How to calculate public liability insurance information

Home » Trend » How to calculate public liability insurance informationYour How to calculate public liability insurance images are ready in this website. How to calculate public liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the How to calculate public liability insurance files here. Find and Download all free vectors.

If you’re searching for how to calculate public liability insurance pictures information linked to the how to calculate public liability insurance topic, you have pay a visit to the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

How To Calculate Public Liability Insurance. Business interruption insurance is an obvious insurance type that needs to know your estimated turnover. How is the sum insured decided for public liability insurance? The cost will depend heavily on the type and size of business that you run. The public liability insurance covers your legal liability to a third (3rd) party as a result of an accident happening in connection with your business operations.

Public Liability Insurance Agency Singapore Commercial From credence.agency

Public Liability Insurance Agency Singapore Commercial From credence.agency

For public liability, it is commonly £1 million, £2 million or £5 million. If your revenue is less than $5,000,000 a year, you should look at coverage amounts between $1,000,000 to $2,000,000. If the quote is $25 per square foot, multiply $25 by the amount of occupied square footage in your office. Types of public liability insurance policies. However, for businesses such as consulting firms, liability insurance is based on the square footage of occupancy. Public liability cover levels are in the millions because compensation figures can take into account things such as the third party’s loss of earnings, medical costs and ongoing care costs, so the amounts can.

For example, if the quote is for 10.

How is the sum insured decided for public liability insurance? With an appropriate public liability insurance policy, all such expenses are covered. The cover level is the maximum amount that your insurer will pay out in the event of an insurable claim. Public liability, for example, is based on turnover and staff numbers so the higher the revenue and staff count, the higher the cost of your public liability cover. Higher the risk, the higher the premium you will pay or vice versa. Click the button below for a quote on your public liability insurance, or read through the rest of our guide below.

Source: issuu.com

Source: issuu.com

When it comes to working out premiums for public & employer’s liability, insurers can use a number of rating factors. All management consultants have a ‘base rate’ of 1.25% (this figure can vary hugely by insurer). Business interruption insurance is an obvious insurance type that needs to know your estimated turnover. Rates assigned to those classifications. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees.

Source: moneysupermarket.com

Source: moneysupermarket.com

The number of areas you would want to cover in your policy might also affect the. For example, if the quote is for 10 percent, multiply your gross revenues by 0.10 to calculate your cost. Calculate quotes by multiplying the rate by the size or revenues of your company. The number of areas you would want to cover in your policy might also affect the. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees.

Source: moneysupermarket.com

Source: moneysupermarket.com

This method is most suitable for smaller businesses. Your provider has to assess how much risk it is taking on by covering your business. While deciding the premium for public liability insurance, the insurers take various factors into consideration. Types of public liability insurance policies. Exposure base applied to the rates.

Source: startupnation.com

Source: startupnation.com

According to the iso system, premiums are largely based on three elements: Rates assigned to those classifications. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees. The number of areas you would want to cover in your policy might also affect the. Public liability insurance provides cover limits of £1m, £2m or £5million.

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

The insurance indemnifies you against all sums which you become legally liable for damages and claimant’s costs and expenses in. Public liability, for example, is based on turnover and staff numbers so the higher the revenue and staff count, the higher the cost of your public liability cover. We explain the benefits of reviewing pl limits of indemnity, and offer guidance on choosing a suitable level of cover. This method is most suitable for smaller businesses. When it comes to working out premiums for public & employer’s liability, insurers can use a number of rating factors.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

If the quote is $25 per square foot, multiply $25 by the amount of occupied square footage in your office. Public liability cover levels are in the millions because compensation figures can take into account things such as the third party’s loss of earnings, medical costs and ongoing care costs, so the amounts can. Most insurance companies base quotes for manufacturing and large distribution companies on sales revenues. Click the button below for a quote on your public liability insurance, or read through the rest of our guide below. Public liability, for example, is based on turnover and staff numbers so the higher the revenue and staff count, the higher the cost of your public liability cover.

