How much is unemployment insurance in nevada information

Home » Trend » How much is unemployment insurance in nevada informationYour How much is unemployment insurance in nevada images are ready in this website. How much is unemployment insurance in nevada are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is unemployment insurance in nevada files here. Find and Download all royalty-free photos.

If you’re searching for how much is unemployment insurance in nevada pictures information related to the how much is unemployment insurance in nevada topic, you have pay a visit to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

How Much Is Unemployment Insurance In Nevada. In some cases, such as when the nevada unemployment rate is high, it may be difficult to find work. Nevada unemployment benefits and eligibility. This is vastly higher than the wage base found in most states. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a minimum of $16 per week and a maximum of $407 per week (as of july 1,.

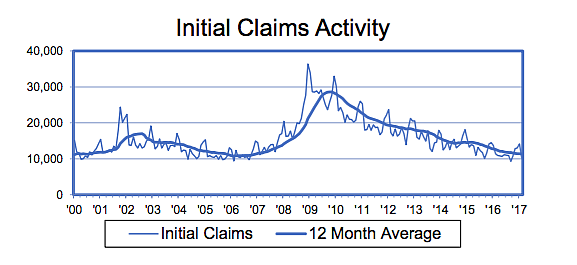

13 Nevada State Page Unemployment Chart 2.20.2015 CROPPED From eb5affiliatenetwork.com

13 Nevada State Page Unemployment Chart 2.20.2015 CROPPED From eb5affiliatenetwork.com

Each state has a different rate, and benefits vary. The maximum unemployment benefit you can get in nevada is $769 a week through september 6, 2021. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a maximum of. It provides an additional $600 per week in benefits and payments through july 31, 2020. In recent years, the rate has been just under 3%. Established employers are subject to a lower or higher rate than new employers depending on an experience rating. this means, among other things, whether your business has ever had any employees who made claims for state unemployment benefits.

Nevada unemployment insurance & modified business tax.

If you’re starting a new small business (congratulations!), you should use 2.95%. Employees whose wages are not reported for unemployment insurance;. The benefits will end after 26 weeks. As of 2020, nevada employers must pay ui tax on the first $32,500 of wages paid to any employee. Employing units in nevada, who meet registration requirements, must pay unemployment insurance (ui) tax at a rate of 2.95 percent (.0295) of wages paid to each employee up to the taxable wage limit. In some cases, such as when the nevada unemployment rate is high, it may be difficult to find work.

Source: francesapres.blogspot.com

Source: francesapres.blogspot.com

This may change if benefits are extended by nevada unemployment laws. Each state has a different rate, and benefits vary. If you qualify for benefits, you can be paid a maximum of 26 weeks of unemployment insurance of your full weekly benefit amount during a full benefit year. At licensesuite, we offer affordable nevada unemployment insurance tax registration compliance solutions that include a comprehensive overview of your licensing requirements. Nevada unemployment insurance is administered by employment and training administration (eta).

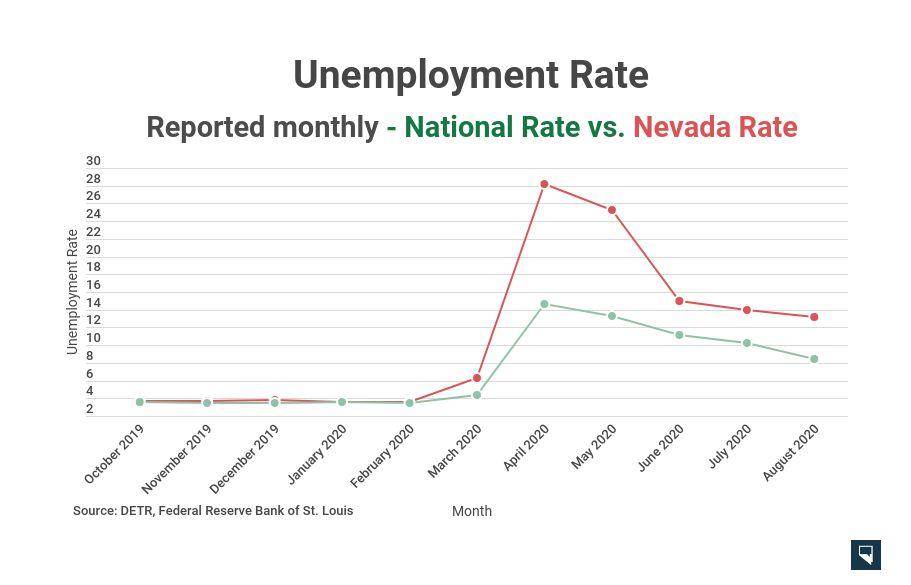

Source: nnbw.com

Source: nnbw.com

According to federal rules, a regular unemployment insurance (ui) claim expires after one year. Nevada unemployment benefits and eligibility. For further details refer to the unemployment benefits article. State of nevada department of employment, training and rehabilitation employment security division unemployment insurance program To be eligible for nv unemployment insurance, you must have lived and worked in nevada for the last 12 months and earned a certain amount.

