How to claim depreciation on insurance claim Idea

Home » Trending » How to claim depreciation on insurance claim IdeaYour How to claim depreciation on insurance claim images are ready in this website. How to claim depreciation on insurance claim are a topic that is being searched for and liked by netizens today. You can Get the How to claim depreciation on insurance claim files here. Get all royalty-free photos.

If you’re looking for how to claim depreciation on insurance claim pictures information connected with to the how to claim depreciation on insurance claim interest, you have come to the ideal site. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

How To Claim Depreciation On Insurance Claim. Claiming recoverable depreciation from your insurance company begins with filing a claim. Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. The rate of depreciation is 50%. The policyholder uses the insurance money to perform roof repairs and the contractor’s invoice is submitted to the insurance company.

Home Insurance Claim Depreciation Lawsuits From classaction.org

Home Insurance Claim Depreciation Lawsuits From classaction.org

For any paint related job. In most instances, you should notify your claim professional of your intent to recover your depreciation within 6 months or 180 days of the date of loss. In some states, and depending on your policy, the length of time to do so may be longer or shorter. We received an estimate & they deducted the depreciated value of the carpet from the cash we received. In motor vehicle insurance claims only. A claims adjuster will visit your home or business and.

Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps.

We had a large leak in our kitchen this summer, which ended up flooding our basement. Once the insurer has proof that the roof has been completed, the insurance company releases the recoverable depreciation payment (in the above example, $5,000) to resolve the claim. We had a large leak in our kitchen this summer, which ended up flooding our basement. Pay you less than their replacement cost, until (12). So if you start doing the work and replacing items, provide the receipts to the insurance company as you get them. Claiming recoverable depreciation from your insurance company begins with filing a claim.

