How much is homeowners insurance in pa information

Home » Trending » How much is homeowners insurance in pa informationYour How much is homeowners insurance in pa images are ready. How much is homeowners insurance in pa are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is homeowners insurance in pa files here. Get all free photos and vectors.

If you’re looking for how much is homeowners insurance in pa images information linked to the how much is homeowners insurance in pa interest, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

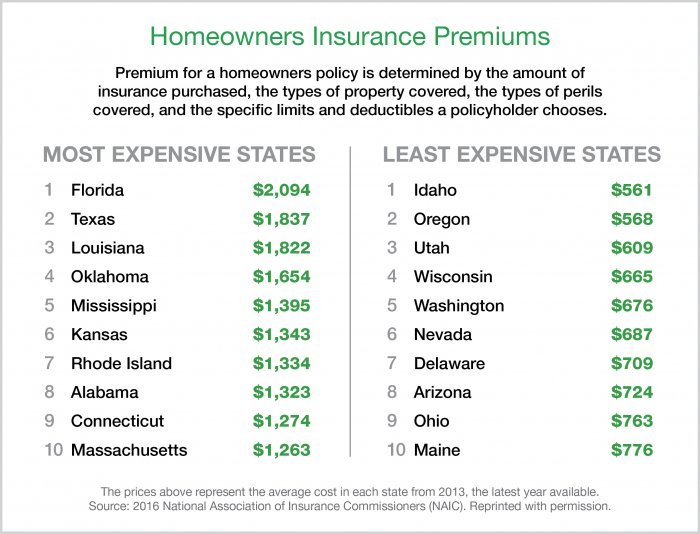

How Much Is Homeowners Insurance In Pa. Making it crucial for pennsylvanians to compare coverage packages from several property insurance companies, both national and regional. Looking for a homeowners insurance policy, always shop around and compare coverage and price. The more valuable your home is, the more coverage you’ll need and the higher your annual insurance premium becomes as a result. Below is more information on the different types of coverage a homeowners policy can provide.

How much does home insurance cost in PA? From youngalfred.com

Its average premium is just $397 per year. Even if you don’t own a home, but rather rent an apartment, you can purchase renters insurance to cover your personal belongings. Experts recommend you have at least $300,000 liability coverage to protect your home against a lawsuit. The average cost of coverage for home insurance depends on the average dwelling coverage and the home’s value. Thus, competition for each customer is fierce. The location of your home impacts the price of your homeowners insurance.

Is $1,249 per year or $104 a month, according to the national association of insurance commissioners (naic).

The cost of your home insurance policy is determined by several factors. And the average cost of homeowners in pa is $1,307 a year, or $109 a month. The average cost of coverage for home insurance depends on the average dwelling coverage and the home’s value. Below is more information on the different types of coverage a homeowners policy can provide. Though not mandatory under pennsylvania law, a. The average annual premium in 2021 was $1,312.