Source: thenevadaindependent.com

Source: thenevadaindependent.com

To be eligible for nv unemployment insurance, you must have lived and worked in nevada for the last 12 months and earned a certain amount. Nevada unemployment insurance & modified business tax. Employees whose wages are not reported for unemployment insurance;. The nevada department of employment, training and rehabilitation (detr) is providing information about next steps to claimants who filed for unemployment insurance at the beginning of the pandemic and are coming to the end of their benefit year. How much you receive is based on how much you earned during the period of time used to create your eligibility.

Source: kunr.org

Source: kunr.org

This includes many different groups of people: However, companies can qualify for a tax credit of up to 5.4% based on their timely payment of state unemployment taxes. Seb+ is 13 + 7 weeks when nevada�s unemployment rate is over 8% for 3 months. The cost of a nevada unemployment insurance tax registration depends on a company�s industry, geographic service regions and possibly other factors. You will have to verify with your state’s unemployment office to see the highest payout for your state.

Source: noradarealestate.com

Source: noradarealestate.com

The futa tax rate for 2021 is 6% on the first $7,000 of employee wages (a max of $420 per year per employee). Nevada unemployment insurance & modified business tax. At licensesuite, we offer affordable nevada unemployment insurance tax registration compliance solutions that include a comprehensive overview of your licensing requirements. However, companies can qualify for a tax credit of up to 5.4% based on their timely payment of state unemployment taxes. Each state has a different rate, and benefits vary.

Source: thenevadaindependent.com

Source: thenevadaindependent.com

Employees whose wages are not reported for unemployment insurance;. The nevada department of employment, training and rehabilitation (detr) is providing information about next steps to claimants who filed for unemployment insurance at the beginning of the pandemic and are coming to the end of their benefit year. To be eligible for nv unemployment insurance, you must have lived and worked in nevada for the last 12 months and earned a certain amount. As an employer, you have to pay the state’s unemployment insurance. De division of unemployment insurance:

Source: francesapres.blogspot.com

Source: francesapres.blogspot.com

The maximum unemployment benefit you can get in nevada is $769 a week through september 6, 2021. This may change if benefits are extended by nevada unemployment laws. If you are living in nevada, but earned your wages in another state, you can file an interstate claim. Most states currently offer 26 weeks of unemployment benefits (see. After that, the maximum weekly benefit is $469.

Source: 8newsnow.com

Source: 8newsnow.com

The maximum unemployment benefit you can get in nevada is $769 a week through september 6, 2021. Typically, the maximum benefit you can claim from nevada unemployment insurance is $469 per week, for 26 weeks. Welcome to nevada’s unemployment insurance self service website. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a minimum of $16 per week and a maximum of $407 per week (as of july 1,. Employing units in nevada, who meet registration requirements, must pay unemployment insurance (ui) tax at a rate of 2.95 percent (.0295) of wages paid to each employee up to the taxable wage limit.

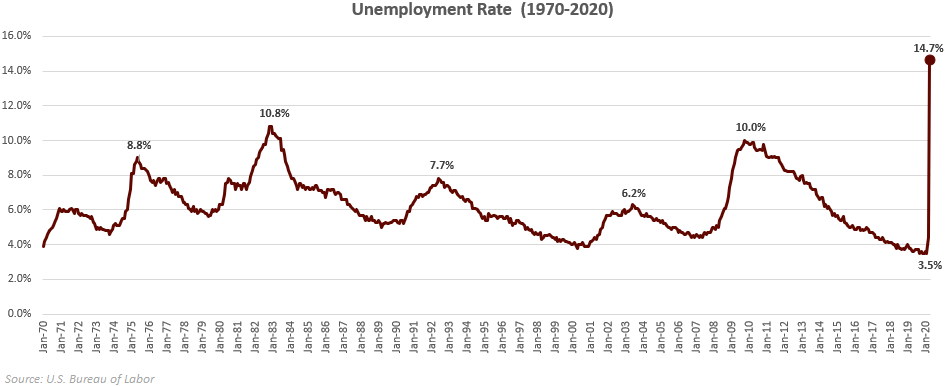

Source: rcg1.com

Source: rcg1.com

How much you receive is based on how much you earned during the period of time used to create your eligibility. This is vastly higher than the wage base found in most states. The maximum unemployment benefit you can get in nevada is $769 a week through september 6, 2021. Unfortunately, there�s no easy way to calculate exactly how much money you�ll receive through unemployment benefits or for how long you�ll be able to collect those benefits unless your state has an online unemployment calculator. Hi unemployment insurance state website:

