How much does flood insurance cost in zone a. How much does flood insurance cost in zone x. In texas 597,951 properties (11.4% of the. The national flood insurance program (nfip) government plan’s normal expense is around $707 each year.

Source: yesensure.com

Source: yesensure.com

Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). The national flood insurance program (nfip), instituted by congress in 1968, provides flood insurance policies to homeowners, business owners and renters in communities that participate in the program. The average annual premiums for flood insurance vary by up to $1,035 between states. In 2019, the arkansas river that runs through oklahoma reached its highest water level ever recorded, causing weeks of flooding to farm lands, closing schools and leaving destruction in it�s wake.don�t wait until a rainstorm or hurricane is looming on the horizon or flooding is in the forecast to look into flood insurance. Compare how much the average homeowner in each state pays for.

Ron eveligh, cincinnati insurance board director, says a flood policy costs about $500 a year for $250,000 of coverage. $860 is the average flood insurance rate for tulsa county, oklahoma. Be that as it may, few out of every odd state and local area approach nfip insurance. Compare how much the average homeowner in each state pays for. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves.

Source: betterflood.com

Source: betterflood.com

The federal emergency management agency. Today, we will unpack these changes coming to oklahoma and how they can impact your flood insurance in the future. A new rating program, called risk rating 2.0, is coming to fema policies in october 2021 and is designed to. This includes 115 active flood policies with $118,316 in written flood premiums. Today, we want to talk about what the recent community rating system (crs) score change in tulsa.

Source: betterflood.com

Source: betterflood.com

Guide for homeowners in 2021. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. In texas 597,951 properties (11.4% of the. The average annual premiums for flood insurance vary by up to $1,035 between states. How much does flood insurance cost in zone a.

Source: slideshare.net

Source: slideshare.net

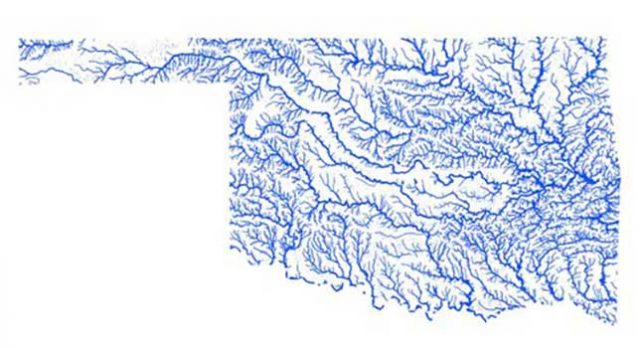

Today, we�re going to discuss the upcoming changes to federal flood insurance in oklahoma. How much does flood insurance cost in zone x. How many people in texas and oklahoma have flood insurance coverage and how much does it cost them? For homes in zone x, there is little to moderate chance of flooding at only 0.2 to 1% annually. Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30 years.

Source: slideshare.net

Source: slideshare.net

Today, we�re going to discuss the upcoming changes to federal flood insurance in oklahoma. A $200 policy for a home 100 miles off the coast is a little cost to pay when you consider the capability of category 5 typhoon to flood your home. We are your flood insurance specialists. Today, we�re going to discuss the upcoming changes to federal flood insurance in oklahoma. To insure your oklahoma home against flood damage, buy insurance from a private flood insurance company or through the national flood insurance program (nfip).

Source: liveinsurancenews.com

Source: liveinsurancenews.com

To insure your oklahoma home against flood damage, buy insurance from a private flood insurance company or through the national flood insurance program (nfip). Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30 years. Flood insurance will make sure you stay dry while the whole world seems to be under water. The total number of written flood premiums in tulsa is $287,151. If you’re not sure which area your.

Source: ipoklahoma.com

Source: ipoklahoma.com

When flood insurance is required. Much like the aforementioned zone ae, homes in zone a also have a 1% chance of flooding annually and a 26% chance of flooding in the span of 30 years. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. Florida is closely followed by maryland and texas, two other states that. The federal emergency management agency.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is flood insurance in oklahoma by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.