How soon before closing should i get homeowners insurance information

Home » Trend » How soon before closing should i get homeowners insurance informationYour How soon before closing should i get homeowners insurance images are available. How soon before closing should i get homeowners insurance are a topic that is being searched for and liked by netizens today. You can Get the How soon before closing should i get homeowners insurance files here. Find and Download all royalty-free photos.

If you’re searching for how soon before closing should i get homeowners insurance pictures information related to the how soon before closing should i get homeowners insurance topic, you have come to the right blog. Our site always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

How Soon Before Closing Should I Get Homeowners Insurance. In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing. Many lenders require home insurance to protect the property. Most mortgage lenders will require proof of homeowners insurance at least three business days prior to closing on the home , and it’s not unusual for lenders to. Policy holders can get an extra premium of one million dollars.

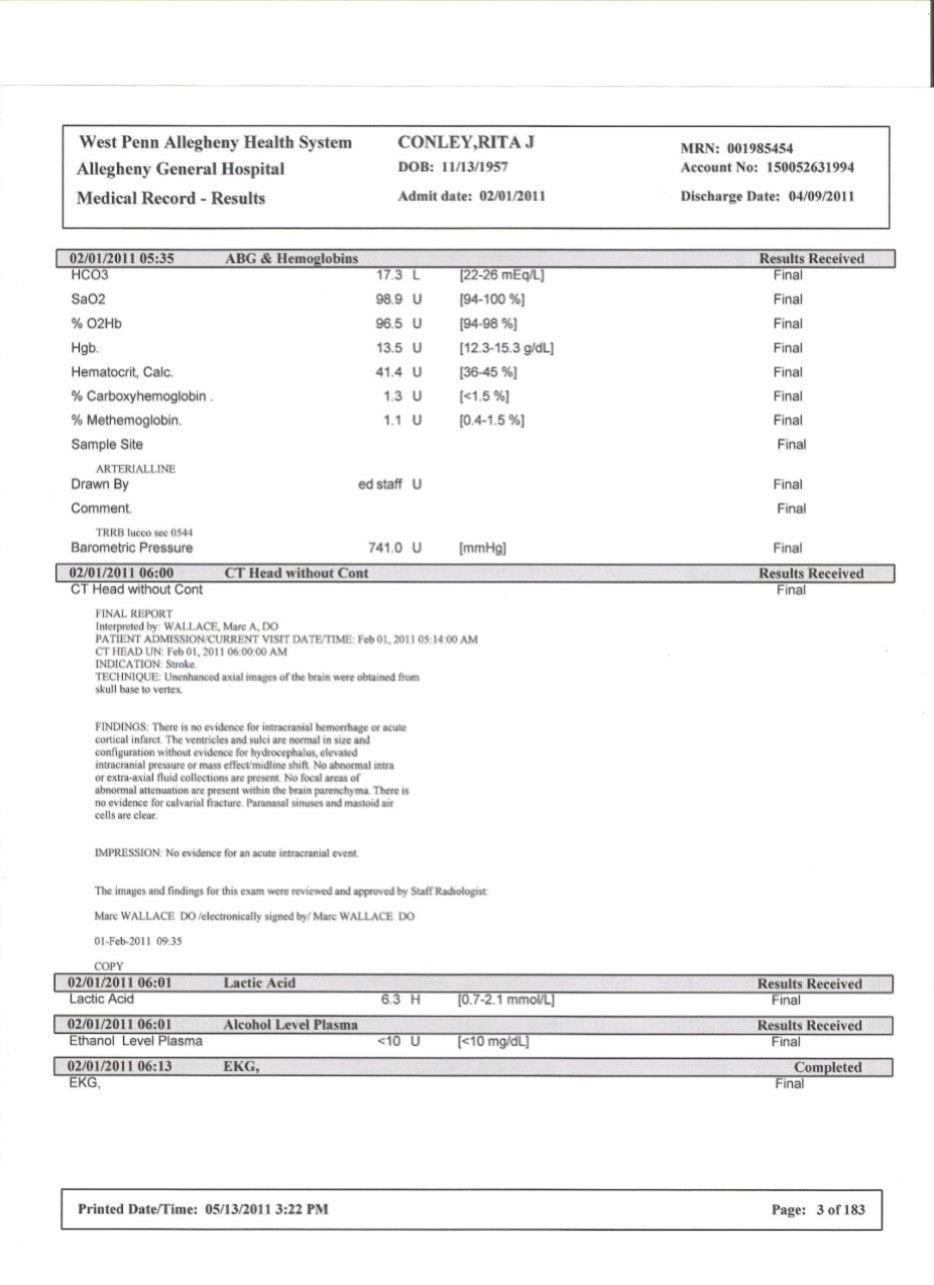

Home Buying Checklist What Happens After Your Offer is From visual.ly

Home Buying Checklist What Happens After Your Offer is From visual.ly

Policy holders can get an extra premium of one million dollars. You’ll want to let them know that you’re moving in the near future. Getting a homeowners insurance policy doesn’t take long. How much does homeowners insurance cost? Begin to obtain quotes as soon as you begin to seriously look at purchasing a home. If you are building a home, you can contact your carrier to secure coverage from the beginning of the building process.

Unlike homeowners insurance, which covers the structural property, renters insurance only insures your belongings and liability for accidents that happen on the premise.

That�s because most mortgage lenders require you to buy some type of homeowners coverage before closing. Policy holders can get an extra premium of one million dollars. If you need to relocate before you sell your existing home, you should know that a vacant or unoccupied home may not be covered by your homeowners policy, according to the according to the iii. In such situation homeowners insurance will soon give you a minimum of $20,000 as coverage. You should try to have a home insurance policy in place a couple of weeks before closing. While many lenders provide insurance referrals, choosing a home insurance company is your decision.

Source: imoney.my

Source: imoney.my

Before closing on a new home, your lender will require you to purchase a home insurance policy. To be on the safe side, start shopping for homeowners insurance around three weeks to a month ahead of your closing date. It�s a good idea to start shopping for homeowners insurance as soon as you sign a contract to buy a home. This gives you plenty of time to compare coverage options and rates. So, you should plan to look for policies while choosing a mortgage company.

Source: houselogic.com

Source: houselogic.com

