How to calculate cash surrender value of life insurance information

Home » Trending » How to calculate cash surrender value of life insurance informationYour How to calculate cash surrender value of life insurance images are ready. How to calculate cash surrender value of life insurance are a topic that is being searched for and liked by netizens today. You can Get the How to calculate cash surrender value of life insurance files here. Download all free images.

If you’re searching for how to calculate cash surrender value of life insurance pictures information connected with to the how to calculate cash surrender value of life insurance topic, you have come to the right site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

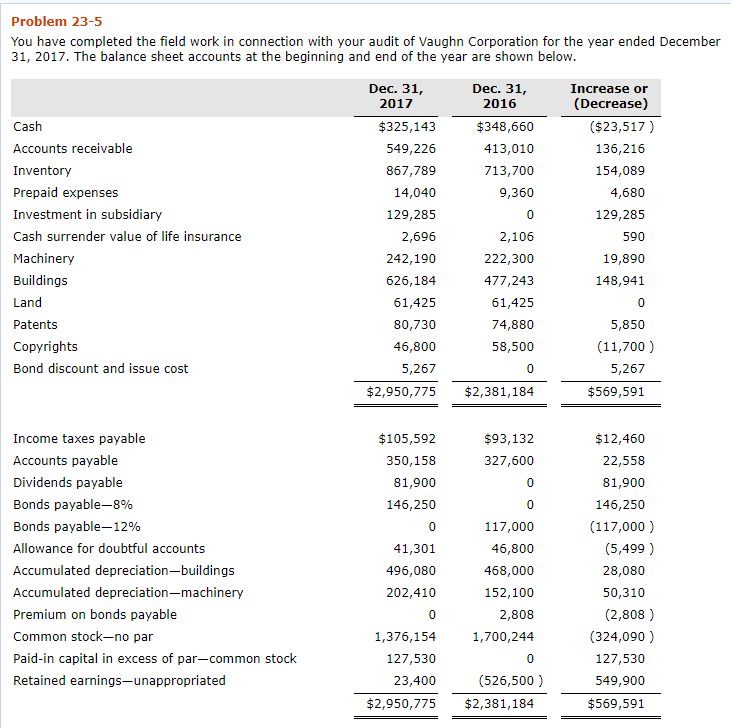

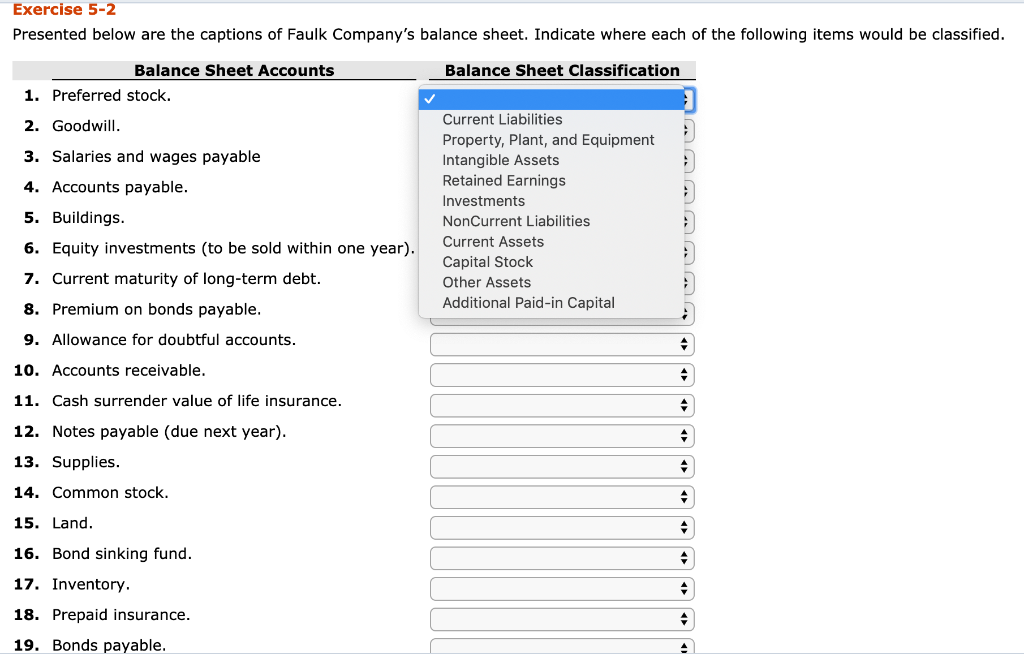

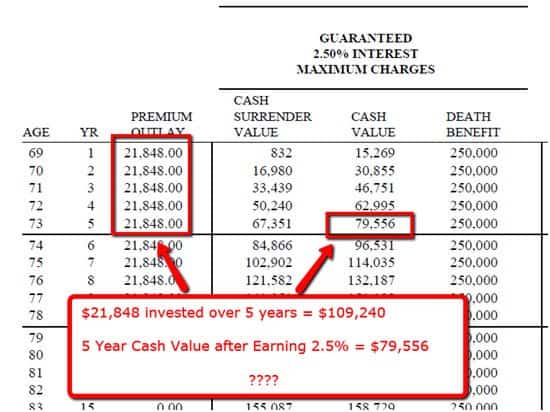

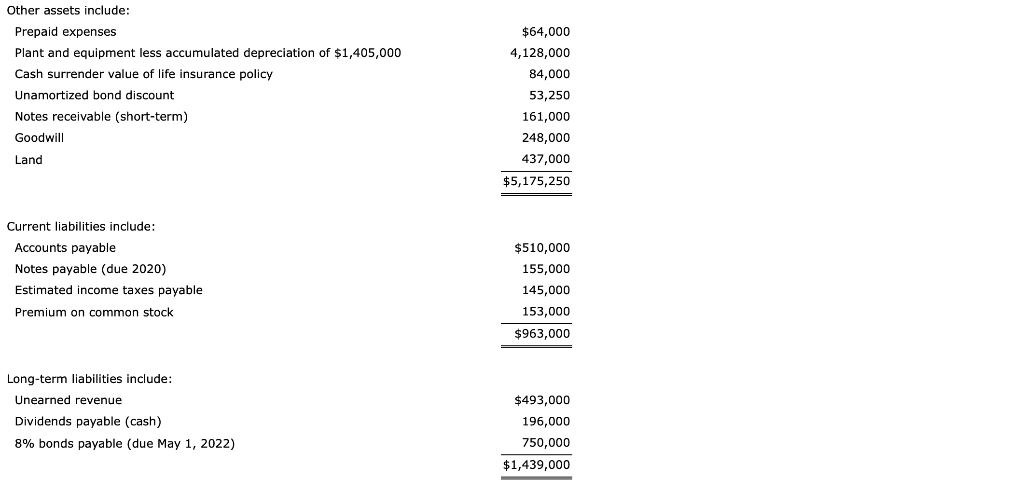

How To Calculate Cash Surrender Value Of Life Insurance. People surrender their life insurance policies for numerous reasons. For variable policies, the cash is invested into sub accounts that work like a mutual fund—the cash value grows or. These charts will clearly show you how much cash value your whole life insurance has accrued. Special surrender value can be calculated using a simple formula which is:

New York Life Insurance Company Reviews How To Calculate From newyorklifeinsurancecompanyreviewswoy.blogspot.com

New York Life Insurance Company Reviews How To Calculate From newyorklifeinsurancecompanyreviewswoy.blogspot.com

When you take life insurance, there are two options; How is cash surrender value in life insurance taxed? The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date. You want to surrender the policy to access the cash value in it. Variable and indexed universal life policies accumulate cash value differently. To understand what is the cash surrender value of term life insurance, you need to comprehend how it works.

These charts will clearly show you how much cash value your whole life insurance has accrued.

To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. These fees depend on the policy�s specific terms but usually include a surrender charge and processing fees. It’s unlikely that cash value will exceed the premiums paid if you surrender the policy within the first ten years. What is the surrender value in a life insurance plan? Permanent and term life insurance and both have benefits and downsides. Essentially, the life insurance cash surrender value is going to be less than the face value of the.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

