How to prove insurance bad faith information

Home » Trending » How to prove insurance bad faith informationYour How to prove insurance bad faith images are ready in this website. How to prove insurance bad faith are a topic that is being searched for and liked by netizens now. You can Download the How to prove insurance bad faith files here. Get all free photos and vectors.

If you’re looking for how to prove insurance bad faith images information connected with to the how to prove insurance bad faith keyword, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

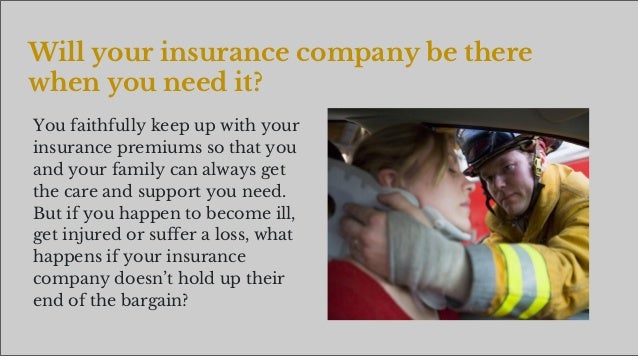

How To Prove Insurance Bad Faith. The insurance company is acting in bad faith. If you suspect bad faith in your case, you can prove your case by documenting the actions of the insurance company. Here is what you need to prove that you have a bad faith insurance case: When your insurance company is dishonest, they are acting in bad faith.

An Idiot’s Guide To Bad Faith Insurance Claims ClaimsMate From claimsmate.com

An Idiot’s Guide To Bad Faith Insurance Claims ClaimsMate From claimsmate.com

Paying for insurance is a way to be prepared in an emergency and be ready for the unexpected. “(1) the existence of an insurance Two elements you, if you hope to win a common law claim of bad faith, must prove are: Proving an insurance company acted in bad faith can be difficult. Dl law group can help if you want to learn more about legal options for resolving insurance bad faith. Here is what you need to prove that you have a bad faith insurance case:

Unfortunately, not all insurance companies are honest.

If you suspect your insurance company is acting in bad faith, it’s critical you seek legal counsel right away. Usually, it takes assistance from a skilled attorney to help recognize when bad faith has been perpetrated against a client. An attorney will be familiar with the language used in insurance. Second, you must show that the reason for the insurer’s denial was unreasonable. If you can prove these above two elements, you may have a case of insurance bad faith. One of the most common bad faith examples involves an insurance company.

Source: zalma.com

Source: zalma.com

Usually, it takes assistance from a skilled attorney to help recognize when bad faith has been perpetrated against a client. Contact us if you have questions about how to prove insurance bad faith. Bad faith among insurance companies in the state of florida can be a serious problem. To prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy. Usually, it takes assistance from a skilled attorney to help recognize when bad faith has been perpetrated against a client.

Source: slideshare.net

Source: slideshare.net

If you suspect bad faith in your case, you can prove your case by documenting the actions of the insurance company. Pittsburgh bad faith insurance lawyers at alpernschubert p.c. If your insurance provider is failing to pay your claim without a reasonable basis or without properly investigating the claim in a timely manner, you may be experiencing bad faith insurance practices. Here is what you need to prove that you have a bad faith insurance case: Unfortunately, not all insurance companies are honest.

Source: txerisalawyer.com

Source: txerisalawyer.com

Dl law group can help if you want to learn more about legal options for resolving insurance bad faith. Don’t delay—call our team today to discuss your case. When insurance companies look to support their bottom line by delaying or denying policyholder’s claims, they are acting in “bad faith.” to prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy. Determining whether your insurance company acted in bad faith can be tricky. Differences among states, however, do exist.

Source: slideshare.net

Source: slideshare.net

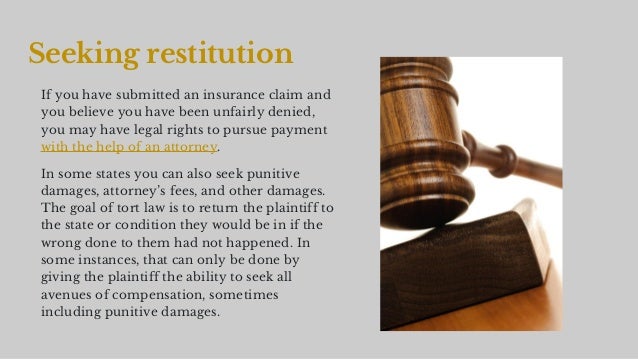

In order to prevail in a bad faith insurance lawsuit, you must be able to prove that not only did the insurance company have no reasonable basis for denying you the benefits of the policy, but also that they knew you had a valid claim and decided to deny it anyway. Contact a montgomery personal injury lawyer at our firm now so that we can look into your insurance company�s alleged bad faith actions. Refusal of payment without providing valid reasoning. The claims adjuster spoke with the policyholder over the phone. If you suspect your insurance company is acting in bad faith, it’s critical you seek legal counsel right away.

Source: slideshare.net

Source: slideshare.net

The longer you wait, the harder it is to prove your claim. This is not an issue you want to wait on. However, the following four scenarios are the most common examples of bad faith when attorneys look to prove bad faith insurance claims. An attorney will be familiar with the language used in insurance. When your insurance company is dishonest, they are acting in bad faith.