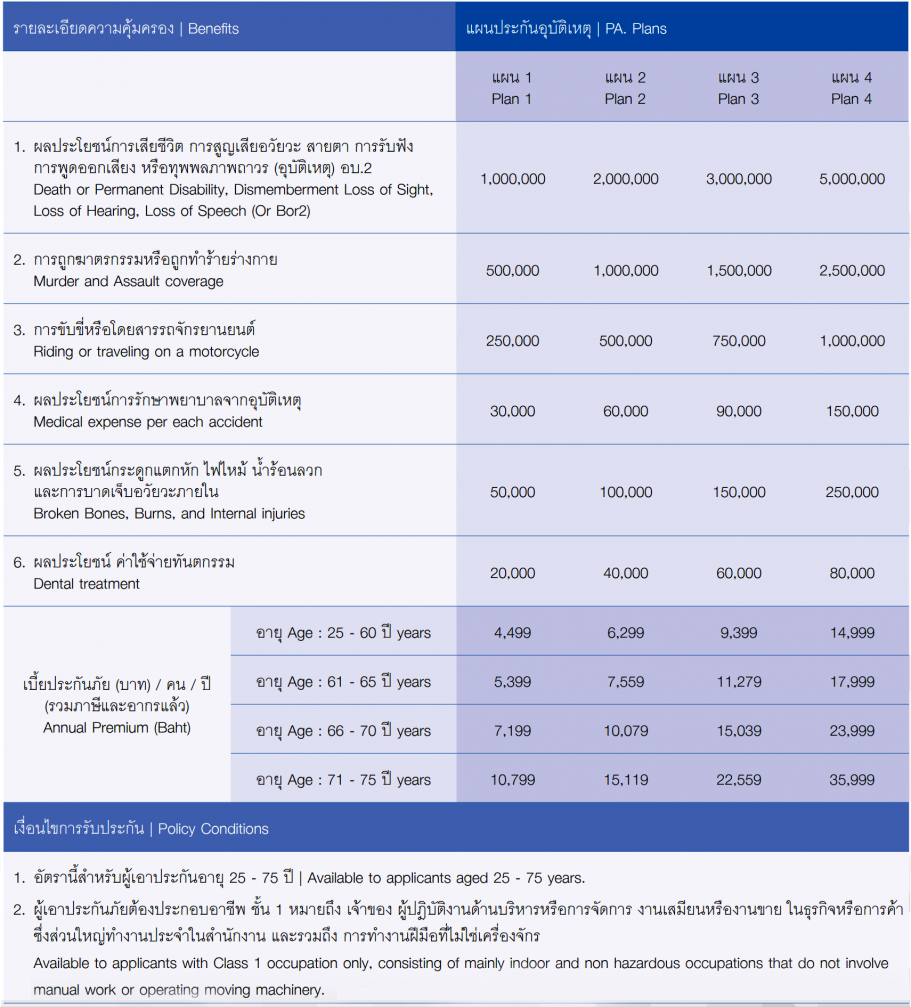

Source: pahealthbenefits.com

Source: pahealthbenefits.com

A homeowner’s insurance policy will cover your family�s personal belongings, your home and the contents of your home, such as furniture, appliances, rugs, clothing, etc. Deductible home insurance cost discount homeowners insurance cost ; Even if you don’t own a home, but rather rent an apartment, you can purchase renters insurance to cover your personal belongings. *you are not required to. A typical homeowners policy costs $114 per month in philadelphia, pennsylvania.

Source: erwininsurancehersheypamononobi.blogspot.com

Incidents like this occur regularly. Pennsylvanians’ homeowners and renters insurance. That�s well under the state average of $1,047 per year. Even if you don’t own a home, but rather rent an apartment, you can purchase renters insurance to cover your personal belongings. How much is homeowners insurance?

