How much is flood insurance in sc Idea

Home » Trending » How much is flood insurance in sc IdeaYour How much is flood insurance in sc images are ready. How much is flood insurance in sc are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is flood insurance in sc files here. Get all royalty-free photos and vectors.

If you’re searching for how much is flood insurance in sc images information connected with to the how much is flood insurance in sc interest, you have come to the ideal blog. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

How Much Is Flood Insurance In Sc. Let inlet view give you the assurance that you have the proper flood insurance coverage for your surfside beach investment. If the principal amount of a loan is only $200,000, the extra coverage is not necessary. The federal emergency management agency. The average yearly home insurance rate in south carolina is $3,377 for a dwelling coverage baseline amount of $250,000.

Flood Insurance Washington State From soundpacificins.com

Flood Insurance Washington State From soundpacificins.com

The program offers lower coverage levels for residential properties, up to $250,000 in building coverage and up to $100,000 in contents coverage.18 fév. Average cost of flood insurance by state. Compare how much the average homeowner in each state pays for. 11019 tournament blvd, suite 202. Lender c qualifies for the small lender exemption at the beginning of 2017. They had to spend about $391 per $100,000 of coverage.

Compare how much the average homeowner in each state pays for.

Looking at richland, south carolina, we find 1,497 active flood policies. Compare how much the average homeowner in each state pays for. In 2016, nearly 200,500 nfip. Let inlet view give you the assurance that you have the proper flood insurance coverage for your surfside beach investment. Make sure your property is adequately protected by investing in a flood insurance policy. Many people assume flood insurance is in standard home insurance policies, so it’s good you’re aware of your coverage!

Source: blog.aisinsurance.com

Source: blog.aisinsurance.com

As we witnessed from this event, many areas that have never flooded did during that event. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. Residents and business owners in surfside beach, sc are not strangers to the reality of flooding. I hold many insurance designations and i am very involved within the industry, sitting on our state�s insurance association board. Make sure your property is adequately protected by investing in a flood insurance policy.

The premiums in richland total $983,845 which allows the average flood rate to be $657. Lender c qualifies for the small lender exemption at the beginning of 2017. The average flood rate rises to $634 in lexington, south carolina. In truth, many flood insurance claims occur in. They had to spend about $391 per $100,000 of coverage.

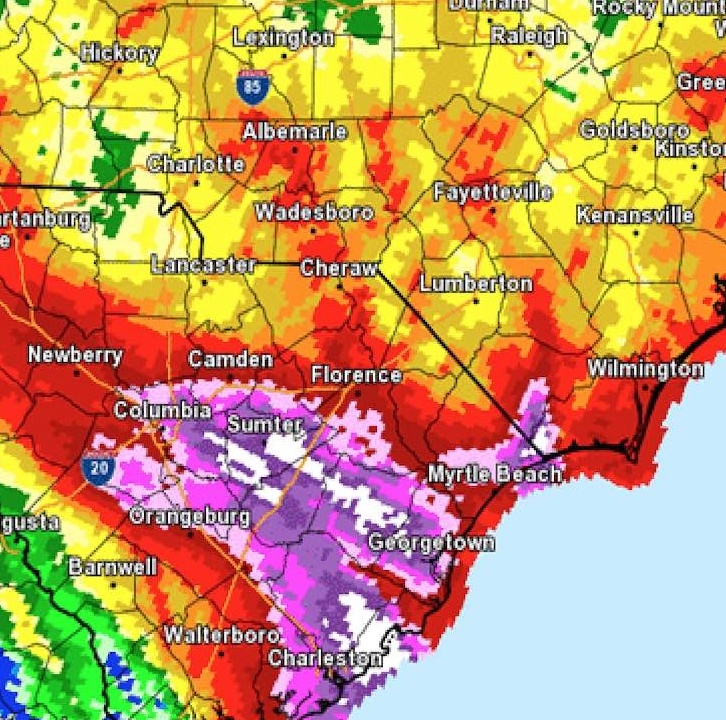

Source: wmbfnews.com

Source: wmbfnews.com

How much does south carolina flood insurance cost? 11019 tournament blvd, suite 202. Flood insurance is a common reality with charleston real estate. The average flood rate rises to $634 in lexington, south carolina. Also, is flood insurance required in sc?

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

Now mention “inlet view insurance” and if they�ve done their homework, they know that inlet view insurance can give them the assurance that they have the proper flood insurance. I am very involved on a federal level with flood insurance reform. You can’t afford to put off getting flood insurance any longer. Make sure your property is adequately protected by investing in a flood insurance policy. The 1000 year flood event of 2015 is testament to the fact that floods can occur at any time, not only associated with hurricanes and wind events.

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

In our research, we found the average cost of flood insurance for north carolina homeowners to be $718 per year. openfema. accessed october 21, 2021. Also, is flood insurance required in sc? The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. In 2016, nearly 200,500 nfip.

