How points affect insurance rates information

Home » Trending » How points affect insurance rates informationYour How points affect insurance rates images are ready in this website. How points affect insurance rates are a topic that is being searched for and liked by netizens now. You can Get the How points affect insurance rates files here. Download all free photos.

If you’re searching for how points affect insurance rates images information linked to the how points affect insurance rates interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

How Points Affect Insurance Rates. Car insurance premiums for drivers with 3 points. The association of british insurers (abi) has found that people with penalty points report a higher number of driving incidents and are more likely to make a claim than more careful road users. Points tied to an insurance provider can affect rates or premiums, though. Reckless driving will also result in four points but up to an 18.1 percent increase.

How Two Different Points Systems Affect Your Car Insurance From slideshare.net

How Two Different Points Systems Affect Your Car Insurance From slideshare.net

This means that not every company will penalize you the same. How demerit points affect insurance rates. How do insurance points affect premiums? As time goes by, if you keep your driving record clean, and don�t file any claims, the insurance points on your record could be reduced, leading to a lower premium. For example, one speeding ticket will increase your rate by 25% on average, whereas a dui conviction will generally raise your premium by 79%. Before the penalty points system was introduced, motorists were simply fined or banned if they were caught breaking the rules of the road.

Convictions affect insurance, not points.

10 traffic violations that affect your insurance speeding. Car insurance companies will look at. The higher risk you show of filing a future claim the higher your auto insurance rates will be and when you receive (or lose) points from a traffic law violation then you are automatically classified as a higher risk driver than someone without points. 950 tower ln, suite 600, foster city 94404. Below are a few examples of how driver�s license points can impact insurance rates in some states. Generally, the more points you have on.

Source: slideshare.net

Source: slideshare.net

Generally, the more points you have on. Car insurance with points on your license in new york state. Points aren’t just bad for your driving record. The higher risk you show of filing a future claim the higher your auto insurance rates will be and when you receive (or lose) points from a traffic law violation then you are automatically classified as a higher risk driver than someone without points. Your driver’s license is the only place you don’t want to score points.

Source: noclutter.cloud

Source: noclutter.cloud

This means that not every company will penalize you the same. This means that not every company will penalize you the same. It is primarily related to the infraction and amount of points. In this article, we’ll explain: In considering insurance rates, insurance company looks at “convictions” not the accumulation of.

Source: slideshare.net

Source: slideshare.net

Generally, the more points you have on. The details of points systems vary depending on where you live, but after a certain number of points, you risk having your license suspended or revoked. Below are a few examples of how driver�s license points can impact insurance rates in some states. If you have three points on your licence for an offence like speeding or not complying with traffic lights, your car insurance could increase by 5%. A driving record includes all driver’s license issuances, renewals, violations, points, accidents, suspensions, and other related occurrences.

Source: slideshare.net

Source: slideshare.net

It is primarily related to the infraction and amount of points. 10 traffic violations that affect your insurance speeding. Before the penalty points system was introduced, motorists were simply fined or banned if they were caught breaking the rules of the road. For example, if you cause an accident, not only may it result in points being added to your record, but it’ll probably prompt your premium to go up, too. While the points you net depend on your state�s driving laws, moving violations will hike your insurance rates in most cases.

Source: slideshare.net

Source: slideshare.net

The ways that points affect insurance rates doesn�t always correlate with the points on your state driving record. This means that not every company will penalize you the same. Auto insurance rates are affected by a number of variables including your credit history, the type of vehicle insured and more. The details of points systems vary depending on where you live, but after a certain number of points, you risk having your license suspended or revoked. In california, average insurance rates are around $1570.

Source: blog.appwinit.com

Source: blog.appwinit.com

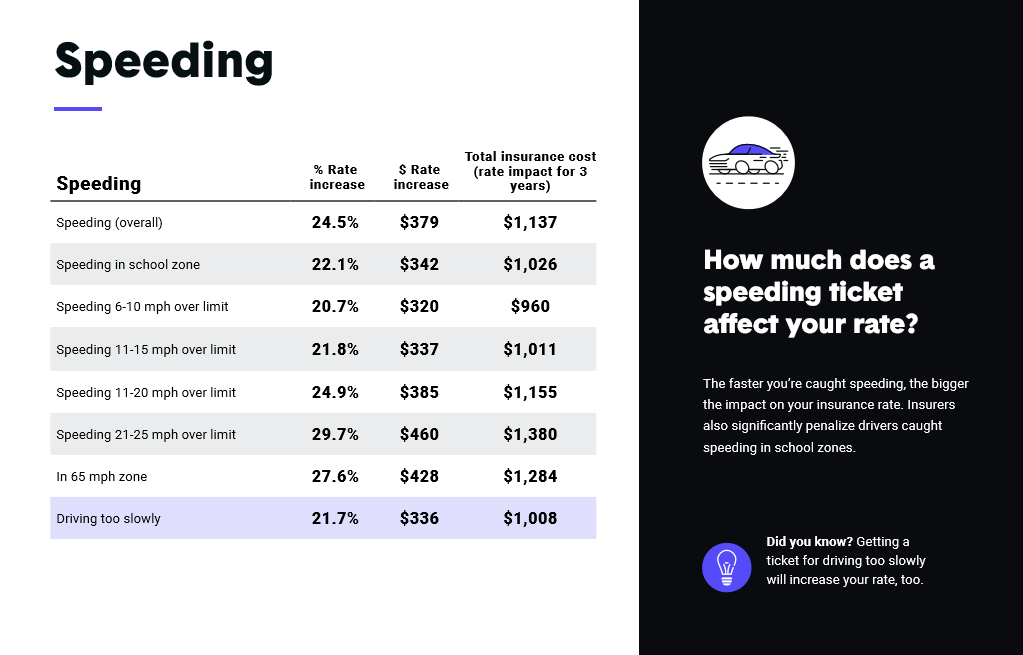

That means the more points you have on your driving record, the higher your insurance rates will be. Speeding can raise your insurance rate significantly, depending on frequency and the. Insurance points are used to assess your eligibility for auto insurance coverage and for calculation of rates. Car insurance premiums for drivers with 3 points. What you need to know:

Source: slideshare.net

Source: slideshare.net

For example, in california, disobeying a traffic control signal caused rates to increase 20.2%, while speeding resulted in a 25.6% rate increase, despite the. Reckless driving will also result in four points but up to an 18.1 percent increase. Studies from the governors highway safety association indicate the issue is only getting worse. It is primarily related to the infraction and amount of points. The introduction of the new system in 1988 was part of an attempt to provide the.

Source: diarisyakirah.blogspot.com

Source: diarisyakirah.blogspot.com

Any number of penalty points will affect your insurance premiums, and if you rack up 12 points, you could lose your driving licence. Licence suspensions dramatically affect insurance rates. The different kinds of driver’s license points. Your rates will increase by about 26% if you have six points on your record. Before the penalty points system was introduced, motorists were simply fined or banned if they were caught breaking the rules of the road.

Source: slideshare.net

Source: slideshare.net

Car insurance premiums for drivers with 3 points. How demerit points affect insurance rates. It is primarily related to the infraction and amount of points. If you have ever wondered: Points aren’t just bad for your driving record.

Source: slideshare.net

Source: slideshare.net

Car insurance with points on your license in new york state. Those moving from no points to three points see a 16% average increase in the cost of car insurance premiums, equating to a £160 rise. The more points you have on your licence, the more expensive your insurance is likely to be. Car insurance premiums for drivers with 3 points. Points aren’t just bad for your driving record.

Source: youtube.com

Source: youtube.com

For example, in california, disobeying a traffic control signal caused rates to increase 20.2%, while speeding resulted in a 25.6% rate increase, despite the. Those moving from no points to three points see a 16% average increase in the cost of car insurance premiums, equating to a £160 rise. When it’s time to renew your policy, your insurance company will likely pull the driving record of all insured drivers listed on your policy, flannagan says. The more of these points you have, the closer you are to facing some pretty severe and damaging consequences and the. The introduction of the new system in 1988 was part of an attempt to provide the.

Source: youtube.com

Source: youtube.com

The more points you have on your licence, the more expensive your insurance is likely to be. The different kinds of driver’s license points. Speeding can raise your insurance rate significantly, depending on frequency and the. Insurance points are used to assess your eligibility for auto insurance coverage and for calculation of rates. Car insurance companies have their own methods for inflating your rates after you�ve had accidents and violations.

Source: slideshare.net

Source: slideshare.net

In considering insurance rates, insurance company looks at “convictions” not the accumulation of. For example, if you cause an accident, not only may it result in points being added to your record, but it’ll probably prompt your premium to go up, too. According to wallethub, just two points on your driving record can increase your auto insurance premiums by 20% or more. Licence suspensions dramatically affect insurance rates. Your rates will increase by about 26% if you have six points on your record.

Source: njmcdirects.online

Source: njmcdirects.online

The different kinds of driver’s license points. It is primarily related to the infraction and amount of points. Car insurance with points on your license in new york state. What you need to know: When it’s time to renew your policy, your insurance company will likely pull the driving record of all insured drivers listed on your policy, flannagan says.

Source: slideshare.net

Source: slideshare.net

The association of british insurers (abi) has found that people with penalty points report a higher number of driving incidents and are more likely to make a claim than more careful road users. For example, in california, disobeying a traffic control signal caused rates to increase 20.2%, while speeding resulted in a 25.6% rate increase, despite the. For example, if you cause an accident, not only may it result in points being added to your record, but it’ll probably prompt your premium to go up, too. The more points you have on your licence, the more expensive your insurance is likely to be. Car insurance companies have their own methods for inflating your rates after you�ve had accidents and violations.

Source: fashion-by-clev.blogspot.com

Source: fashion-by-clev.blogspot.com

Having points on your driver’s license will also impact your car insurance rates if you decide to switch carriers or obtain new car insurance. This means that not every company will penalize you the same. For example, in california, disobeying a traffic control signal caused rates to increase 20.2%, while speeding resulted in a 25.6% rate increase, despite the. The exact amount that your premium increases after accumulating 3 points will depend on your state, insurance company, and individual driving record. Studies from the governors highway safety association indicate the issue is only getting worse.

Source: slideshare.net

Source: slideshare.net

The different kinds of driver’s license points. This means that not every company will penalize you the same. Any number of penalty points will affect your insurance premiums, and if you rack up 12 points, you could lose your driving licence. In considering insurance rates, insurance company looks at “convictions” not the accumulation of. Below are a few examples of how driver�s license points can impact insurance rates in some states.

Source: lawforumworld.com

Source: lawforumworld.com

What you need to know: If you have ever wondered: Speeding can raise your insurance rate significantly, depending on frequency and the. How do insurance points affect premiums? 10 traffic violations that affect your insurance speeding.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how points affect insurance rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.