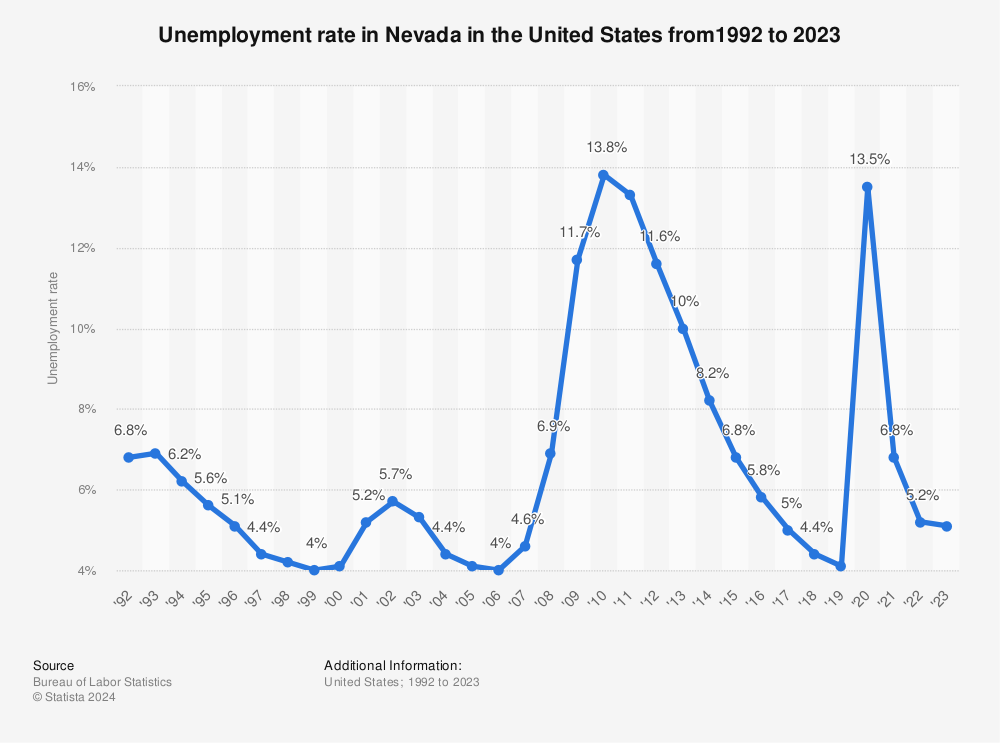

Source: statista.com

Source: statista.com

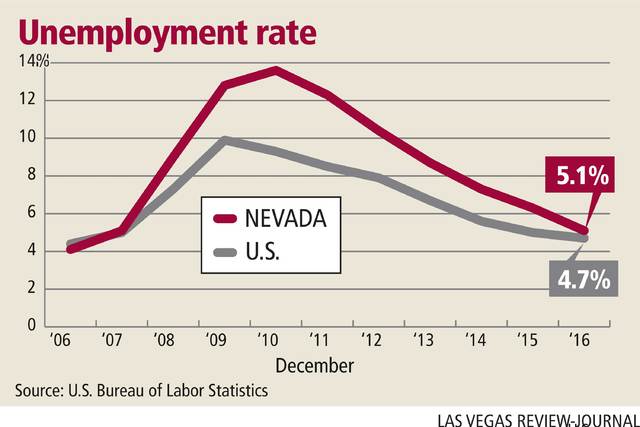

Seb+ is 13 + 7 weeks when nevada�s unemployment rate is over 8% for 3 months. Nevada should reduce the taxable wage base to an amount equal to 25 percent of the average wage or, alternatively, adopt the wage base used by the federal government (currently $7,000). For further details refer to the unemployment benefits article. For 2021, nevada’s unemployment insurance rates range from 0.25% to 5.40% with a taxable wage base of up to $33,400 per employee per year. Seb+ is 13 + 7 weeks when nevada�s unemployment rate is over 8% for 3 months.

Source: reviewjournal.com

Source: reviewjournal.com

For further details refer to the unemployment benefits article. The maximum unemployment benefit you can get in nevada is $769 a week through september 6, 2021. Unfortunately, there�s no easy way to calculate exactly how much money you�ll receive through unemployment benefits or for how long you�ll be able to collect those benefits unless your state has an online unemployment calculator. The cost of a nevada unemployment insurance tax registration depends on a company�s industry, geographic service regions and possibly other factors. You will have to verify with your state’s unemployment office to see the highest payout for your state.

