How to get out of flood insurance information

Home » Trend » How to get out of flood insurance informationYour How to get out of flood insurance images are ready in this website. How to get out of flood insurance are a topic that is being searched for and liked by netizens now. You can Download the How to get out of flood insurance files here. Find and Download all free vectors.

If you’re looking for how to get out of flood insurance pictures information related to the how to get out of flood insurance keyword, you have visit the ideal blog. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

How To Get Out Of Flood Insurance. You can buy federal flood insurance no matter where you live if your community participates in the nfip. Without flood insurance, most residents must pay out of pocket or take out loans to repair and replace damaged items. How do i get flood insurance without an elevation certificate? Whether it’s a major flood event or a few inches of water in your home, flood insurance helps you protect the life you’ve built.

Flood Insurance A Buyer�s Guide CoverHound From coverhound.com

Flood Insurance A Buyer�s Guide CoverHound From coverhound.com

There are nearly 100 insurance companies that provide nfip policies. Call your insurance agent or company today. Here are six strategies to save money flood insurance: How do i get flood insurance without an elevation certificate? Better overall cheap flood insurance policy is the nfip prp for low to moderate risk flood zones usually identified with an x flood zone. You can get this process started by getting a copy of the elevation certificate for your property, and emailing it to bhubbard@nationalfloodexperts.com.

Here are six strategies to save money flood insurance:

Whether you’re buying a new policy or renewing an existing policy, you can buy flood insurance by calling your insurance company or calling your local independent agent, who can write flood insurance directly with. Under the right circumstances, you can get out of paying flood insurance through getting a loma. How do you get out of flood insurance? Flood insurance has a waiting period, which requires homeowners to purchase a policy well before a flooding event occurs in order for them to get coverage for it. To be able to claim on your home insurance, you�d need to have had a policy in place at least 72 hours before the floods. To qualify for a loma the home must be sitting higher than the base flood elevation (bfe).

Source: pinterest.com

Source: pinterest.com

Call your insurance agent or company today. How do you get out of flood insurance? Whether you’re buying a new policy or renewing an existing policy, you can buy flood insurance by calling your insurance company or calling your local independent agent, who can write flood insurance directly with. When fema approves your application, you will be issued an official letter of map amendment, which effectively rezones your home out of a flood plain. There are nearly 100 insurance companies that provide nfip policies.

Source: marineagency.com

Source: marineagency.com

Call your existing insurance provider and get a quote on a flood policy. Federal flood insurance policies through the national flood insurance program, which is backed by fema, are sold through private insurers. National flood experts will inspect your home for free. Ae flood zone cheap flood insurance private flood insurance can be cheaper then the nfip policies for those who have a property that is in a high risk flood zone. Participate in discount programs, such as the bundling of your insurance policies.

Source: pinterest.com

Source: pinterest.com

You can get this process started by getting a copy of the elevation certificate for your property, and emailing it to bhubbard@nationalfloodexperts.com. Ae flood zone cheap flood insurance private flood insurance can be cheaper then the nfip policies for those who have a property that is in a high risk flood zone. If you fear floods this season or are already dealing with them, here are some tips on how to get the most out of your flood insurance policy. Flood insurance has a waiting period, which requires homeowners to purchase a policy well before a flooding event occurs in order for them to get coverage for it. The best way to find flood insurance without a flood elevation certificate is to consult a licensed flood insurance agent to see if they work with any companies that don’t rely on a certificate to price out flood risk.

Source: pinterest.com

Source: pinterest.com

Whether it’s a major flood event or a few inches of water in your home, flood insurance helps you protect the life you’ve built. You can buy federal flood insurance no matter where you live if your community participates in the nfip. Better overall cheap flood insurance policy is the nfip prp for low to moderate risk flood zones usually identified with an x flood zone. National flood experts will inspect your home for free. Private flood insurance is typically provided as a secondary policy on homes with a primary homeowner insurance policy.

