How much is my life insurance policy worth information

Home » Trend » How much is my life insurance policy worth informationYour How much is my life insurance policy worth images are ready in this website. How much is my life insurance policy worth are a topic that is being searched for and liked by netizens now. You can Download the How much is my life insurance policy worth files here. Get all free vectors.

If you’re searching for how much is my life insurance policy worth pictures information related to the how much is my life insurance policy worth interest, you have visit the ideal site. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

How Much Is My Life Insurance Policy Worth. For example, if you have a $250,000 policy and withdraw $25,000, your beneficiaries will only receive a $225,000 death benefit from your policy. For example, a policy with a face amount of $1 million will be much more valuable than one with a face amount of $100,000. Naturally, the dollar value of the policy plays a big role in determining its value. 3) sometimes a permanent policy can be sold as a life settlement.

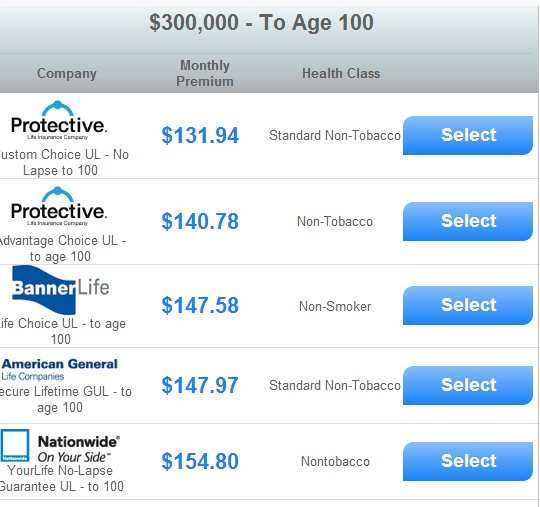

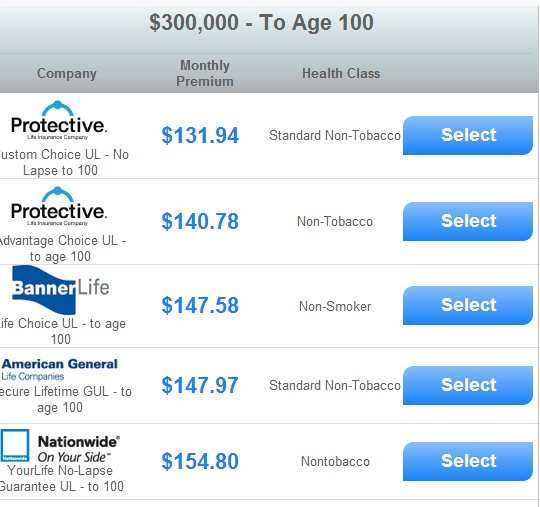

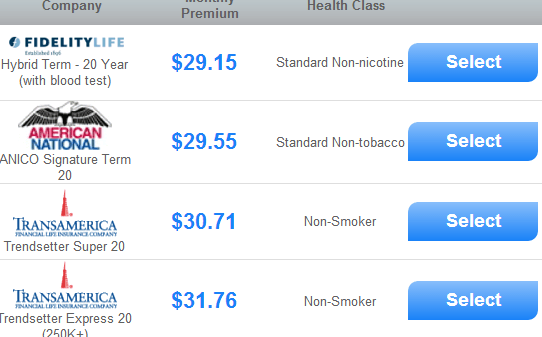

Typical Term Life Insurance Rates How Much Does Life From insurechance.com

Typical Term Life Insurance Rates How Much Does Life From insurechance.com

An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. Life insurance policy valuation factors. Lapses in coverage are not recommended. The death benefit is the amount the policy pays as a lump sum (generally income tax free) when the life insured dies. Add up your liabilities and subtract your assets to estimate your coverage. If you already have other life insurance or are able to switch to a less costly term life policy, cashing in may be the best option for you.

Get a copy of the life insurance policy or determine the policy number.

