How to get life insurance on someone information

Home » Trending » How to get life insurance on someone informationYour How to get life insurance on someone images are available. How to get life insurance on someone are a topic that is being searched for and liked by netizens today. You can Get the How to get life insurance on someone files here. Get all royalty-free photos.

If you’re searching for how to get life insurance on someone pictures information related to the how to get life insurance on someone keyword, you have visit the right blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

How To Get Life Insurance On Someone. Buying life insurance on someone else and naming yourself as beneficiary might sound like a plot point in a film noir mystery. It costs $21.56 a month. In other words, you will have to show why you want. Then you can look into speaking with the life insurance company.

In other words, you will have to show why you want. Buying a permanent life insurance policy may make sense for some people based on their needs. That way the life insurance company can figure out their risk level and set the premium accordingly. The contestability period typically encompasses the first two years after someone purchases a life insurance policy. For 95% of young canadian families, term life insurance is the best type of life insurance because it provides sufficient coverage at a highly affordable price. To claim life insurance after a loved one dies, you need to start by finding the policy document.

Not only do you need to prove insurable interest to buy life insurance on someone, you also need their consent.

So to recap, you can not take out a life insurance policy on someone without their knowledge, and no one should be able to do it to you. Some policies do not require any exam, medical. That money is often free from federal income. As you get older, rates will only increase over time and you may experience other health issues that increase your risk to an insurer. When setting up a policy, the policy owner names one or more beneficiaries who receive the death benefit. But taking out a policy on another person makes good sense in some.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

Plan for the unexpected—yes, it’s easier and more affordable to get life insurance when you are young and healthy. But taking out a policy on another person makes good sense in some. For 95% of young canadian families, term life insurance is the best type of life insurance because it provides sufficient coverage at a highly affordable price. How much does a $50,000 life insurance policy cost? As you get older, rates will only increase over time and you may experience other health issues that increase your risk to an insurer.

Getting life insurance with depression. In order to have a valid policy, the owner must: In other words, you will have to show why you want. While there may be ways to add to existing life insurance policies, unfortunately, if you or a loved one has been diagnosed with a terminal condition like heart disease or cancer, it is unlikely that you will be able to purchase a new life insurance policy. You depend on their income to pay for household expenses that would continue such as the mortgage or rent;

Source: comparecover.com

Source: comparecover.com

Unlike other situations when you buy life insurance on someone else, children don’t have to undergo a medical exam or sign the policy. Here are the most common reasons folks get life insurance on someone else like their spouse or partner: To get life insurance for someone else, the other person needs to know that you are getting the policy, agree to it, and sign the application. Life insurance companies don’t automatically dole out payments upon a policyholder’s death. It costs $21.56 a month.

Source: pinterest.com

Source: pinterest.com

Plus, in most cases, the insured person will need a medical exam. It would be nearly impossible to buy life insurance on someone without them knowing because most insurance companies will require a medical exam from the insured person. Then they must participate in the underwriting process, whether that be take an exam, do a phone interview, or provide access to medical records, if needed. When setting up a policy, the policy owner names one or more beneficiaries who receive the death benefit. Most people buy life insurance as both the policyholder and the insured person under the policy and then name a beneficiary to receive the death benefit.but occasionally it may make sense to purchase a policy that insures someone else and names you as the beneficiary.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

It would be nearly impossible to buy life insurance on someone without them knowing because most insurance companies will require a medical exam from the insured person. Then they must participate in the underwriting process, whether that be take an exam, do a phone interview, or provide access to medical records, if needed. Here are the most common reasons folks get life insurance on someone else like their spouse or partner: Some policies do not require any exam, medical. But taking out a policy on another person makes good sense in some.

Source: ncsf.com

Source: ncsf.com

In other words, you will have to show why you want. Unlike other situations when you buy life insurance on someone else, children don’t have to undergo a medical exam or sign the policy. Even policies that do not require an exam would need. The risk is not any lower once the person has been incarcerated, but life insurance does not get reevaluated once the policy has been. During this time, the insurance company can investigate claims to ensure the person did not commit fraud or lie on.

Source: capitolbenefits.com

Source: capitolbenefits.com

In order to have a valid policy, the owner must: In order to have a valid policy, the owner must: If this is on an adult, they have to be aware and sign the policy which is being taken out on them. To clearly illustrate your insurable interest. The contestability period typically encompasses the first two years after someone purchases a life insurance policy.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

Then you can look into speaking with the life insurance company. Life insurance companies don’t automatically dole out payments upon a policyholder’s death. Buying life insurance on someone else and naming yourself as beneficiary might sound like a plot point in a film noir mystery. In other words, you will have to show why you want. Founder, denverwest insurance professionals, inc., getting a policy on someone else is just like getting a policy on yourself with one exception.

Source: lifecareinsurance.ca

Source: lifecareinsurance.ca

Life insurance companies don’t automatically dole out payments upon a policyholder’s death. To get life insurance for someone else, the other person needs to know that you are getting the policy, agree to it, and sign the application. To claim life insurance after a loved one dies, you need to start by finding the policy document. So to recap, you can not take out a life insurance policy on someone without their knowledge, and no one should be able to do it to you. This is especially true if the surviving spouse doesn’t work and has small children to care for.

