How to collect pip insurance Idea

Home » Trend » How to collect pip insurance IdeaYour How to collect pip insurance images are ready. How to collect pip insurance are a topic that is being searched for and liked by netizens today. You can Get the How to collect pip insurance files here. Download all free photos.

If you’re looking for how to collect pip insurance pictures information connected with to the how to collect pip insurance interest, you have visit the right site. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

How To Collect Pip Insurance. To collect pip insurance after a car accident, you must file a claim with your car insurance carrier. How to collect pip insurance. Pip should be able to go against the driver�s insurance policy and you should be able to get that money quickly. The policy limit extends to each person injured in an accident, and it refers to the total amount of benefits available across all expenses.

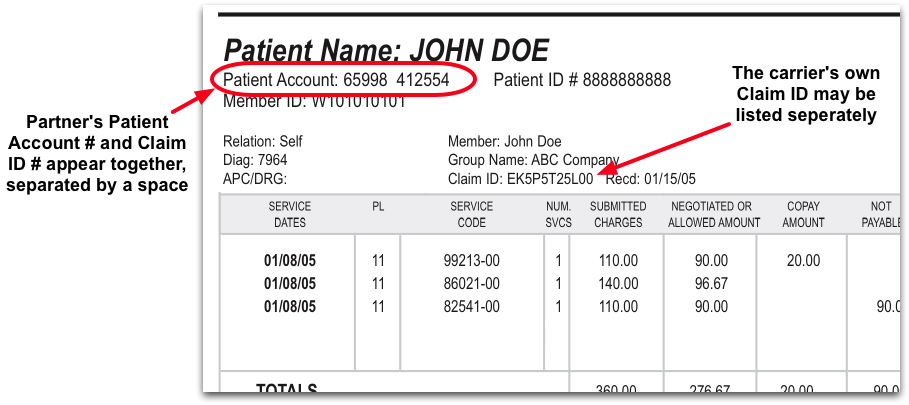

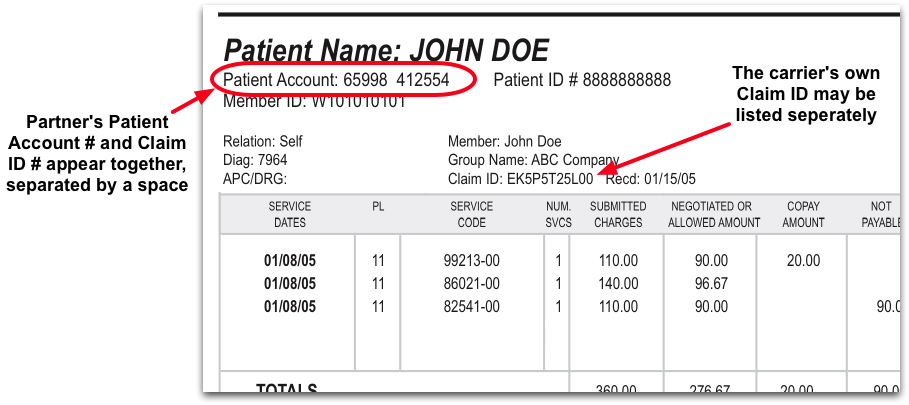

What is a Claim ID Number? PCC Learn From learn.pcc.com

What is a Claim ID Number? PCC Learn From learn.pcc.com

Call the pip insurance company and make a claim. Your pip insurance also applies to anyone else injured inside your vehicle, and any pedestrian struck by your vehicle. Most motor vehicle policies in washington include pip coverage. Then, you can obtain uninsured motorist (um) coverage. The law allows insurance companies to collect higher rates while providing fewer benefits. Remember that you will need the pip policy number on hand to set up the claim.

After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses.