If you find an old life insurance policy, how you go about determining if it�s worth anything depends on whether it belonged to you or someone else. The current premium you pay on your policy is also a determining factor since the life settlement broker or provider will take over your payments. However, because there are people outside of those circumstances who want to sell their life insurance policies, there is an ample number of exceptions to those general rules of thumb. Those who choose to sell their life insurance policy , also known as a life insurance buyout, receive an average of four times more than they would earn from surrendering their policy back to their. Its death benefit and its cash value. An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement.

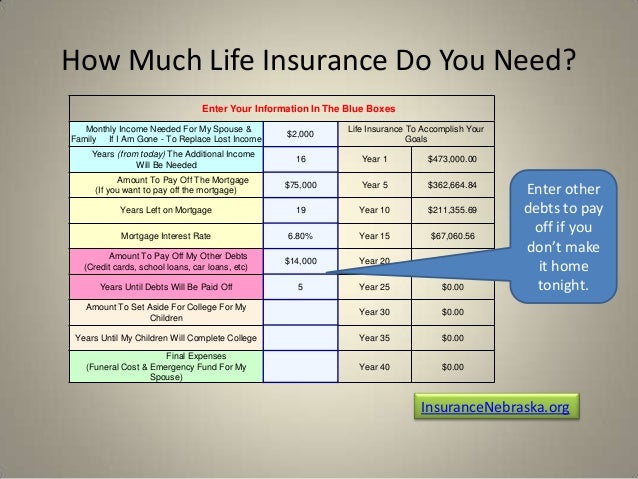

Source: slideshare.net

Source: slideshare.net

Several factors go into determining how much a buyer will offer for your life insurance policy. The face amount of current life insurance policies does not count toward your net worth, but the cash value of policies and all inherited death benefits do count toward your net worth. Naturally, the dollar value of the policy plays a big role in determining its value. The current premium you pay on your policy is also a determining factor since the life settlement broker or provider will take over your payments. Life insurance policy valuation factors.

Source: pinterest.com

Source: pinterest.com

Death benefit, type of policy, cash value, policy age, health condition, and outstanding loans or withdrawals. The cash value is what the policy is worth to the owner during life. In determining your net worth, you need to properly account for the value of your life insurance. Each time you make a payment on your policy, your money is disbursed into these categories. To check on the worth of old life insurance policies:

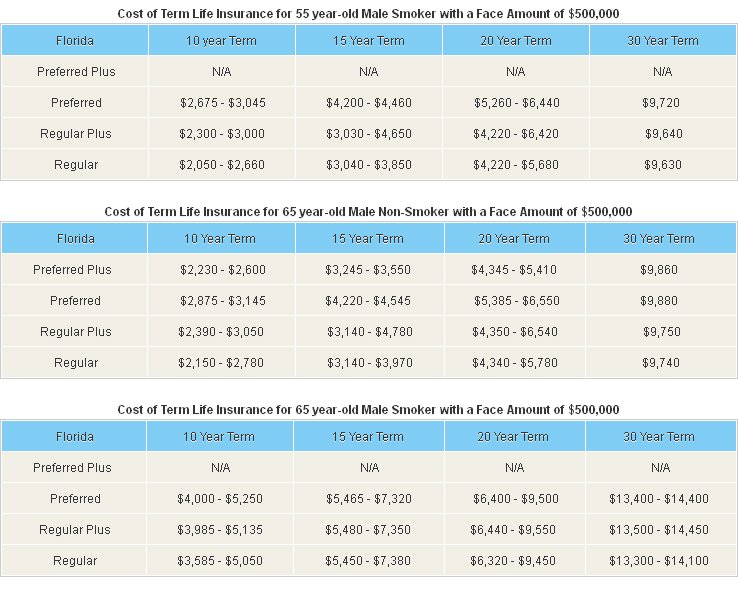

Source: termlife-insurance.com

Source: termlife-insurance.com

How much is my life insurance policy worth? Moneysupermarket life insurance data showed that company directors were found to have the highest average cover amount (£222,586), followed by doctors (£187,410), dentists (£168,214), marketing professionals (£161,575) and those working in sport and fitness (£157,894). For example, a policy with a face amount of $1 million will be much more valuable than one with a face amount of $100,000. Several factors go into determining how much a buyer will offer for your life insurance policy. The amount of cash value that has accumulated inside a policy is another crucial factor to consider, along with the interest rate that is being paid on this amount.