Source: pinterest.com

Source: pinterest.com

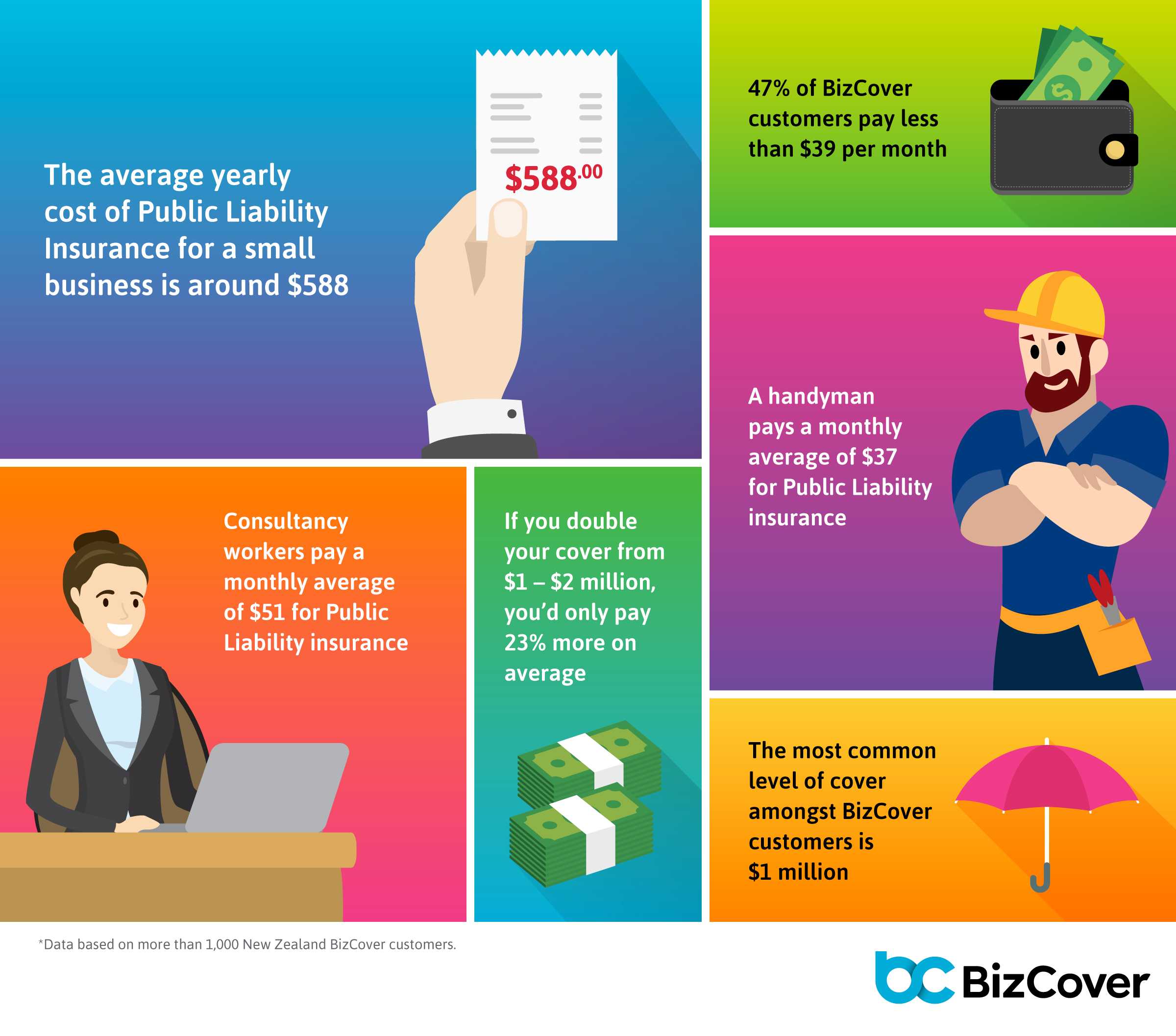

To calculate the premium for product liability insurance policy, the insurance company looked into various factors, such as= type of your business activity= there are some firms which are riskier than the other. Typically public liability cover is available in either $5million, $10million and $20million. The cost of public liability can vary greatly from as little as $300 a year through to many thousands per year. When it comes to working out premiums for public & employer’s liability, insurers can use a number of rating factors. Rates assigned to those classifications.