Source: foxysletters.blogspot.com

Source: foxysletters.blogspot.com

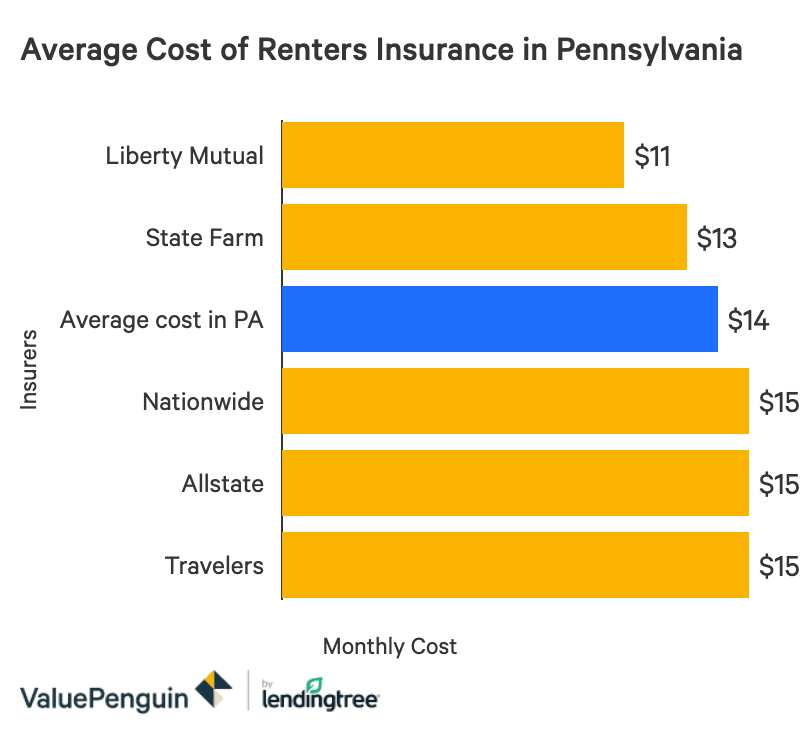

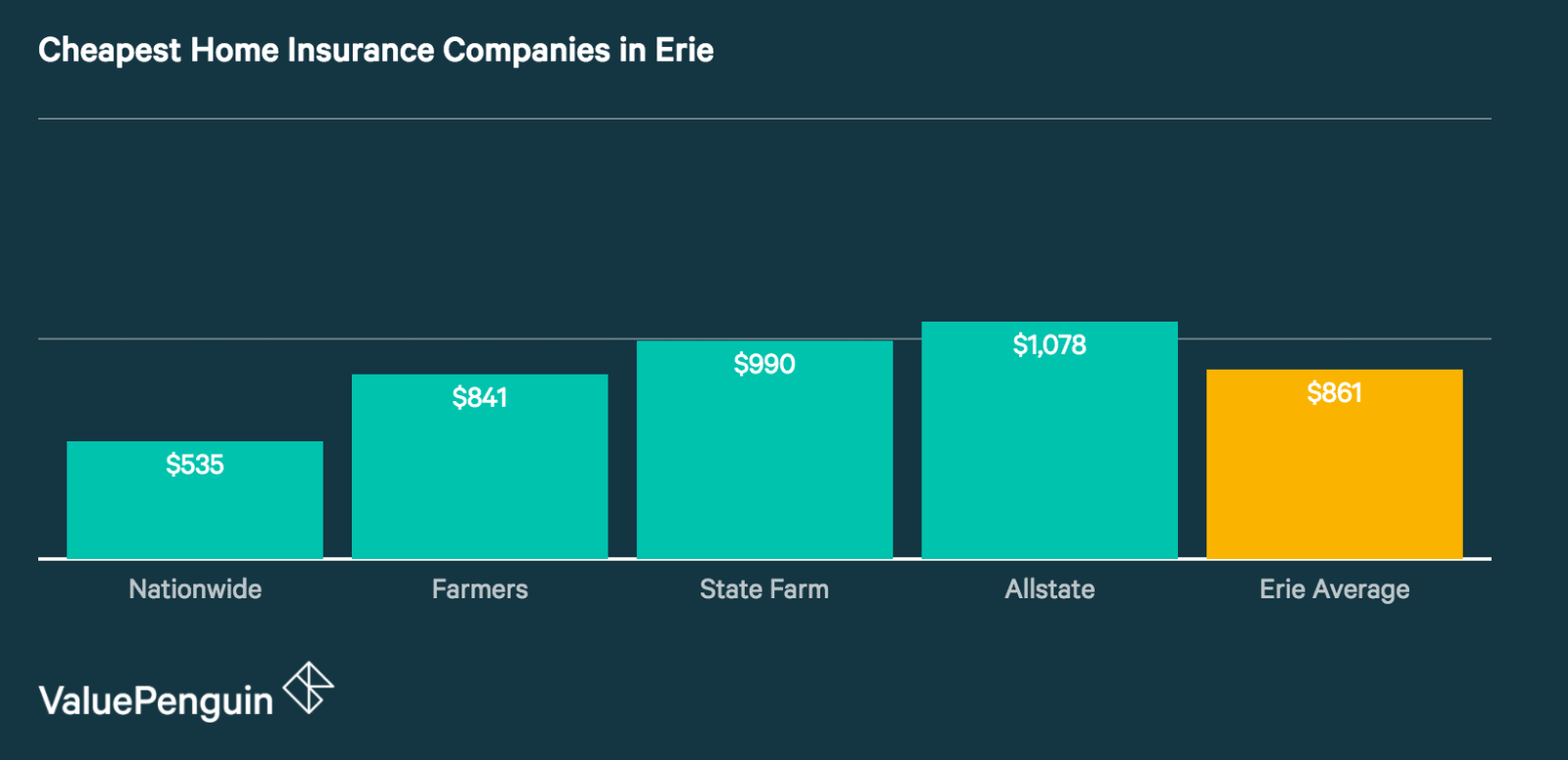

Nationwide is the cheapest pennsylvania homeowners insurance company, among carriers surveyed. [1] but homeowners insurance rates vary widely based on where you live, how old your home is, how much it’d cost to rebuild your house, and your claims history. Even if you don’t own a home, but rather rent an apartment, you can purchase renters insurance to cover your personal belongings. Though not mandatory under pennsylvania law, a. Is $1,249 per year or $104 a month, according to the national association of insurance commissioners (naic).

Source: pinterest.com

Source: pinterest.com

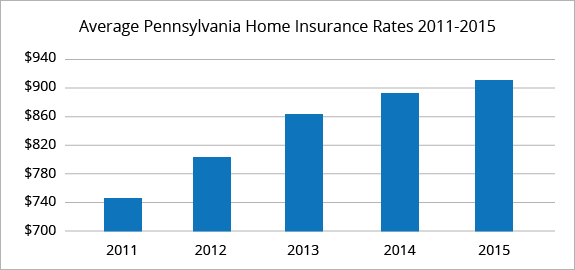

This is significantly lower than. How much does home insurance cost in pa? The average cost of homeowners insurance in pennsylvania is $1,720 for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible. Home insurance costs are typically calculated using information on the home�s age, size, construction type, replacement cost, and location. How much is homeowners insurance?

Source: pinterest.com

Source: pinterest.com

This can include the overall value of your. The cost of homeowners insurance in pennsylvania is $1,680 a year for the average amount of coverage. It provides protection to your home from damage caused by fire, theft, natural disasters, and other things. How much is homeowners insurance? A homeowner’s insurance policy will cover your family�s personal belongings, your home and the contents of your home, such as furniture, appliances, rugs, clothing, etc.