The easiest way to understand cash surrender values is to work with a florida independent insurance agent.if you�re looking for a. The surrender value and charges can differ for each policy as. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit. The average cash surrender value of a life insurance policy is the amount of cash you will receive on the insurance policy if you forfeit or surrender the policy. What is the surrender value in a life insurance plan?

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

For example, during the retained earnings balance sheet first policy year, your surrender value could be 0% of the cash value, if you have any cash value built up. The calculation of cash surrender value is based on the savings component of whole life insurance policies. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy). These fees depend on the policy�s specific terms but usually include a surrender charge and processing fees. Life insurance is designed to pay a large sum of money to someone when you pass away.

Source: cookingwiththepros.us

Source: cookingwiththepros.us

Cash value is not considered taxable while it remains part of your life insurance policy. The surrender value of life insurance policy can be calculated easily using an effective online tool called surrender value calculator. Special surrender value can be calculated using a simple formula which is: To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Just as it sounds, a withdrawal allows you to receive money from your policy.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit. Subsequently, you will receive $5,600, and the company will earn $1,400 in fees. A whole life insurance policy�s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy. It�s important to find out your cash surrender value, which is your cash value minus any surrender charges you�re required to pay.

Source: lsminsurance.ca

Source: lsminsurance.ca

These fees depend on the policy�s specific terms but usually include a surrender charge and processing fees. You need to provide some of the basic information to calculate the surrender value. A surrender charge is a fee the insurance company charges when a policyholder wants to terminate the policy and take out their funds. For example, during the retained earnings balance sheet first policy year, your surrender value could be 0% of the cash value, if you have any cash value built up. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy).