Source: waterpult.ru

Public liability insurance provides cover limits of £1m, £2m or £5million. The level of indemnity you opt for will depend on the type of land you own and the risks you face — generally the lower the indemnity, the lower the premium. When it comes to working out premiums for public & employer’s liability, insurers can use a number of rating factors. Public liability insurance provides cover limits of £1m, £2m or £5million. A basic insurance policy can cost less than £100 a year including insurance premium tax.

Source: alltradescover.com.au

Source: alltradescover.com.au

The most common are per capita (per person) rated and wage roll and turnover rated. Your class code will be compared to other factors such as the size of your payroll, your gross sales, and the size and type of buildings you own or lease, to help determine your insurance needs and your insurance rates. Your provider has to assess how much risk it is taking on by covering your business. For public liability, it is commonly £1 million, £2 million or £5 million. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees.

Source: svroofing.co

Source: svroofing.co

If your revenue is less than $5,000,000 a year, you should look at coverage amounts between $1,000,000 to $2,000,000. Business interruption insurance is an obvious insurance type that needs to know your estimated turnover. For example, if the quote is for 10 percent, multiply your gross revenues by 0.10 to calculate your cost. We explain the benefits of reviewing pl limits of indemnity, and offer guidance on choosing a suitable level of cover. How public liability insurance cost is calculated a basic insurance policy can cost less than £100 a year including insurance premium tax.

Source: credence.agency

Source: credence.agency

Types of public liability insurance policies. The public liability insurance covers your legal liability to a third (3rd) party as a result of an accident happening in connection with your business operations. Types of public liability insurance policies. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees. The indemnity, the maximum amount that can be paid out in a claim, varies.

Classifications assigned to the business. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees. The public liability insurance covers your legal liability to a third (3rd) party as a result of an accident happening in connection with your business operations. However, for businesses such as consulting firms, liability insurance is based on the square footage of occupancy. Typically public liability cover is available in either $5million, $10million and $20million.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

To calculate the premium for product liability insurance policy, the insurance company looked into various factors, such as= type of your business activity= there are some firms which are riskier than the other. To calculate the premium for product liability insurance policy, the insurance company looked into various factors, such as= type of your business activity= there are some firms which are riskier than the other. Your provider has to assess how much risk it is taking on by covering your business. If the quote is $25 per square foot, multiply $25 by the amount of occupied square footage in your office. The foremost thing that severely affects the premium of 3 rd party liability insurance is the amount of risk your business is exposed to.

Source: educainfosr.blogspot.com

Source: educainfosr.blogspot.com

If the quote is $25 per square foot, multiply $25 by the amount of occupied square footage in your office. The public liability insurance cost for a trade business can be affected by a range of different factors. If your revenue is less than $5,000,000 a year, you should look at coverage amounts between $1,000,000 to $2,000,000. Public liability insurance provides cover limits of £1m, £2m or £5million. The cost of the premiums will depend on the type and nature of your business, your turnover and the number of employees.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

For instance, if you’re a dj or live performer, some venues might want you to have a certain level of. Types of public liability insurance policies. How public liability insurance cost is calculated. For instance, if you’re a dj or live performer, some venues might want you to have a certain level of. Fire, flood, severe weather or closure of a major supplier may result in loss of.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

The number of areas you would want to cover in your policy might also affect the. Public liability insurance provides cover limits of £1m, £2m or £5million. While deciding the premium for public liability insurance, the insurers take various factors into consideration. A basic insurance policy can cost less than £100 a year including insurance premium tax. Calculate quotes by multiplying your insurance rates by the size or revenue (whichever applies) of your company.

Source: youtube.com

Source: youtube.com

Typically public liability cover is available in either $5million, $10million and $20million. All management consultants have a ‘base rate’ of 1.25% (this figure can vary hugely by insurer). The most common are per capita (per person) rated and wage roll and turnover rated. Rates assigned to those classifications. With an appropriate public liability insurance policy, all such expenses are covered.

Fire, flood, severe weather or closure of a major supplier may result in loss of. We look at four things to consider to ensure adequate levels of public and products liability insurance. A basic insurance policy can cost less than £100 a year including insurance premium tax. When it comes to working out premiums for public & employer’s liability, insurers can use a number of rating factors. To calculate the premium for product liability insurance policy, the insurance company looked into various factors, such as= type of your business activity= there are some firms which are riskier than the other.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate public liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.