Source: pinterest.com

Source: pinterest.com

So to recap, you can not take out a life insurance policy on someone without their knowledge, and no one should be able to do it to you. Not only do you need to prove insurable interest to buy life insurance on someone, you also need their consent. Get a life insurance quote. Life insurance often forms a substantial part of the deceased’s estate, and can release funds for. Here are the most common reasons folks get life insurance on someone else like their spouse or partner:

Source: pinterest.com

Source: pinterest.com

The risk is not any lower once the person has been incarcerated, but life insurance does not get reevaluated once the policy has been. Life insurance often forms a substantial part of the deceased’s estate, and can release funds for. Here are the most common reasons folks get life insurance on someone else like their spouse or partner: Then you can look into speaking with the life insurance company. To get life insurance for someone else, the other person needs to know that you are getting the policy, agree to it, and sign the application.

Source: financialsecurityfirst.com

Source: financialsecurityfirst.com

Here are the most common reasons folks get life insurance on someone else like their spouse or partner: Buying a permanent life insurance policy may make sense for some people based on their needs. It costs $21.56 a month. Getting life insurance with depression. Founder, denverwest insurance professionals, inc., getting a policy on someone else is just like getting a policy on yourself with one exception.

Source: pinterest.com

Source: pinterest.com

Then you can look into speaking with the life insurance company. It would be nearly impossible to buy life insurance on someone without them knowing because most insurance companies will require a medical exam from the insured person. Buying a permanent life insurance policy may make sense for some people based on their needs. Even policies that do not require an exam would need. Legally, you can’t take out life insurance on someone without notifying them.

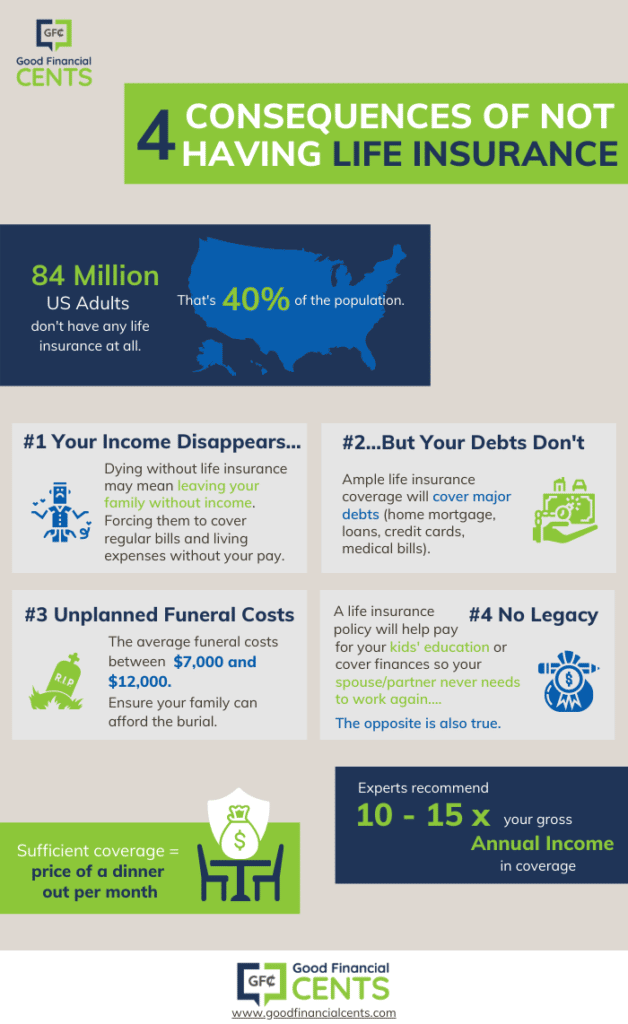

Source: goodfinancialcents.com

Source: goodfinancialcents.com

Then they must participate in the underwriting process, whether that be take an exam, do a phone interview, or provide access to medical records, if needed. That is barely two drinks a month in nyc—am i right? I have a term life insurance policy for a million dollars of coverage. This is especially true if the surviving spouse doesn’t work and has small children to care for. For 95% of young canadian families, term life insurance is the best type of life insurance because it provides sufficient coverage at a highly affordable price.

Source: youtube.com

Source: youtube.com

Some policies do not require any exam, medical. But there are also benefits to having it in place in the event you get ill. Some policies do not require any exam, medical. If a person already has a life insurance policy before they are arrested, or convicted if the person bonds out after the arrest, the insurance company will not cancel the policy as long as the premiums are paid. It costs $21.56 a month.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

Getting life insurance with depression. Getting life insurance with depression. The person you want to insure needs to give you written permission to buy life insurance for them. How to get life insurance quotes with no phone calls! Unlike other situations when you buy life insurance on someone else, children don’t have to undergo a medical exam or sign the policy.

Source: vecteezy.com

Source: vecteezy.com

Getting life insurance with depression. The person you want to insure needs to give you written permission to buy life insurance for them. A life insurance policy pays out a death benefit when an insured person dies. During this time, the insurance company can investigate claims to ensure the person did not commit fraud or lie on. Unlike other situations when you buy life insurance on someone else, children don’t have to undergo a medical exam or sign the policy.

Source: schwabagency.com

Source: schwabagency.com

For 95% of young canadian families, term life insurance is the best type of life insurance because it provides sufficient coverage at a highly affordable price. Founder, denverwest insurance professionals, inc., getting a policy on someone else is just like getting a policy on yourself with one exception. Some policies do not require any exam, medical. To purchase life insurance for another party, you will need: It costs $21.56 a month.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to get life insurance on someone by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.