Source: btins.com

Source: btins.com

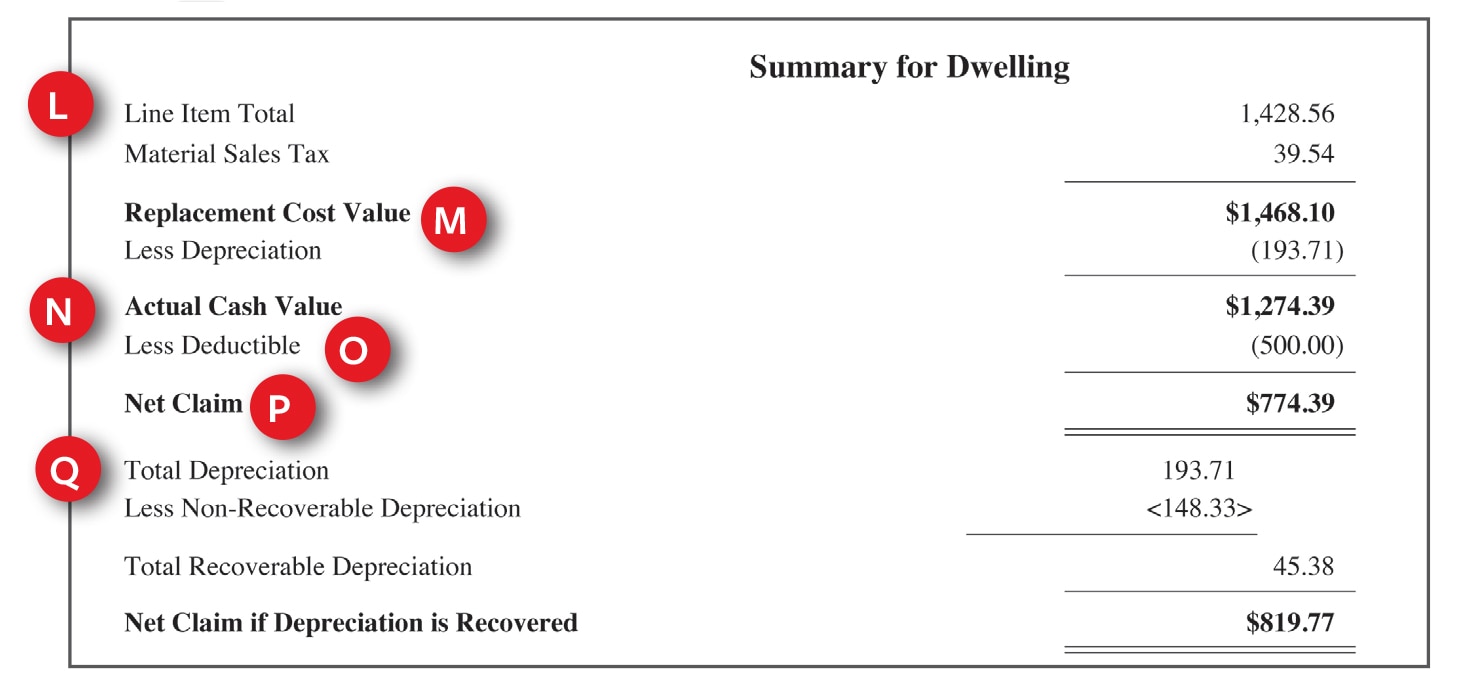

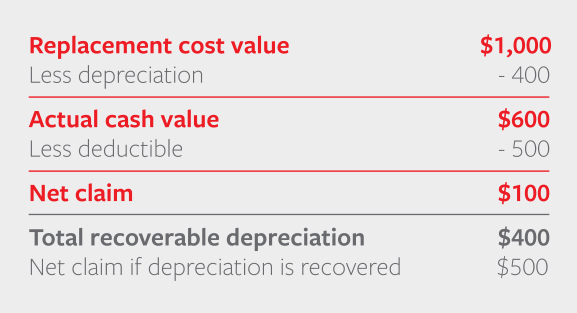

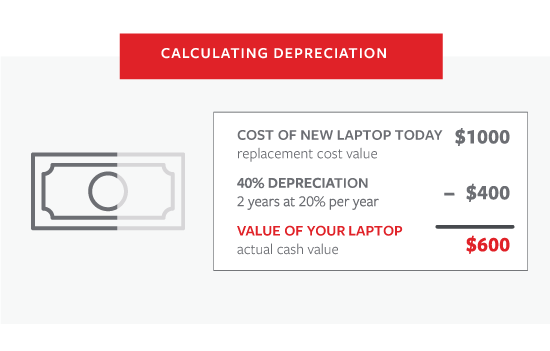

This will make it easier if you ever need to file a claim. The estimate your insurance company wrote breaks down depreciation for every item, piece by piece. If you have replacement cost coverage, depreciating an insurance claim will involve at least two payments. $2,000 (the initial cost and value of the oven when brand new) divided by 10 years (the expected useful lifespan of the oven) = depreciation of $200 per year. With recoverable depreciation, the claim is adjusted upwards to include the depreciation amount:

Source: travelers.com

Source: travelers.com

However, you should be able to file a second claim for recoverable depreciation. Then the company will send you a check for the acv amount, minus your insurance deductible. An insurance claim amounted to $6,000 was filed. For any paint related job. This will make it easier if you ever need to file a claim.

Source: bankbazaar.com

Source: bankbazaar.com

$2,000 (the initial cost and value of the oven when brand new) divided by 10 years (the expected useful lifespan of the oven) = depreciation of $200 per year. Depreciation is the amount your property drops in value since you first bought it. Submitting a request for recoverable depreciation. If you do not use all of your depreciation to get your home fix your insurance company will subtract that your deductible from the final or lower price which is on the invoice rather than the total amount of the insurance claim was allowed. For any paint related job.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

How to recover depreciation value on homeowners insurance claims. A thief may have violated your right to privacy and raided your home. Be sure to file the necessary paperwork to recover the depreciation, and make sure you know the deadlines. So if you start doing the work and replacing items, provide the receipts to the insurance company as you get them. However, you should be able to file a second claim for recoverable depreciation.

Source: houstonremodeling.com

Source: houstonremodeling.com

If you have replacement cost coverage, depreciating an insurance claim will involve at least two payments. Submitting a request for recoverable depreciation. The initial amount is based on the (12). Pay you less than their replacement cost, until (12). The estimate your insurance company wrote breaks down depreciation for every item, piece by piece.

Source: relakhs.com

Source: relakhs.com

If you have to file an insurance claim, chances are you�re already stressed out. Insurance question from dublin, oh. $2,000 (the initial cost and value of the oven when brand new) divided by 10 years (the expected useful lifespan of the oven) = depreciation of $200 per year. The rate of depreciation in both the cases. Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps.

Source: noblepagroup.com

Source: noblepagroup.com

After loss or damage occurs, call and initiate the claim process with your insurance provider. Submit all your receipts to your insurance adjuster. How to claim depreciation on insurance claim. Depreciation is the amount your property drops in value since you first bought it. Insurers may use an irs depreciation schedule or their own schedule.