Source: 8newsnow.com

Source: 8newsnow.com

Select your state to learn more about your eligibility, the application process, and how to submit your claim. How much you receive is based on how much you earned during the period of time used to create your eligibility. This may change if benefits are extended by nevada unemployment laws. Welcome to nevada’s unemployment insurance self service website. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a minimum of $16 per week and a maximum of $407 per week (as of july 1,.

Source: nvretirementplanners.com

Source: nvretirementplanners.com

If you are living in nevada, but earned your wages in another state, you can file an interstate claim. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a maximum of. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a minimum of $16 per week and a maximum of $407 per week (as of july 1,. Employees whose wages are not reported for unemployment insurance;. How much you receive is based on how much you earned during the period of time used to create your eligibility.

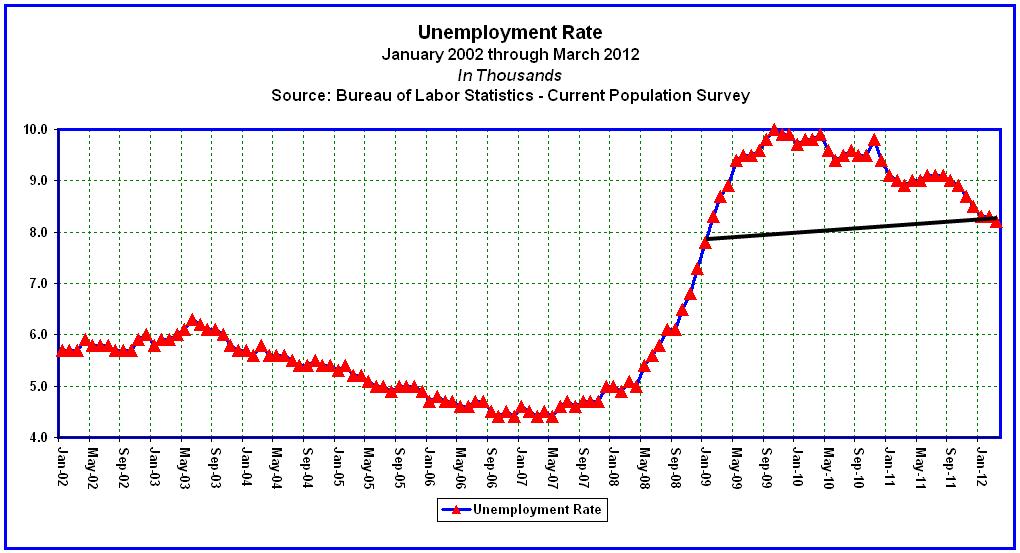

Source: unemployment-extension.com

Source: unemployment-extension.com

Generally the range of the weekly benefit amount is from $16.00 to $469.00. Welcome to nevada’s unemployment insurance self service website. Select your state to learn more about your eligibility, the application process, and how to submit your claim. If you qualify for benefits, you can be paid a maximum of 26 weeks of unemployment insurance of your full weekly benefit amount during a full benefit year. Amount and duration of unemployment benefits in nevada if you are eligible to receive unemployment, your weekly benefit rate (wbr) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a maximum of.

Source: eb5affiliatenetwork.com

Source: eb5affiliatenetwork.com

In recent years, the rate has been just under 3%. Nevada unemployment benefits and eligibility. How much unemployment benefits can i get in nevada? Nevada unemployment benefits and eligibility. Welcome to nevada’s unemployment insurance self service website.

Source: dicksoncg.com

Source: dicksoncg.com

Nevada unemployment benefits and eligibility. As of 2020, nevada employers must pay ui tax on the first $32,500 of wages paid to any employee. It adds an additional 13 weeks of benefits through december 31, 2020. How much you receive is based on how much you earned during the period of time used to create your eligibility. Unfortunately, there�s no easy way to calculate exactly how much money you�ll receive through unemployment benefits or for how long you�ll be able to collect those benefits unless your state has an online unemployment calculator.

Source: thenevadaindependent.com

Source: thenevadaindependent.com

Welcome to nevada’s unemployment insurance self service website. This includes many different groups of people: Most states currently offer 26 weeks of unemployment benefits (see. To access this system, please visit ui.nv.gov. As of 2020, nevada employers must pay ui tax on the first $32,500 of wages paid to any employee.

Source: reviewjournal.com

Source: reviewjournal.com

Typically, the maximum benefit you can claim from nevada unemployment insurance is $469 per week, for 26 weeks. Also, how much is the minimum unemployment benefit in nevada? Employees whose wages are not reported for unemployment insurance;. This may change if benefits are extended by nevada unemployment laws. To be eligible for nv unemployment insurance, you must have lived and worked in nevada for the last 12 months and earned a certain amount.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is unemployment insurance in nevada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.