Source: valuepenguin.com

Source: valuepenguin.com

Is $1,249 per year or $104 a month, according to the national association of insurance commissioners (naic). The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage. From philadelphia to erie see how much you can save, learn coverage options for your home, and more. Based on national averages, homeowners in the keystone state pay similar rates to those across the country. The average annual premium in 2021 was $1,312.

Source: valuepenguin.com

Source: valuepenguin.com

How much is homeowners insurance? Pennsylvanians’ homeowners and renters insurance. The average cost of homeowners insurance in pennsylvania is $1,720 for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible. The cost of homeowners insurance in pennsylvania is $1,680 a year for the average amount of coverage. A homeowner’s insurance policy will cover your family�s personal belongings, your home and the contents of your home, such as furniture, appliances, rugs, clothing, etc.

Source: quotewizard.com

Source: quotewizard.com

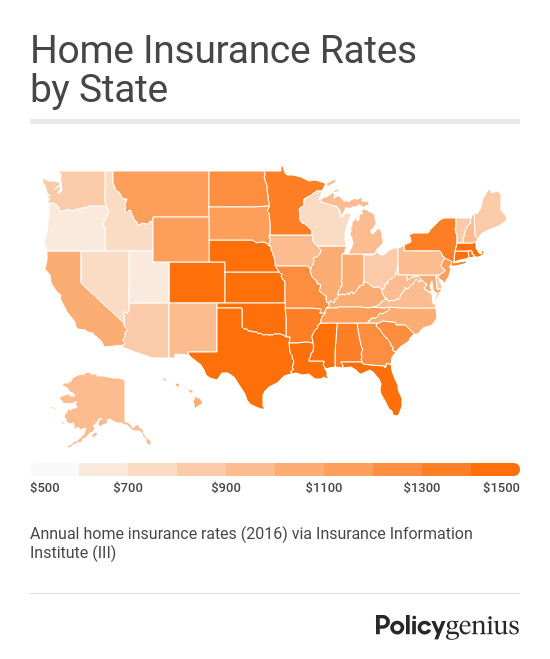

From philadelphia to erie see how much you can save, learn coverage options for your home, and more. [1] but homeowners insurance rates vary widely based on where you live, how old your home is, how much it’d cost to rebuild your house, and your claims history. What you pay for homeowners insurance depends on many factors. It provides protection to your home from damage caused by fire, theft, natural disasters, and other things. This is significantly lower than.