Source: classaction.org

Source: classaction.org

If you’re currently in the process of making an insurance claim, or, if you own insured property and assets that are subject to future claims, then it’s important you understand how recoverable depreciation works. Then the company will send you a check for the acv amount, minus your insurance deductible. He will send you another settlement check representing the difference between the replacement cost on the receipts and the initial depreciated settlement check you already received. The estimate your insurance company wrote breaks down depreciation for every item, piece by piece. Maintain an inventory of your belongings, using photos and videos when you can.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Pay you less than their replacement cost, until (12). An insurance adjuster will calculate the rcv, acv and depreciation of the property that was lost or damaged. Based on this information, the annual depreciation allowed per year is the total cost divided by the total expected lifespan (useful life), which works out to: General depreciation rules by claiming a deduction over the effective life of the asset. How to claim depreciation on insurance claim.

Source: travelers.com

Source: travelers.com

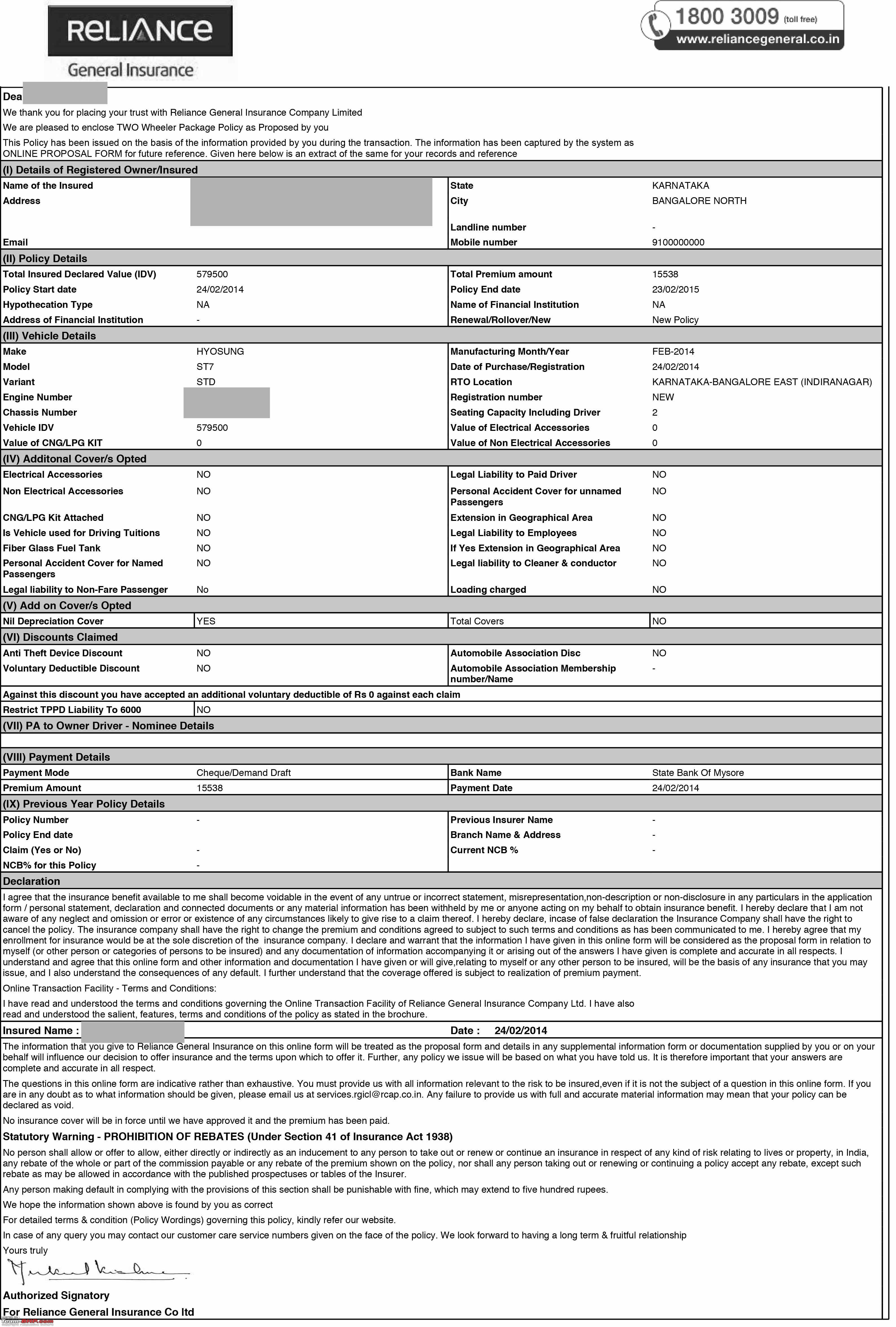

They are required to release your depreciation on those specific items as you incur the costs. Here are three terms that will help you understand how depreciation works in connection with insurance claims. More important than ever to claim depreciation mortgage from www.mortgagehouse.com.au. Your insurer may depreciate (11). The rate of depreciation is 50%.

Source: echolshomeimprovements.com

Source: echolshomeimprovements.com

When you need to replace your property, depreciation can affect your insurance claims. Talk to your insurance agent about what is needed and always get copies of your receipts. The policyholder uses the insurance money to perform roof repairs and the contractor’s invoice is submitted to the insurance company. Based on this information, the annual depreciation allowed per year is the total cost divided by the total expected lifespan (useful life), which works out to: He will send you another settlement check representing the difference between the replacement cost on the receipts and the initial depreciated settlement check you already received.

Source: goodshepherdroofing.com

Source: goodshepherdroofing.com

Talk to your insurance agent about what is needed and always get copies of your receipts. When you need to replace your property, depreciation can affect your insurance claims. From the 7th month onwards, the rate of depreciation depends on the age of the car. Provide either the original documents or legible copies to your claim professional, and remember to keep copies for your files. How to recover depreciation value on homeowners insurance claims.

Source: rethority.com

Source: rethority.com