Source: slideshare.net

Source: slideshare.net

When your insurance company is dishonest, they are acting in bad faith. One of the most common bad faith examples involves an insurance company. To prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy. Bad faith laws are designed to protect you from actions that could be detrimental to you. Pittsburgh bad faith insurance lawyers at alpernschubert p.c.

Source: slideshare.net

Source: slideshare.net

Insurance carriers are not going to come out and say that they are acting in bad faith. Second, you must show that the reason for the insurer’s denial was unreasonable. Proving an insurance company acted in bad faith can be difficult. The longer you wait, the harder it is to prove your claim. In order to prevail in a bad faith insurance lawsuit, you must be able to prove that not only did the insurance company have no reasonable basis for denying you the benefits of the policy, but also that they knew you had a valid claim and decided to deny it anyway.

Source: slideshare.net

Source: slideshare.net

Differences among states, however, do exist. Contact a montgomery personal injury lawyer at our firm now so that we can look into your insurance company�s alleged bad faith actions. When insurance companies look to support their bottom line by delaying or denying policyholder’s claims, they are acting in “bad faith.” to prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy. Don’t delay—call our team today to discuss your case. Second, you must show that the reason for the insurer’s denial was unreasonable.

Source: slideshare.net

Source: slideshare.net

The evaluation of reasonability is objective and based entirely on the facts of the situation your insurer was privy to at the time it made the decision in question. This is not an issue you want to wait on. If you can prove these above two elements, you may have a case of insurance bad faith. This requires an insurance company to conduct prompt and thorough investigations in to a policyholder’s claim. Every time you speak to a representative on the phone, jot down notes about the date of the conversation and the topics of discussion.

Source: claimsmate.com

Source: claimsmate.com

One of the most common bad faith examples involves an insurance company. Don’t delay—call our team today to discuss your case. If you suspect bad faith in your case, you can prove your case by documenting the actions of the insurance company. The type of bad faith that will make a jury angry enough to award punitive damages is usually apparent from the record alone, without an expert to explain To prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy.

Source: slideshare.net

Source: slideshare.net

This can include dishonestly in adjusting the claim, failing to process a claim within a timely fashion, or some other type of intentional. Second, you must show that the reason for the insurer’s denial was unreasonable. Differences among states, however, do exist. If you can prove an insurance company is failing to fulfill implied duties, then you may be able to file a bad faith insurance claim. Unfortunately, not all insurance companies are honest.

Source: pinterest.com

Source: pinterest.com

If you suspect bad faith in your case, you can prove your case by documenting the actions of the insurance company. Differences among states, however, do exist. One of the most common bad faith examples involves an insurance company. Every time you speak to a representative on the phone, jot down notes about the date of the conversation and the topics of discussion. Second, you must show that the reason for the insurer’s denial was unreasonable.

Source: enjuris.com

Source: enjuris.com

Sometimes, they fail to fulfill mandated contractual duties to the insured individual. One of the most common bad faith examples involves an insurance company. Proving an insurance company acted in bad faith can be difficult. Contact us if you have questions about how to prove insurance bad faith. Usually, it takes assistance from a skilled attorney to help recognize when bad faith has been perpetrated against a client.

Source: wisconsinlawyer.com

Source: wisconsinlawyer.com

If you can prove an insurance company is failing to fulfill implied duties, then you may be able to file a bad faith insurance claim. One of the most common bad faith examples involves an insurance company. Usually, it takes assistance from a skilled attorney to help recognize when bad faith has been perpetrated against a client. Determining whether your insurance company acted in bad faith can be tricky. An attorney will be familiar with the language used in insurance.

Source: slideshare.net

Source: slideshare.net

Two elements you, if you hope to win a common law claim of bad faith, must prove are: This can include dishonestly in adjusting the claim, failing to process a claim within a timely fashion, or some other type of intentional. If you can prove these above two elements, you may have a case of insurance bad faith. Bad faith among insurance companies in the state of florida can be a serious problem. To prove a company acted in bad faith, you must be able to show that they acted unreasonably and did not honor the terms and conditions set by your insurance policy.

Source: slideshare.net

Source: slideshare.net

Every time you speak to a representative on the phone, jot down notes about the date of the conversation and the topics of discussion. Contact a montgomery personal injury lawyer at our firm now so that we can look into your insurance company�s alleged bad faith actions. “(1) the existence of an insurance If you suspect your insurance company is acting in bad faith, it’s critical you seek legal counsel right away. If you can prove these above two elements, you may have a case of insurance bad faith.

Source: slideshare.net

Source: slideshare.net

Insurance carriers are not going to come out and say that they are acting in bad faith. This may make you eligible for a bad faith claim against the company. However, the following four scenarios are the most common examples of bad faith when attorneys look to prove bad faith insurance claims. If you can prove these above two elements, you may have a case of insurance bad faith. Here is what you need to prove that you have a bad faith insurance case:

Source: injurix.com

Source: injurix.com

Proving an insurance company acted in bad faith can be difficult. The longer you wait, the harder it is to prove your claim. Bad faith laws are designed to protect you from actions that could be detrimental to you. Contact a montgomery personal injury lawyer at our firm now so that we can look into your insurance company�s alleged bad faith actions. Differences among states, however, do exist.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to prove insurance bad faith by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.