Source: abterrace.com.au

Source: abterrace.com.au

How do i get flood insurance without an elevation certificate? If you recently mitigated your home’s flood risk by elevating your house or filling in your basement, an ec can provide the proof you need to get discounts on flood insurance. You can buy federal flood insurance no matter where you live if your community participates in the nfip. Choose a flood insurance deductible: Warning most homeowners insurance policies do.

Source: social.selective.com

Source: social.selective.com

There are nearly 100 insurance companies that provide nfip policies. To be able to claim on your home insurance, you�d need to have had a policy in place at least 72 hours before the floods. If you fear floods this season or are already dealing with them, here are some tips on how to get the most out of your flood insurance policy. Better overall cheap flood insurance policy is the nfip prp for low to moderate risk flood zones usually identified with an x flood zone. To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance.

Source: pinterest.com

Source: pinterest.com

Here are six strategies to save money flood insurance: How do you get out of flood insurance? Federal flood insurance policies through the national flood insurance program, which is backed by fema, are sold through private insurers. Here are six strategies to save money flood insurance: Whether you’re buying a new policy or renewing an existing policy, you can buy flood insurance by calling your insurance company or calling your local independent agent, who can write flood insurance directly with.

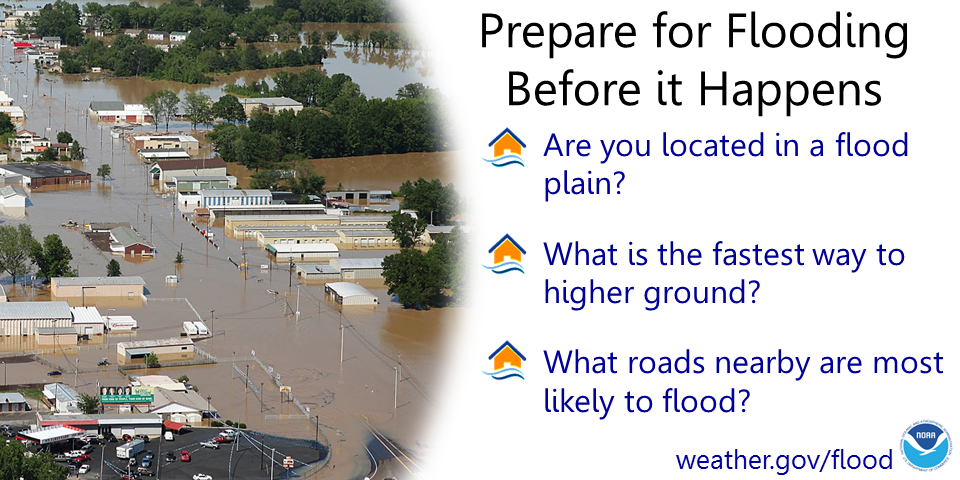

Source: weather.gov

Source: weather.gov

Shop through an insurer or agent. The best way to find flood insurance without a flood elevation certificate is to consult a licensed flood insurance agent to see if they work with any companies that don’t rely on a certificate to price out flood risk. To be able to claim on your home insurance, you�d need to have had a policy in place at least 72 hours before the floods. Private insurance may cover your home above the $250,000 replacement ceiling by nfip. Unfortunately, criminals sometimes seize the opportunity after a flood to prey on those that are already in a bad situation.

Source: moneycrashers.com

Source: moneycrashers.com

Without flood insurance, most residents must pay out of pocket or take out loans to repair and replace damaged items. Choose a flood insurance deductible: Private insurance may cover your home above the $250,000 replacement ceiling by nfip. How do you get out of flood insurance? Participate in discount programs, such as the bundling of your insurance policies.

Source: thoughtco.com

Source: thoughtco.com

Shop through an insurer or agent. You can get this process started by getting a copy of the elevation certificate for your property, and emailing it to bhubbard@nationalfloodexperts.com. How do i get flood insurance without an elevation certificate? Private insurance may cover your home above the $250,000 replacement ceiling by nfip. A loma (letter of map amendment) is a letter from fema that allows lenders to waive federal flood insurance requirements.