You’re required to get enough insurance to cover 100 percent of the cost to replace or rebuild the home. So, you should plan to look for policies while choosing a mortgage company. When you take ownership of the new home, you should have a homeowners insurance policy in place for it. There’s a lot to consider when choosing a homeowners policy, especially when you’re trying to factor in all the other expenses you’ll be covering at closing. You should try to have a home insurance policy in place a couple of weeks before closing.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

Most mortgage lenders require proof of homeowners insurance a minimum of three. The new owners will need to get their own insurance policy. A binder is a legal agreement from your insurance company promising to insure your new home as soon as you close. Come with me, let me show you,’ then we don’t have that stress at the end,” helbert. Acquiring homeowners insurance is one condition that you’ll have to meet before closing.

Source: styrowing.com

Source: styrowing.com

Do i need homeowners insurance to qualify for a loan? Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Most mortgage lenders require proof of homeowners insurance before they’ll let you close on a home. In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing. The new owners will need to get their own insurance policy.

Source: somedayilllearn.com

Source: somedayilllearn.com

Obtaining homeowners insurance should be part of the home purchase process and is almost always required before closing on a home. To be on the safe side, start shopping for homeowners insurance around three weeks to a month ahead of your closing date. If you are building a home, you can contact your carrier to secure coverage from the beginning of the building process. In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing. That’s why you should start shopping for homeowner’s insurance as soon as you receive an accepted agreement for purchase and sale.

Source: venturebeat.com

Source: venturebeat.com

When should i get homeowners insurance before closing? That’s why you should start shopping for homeowner’s insurance as soon as you receive an accepted agreement for purchase and sale. Typically, you will have a month or more between the time you sign a contract and the day you close on your new home. The time between the getting your offer accepted and closing can last two to three months and this period is generally an ideal time to shop for insurance quotes. Most mortgage lenders require proof of homeowners insurance a minimum of three.

Source: usermanual.wiki

Source: usermanual.wiki

When should i get homeowners insurance before closing? This coverage include at the scene emergency aid, bodily injury medical expenses, legal defense fees, loss of income compensation, funeral expenses, bail bonds (the person must be listed on. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. The day before closing shouldn’t be a very stressful time, and working with a top agent will do wonders for your confidence come closing day. In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing.

Source: troyfaininsurance.com

Source: troyfaininsurance.com

Protecting yourself and the lender. Acquiring homeowners insurance is one condition that you’ll have to meet before closing. Protecting yourself and the lender. Yes, the buyer should have homeowners insurance before closing on the property. How soon before closing should i get homeowners insurance?