The depreciation check of insurance claim usually only cut after your contractor submits his final invoice. When you file an insurance claim, your insurer will take the depreciation into account when cutting you a check. Likewise, if the company receives an insurance claim from the insurance company amounting to 100% of the loss value of the fixed asset, it can make the journal entry for insurance claim received by debiting the cash account and the accumulated depreciation account and crediting the fixed asset account. Insurance claims tools and databases. Depreciation is the amount your property drops in value since you first bought it.

.jpg “Roofing Contractor Forms for Insurance Restoration”) Source: actcontractorsforms.com

Here is the usual process for recovering depreciation on a home insurance claim: The estimate your insurance company wrote breaks down depreciation for every item, piece by piece. Submitting a claim generally, to recover the cost of depreciation, you must repair or replace the damaged asset, submit the invoices and receipts with the claim, and provide original claim forms and receipts, and contact an insurance professional for further steps. They are required to release your depreciation on those specific items as you incur the costs. We had a large leak in our kitchen this summer, which ended up flooding our basement.

Source: team-bhp.com

Source: team-bhp.com

The estimate your insurance company wrote breaks down depreciation for every item, piece by piece. Claiming recoverable depreciation from your insurance company begins with filing a claim. The rate of depreciation in both the cases. We received an estimate & they deducted the depreciated value of the carpet from the cash we received. So if you start doing the work and replacing items, provide the receipts to the insurance company as you get them.

Source: youtube.com

Source: youtube.com

The rate of depreciation is 0% for the first 6 months. Here is the usual process for recovering depreciation on a home insurance claim: He will send you another settlement check representing the difference between the replacement cost on the receipts and the initial depreciated settlement check you already received. Your adjuster will depreciate items, i.e. Submitting a request for recoverable depreciation.

Source: earlytoshare.blogspot.com

$2,000 (the initial cost and value of the oven when brand new) divided by 10 years (the expected useful lifespan of the oven) = depreciation of $200 per year. Pay you less than their replacement cost, until (12). Recoverable depreciation is an important, and often misunderstood, concept in the insurance industry. Claiming recoverable depreciation from your insurance company begins with filing a claim. Be sure to file the necessary paperwork to recover the depreciation, and make sure you know the deadlines.

Source: quietskydesign.blogspot.com

Source: quietskydesign.blogspot.com

More important than ever to claim depreciation mortgage from www.mortgagehouse.com.au. From the 7th month onwards, the rate of depreciation depends on the age of the car. The rate of depreciation is 0% for the first 6 months. Based on this information, the annual depreciation allowed per year is the total cost divided by the total expected lifespan (useful life), which works out to: Insurance question from dublin, oh.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to claim depreciation on insurance claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.