How much is fr44 insurance in virginia Idea

Home » Trending » How much is fr44 insurance in virginia IdeaYour How much is fr44 insurance in virginia images are available. How much is fr44 insurance in virginia are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is fr44 insurance in virginia files here. Get all free images.

If you’re looking for how much is fr44 insurance in virginia images information connected with to the how much is fr44 insurance in virginia interest, you have visit the right site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

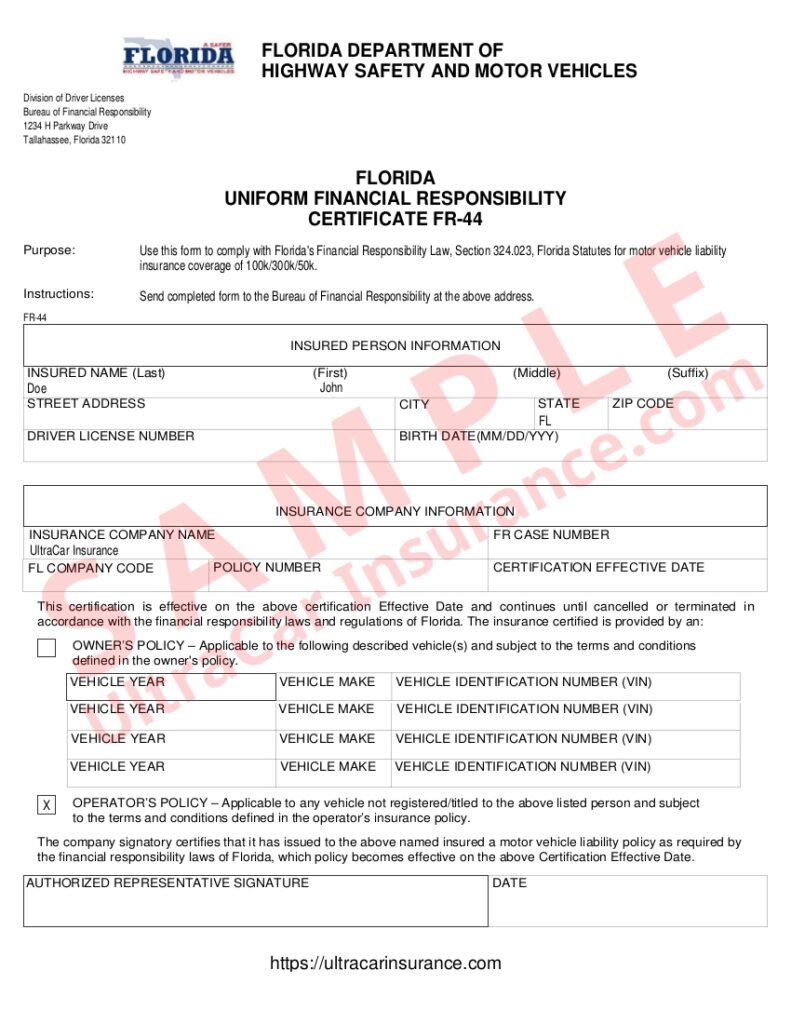

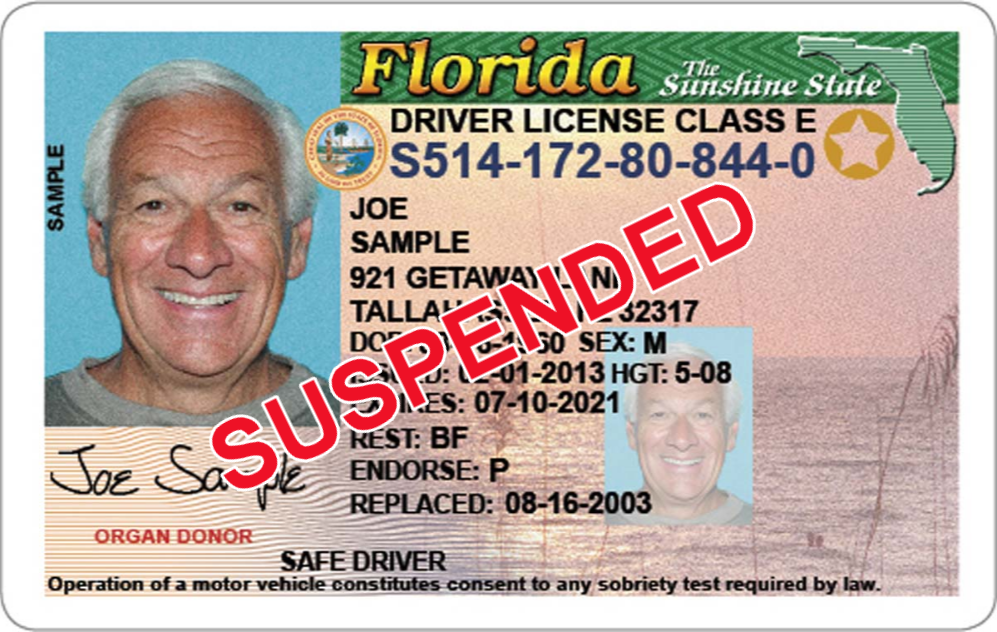

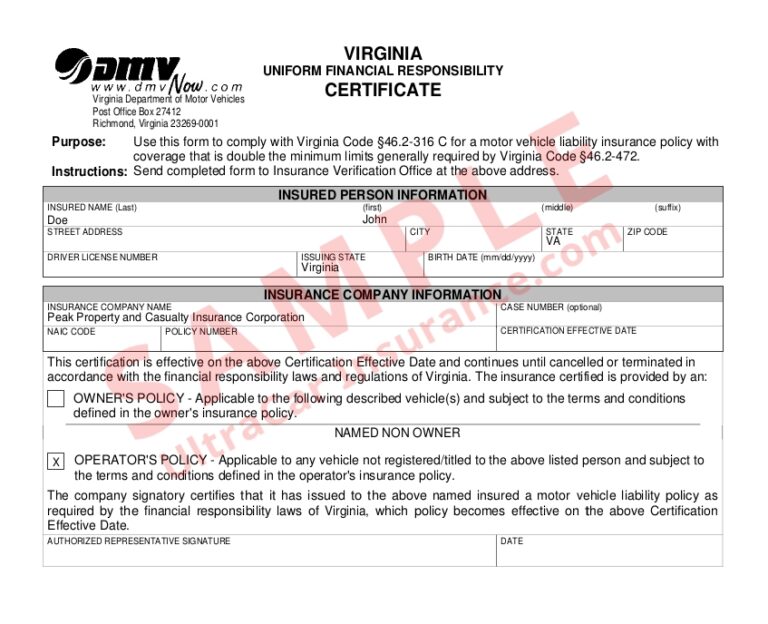

How Much Is Fr44 Insurance In Virginia. $50,000 bodily injury liability per person. $60,000 bodily injury per person; Maiming someone in a car acci (8). The liability insurance requirements for fr44 coverage are 60/120/40:

Fr44 Insurance Virginia Car Insurance In Virginia From bostonlatestnews.blogspot.com

$120,000 bodily injury per accident; See what we can do to get your drivers license reinstated: There are coverage limitations with non owner fr44. Cheapest virginia fr44 filing & insurance. The cost of fr44 insurance is determined by your state’s minimum liability requirements. Since you need higher liability limits and you have a dui conviction your auto insurance will be much more.

Those convicted, must carry higher liability limits on their auto or operator only insurance (4).