Source: fbfs.com

Source: fbfs.com

Policy premium payments, insurance company operating costs and cash value. Can i sell my life insurance policy? Some life insurance policies have similar processes to accrue cash value. There are two key values to a life insurance policy: Your life insurance policy’s value depends on a few variables, including the size of your insurance policy, the type of policy you have, your policy’s premiums, and your health status.

Source: masonfinance.com

Source: masonfinance.com

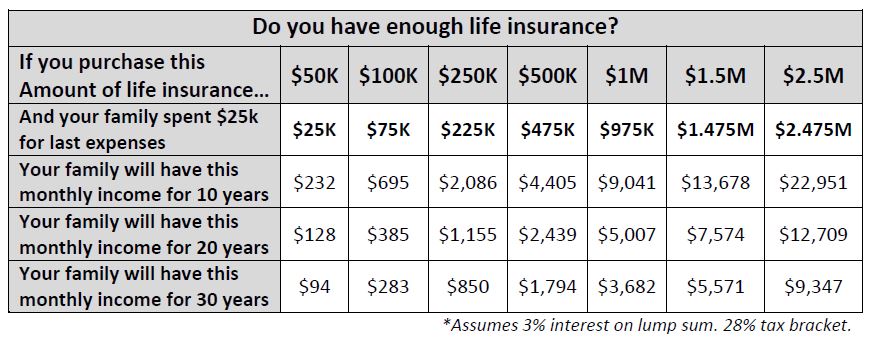

An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. In determining your net worth, you need to properly account for the value of your life insurance. The death benefit is the amount the policy pays as a lump sum (generally income tax free) when the life insured dies. An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. A whole life insurance cash surrender value on a policy with a face value of $275,000 after 15 years might be as much as $21,000 depending on how well the investment fund has performed.

Source: beyondquotes.com

Source: beyondquotes.com

Lapses in coverage are not recommended. If you find an old life insurance policy, how you go about determining if it�s worth anything depends on whether it belonged to you or someone else. The amount of a life settlement depends on the remaining amount of premiums that must be paid between selling the policy and the death benefit payment, the investor rate of return, and the expected lifespan of. To check on the worth of old life insurance policies: For example, a policy with a face amount of $1 million will be much more valuable than one with a face amount of $100,000.