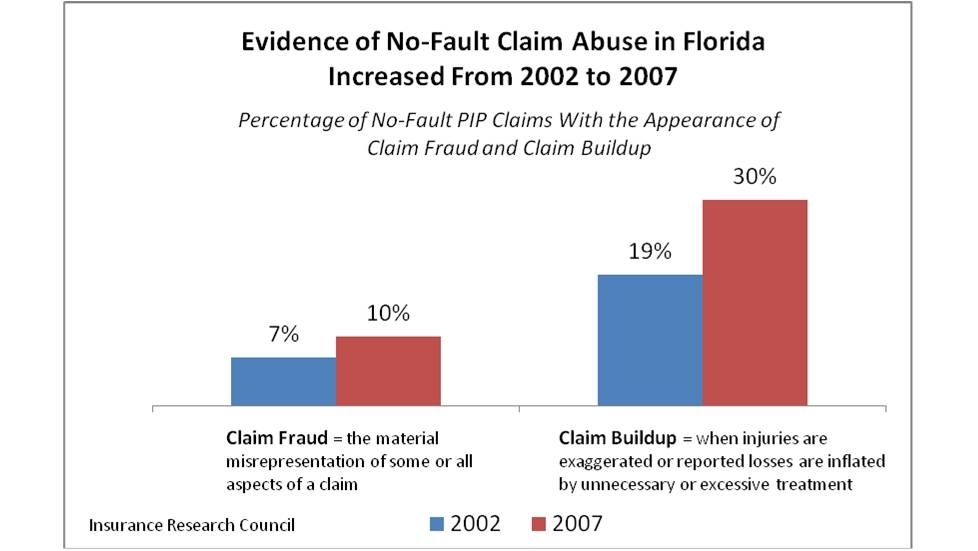

Just call your insurer and the driver�s insurer and ask for their application forms. Read your insurance company’s claim process so you know exactly what to do in case you’re harmed in an accident. Then, you can obtain uninsured motorist (um) coverage. The company will investigate the claim and then will release the amount as per your limits. The original purpose of pip (personal injury protection) insurance was to help prevent insurance fraud, but in reality, thousands were affected by the passing of this law that took effect on january 1, 2013.from medical providers to injured motorists and even insurers, pip has taken its toll. To collect pip insurance after a car accident, you must file a claim with your car insurance carrier.

Source: lowmanlawfirm.com

Source: lowmanlawfirm.com

The original purpose of pip (personal injury protection) insurance was to help prevent insurance fraud, but in reality, thousands were affected by the passing of this law that took effect on january 1, 2013.from medical providers to injured motorists and even insurers, pip has taken its toll. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. The steps for how to collect pip insurance are the same, regardless of who is liable. To opt out of pip coverage, you have to reject it in writing. Requirements for this coverage vary from state to state.

Source: claimformmiyakugu.blogspot.co.za

Source: claimformmiyakugu.blogspot.co.za

Let’s take a closer look at the personal injury protection definition. Pip should be able to go against the driver�s insurance policy and you should be able to get that money quickly. The quicker you report, the better. How to collect pip insurance. Have insurance that is purchased from a florida licensed insurance carrier.

Source: michiganautolaw.com

Source: michiganautolaw.com

Remember that you will need the pip policy number on hand to set up the claim. To collect pip benefits after you were injured in a car accident, you must file an application for michigan pip benefits with the applicable auto insurance within one year from the date of your car accident. How to collect pip insurance. Personal injury protection works to cover all the medical expenses of the driver and the passengers after an accident. The steps for how to collect pip insurance are the same, regardless of who is liable.

Source: injurylawyers.com

Source: injurylawyers.com

The policy limit extends to each person injured in an accident, and it refers to the total amount of benefits available across all expenses. Pip should be able to go against the driver�s insurance policy and you should be able to get that money quickly. Soon after your car accident, it is vital to report the collision to your insurance provider. How does pip insurance work? Personal injury protection works to cover all the medical expenses of the driver and the passengers after an accident.

Source: youngalfred.com

Source: youngalfred.com

The steps for how to collect pip insurance are the same, regardless of who is liable. You can typically obtain coverage for $5,000 or $10,000 if you want additional financial protection. Let’s understand how to collect pip insurance with an example. This means that you receive. How to collect pip insurance.

Source: epainassist.com

Source: epainassist.com

The quicker you report, the better. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. Personal injury protection works to cover all the medical expenses of the driver and the passengers after an accident. What exactly is pip insurance? Have a minimum of $10,000 in pip insurance and $10,000 in property damage liability insurance (pdl).

Source: joy-bernard.blogspot.com

Source: joy-bernard.blogspot.com

Then, you can obtain uninsured motorist (um) coverage. Personal injury protection (pip) is a type of car insurance that covers expenses, like medical bills, legal fees, lost wages, and more, when you are in a car accident, regardless of fault. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. Without your written rejection, your insurance company has to provide the coverage, and you have to pay for it. Pip is designed to provide relief to individuals that have been injured, incurred medical bills, and/or lost wages due to being involved in an accident.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

The policy limit extends to each person injured in an accident, and it refers to the total amount of benefits available across all expenses. If you’re involved in an accident, contact the claims officer right away. In pennsylvania, all drivers are required to have pip coverage. How to collect personal injury protection (pip) insurance. You can even make a copy of the chat so that there is a record.

Source: insurance.com

After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. Collecting pip is pretty easy. Call the pip insurance company and make a claim. You can even make a copy of the chat so that there is a record. If you’re involved in an accident, contact the claims officer right away.