The cost to file an fr44 form in virginia usually averages from $15 to $25. Virginia dwi laws & penalties That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423. Virginia dwi laws & penalties. Those convicted, must carry higher liability limits on their auto or operator only insurance (4). $50,000 bodily injury liability per person.

Source: bostonlatestnews.blogspot.com

Source: bostonlatestnews.blogspot.com

$60,000 bodily injury per person; State farm does not offer fr44 insurance. In addition, there’s usually a fee of $15 to $25 for your in. The cost to file an fr44 form in virginia usually averages from $15 to $25. If you don’t own a vehicle, acquiring proof of car insurance coverage can be tricky.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Since you need higher liability limits and you have a dui conviction your auto insurance will be much more. Maiming someone in a car acci (8). That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423. Cheapest virginia fr44 filing & insurance. $50,000 bodily injury liability per person.

A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. Virginia and florida are the only states that mandate obtaining an fr44 certificate after a conviction for dui or otherwise. $60,000 bodily injury per person; $50,000 bodily injury liability per person. There are coverage limitations with non owner fr44.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. Those convicted, must carry higher liability limits on their auto or operator only insurance (4). Virginia dwi laws & penalties. The state�s minimum required coverage for bodily injury liability can be waived. You must have auto insurance coverage to obtain an fr44.