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

These charts will clearly show you how much cash value your whole life insurance has accrued. How does ’cash value’ work in a life insurance policy? Cash value is not considered taxable while it remains part of your life insurance policy. You pay a premium to procure insurance coverage, and a portion of this premium is used towards providing life coverage and administrative fees. The surrender value of life insurance policy can be calculated easily using an effective online tool called surrender value calculator.

Source: britneyspearspictzzd.blogspot.com

Source: britneyspearspictzzd.blogspot.com

However, with certain policies, you can end your life insurance contract early and receive a cash payout, referred to as the cash surrender value. Permanent and term life insurance and both have benefits and downsides. These charts will clearly show you how much cash value your whole life insurance has accrued. When you take life insurance, there are two options; How does ’cash value’ work in a life insurance policy?

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

Then your insurance company adjusts for their surrender charge of 20 percent, for example. Surrendering a policy cancels your coverage. You can access the surrender value calculator online on the website of an insurance company. This way you will learn the total actual payout you would receive from surrendering a life insurance policy. If you want to stop making payments on your policy, you have the option to work with your insurance.

Source: thismyshiatsxz.blogspot.com

Source: thismyshiatsxz.blogspot.com

To understand what is the cash surrender value of term life insurance, you need to comprehend how it works. People surrender their life insurance policies for numerous reasons. This comes from the monthly or annual premiums you pay to prevent a policy lapse. When you take life insurance, there are two options; Cash surrender value generally equals the cash value of the policy minus any applicable fees.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

For example, during the retained earnings balance sheet first policy year, your surrender value could be 0% of the cash value, if you have any cash value built up. Cash value is not considered taxable while it remains part of your life insurance policy. On the other hand, the cash surrender value refers to the cash value minus how much you�ll pay in surrender fees. Permanent and term life insurance and both have benefits and downsides. People surrender their life insurance policies for numerous reasons.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

How to calculate cash surrender value of life insurance. The surrender value of life insurance policy can be calculated easily using an effective online tool called surrender value calculator. For variable policies, the cash is invested into sub accounts that work like a mutual fund—the cash value grows or. Cash value is not considered taxable while it remains part of your life insurance policy. The cash surrender value of life insurance is the amount an insurance company will pay you when you surrender or voluntarily terminate your policy before it reaches its maturity or before the events covered in the policy occurs.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

You need to provide some of the basic information to calculate the surrender value. Cash value vs surrender value. If you want to stop making payments on your policy, you have the option to work with your insurance. You can calculate your life insurance’s cash value by adding the total of the premium payments you’ve made for the policy and subtracting fees, commissions, and expenses charged by the insurer. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Cash value vs surrender value. If you want to stop making payments on your policy, you have the option to work with your insurance. For example, during the retained earnings balance sheet first policy year, your surrender value could be 0% of the cash value, if you have any cash value built up. What is the surrender value in a life insurance plan? Company to cancel it (and the death benefit) and receive its cash surrender value.

Source: clips-dkso.blogspot.com

Source: clips-dkso.blogspot.com

For variable policies, the cash is invested into sub accounts that work like a mutual fund—the cash value grows or. These fees depend on the policy�s specific terms but usually include a surrender charge and processing fees. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit. This amount is payable to you after deducting the applicable surrender charges. You pay a premium to procure insurance coverage, and a portion of this premium is used towards providing life coverage and administrative fees.

Source: chegg.com

Source: chegg.com

The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. *accessing the cash value of the policy will reduce the available cash surrender value and death benefit. This comes from the monthly or annual premiums you pay to prevent a policy lapse. Special surrender value can be calculated using a simple formula which is: Variable and indexed universal life policies accumulate cash value differently.

Source: wealthmanagement.com

Source: wealthmanagement.com

However, with certain policies, you can end your life insurance contract early and receive a cash payout, referred to as the cash surrender value. Then your insurance company adjusts for their surrender charge of 20 percent, for example. You can access the surrender value calculator online on the website of an insurance company. Essentially, the life insurance cash surrender value is going to be less than the face value of the. How is cash surrender value in life insurance taxed?

Source: monegenix.com

Source: monegenix.com

People surrender their life insurance policies for numerous reasons. You pay 1000 in surrender charges and receive a check from the insurance company for 12000. These fees depend on the policy�s specific terms but usually include a surrender charge and processing fees. The calculation of cash surrender value is based on the savings component of whole life insurance policies. The average cash surrender value of a life insurance policy is the amount of cash you will receive on the insurance policy if you forfeit or surrender the policy.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Cash value vs surrender value. For variable policies, the cash is invested into sub accounts that work like a mutual fund—the cash value grows or. The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy. Surrendering a policy cancels your coverage.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to calculate cash surrender value of life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.