The program offers lower coverage levels for residential properties, up to $250,000 in building coverage and up to $100,000 in contents coverage.18 fév. Flood insurance is a common reality with charleston real estate. Talk to any resident or business owner in garden city and mention the word “flood”, you should almost be able to see the chill run up their spine. Make sure your property is adequately protected by investing in a flood insurance policy. § a bank must escrow flood insurance premiums and fees for any loans made, increased, extended, or renewed on or after july 1 of the succeeding calendar year after it has a change in status.

Source: insurancejournal.com

Source: insurancejournal.com

Lender c qualifies for the small lender exemption at the beginning of 2017. On average, the cost of flood insurance in south carolina can range from $630 to $680 per year. Many homes and businesses in the lexington, sc area are prone to flood damage. Florida is closely followed by maryland and texas, two other states that. Click here to learn more about this important insurance, and discover how an independent insurance agent can help you get the coverage you need.

Source: sccins.com

Source: sccins.com

The program offers lower coverage levels for residential properties, up to $250,000 in building coverage and up to $100,000 in contents coverage.18 fév. Cost of flood insurance in south carolina. How much does flood insurance cost in south carolina? The biggest factor in the premium is what sc flood zone your business is in, followed by how much you want to insure. If you live in an sfha and have received disaster assistance in the form of a federal grant or loan, you must.

Source: postandcourier.com

Source: postandcourier.com

Lender c qualifies for the small lender exemption at the beginning of 2017. Flood insurance is a common reality with charleston real estate. If the principal amount of a loan is only $200,000, the extra coverage is not necessary. Click here to learn more about this important insurance, and discover how an independent insurance agent can help you get the coverage you need. Residents and business owners in surfside beach, sc are not strangers to the reality of flooding.

Source: linkpico.com

Source: linkpico.com

Compare how much the average homeowner in each state pays for. As direct representatives of fema, all policies are processed through the nfip. Lender c qualifies for the small lender exemption at the beginning of 2017. Many homes and businesses in the lexington, sc area are prone to flood damage. You can’t afford to put off getting flood insurance any longer.

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

[1] why you can trust our sources. Cost of flood insurance in south carolina. As we witnessed from this event, many areas that have never flooded did during that event. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. If the principal amount of a loan is only $200,000, the extra coverage is not necessary.

Source: insurance-prop2.blogspot.com

Source: insurance-prop2.blogspot.com

You can’t afford to put off getting flood insurance any longer. I am very involved on a federal level with flood insurance reform. In truth, many flood insurance claims occur in. Do i need to purchase flood insurance? Talk to any resident or business owner in garden city and mention the word “flood”, you should almost be able to see the chill run up their spine.

Source: myrtlebeachhomesandlifestyles.com

Source: myrtlebeachhomesandlifestyles.com

This average annual price is 60.6% more (25). Among cities we surveyed, raleigh had the highest rates, with an average premium of $944 per year. As we witnessed from this event, many areas that have never flooded did during that event. The biggest factor in the premium is what sc flood zone your business is in, followed by how much you want to insure. Coverage is available for homeowners and renters.

Source: clovered.com

Source: clovered.com

Both homeowners and renters can get flood insurance coverage from the nfip, which is managed by the federal emergency management agency (fema). Many people assume flood insurance is in standard home insurance policies, so it’s good you’re aware of your coverage! openfema. accessed october 21, 2021. Cost of flood insurance in south carolina. Average cost of flood insurance by state.

Source: postandcourier.com

Source: postandcourier.com

Residents and business owners in surfside beach, sc are not strangers to the reality of flooding. This average annual price is 60.6% more (25). How much does south carolina flood insurance cost? This guide explains pre & post firm, zones, elevation, and maps, but not wind and hail, a significant cost affecting your. Compare how much the average homeowner in each state pays for.

Source: postandcourier.com

Source: postandcourier.com

In truth, many flood insurance claims occur in. Coverage is available for homeowners and renters. Florida is closely followed by maryland and texas, two other states that. Lexington has 1,456 flood policies in effect with $923,191 in written premium. This guide explains pre & post firm, zones, elevation, and maps, but not wind and hail, a significant cost affecting your.

Source: southcarolinafloodinsurance.org

Source: southcarolinafloodinsurance.org

Lexington has 1,456 flood policies in effect with $923,191 in written premium. Coverage is available for homeowners and renters. [1] why you can trust our sources. That’s a good amount less than the national average, which is over $950 per year. In 2019, flood claims paid by the nfip averaged $52,000 and the average nfip annual premium cost $700, according to fema.

Source: postandcourier.com

Source: postandcourier.com

Now mention “inlet view insurance” and if they�ve done their homework, they know that inlet view insurance can give them the assurance that they have the proper flood insurance. This average annual price is 60.6% more (25). They had to spend about $391 per $100,000 of coverage. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. Among cities we surveyed, raleigh had the highest rates, with an average premium of $944 per year.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is flood insurance in sc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.