Source: selectsr22insurance.com

Source: selectsr22insurance.com

How much does fr44 virginia cost? Virginia dwi laws & penalties. The liability insurance requirements for fr44 coverage are 60/120/40: $120,000 bodily injury per accident; The cost of the fr44 form itself isn’t that steep—usually around $15 to $25.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Virginia dwi laws & penalties. State farm does not offer fr44 insurance. $100,000 bodily injury liability per accident. Virginia and florida are the only states that mandate obtaining an fr44 certificate after a conviction for dui or otherwise. Those convicted, must carry higher liability limits on their auto or operator only insurance (4).

Source: dandzelia-z.blogspot.com

The liability insurance requirements for fr44 coverage are 60/120/40: Therefore, minimum liability coverage for fr44 insurance is two times higher than for sr22 insurance. These limits are $50,000 for bodily injury per person and $100,000 per incident, plus $40,000 for property damage. The cost of the fr44 form itself isn’t that steep—usually around $15 to $25. Virginia dwi laws & penalties.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Ultracar insurance specializes in virginia fr44 insurance. Both florida and virginia require this filing after a dui but check with your state in the event the law has changed. How much does fr44 virginia cost? While it can vary between insurers, the fee for filing an fr44 is usually around $25, but the increase in. Virginia dwi laws & penalties

Source: outonomortoeoutrascomedias.blogspot.com

Cheapest virginia fr44 filing & insurance. $60,000 bodily injury per person; The state�s minimum required coverage for bodily injury liability can be waived. The cost to file an fr44 form in virginia usually averages from $15 to $25. Cheapest virginia fr44 filing & insurance.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

The state�s minimum required coverage for bodily injury liability can be waived. As you can see below the requirements for fr44 insurance are much higher. Maiming someone in a car acci (8). Cheapest virginia fr44 filing & insurance. Since you need higher liability limits and you have a dui conviction your auto insurance will be much more.

Source: bostonlatestnews.blogspot.com

$60,000 bodily injury per person; The cost of fr44 insurance is determined by your state’s minimum liability requirements. Since you need higher liability limits and you have a dui conviction your auto insurance will be much more. That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423. In addition, there’s usually a fee of $15 to $25 for your in.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Since you need higher liability limits and you have a dui conviction your auto insurance will be much more. $120,000 bodily injury per accident; There are coverage limitations with non owner fr44. As you can see below the requirements for fr44 insurance are much higher. While it can vary between insurers, the fee for filing an fr44 is usually around $25, but the increase in.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Virginia fr44 insurance requirements standard state minimum liability limits are only $25k per person for bodily injury and $50k per accident plus $20k for property damage. The liability insurance requirements for fr44 coverage are 60/120/40: See what we can do to get your drivers license reinstated: These limits are $50,000 for bodily injury per person and $100,000 per incident, plus $40,000 for property damage. You must have auto insurance coverage to obtain an fr44.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Both florida and virginia require this filing after a dui but check with your state in the event the law has changed. How much does fr44 insurance cost? Maiming someone in a car acci (8). As you can see below the requirements for fr44 insurance are much higher. Virginia fr44 insurance has higher premiums and higher coverage requirements than virginia sr22 insurance.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

$60,000 bodily injury per person; As you can see below the requirements for fr44 insurance are much higher. Car insurance companies issue the fr44 certificate. That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423. How much does fr44 virginia cost?

Source: mylovingstardoll.blogspot.com

Source: mylovingstardoll.blogspot.com

Virginia dwi laws & penalties The filing fee for an fr44 is usually about $25. State farm does not offer fr44 insurance. The cost to file an fr44 form in virginia usually averages from $15 to $25. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Virginia and florida are the only states that mandate obtaining an fr44 certificate after a conviction for dui or otherwise. $120,000 bodily injury per accident; While it can vary between insurers, the fee for filing an fr44 is usually around $25, but the increase in. If you don’t own a vehicle, acquiring proof of car insurance coverage can be tricky. Therefore, minimum liability coverage for fr44 insurance is two times higher than for sr22 insurance.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

If you don’t own a vehicle, acquiring proof of car insurance coverage can be tricky. That’s $349 more than the annual average cost for a standard policy for a driver with a clean record of $423. The cost of the fr44 form itself isn’t that steep—usually around $15 to $25. The cost of fr44 insurance is determined by your state’s minimum liability requirements. How much does fr44 insurance cost?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is fr44 insurance in virginia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.