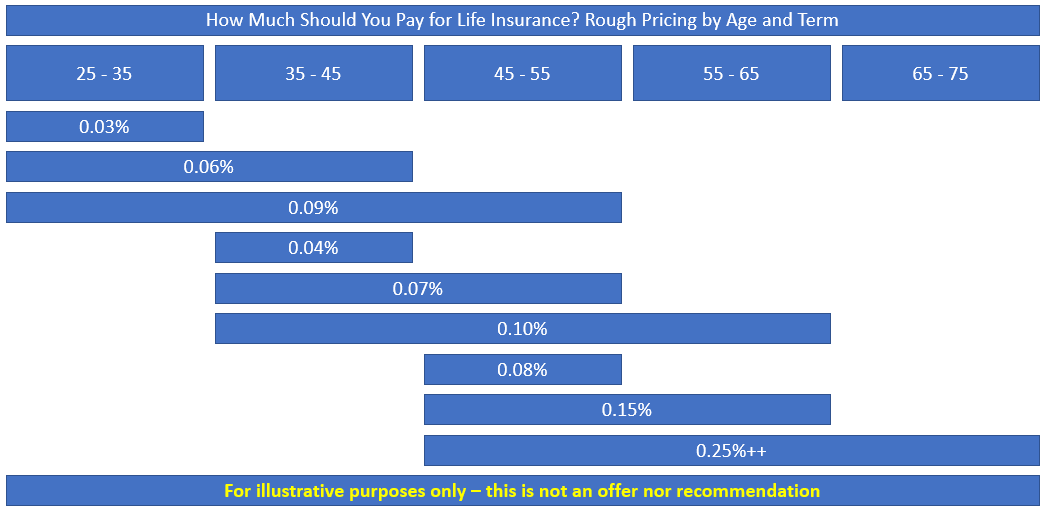

Source: financialmentor.com

Source: financialmentor.com

Death benefit, type of policy, cash value, policy age, health condition, and outstanding loans or withdrawals. Policy premium payments, insurance company operating costs and cash value. In determining your net worth, you need to properly account for the value of your life insurance. Moneysupermarket life insurance data showed that company directors were found to have the highest average cover amount (£222,586), followed by doctors (£187,410), dentists (£168,214), marketing professionals (£161,575) and those working in sport and fitness (£157,894). Scroll down to learn more about checking the value of old life insurance policies.

Source: gfmasset.com

Source: gfmasset.com

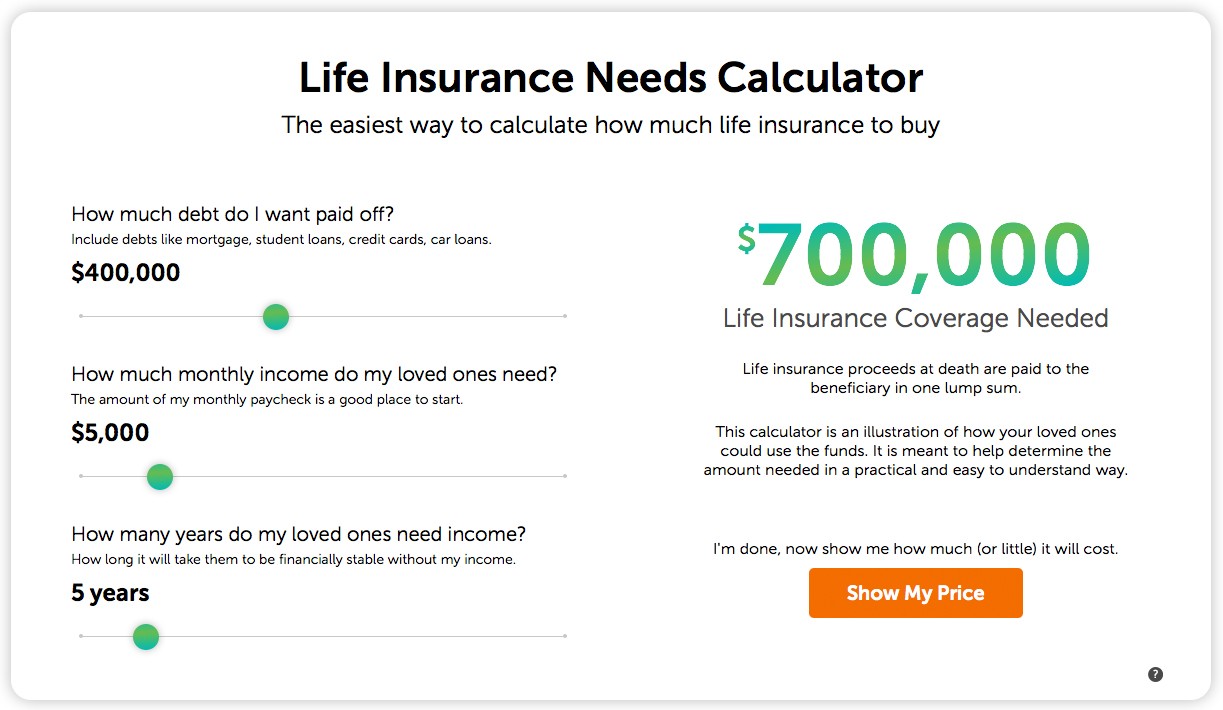

This lets you know your current financial position. Policy premium payments, insurance company operating costs and cash value. Use our life insurance calculator to figure out how much life insurance you need. For example, if you have a $250,000 policy and withdraw $25,000, your beneficiaries will only receive a $225,000 death benefit from your policy. The face amount of current life insurance policies does not count toward your net worth, but the cash value of policies and all inherited death benefits do count toward your net worth.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Several factors go into determining how much a buyer will offer for your life insurance policy. The current premium you pay on your policy is also a determining factor since the life settlement broker or provider will take over your payments. Each time you make a payment on your policy, your money is disbursed into these categories. The value of your life insurance is determined by several factors: There are two key values to a life insurance policy:

Source: insurechance.com

Source: insurechance.com

Moneysupermarket life insurance data showed that company directors were found to have the highest average cover amount (£222,586), followed by doctors (£187,410), dentists (£168,214), marketing professionals (£161,575) and those working in sport and fitness (£157,894). There are two key values to a life insurance policy: The death benefit is the amount the policy pays as a lump sum (generally income tax free) when the life insured dies. Your life insurance payments are split into three main categories: In general, if you are over the age of 65 or you are younger but have a terminal diagnosis from a doctor with less than two years to live, and your life insurance policy has a face value of more than $100,000, you can sell your life insurance policy.

Source: quotacy.com

Source: quotacy.com

An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. Another important thing to remember about cash value life insurance is that you can’t surrender. For example, if you have a $250,000 policy and withdraw $25,000, your beneficiaries will only receive a $225,000 death benefit from your policy. Of course, the amount of coverage you have is one of the most important considerations. The death benefit is the amount the policy pays as a lump sum (generally income tax free) when the life insured dies.

Source: insurechance.com

Source: insurechance.com

In general, if you are over the age of 65 or you are younger but have a terminal diagnosis from a doctor with less than two years to live, and your life insurance policy has a face value of more than $100,000, you can sell your life insurance policy. Can i sell my life insurance policy? In determining your net worth, you need to properly account for the value of your life insurance. Each time you make a payment on your policy, your money is disbursed into these categories. Your life insurance payments are split into three main categories:

Source: iammrfoster.com

Source: iammrfoster.com

The amount of a life settlement depends on the remaining amount of premiums that must be paid between selling the policy and the death benefit payment, the investor rate of return, and the expected lifespan of. The life insurance settlement agency recognizes that institutions typically prefer to buy universal life insurance policies with benefits exceeding $100,000 from people who are older than 65. If you have permanent insurance, your policy has three possible values: Death benefit, type of policy, cash value, policy age, health condition, and outstanding loans or withdrawals. Life insurance policy valuation factors.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

A whole life insurance cash surrender value on a policy with a face value of $275,000 after 15 years might be as much as $21,000 depending on how well the investment fund has performed. Moneysupermarket life insurance data showed that company directors were found to have the highest average cover amount (£222,586), followed by doctors (£187,410), dentists (£168,214), marketing professionals (£161,575) and those working in sport and fitness (£157,894). 3) sometimes a permanent policy can be sold as a life settlement. The face amount of current life insurance policies does not count toward your net worth, but the cash value of policies and all inherited death benefits do count toward your net worth. 2) the cash value (f there is any), which is what you could borrow from, or get in cash if you surrendered the policy.

Source: mcgriffwilliams.com

Source: mcgriffwilliams.com

Life insurance policy valuation factors. Check the kind of insurance the policy represents. How much is my life insurance policy worth? The current premium you pay on your policy is also a determining factor since the life settlement broker or provider will take over your payments. If you already have other life insurance or are able to switch to a less costly term life policy, cashing in may be the best option for you.

Source: moneyunder30.com

Source: moneyunder30.com

- sometimes a permanent policy can be sold as a life settlement. Can i sell my life insurance policy? A whole life insurance cash surrender value on a policy with a face value of $275,000 after 15 years might be as much as $21,000 depending on how well the investment fund has performed. Several factors go into determining how much a buyer will offer for your life insurance policy. Use our life insurance calculator to figure out how much life insurance you need.

Source: fqenois.blogspot.com

Source: fqenois.blogspot.com

Check the kind of insurance the policy represents. Each time you make a payment on your policy, your money is disbursed into these categories. The death benefit is the amount the policy pays as a lump sum (generally income tax free) when the life insured dies. Naturally, the dollar value of the policy plays a big role in determining its value. Of course, the amount of coverage you have is one of the most important considerations.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much is my life insurance policy worth by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.