Source: unexpectedlydomestic.com

Source: unexpectedlydomestic.com

This gives you plenty of time to compare coverage options and rates. That way, the coverage will be set and if there are any issues with the policy, you can clear them up before your closing date. To be on the safe side, start shopping for homeowners insurance around three weeks to a month ahead of your closing date. There’s a lot to consider when choosing a homeowners policy, especially when you’re trying to factor in all the other expenses you’ll be covering at closing. Begin to obtain quotes as soon as you begin to seriously look at purchasing a home.

Source: pedalsure.com

Source: pedalsure.com

Many lenders require home insurance to protect the property. The time between the getting your offer accepted and closing can last two to three months and this period is generally an ideal time to shop for insurance quotes. The day before closing shouldn’t be a very stressful time, and working with a top agent will do wonders for your confidence come closing day. This gives you plenty of time to compare coverage options and rates. This makes sense given that renters aren’t liable for the building itself.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

Can i get homeowners insurance before closing? It�s a good idea to start shopping for homeowners insurance as soon as you sign a contract to buy a home. Alternatively, you can switch to new homeowners insurance once your policy expires. You’ll want to let them know that you’re moving in the near future. You should try to have a home insurance policy in place a couple of weeks before closing.

Source: healthcare.utah.edu

Source: healthcare.utah.edu

In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing. There’s no need to get renters insurance until you move in. Most lenders will require you to provide proof of insurance in the form of a binder at least three days prior to closing on your new home. Getting a homeowners insurance policy doesn’t take long. To be on the safe side, start shopping for homeowners insurance around three weeks to a month ahead of your closing date.

Source: ifunny.co

Source: ifunny.co

Can i get homeowners insurance before closing? Getting a homeowners insurance policy doesn’t take long. That’s what landlord insurance is for. There’s no need to get renters insurance until you move in. Theft, vandalism, fire, or water damage are far more likely to happen in vacant houses than in occupied ones, says loretta worters, a vice president with iii.

Source: malhotrainsurance.com

Source: malhotrainsurance.com

Protecting yourself and the lender. That�s because most mortgage lenders require you to buy some type of homeowners coverage before closing. Unlike homeowners insurance, which covers the structural property, renters insurance only insures your belongings and liability for accidents that happen on the premise. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Start looking for home insurance three weeks to a month before your actual closing date.

Source: mullerinsurance.com

Source: mullerinsurance.com

Do i need homeowners insurance to qualify for a loan? Most mortgage lenders require proof of homeowners insurance before they’ll let you close on a home. The time between the getting your offer accepted and closing can last two to three months and this period is generally an ideal time to shop for insurance quotes. If you need to relocate before you sell your existing home, you should know that a vacant or unoccupied home may not be covered by your homeowners policy, according to the according to the iii. Yes, the buyer should have homeowners insurance before closing on the property.

Source: healthcare.utah.edu

Source: healthcare.utah.edu

Start looking for home insurance three weeks to a month before your actual closing date. This allows you to shop around for quotes and gives you time to get your policy in place before closing on the purchase. It�s a good idea to start shopping for homeowners insurance as soon as you sign a contract to buy a home. If you need to relocate before you sell your existing home, you should know that a vacant or unoccupied home may not be covered by your homeowners policy, according to the according to the iii. Do i need homeowners insurance to qualify for a loan?

Source: dreamfinancialplanning.com

Source: dreamfinancialplanning.com

Do i need homeowners insurance to qualify for a loan? Before your lender grants the mortgage, you will need to provide proof of homeowner’s insurance to close. When you take ownership of the new home, you should have a homeowners insurance policy in place for it. In a typical home buying transaction, you will bring proof of the insurance policy to the closing, or you can fax a copy to the escrow company or lender prior to closing. That’s why you should start shopping for homeowner’s insurance as soon as you receive an accepted agreement for purchase and sale.

Source: thebalance.com

Source: thebalance.com

A binder is a legal agreement from your insurance company promising to insure your new home as soon as you close. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Theft, vandalism, fire, or water damage are far more likely to happen in vacant houses than in occupied ones, says loretta worters, a vice president with iii. In most cases, yes, you will need to purchase a homeowners insurance policy before the lender will allow the closing to proceed. So, you should plan to look for policies while choosing a mortgage company.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how soon before closing should i get homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.