Making it crucial for pennsylvanians to compare coverage packages from several property insurance companies, both national and regional. *you are not required to. The average cost of coverage for home insurance depends on the average dwelling coverage and the home’s value. When paired with the high cost of repairing or rebuilding a home, purchasing a robust homeowners policy can seem like a great idea. Even if you don’t own a home, but rather rent an apartment, you can purchase renters insurance to cover your personal belongings.

Source: insuranceglitz.com

Source: insuranceglitz.com

When paired with the high cost of repairing or rebuilding a home, purchasing a robust homeowners policy can seem like a great idea. How much is homeowners insurance in pennsylvania? Home insurance costs are typically calculated using information on the home�s age, size, construction type, replacement cost, and location. If you have a lot of assets, though, you might consider increasing your coverage to $300,000 or $500,000. These are the top four options from hundreds of customers searching for home insurance in pa.

Source: youngalfred.com

The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage. *you are not required to. Pennsylvanians’ homeowners and renters insurance. The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage. Deductible home insurance cost discount homeowners insurance cost ;

Source: youngalfred.com

Get a personalized pa home insurance quote from root. How much does home insurance cost in pa? How much is homeowners insurance? It provides protection to your home from damage caused by fire, theft, natural disasters, and other things. Is $1,249 per year or $104 a month, according to the national association of insurance commissioners (naic).

Source: homedesign-plans88.blogspot.com

Dwelling—this part of the policy pays to rebuild your home if an event destroys it.to determine how much it would cost to rebuild your home, talk to a local appraiser, use the estimation provided by your insurance company, or purchase. So, what variables impact your home insurance premium? The average cost of homeowners insurance in the u.s. The location of your home impacts the price of your homeowners insurance. Homeowners insurance protects your home and your personal property.

Source: valuepenguin.com

Source: valuepenguin.com

Dwelling—this part of the policy pays to rebuild your home if an event destroys it.to determine how much it would cost to rebuild your home, talk to a local appraiser, use the estimation provided by your insurance company, or purchase. The average annual premium in 2021 was $1,312. Homeowners insurance protects your home and your personal property. Its average premium is just $397 per year. The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage.

Source: policygenius.com

Source: policygenius.com

How much is homeowners insurance in pennsylvania? Upper darby, pa homeowners insurance cost by on age of home. Homeowners insurance companies in pennsylvania split up policies into six categories: Nationwide is the cheapest pennsylvania homeowners insurance company, among carriers surveyed. And the average cost of homeowners in pa is $1,307 a year, or $109 a month.

Source: kahentytonelamaa.blogspot.com

The average annual premium in 2021 was $1,312. The top three writers of homeowners insurance in pennsylvania are separated by about 4 percentage points. A homeowner’s insurance policy will cover your family�s personal belongings, your home and the contents of your home, such as furniture, appliances, rugs, clothing, etc. Incidents like this occur regularly. The average yearly cost of homeowners insurance is $1,806 for a dwelling coverage of $200,000 and liability coverage of $100,000.

Source: forbes.com

Source: forbes.com

The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage. Upper darby, pa homeowners insurance cost by on age of home. On average, pennsylvanian homeowners pay around $900 per year for homeowners insurance, compared to the national average of $1,173. Though not mandatory under pennsylvania law, a. How much is homeowners insurance in pennsylvania?

Source: everquote.com

Source: everquote.com

The type of natural disasters or incidents that occur in your area can influence how much you pay for coverage each year. The average homeowners insurance policy in pennsylvania costs $730 per year for $250,000 in dwelling coverage. So, what variables impact your home insurance premium? How much is homeowners insurance in pennsylvania? It may also protect you against lawsuits if someone gets hurt on your property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is homeowners insurance in pa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.