Source: ezmart4u.com

Source: ezmart4u.com

Warning most homeowners insurance policies do. Federal flood insurance policies through the national flood insurance program, which is backed by fema, are sold through private insurers. If you elevate your house above sea level or above the risk of flooding, it’s less likely that your house or belongings will be damaged, lowering your insurance premiums. Unfortunately, criminals sometimes seize the opportunity after a flood to prey on those that are already in a bad situation. Without flood insurance, most residents must pay out of pocket or take out loans to repair and replace damaged items.

Source: jeanlee03.blogspot.com

Source: jeanlee03.blogspot.com

Under the right circumstances, you can get out of paying flood insurance through getting a loma. Shop through an insurer or agent. Choose a flood insurance deductible: To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance. The best way to find flood insurance without a flood elevation certificate is to consult a licensed flood insurance agent to see if they work with any companies that don’t rely on a certificate to price out flood risk.

Source: houselogic.com

Source: houselogic.com

To qualify for a loma the home must be sitting higher than the base flood elevation (bfe). Federal flood insurance policies through the national flood insurance program, which is backed by fema, are sold through private insurers. To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance. Flood insurance can be expensive, especially if you live near the coast louisiana or florida. The best way to find flood insurance without a flood elevation certificate is to consult a licensed flood insurance agent to see if they work with any companies that don’t rely on a certificate to price out flood risk.

Source: americaneaglela.com

Source: americaneaglela.com

Warning most homeowners insurance policies do. There are nearly 100 insurance companies that provide nfip policies. Federal flood insurance policies through the national flood insurance program, which is backed by fema, are sold through private insurers. Flood insurance has a waiting period, which requires homeowners to purchase a policy well before a flooding event occurs in order for them to get coverage for it. The best way to find flood insurance without a flood elevation certificate is to consult a licensed flood insurance agent to see if they work with any companies that don’t rely on a certificate to price out flood risk.

Source: coverhound.com

Source: coverhound.com

If you elevate your house above sea level or above the risk of flooding, it’s less likely that your house or belongings will be damaged, lowering your insurance premiums. If you are successful in obtaining the loma, give it to the lender and they will usually waive the flood insurance requirement by making a “redetermination” or simply writing you a letter. Give the lender’s letter or form to your insurance agent and ask for a cancellation of your policy. But you can still find ways to save. Flood insurance has a waiting period, which requires homeowners to purchase a policy well before a flooding event occurs in order for them to get coverage for it.

Source: cbs58.com

Under the right circumstances, you can get out of paying flood insurance through getting a loma. Flood insurance agency, typtap (only florida), golden bear (only california) varies; You can buy federal flood insurance no matter where you live if your community participates in the nfip. Whether you’re buying a new policy or renewing an existing policy, you can buy flood insurance by calling your insurance company or calling your local independent agent, who can write flood insurance directly with. Assurant insurance is one of the more longstanding insurance companies.

Source: escatologiaaberta.blogspot.com

Source: escatologiaaberta.blogspot.com

Ae flood zone cheap flood insurance private flood insurance can be cheaper then the nfip policies for those who have a property that is in a high risk flood zone. It opened its doors in 1892, starting with disability insurance. Warning most homeowners insurance policies do. You can buy federal flood insurance no matter where you live if your community participates in the nfip. To be able to claim on your home insurance, you�d need to have had a policy in place at least 72 hours before the floods.

Source: stormdamages.claims

Source: stormdamages.claims

But you can still find ways to save. Your flood insurance deductible is the amount you’re responsible for paying on each claim before your insurance kicks in. But you can still find ways to save. A loma (letter of map amendment) is a letter from fema that allows lenders to waive federal flood insurance requirements. Flood insurance can be expensive, especially if you live near the coast louisiana or florida.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to get out of flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.