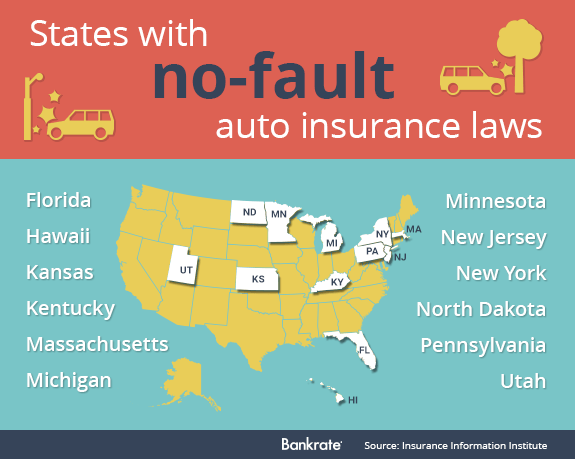

Source: bankrate.com

Source: bankrate.com

Remember that you will need the pip policy number on hand to set up the claim. Here�s how pip claims work, and what policyholders need to know. Pip should be able to go against the driver�s insurance policy and you should be able to get that money quickly. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. This coverage applies to your entire household and protects you financially if any of you are involved in an accident with an uninsured person.

Source: lawhelplouisville.com

Source: lawhelplouisville.com

Personal injury protection (pip) is auto insurance coverage for lost wages, medical bills, and other expenses that can result from personal injuries suffered in a maryland auto accident. Have continuous coverage even if a vehicle is not being driven or if the vehicle is inoperable. Personal injury protection (pip) is auto insurance coverage for lost wages, medical bills, and other expenses that can result from personal injuries suffered in a maryland auto accident. Personal injury protection (pip) is included in auto insurance. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses.

Source: accidentfirm.com

Remember that you will need the pip policy number on hand to set up the claim. Whether the policy is mandatory or not, you can collect pip repayments without regard to. Collecting pip is pretty easy. Pip should be able to go against the driver�s insurance policy and you should be able to get that money quickly. Personal injury protection (pip) is included in auto insurance.

Source: fotorise.com

Source: fotorise.com

To collect pip insurance after a car accident, you must file a claim with your car insurance carrier. Your pip insurance also applies to anyone else injured inside your vehicle, and any pedestrian struck by your vehicle. What exactly is pip insurance? If you have purchased car insurance in pennsylvania, you have likely been asked to confirm coverage levels for a number of different types of coverage — including personal injury protection, or pip. How to collect pip insurance.

Source: learn.pcc.com

Source: learn.pcc.com

The policy limit extends to each person injured in an accident, and it refers to the total amount of benefits available across all expenses. Personal injury protection (pip) is auto insurance coverage for lost wages, medical bills, and other expenses that can result from personal injuries suffered in a maryland auto accident. Let’s take a closer look at the personal injury protection definition. Here�s how pip claims work, and what policyholders need to know. After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses.

Your pip insurance also applies to anyone else injured inside your vehicle, and any pedestrian struck by your vehicle. Pip is designed to provide relief to individuals that have been injured, incurred medical bills, and/or lost wages due to being involved in an accident. Requirements for this coverage vary from state to state. Let’s take a closer look at the personal injury protection definition. How to collect personal injury protection (pip) insurance.

Source: dolmanlaw.com

Source: dolmanlaw.com

Pip is designed to provide relief to individuals that have been injured, incurred medical bills, and/or lost wages due to being involved in an accident. How to collect pip insurance. To collect pip benefits after you were injured in a car accident, you must file an application for michigan pip benefits with the applicable auto insurance within one year from the date of your car accident. Read your insurance company’s claim process so you know exactly what to do in case you’re harmed in an accident. The law allows insurance companies to collect higher rates while providing fewer benefits.

Source: carsurance.net

Source: carsurance.net

This coverage applies to your entire household and protects you financially if any of you are involved in an accident with an uninsured person. First, be sure that your personal injury protection coverage meets the florida’s requirements. Personal injury protection (pip) is auto insurance coverage for lost wages, medical bills, and other expenses that can result from personal injuries suffered in a maryland auto accident. To collect pip insurance after a car accident, you must file a claim with your car insurance carrier. Let’s take a closer look at the personal injury protection definition.

Source: popularworldnews.com

Source: popularworldnews.com

North dakota drivers must buy at least $30,000 in pip coverage. Personal injury protection (pip) is a type of car insurance that covers expenses, like medical bills, legal fees, lost wages, and more, when you are in a car accident, regardless of fault. What exactly is pip insurance? After you have filed your claim, the insurance company should review it and pay out your benefits to cover your expenses. Without your written rejection, your insurance company has to provide the coverage, and you have to pay for it.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to collect pip insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.